Run the Numbers: Nearly Half of Online Shoppers Will Only Buy on Sale This Season + More Holiday Stats

Click here to read the full article.

Run the Numbers unpacks the data that’s driving top retail trends in the industry.

It’s an unpredictable time to be a retailer — with shifting consumer spending, the United States-China trade war and a shorter-than-usual holiday shopping season among the factors impacting the all-important fourth quarter period.

More from Footwear News

Despite Trade War Fears and Economic Uncertainty, NRF Predicts Solid Rise in Holiday Spending

Is the Holiday Shopping Season Not as Important to Retailers as Years Past?

Why Sustainability Should Be Top of Mind for Retailers This Holiday Season

But according to cloud computing firm Salesforce’s annual study on digital commerce, shoppers are still gearing up to spend, driving online revenues up 13% year over year, as total sales reach a record $136 billion in the U.S. and $768 billion across the globe.

“With six fewer days between Thanksgiving and Christmas, retailers will feel the pressure to create and fulfill demand before and after Cyber Week,” said Rob Garf, Salesforce’s VP of strategy and insights for retail and consumer goods. “A very strong digital season is ahead: Retailers that provide more personalized experiences, click-and-collect offerings and, of course, unbeatable prices will be the ones that succeed this holiday season.”

In its yearly report, the firm — which used data gathered from more than half a billion shoppers and a survey of 10,000-plus consumers — outlined four predictions that retailers should watch this upcoming season, from the best days to offer discounts to the omnichannel offerings that could lure in more shoppers.

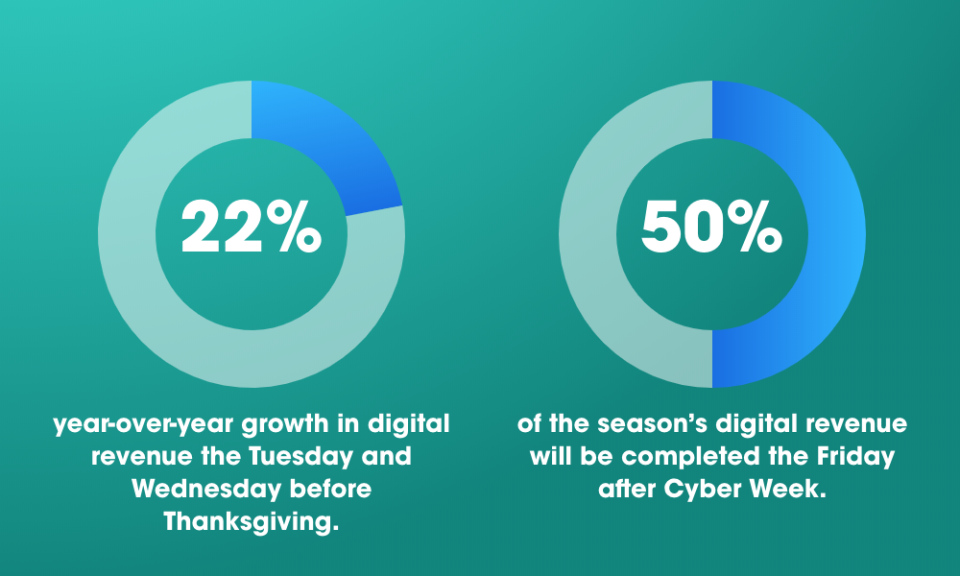

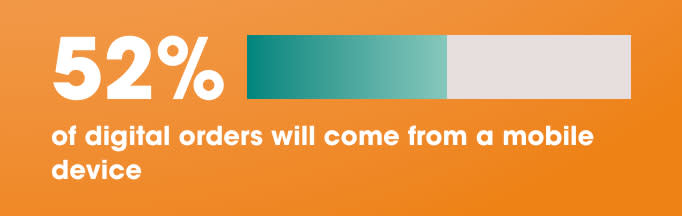

A shorter holiday season

According to Salesforce, a late start to Thanksgiving — creating a shorter overall holiday season — will force retailers to make up for lost time with exclusive product drops, artistic collaborations and special promotions. Consumers looking to take advantage of those deals will likely engage in early-bird shopping, which the firm expects to drive 19% year-over-year growth in global digital revenues. For Black Friday, online sales are forecasted at $7.3 billion in the U.S. and $39.6 billion globally, while Cyber Monday will rake in a respective $8.2 billion and $32.2 billion.

Omnichannel offerings

Retailers that have invested in omnichannel experiences are forecasted to take home more gains. One such offering that could draw in shoppers, reports Salesforce, is click-and-collect. Also known as buy online, pick-up in store, the service — which allows customers to save on shipping and returns by collecting their purchases at the local brick-and-mortar — is predicted to draw in 48% more active digital shoppers compared with retailers that don’t have the option. (The firm defines “active shoppers” as those who create baskets, begin checkouts and perform site searches or similar activities.) Brick-and-mortar retail still remains an important purchasing channel to consumers, with 83% of shoppers predicted to shop in a physical store this season — creating both incremental spending that can benefit retailers as well as providing convenience for shoppers.

Emerging platforms

Further, nearly one in 10 online buys are made on emerging channels such as social media, messaging platforms and voice-enabled devices. Salesforce defines this category as the “edge” of brand and retailer properties, with Gen Zers 3.5 times more likely than baby boomers to use such purchase points. As Gen Z continues to grow its spending power and influence older generations, Salesforce forecasts social buying to see the double-digit growth this season. (More than a third of Gen Z respondents said Instagram was their preferred source for holiday shopping inspiration.)

Deals, deals, deals

Lastly (and unsurprisingly), the holidays are predicted to usher in significant discounts on merchandise — and customers expect no less. According to Salesforce, 47% of shoppers have indicated that they would only buy items on sale this season. They added that markdowns and promo codes are the No. 1 factor influencing their purchasing decisions, with two-thirds keeping an eye out for promotional emails that tout enticing deals. For this reason, the firm finds that Cyber Monday will be the best day of the year for online retailers and customers looking to score major digital discounts.

Want more?

Run the Numbers: Less Than Half of Americans Will Buy a Product That Costs More Due to Tariffs

Run the Numbers: Retailers Are Raising Wages for Seasonal Workers Amid Labor Shortage

Run the Numbers: Walmart Poised to See Gains Following Changes to Gun Policy

Best of Footwear News

Sign up for FN's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.