In-Seam Shines Spotlight on Menswear

In-Seam is turning its attention to menswear.

The private sourcing platform was created in 2020 by Ann Wehren, a former Seventh Avenue and retail executive, to service “connectors” such as personal shoppers, stylists and high-end salespeople and provide them with a wide assortment of luxury merchandise for their clients.

More from WWD

Richemont Confirms Long-awaited Deal to Sell YNAP to Farfetch and Alabbar Is Off the Table

Coupang to Rescue Farfetch, Injecting $500 Million Into Troubled Firm

Wehren, who worked for Forty Five Ten and Opening Ceremony during her 18-year fashion career, realized during her days in retail that 80 percent of all luxury transactions were made by 20 percent of clients, the majority of whom never actually visited the stores. Instead, they worked with salespeople or personal shoppers to select and edit the assortment and send it to them at their homes or offices.

Once the pandemic forced stores to close, Wehren had a lightbulb of an idea: create a site where these salespeople, whom she calls connectors, could continue to find the luxury brands their clients sought. She named it In-Seam.

Since its founding, In-Seam has received $2 million in seed money and created a private space where these connectors, once vetted by the company, have access to the full assortments of more than 135 luxury brands including Dior, Jil Sander, Rodarte, Altuzarra and more.

The site includes shoppable links and the connectors are paid a flat-rate commission on every sale. “They don’t work for us but we pay them a commission,” Wehren said, adding that the rate is on par with other sites.

In-Seam is working with 165 connectors and continues to add some 10 to 12 a month — all of whom have retail books worth between $1 million and $12 million, she said.

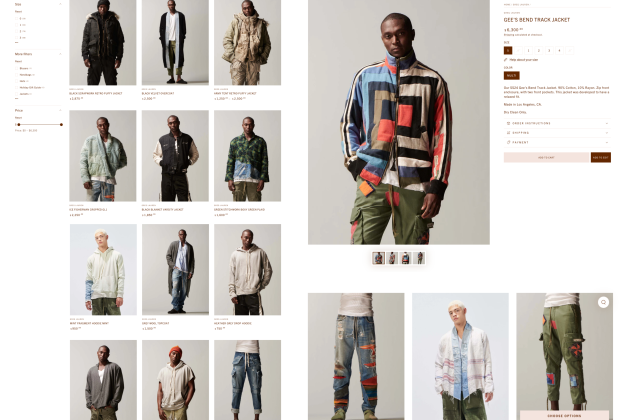

She also works with Dover Street Market, which is where much of the site’s menswear offering is housed, but this fall she teamed with menswear veteran Josh Peskowitz — a veteran of Bloomingdale’s, Magasin and Moda Operandi — to grow the roster of brands and build out a distinct men’s vertical.

Esther Min, vice president of merchandising for In-Seam, added: “Men’s is 30 percent of the global fashion market, but we’re hearing from our connectors that upwards of 50 percent of their business, or more, is fueled by men.”

Wehren said the menswear offering is broken down into two categories — classic or creative — and brands include Dior, Celine, Jil Sander, Greg Lauren, The Elder Statesman and Phipps. By the end of next year she expects to have some 40 to 50 men’s brands on the site.

So how big a business can men’s be for In-Seam?

“We expect our men’s business will be in line with the luxury market, or around 30 percent,” she said.

Right now, she said, men’s represents closer to 40 percent of the business, and Wehren believes that shows an appetite for the category. “Men are more likely to work with someone, require fewer brands and less time,” she said.

That’s not to say they’re not willing to spend. The average unit retail for menswear now is $1,250 while women’s is $1,350, she said, and the average order value is 10 times the size of competitors such as Net-a-porter and Farfetch, she claimed, so there’s lots of opportunity for growth in the future.

“Throughout my career in retail, I’ve only seen the importance of personal styling and private client shopping in menswear increase,” Peskowitz said. “Now more than ever, it’s critical for brands of all sizes to foster relationships with the connectors who drive so much full-priced retail business to their clients. In-Seam’s network of connectors is all over the country, in places where brands may not have wholesale partners or their own stores. The best part for brands is that these connectors are actively looking for newness to present to their clientele. They are predisposed to want to see new brands and new ideas which can be immensely helpful for independent brands who haven’t made inroads into all markets. It’s also great for the established brands who want to push new ideas or silhouettes. And all of this happens privately and at full-price at In-Seam, so partners are protected from additional exposure.”

The In-Seam model is different from traditional retail. The site doesn’t carry inventory but pays brands for products sold and earns revenue from those brands to launch and promote their collections. Among In-Seam’s investors are Alexandra Wilkis Wilson, formerly of Gilt Groupe and Glamsquad; Techstars; Capital Eleven; Josh Kapelman, managing director, executive vice president of Hilldun Corp.; Cris Wassner, managing director and executive vice president at Hilldun; Michele Prandi, vice president, sales at Salvatore Ferragamo, and Andrea Tocco, an executive at Staud.

Best of WWD