How Sephora Reinvented Beauty Retail

If necessity is the mother of invention, Sephora U.S. is the godparent of the modern-day beauty industry.

From incubating some of today’s most powerful brands to pioneering an open-sell environment in prestige, Sephora changed forever how beauty is sold — and transformed the U.S. retail landscape in the process.

More from WWD

“Sephora has been an amazing force for change in the beauty industry,” said Jean-André Rougeot, president and chief executive officer of Sephora Americas, who was president and CEO of Coty when the retailer opened its first New York City store in 1998. “This is a completely different beauty world. Sephora came in with a self-serve brand-agnostic concept that was truly revolutionary.

“I remember many pundits saying this will never work,” Rougeot continued. “But what I think everybody missed is that at the time, the younger generation was really frustrated with the department store experience and there was not a sense of inclusion. Sephora dramatically democratized what beauty was about.”

“They have always been an audacious changemaker, disrupting retail from the start,” said Charlotte Holman Ros, president North America, Parfums Christian Dior. “Dior was founded by a visionary changemaker and our brand and story are driven by the spirit of audacity and finding new ways to spread joy and happiness. Likewise, Sephora was the first of its kind to create an open-sell beauty environment and that spirit of constant disruption to find new ways to engage and create joyous moments of happiness is always at the heart of their strategy.”

Just consider: 25 years ago, when the French-born retailer was readying its first U.S. outpost, department stores were by far the dominant seller of prestige beauty products, with a market share hovering at 80 percent. For the 12 months ending April 2023, that figure is 19 percent, according to Circana’s checkout data.

A handful of brands — a.k.a. the big three — ruled the roost, and as for newcomers hoping to break through? Good luck trying to afford the astronomical costs affiliated with doing business in a full-service environment.

Enter Sephora, at the time France’s largest perfumery in terms of volume, started by Dominique Mandonnaud in 1969 and acquired by LVMH Moët Hennessy Louis Vuitton in 1997 for $262 million.

Back then, Sephora had about 54 doors in France and had just opened its largest, a 14,000 square-foot flagship on Paris’s Champs-Élysées, with one of the widest ranges of fragrance and beauty products anywhere in the world.

The only problem was — most of those brands were happy with their distribution in the U.S. and had no desire to upset the existing balance of power by selling to Sephora’s American arm.

That meant executives had to forge a completely new strategy, one built around small emerging brands that few had ever heard of.

“What they are most known for is curating prestige brands, incubating indie brands, elevating trends,” said Mark Loomis, president, North America, of the Estée Lauder Cos. “Sephora has successfully tapped into Millennial and Gen Z customers and created a destination where they can come and experience multiple prestige brands at one time.”

That skill of identifying and building emerging brands and trends has fundamentally changed beauty — and created a sales juggernaut. Industry sources estimate that Sephora North America has the potential to drive $10 billion in sales.

For its part, Macy’s Inc., parent company to Macy’s, Bloomingdale’s and Bluemercury, doesn’t break out beauty sales but includes cosmetics and fragrances with women’ shoes and accessories. Together, they generated $9.6 billion in sales in 2022. Meanwhile, Ulta Beauty surpassed $10 billion in sales in 2022 for the first time in its history, but that includes sales of mass, masstige and professional products, as well as prestige beauty and services.

“We are the incubator for the industry,” said Rougeot, who declined to comment on the sales figure. “From Day One — some of it by accident, some by strategy — Sephora embarked on a strategy to build brands. Nobody else has done it — even today.”

He ticks off a number of bestselling brands — Fenty, Supergoop, Tatcha, Drunk Elephant — and notes “with great humility” that 90 to 95 percent of the brands successful in Ulta started at Sephora. “The prestige beauty industry would be a lot more boring and a lot smaller without Sephora,” said Rougeot. “We are really impacting the industry and the brands. Our growth has been staggering — we’re growing at an incredible pace and our brand partners are benefiting from this,” he continued. “It’s a great flywheel.”

While the brand lineup has been a key component of Sephora’s success, so has its connection and understanding of the deeper sociocultural shifts that have impacted beauty over the past two decades.

“Sephora has been a force for changing what beauty represents,” said Zena Srivatsa Arnold, who was named chief marketing officer of Sephora U.S. in May. Most recently a senior vice president at PepsiCo., she brings an outside of the industry perspective and a personal love of the category. “Beauty is much more about self-expression and connection with people, which is really powerful.”

“Every client brings themselves to beauty, so we need to meet them where they are,” added Abigail Jacobs, senior vice president, brand and integrated marketing. “Right now, beauty is seen as incredibly empowering, because it is a tool for individuality and expression.”

Sephora executes about eight major campaigns a year across all of its platforms, including holiday, as well as numerous others tied into current events, like Black History month, Hispanic Heritage month and Pride month.

“The overarching story we are always trying to tell is what is unique and special and differentiated about Sephora, whether it is our product or our experience or the surrounding services and features we offer,” said Jacobs.

For example, this year’s Pride campaign included content created by Sephora Squad members inspired by the 24 different Pride flags, in which each creator did a makeup look based on their favorite flag, accompanied by stories that told of their own personal journey. “The future of beauty content is multicultural and intersectional,” said Jacobs. “The future beauty consumer is those things, and our content needs to meet them where they are. Gen Z is a generation that doesn’t define themselves by a single identity. We need both our brands and our content to flex with them.”

In her role, Jacobs also oversees the social media and influencer teams, and the challenges of executing both large-scale and small-scale content are significant. To meet them, Jacobs has created “tiger teams” who work in an agile and flexible way to solve problems quickly. The approach is characteristic of Sephora’s culture and the leadership style that Rougeot brings to the business. He believes in focusing the enterprise on key goals and initiatives, and then letting them run.

“There is no risk-taking without great focus,” he said. “We want you to be laser-focused on what’s going to drive the business.

“I always say in business there are different ways to win. There’s never just one solution to a problem,” he continued. “But the question is — how focused are you? Once you pick a solution, you have to drive relentlessly, bring solutions to it, measure it, have milestones and make sure that the company is on board and understands their roles and commitments.”

A brand veteran who was most recently CEO of Benefit Cosmetics before joining Sephora in 2019, Rougeot considers the general management piece of his role to be the most important.

“I am not an expert in anything, but I can be dangerous on most topics. I can ask questions, I can challenge people,” he said. “I want the people who report to me to be much better than I am — the marketing people 10 times better at marketing, the merchandisers, etc. That’s how you build a winning team.”

Rougeot relishes his interactions with people at all levels of the organization, and is an ebullient, energetic executive who likes to throw in a zinger every now and then. When Sephora at Kohl’s opened around the same time as Ulta Beauty at Target, he loved to quip that consumers don’t want to buy prestige beauty “in between the bananas and the toilet paper.”

While the heavy lifting on the merchandising side is handled by Artemis Patrick, executive vice president, global chief merchandising officer, and Carolyn Bojanowski, executive vice president of merchandising in the U.S., Rougeot loves meeting with founders — and they love him.

Alicia Valencia, global president of Makeup by Mario, recalled a visit she and makeup artist Mario Dedivanovic had with Rougeot, Patrick and senior vice president of makeup Alison Hahn in the very earliest days of ideating the brand. Dedivanovic, who rose to fame as Kim Kardashian’s makeup artist, started his career as a Sephora beauty adviser 20 years ago and was set on launching his brand there.

Valencia and Dedivanovic went to the meeting with a proposal for a launch tower in 75 doors.

“Jean-André looked at us and said, ‘I believe this is going to be a legacy brand. Mario, you will be the next François Nars. I don’t often say that, but I’m very rarely wrong,” Valencia said.

“Mario and I looked at each other and went, ‘holy cow!,’ she continued. “I said, ‘Jean-André, thank you, but we haven’t even raised seed money.’”

Rougeot was emphatic in his support, believing strongly in Dedivanovic’s vision of a brand that combined education and artistry.

It’s a passion, said Valencia, that is shared at all levels of the organization, especially in-store with the beauty advisers. That backing has enabled Makeup by Mario to become a Top 10 brand in two years. “I am in awe of the beauty advisers. Their love and support for him as a makeup artist has enabled us to be at this stage,” she said. “This is the biggest link. It starts with senior management and goes all the way through the organization; the beauty advisers know when something is the real deal, authentic.”

Internally, Rougeot urges his teams to be intellectually curious, looking beyond the confines of beauty retail, to businesses like Best Buy and Dick’s Sporting Goods, for inspiration and best practices.

As an example, he cites the successful implementation of omni-convenience features, like buy online, pick up in store, curbside pickup and same-day delivery. “When we started on this path, which has become a huge part of our business, we were quite bad,” Rougeot said. “So I said, let’s look at the people who do this well. Before we reinvent the wheel, let’s get smart. We learned a lot and we came up with a Sephora solution that is working well.”

Every two years, Sephora’s senior management team identifies what it thinks will be the six or seven key drivers for the next two years. Omni-convenience, for example, was a key tenet of the 2021-2022 plan called “Tree of Growth.”

The current plan is called “Pot of Gold,” and one important component is personalization. “Everyone talks about it — very few do it right,” said Rougeot. That means a cross-functional all-hands-on-deck approach that takes into account the post-pandemic consumer mindset shift. “Previously we were in a single-channel mindset — you would see a purely digital customer who started their journey online or they would come into stores, purchase and go home,” said Nadine Graham, senior vice president of e-commerce. “In the past few years there’s been a big shift. Now any type of client can come to any channel — they’ve shifted to a multichannel mindset and it requires us to think about the customer first and put the customer at the center of everything we do.”

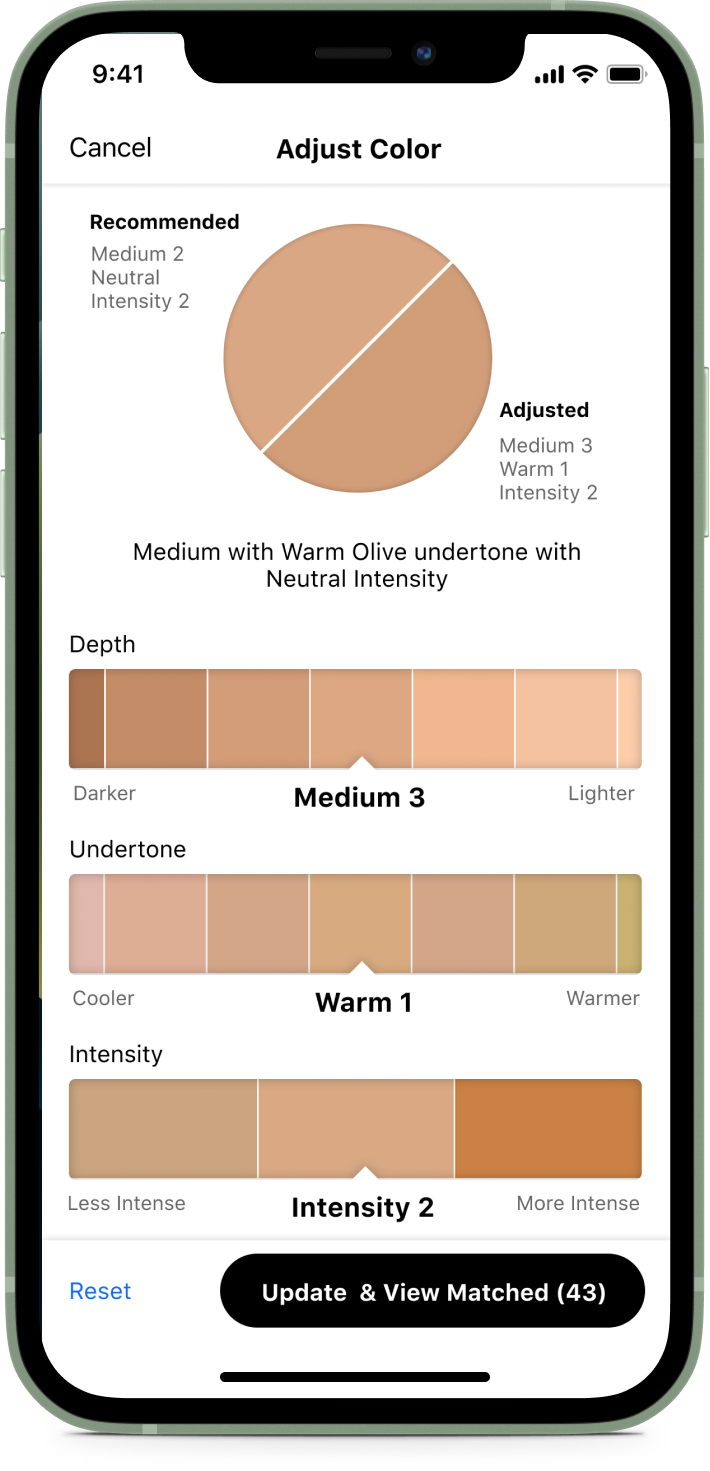

The rollout of Color IQ Foundation Matching technology, which started in 2012, is one such example. The tool, which has been upgraded significantly, uses artificial intelligence to scan a user’s skin and then recommends the foundations that are the best match. Thus far, Sephora is executing about 75,000 sessions a week, or 4 million a year, across its fleet of 534 stores.

ColorIQ has also plays a key role in Sephora’s diversity, equality and inclusion initiatives, another key component of “Pot of Gold.” “It is part of everything we do today,” said Rougeot, acknowledging that much work remains to be done. “We made a clear internal and external statement that we would be the retailer that would be inclusive to all. It’s hard. I’m not saying we do it all the time,” he said, noting that Sephora was the first major retailer in America to take the 15 Percent Pledge, where retailers pledge to allocate at least 15 percent of their shelf space to Black-owned businesses.

“It’s a marathon, not a sprint,” Rougeot continued, “and it is a core part of our value.”

“Sephora has been very open about the opportunity they have to expand their lenses, in terms of how they are viewing people who are shopping, how they are viewing their cast, their leadership team and also the collection of products in store,” said Danessa Myricks, founder and CEO of Danessa Myricks Beauty. “After George Floyd’s death, everyone knew there had to be changes. There was a lot of performative action, but Sephora’s actions came well before George Floyd and the 15 Percent Pledge.”

Myricks first met with Sephora’s team in 2019 when they reached out to her. “We have very thoughtful conversations about us not just as a Black-founded brand, but as a brand they had watched grow over the years and wanted to support and help elevate and create more awareness for,” she said. “They are focused on building brands — not just selling products.”

“Sephora isn’t just about distribution, it’s about brand-building and visibility. That is what makes them so unique,” agreed Nancy Twine, the founder of Briogeo who is credited with introducing textured hair care into the prestige channel. Twine launched in Sephora in 2014, scaled quickly and in 2022 sold to Wella.

While the founder applauded Sephora’s adoption of the 15 Percent Pledge, it’s Sephora’s ongoing and meaningful support for Black-founded brands that has really resonated. “They’ve invested time and money through the Accelerate program to make sure Black-led businesses are set up for retail readiness,” said Twine, who oversees the program’s finance and operations curriculum. “One of the things that they acknowledged was, you can’t just put a brand on a shelf and expect it to succeed. You have to make sure they have the resources to do so.”

Twine said that such efforts also translate in-store and beyond. “Sephora realized they needed to be more intentional with how they were going to get clients in-store, and they started becoming engaged in the opportunity,” she noted. “For example, they did a curl animation, started localizing certain doors that had more textured-hair clients to make sure they could find product. They invested in digital campaigns with bigger content platforms. They really got into it.”

Executives believe that ColorIQ is another step in the right direction, and will help remove a key pain point for shoppers of color — the difficulty of finding the right shade of foundation or concealer. “If you come into a store and the beauty adviser doesn’t look like you, you may not be totally confident that she can find the right match,” said Jacobs. “This tool brings the science to the art of it.

“We call it the ‘trust campaign,’” she continued, “because if you can trust us to find the right complexion product for you, you can trust us for anything.”

To make it even more foolproof for consumers, Sephora has also embarked on an aggressive sampling campaign with its top-selling foundation brands, offering prepackaged individual-use samples. “Sixty or 70 percent of customers say they won’t buy a foundation without sampling it,” said Jacobs. “We know people are churning through different foundations, always looking for the right one. Sampling is a big part of that.”

Leveraging the data gleaned from the 31 million (and counting) members of Sephora’s Beauty Insider loyalty program is also a key component of personalization. “We’re using data as a way to understand what’s most attractive to our clients, what they’re responding to most, to make sure that we have opportunities for personalizing marketing touch points,” said Emeline Berlind, senior vice president, general manager, loyalty.

Personalization extends far beyond data analytics. Beauty Insiders are able to customize their perks, whether samples, savings or even experiences like a facial and wine tasting session at the Caudalie boutique in New York City. “There is an emotional component in addition to the value we offer,” said Berlind. “We’re always looking for new and exciting ways to engage. What are the thing they didn’t even know that they wanted that we’re going to try to give them. Our goal is to stay true to the innovative spirit of Sephora and use it to drive the business.”

Innovation is baked into Sephora, across every platform. Sephora North America was a first-mover in digital, for example, launching its e-commerce site in 1999. Today, it is the number two beauty e-commerce site in the world, behind Tmall.

“Sephora was on the forefront of being a true omnichannel retailer,” said David Greenberg, CEO of L’Oréal USA and president, North America Zone. “You see that in the community they have built and the dynamism and consistency of experience between online and in-store shopping. They really took to heart the notion of letting customers shop the way they want to. They truly are one of the most customer-centric retailers today.”

While digital remains an incredibly important aspect of the business, Rougeot and his team are extremely focused on forging the future of the brick-and-mortar experience.

“The experience starts in our stores — 70 to 80 percent of our new customers come from stores,” he said. “Making our stores exciting and engaging is a critical part of what we need to do.”

Currently, Sephora is betting big on services, particularly around makeup, introducing special-occasion makeup applications like for weddings and proms, drop-in services for those who are looking for a quick zhuzh before a date, say, and in-store makeup lessons. There’s lash applications, Hydrafacials for the face, lips and hands, and brow waxing.

“We’ve seen an uptick in demand, not only for everyday luxury, but also for big moments,” said Joan Willat, executive vice president and chief retail officer. “We’re honing in on the expertise of the beauty adviser in-stores, so that they can give a truly personalized experience to every customer. That’s what leads clients to try new things with us.”

At a time when shoppers can — and do — access information on demand from their phones, Sephora’s 15,000 beauty advisers play a key role in differentiating the retailer from its competition. “We know our loyal customer base is looking for new and different experiences in our stores,” said Willat, “so we prepare our beauty advisers to meet them where they are and reflect that back to them.”

Rougeot, who propelled Benefit Cosmetics to a leading position in brows during his time there, likes to say there is no such thing as bad retail — just boring retail. For him, services help Sephora transcend the purely transactional aspect of retailing. “Services bring a level of emotional commitment between Sephora and the customer that is critical,” he said. “If I give you my face for 60 minutes — that’s an emotional commitment that’s through the roof, provided you do a good job.”

Another key to growth will be to continue to broaden Sephora’s consumer base, primarily through external partnerships. In 2021, Sephora inked a deal with Kohl’s to open store-in-stores there, with 200 opening in the first year and another 400 in 2022. There will be more than 900 by the end of this year.

In a statement released in May with Kohl’s first-quarter numbers, CEO Tom Kingsbury said that comp-store growth was in the mid-teens for the first tranche of stores, and that the 2022 openings were exceeding expectations. The partners also introduced a smaller-format store, measuring about 750 square feet, with 50 planned for the end of this year and a chain-wide rollout to be completed by 2025.

According to Rougeot, makeup sales at Sephora at Kohl’s are already larger than those of Nordstrom, and expectations are that they will exceed Macy’s makeup business by 2025. “There are about 50 million women consumers at Kohl’s, 80 percent of whom had never shopped at Sephora,” he said. “About 8 million of those have started to buy from Sephora at Kohl’s, and I think one day 25 million–30 million will be buying there.”

More recently, Sephora inked a deal with Zappos, a partnership that will launch this July. Executives aren’t releasing much information around the deal with the Amazon-owned Zappos, but Rougeot said it’s a continuation of the vision to be everywhere a potential beauty shopper is.

“Over the last few years we’ve been putting a lot of momentum behind omnichannel convenience to make it easier than ever for clients to shop with Sephora. Zappos allows us to do that,” said Graham, noting commonalities the two retailers share. “We have a shared commitment to superior customer service; we’re both really good at curating premium brands, and our focus on inclusivity is a commitment that Zappos shares as well.”

It all adds up to a dynamic landscape that is helping to fuel Sephora and beauty overall, one of the few categories in the U.S. that is growing thanks to unit sales increases rather than price increases. As to whether or not the current rate of growth is sustainable, time will tell. But Rougeot, for one, is bullish.

“Our growth in beauty today is a little bit extreme — when you see the difference between prestige beauty and electronics or apparel, the gap is quite dramatic,” he said. “I don’t know if that’s sustainable, but beauty growing faster than other categories is sustainable.

“As long as we continue to provide great new brands and trends, drive excitement, show the community that you care about them, then I think prestige beauty will grow significantly faster than mass beauty and apparel and electronics.”

For his part, Rougeot shows no signs of slowing down or letting up. Recently, the end of the day found him at a cocktail reception in San Francisco for the graduates of Sephora’s 2023 Accelerate cohort, dressed in his uniform of striped shirt, Levi’s jeans and Burberry vest, chatting animatedly first with this founder, then another.

An early riser, Rougeot said he wakes up excited to see what the day ahead will hold. “In the shower every morning I’m smiling, because I’m thinking about the three or four things I’m working on today. I’m going to have a meeting about personalization and omni where I’ll learn so much and it’s going to be super cool. That’s rare,” he said. “There is a level of passion, excitement and creativity in beauty that you literally don’t see anywhere else.”

Best of WWD