‘Shippers are Clearly Not Happy’ with Freight Rates, Expert Says

Although spot freight rates have been climbing over the past month, according to various indices, retailers concerned about locking in a longer-term rate at current levels may still be able to wait and get a cheaper deal next year.

While retailers like TJX, Ross Stores and Target have all touted ocean freight rate declines in recent earnings calls, industry players should carefully negotiate with ocean carriers.

More from Sourcing Journal

“We may see more increases in spot ocean rates in the peak season in the short term, but spot rates will soften in the medium term due to the rising tide of overcapacity across the global container shipping sector,” said Philip Damas, managing director, head of Drewry Supply Chain Advisors. “In our discussions with our beneficial cargo owner/shipper customers, for example, we hear that ocean carriers are calling them all the time to try and secure volume. The shipping market remains very weak overall.”

Damas told Sourcing Journal that the maritime research consultancy doesn’t advise shippers to lock in long-term rates right now.

“By waiting a bit longer, shippers will benefit from further reductions in both spot and contract rates in 2024, based on our forecasts,” said Damas.

Port of Los Angeles executive director Gene Seroka shared a similar view on Bloomberg Markets last Monday, saying the current supply-demand curve “is now in the corner of the cargo owner.”

“We’ve seen new capacity come online…having additional capacity means price compression on the downside,” Seroka said.

According to Peter Sand, chief analyst ocean and air freight analytics platform Xeneta, the strongest shippers are paying as little as $475 per 40-foot container for spot business for Transatlantic routes, which is an all-time low.

“The number of long-term contracts coming into force in 2023 is significantly down on past years, indicating that shippers are clearly not happy with the rates on offer nor being drawn into the kind of closer relationship carriers are seeking,” Sand wrote in a blog post.

While the spot rate market has rebounded in the past five weeks—Drewry calculated that rates from Shanghai to Los Angeles rose 44 percent to $2,362 per 40-foot container and Shanghai-to-New York rates jumped 24 percent, to $3,363 in that time frame—contract rates are a different story.

The spot rate increase has been attributed to various external events, with Damas pointing to port labor issues on the U.S. and Canadian West Coasts and water-level capacity restrictions at the Panama Canal, and “carrier actions” such as limited capacity reductions and widespread general rate increases announced by multiple carriers.

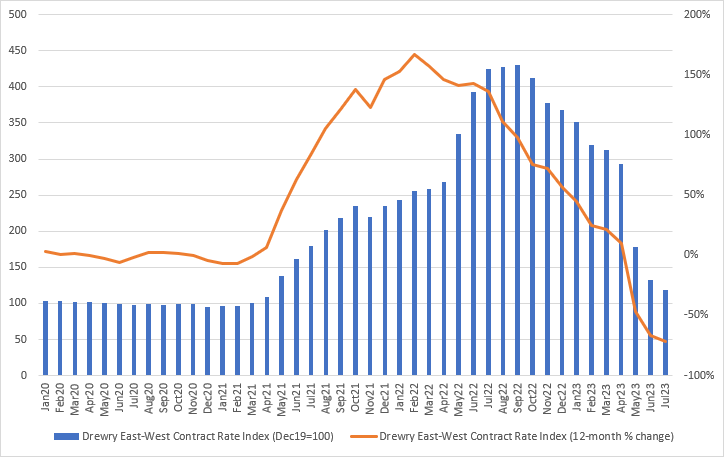

On the other hand, contract rates are continuing their descent. According to the consultancy’s East-West Contract Rate Index, contract rates fell by another 10 percent between June and July.

Container XChange’s XChange Insights platform indicates that the average price of a cargo-worthy 40-foot container in the main ports of the U.S. was approximately $2,000, the lowest since July 2021.

“June 2023 marked the lowest average container prices in key supply chain markets such as China, Europe, and the U.S, when compared to the same month in 2022 and 2021,” according to Container XChange’s August container logistics update. “This decline in container prices could indicate a further strain on profit margins for shipping companies.”

The Container XChange report also touched on U.S. retailers’ peak season expectations, particularly as many are still destocking their excess inventory from last year. The company predicts cargo volumes will reach a peak in August in preparation for the upcoming holiday season as retail sales increase. But even then, total 20-foot equivalent unit (TEU) imports are expected to sink 10.2 percent year over year amid stubbornly high inventories.

The online container logistics platform cited recent Global Port Tracker data from the National Retail Federation (NRF) and Hackett Associations, which said the logistics environment in the second half of 2023 is normalizing thanks to the conclusion of the West Coast labor negotiations. Union dockworkers voted on the tentative six-year deal from Aug. 15-17. The results should be announced in the fall.

“As economists shift from predicting recession to a ‘soft landing’, the industry holds its momentum,” said Christian Roeloffs, co-founder and CEO, Container XChange, in a statement. “While some experts remain cautious, the foundation of a resilient economy, sustained consumer activity, and strategic federal investments improves the outlook of the upcoming holiday season.”