Year in Review: Next-Gen Materials Attract Investment

Over the past 10 years, $3 billion has been invested into next-generation materials, the Material Innovation Initiative (MII) found, with more than $455 million of that raised in 2022 alone.

However, embedding these materials into the supply chain remains difficult.

More from Sourcing Journal

Renewcell—who has partnerships with global brands like Levi’s and Inditex—plans to reach full capacity by 2024. Yet, the Swedish textile-to-textile recycler cited a slowdown in sales to fiber producers for its cellulose pulp fibers. Over the summer, Bolt Threads ceased production of its Mylo mycelium material due to its inability to scale despite being “devastatingly close” to commercial viability, CEO Dan Widmaier told Vogue Business.

Despite scale and adoption challenges, investments are still flowing into material innovation. Here are the top funding rounds 2023 saw.

Fairbrics

French material innovator Fairbrics secured 22 million euros (more than $23 million) in funding to scale its alternative polyester business in January. The European Union’s Horizon 2020 Research & Innovation Program led the round, contributing 17 million euros (over $18 million), while the Partners to the Technology Upscaling brought 5 million euros to the table.

The combined funds will be used to upscale Fairbric’s technology, which captures and recycles CO2 waste fumes from chemical plants, starting with a pilot line of 100kg per day in 2024, followed by 1 ton daily at its demo plant by 2026.

“By using CO2 emissions instead of fossil resources to manufacture polyester, Fairbrics addresses one of the greatest global challenge, climate change caused greenhouse gas (GHG) emission,” Fairbrics CEO and co-founder Benoît Illy said. “This funding comes as a strong recognition of the work Fairbrics has accomplished so far, the quality of the consortium we brought together, and the extraordinary potential of our technology to provide highly polluting industries like textile with an alternate environment-friendly and economically viable solution.”

Kintra Fibers

In April, biodegradable polyester startup Kintra Fibers raised an $8 million Series A funding round led by the H&M Group. The Brooklyn-based materials science company also saw participation from Bestseller Invest FWD, Fashion for Good, New York Ventures, Tech Council Ventures and FAB Ventures. Atlantic Records chairman and CEO Craig Kallman, RXBar cofounder Jared Smith, and Parade founder and CEO Cami Téllez were some of the round’s angel investors.

Kintra’s founding CEO, Billy McCall, said the startup will use the funding and partner support to “accelerate our research and development and our scaling timeline, with real-time feedback on our product from brands and their manufacturing partners.”

With 551 pounds of resin produced in a pilot line, Kintra is using the new backing to expand to a commercial facility capable of producing hundreds of tons of resin. The company plans to produce its first ton of resin this year on the road to commercial scale.

Carbonwave

Carbonwave, a developer of regenerative, plant-based advanced biomaterials from seaweed closed a $5 million Series A funding round in April. Mirova, a Natixis Investment Managers affiliate focused on sustainable investment, led the round. Viridios Capital, Popular Impact Fund and Katapult Ocean also participated.

The seaweed bloom upcycler has raised $12 million to date. This investment will help build large-scale cosmetics emulsifier production facilities in Puerto Rico, where its current R&D facility has developed a soon-to-launch leather alternative from the floating Sargassum seaweed masses.

“In three short years, we’ve become the first company to build a scalable cascading biorefinery to create a commercially sustainable operation harnessing Sargassum into high-value products,” Geoff Chapin, cofounder and CEO of Carbonwave, said. “We are producing viable alternatives that redirect demand from fossil fuel-based products by cost-effectively developing a wide range of regenerative, low-carbon and plant-based alternatives that global industries are seeking to advance their sustainability and decarbonization initiatives while contributing to the bio-circular economy.”

Werewool

In May, Werewool, a New York-based developer of sustainable performance fibers, raised $3.7 million in seed funding. The round was led by venture capitalist companies Material Impact and Sofinnova Partners. The funds will enable the biodegradable fiber producers to develop its first product—protein fibers that can be spun into yarn—as well as expand manufacturing capabilities and grow the team.

“Our mission as a company is to make the fashion industry compatible with nature,” Chui-Lian Lee, Werewool’s co-founder and CEO, said. “Our goal is for our fibers to decompose into nutrient for a healthier ecosystem.”

Werewool fibers have the potential to help eliminate the need for petroleum-based materials, which caught Sofinnova Partners’ eye.

“We believe that biology will play an increasingly important role in the future of clothing and are excited to partner with Werewool in their mission to bring sustainable and biodegradable fibers to market,” Michael Krel, partner at the sustainability-focused European venture capital firm, said.

Ecovative

Mycelium technology company Ecovative announced the initial closing of a Series E funding round of over $30 million in June. Viking Global Investors led the round, which included Standard Investments, Footprint Coalition and AiiM Partners, bringing Ecovative’s total raise to $120 million.

“It’s amazing what mushrooms can do. Ecovative has shown mycelium’s potential across industries, demonstrated product-market fits that are already addressing the needs of the Earth,” Jon Schulhof, managing partner at Footprint Coalition Ventures, said. “And this is just the beginning, with huge addressable markets and the potential to make real, lasting change for circular manufacturing.”

While Ecovative’s previous funding round ($60 million in March 2021) was used to construct the world’s largest mycelium farm, this round is focused on funding the manufacturing and distribution of the New York-based firm’s Forager Foams and Hides for use in finished consumer goods like handbags, apparel and footwear.

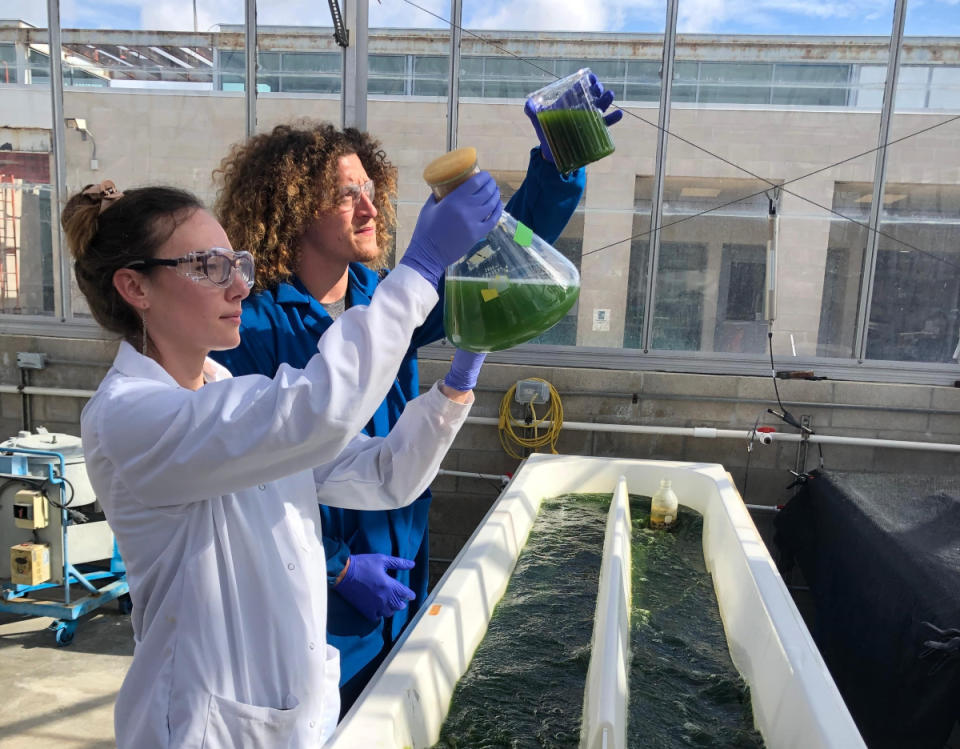

Algenesis

Plant-based materials science company Algensis raised $5 million in a funding round led by First Bright Ventures and Circulate Capital and others.

The company, which produced bio-based plastics from plants and algae, will use the funding to expand its Soleic bioPU material—a renewable, biodegradable and compostable alternative to polyurethane—into breathable, waterproof textiles as well as injection-molded products. The company also plans to strengthen its supply chain by bringing more of its processes in-house and to scale production and commercialization.

“We invest in industrial bio-manufacturing and Algenesis is an excellent representation of new companies creating a highly demanded product, such as bioPU, that comes from biology versus petroleum,” said First Bright Ventures founder Veronica Wu. “To save our planet and ourselves, we must move away from petroleum-based plastics and toward bio-based alternatives. Algenesis is clearly at the forefront of making this possible.”

Cambrium

In November, biology startup Cambrium secured 8 million euros, approximately $9.5 million, in seed funding from Essential Capital, SNR, Valor Equity Partners and HOF Capital.

The Berlin-based company processes novel molecules with unseen abilities through a technology platform that combines biology with machine learning to create alternative materials made without petrochemicals or animal-based elements. Its first molecular ingredient, NovaCell, is a micro-molecular, 100-percent skin-identical collagen designed for skin-care products.

The seed funding will translate NovaCell’s early success into impact by scaling manufacturing and commercial activities toward full replacement of the traditional animal-derived collagen currently on the market. Cambrium will also use the funds to accelerate its product pipeline, introducing molecules for new industries and applications over the next two years.

“The marriage of synthetic biology and AI is rewriting the playbook for molecular innovation,” said Ron Zori, Essential Capital, which led the funding round. “Cambrium is leading the way in this broader shift to reinvent the building blocks of industry, one molecule at a time. We believe their computational biology platform, as demonstrated by the rapid development and launch of NovaColl has the ability to repeatedly translate scientific innovation into high-performance, sustainable molecules supporting a variety of sectors, and we’re thrilled to be part of this journey.”

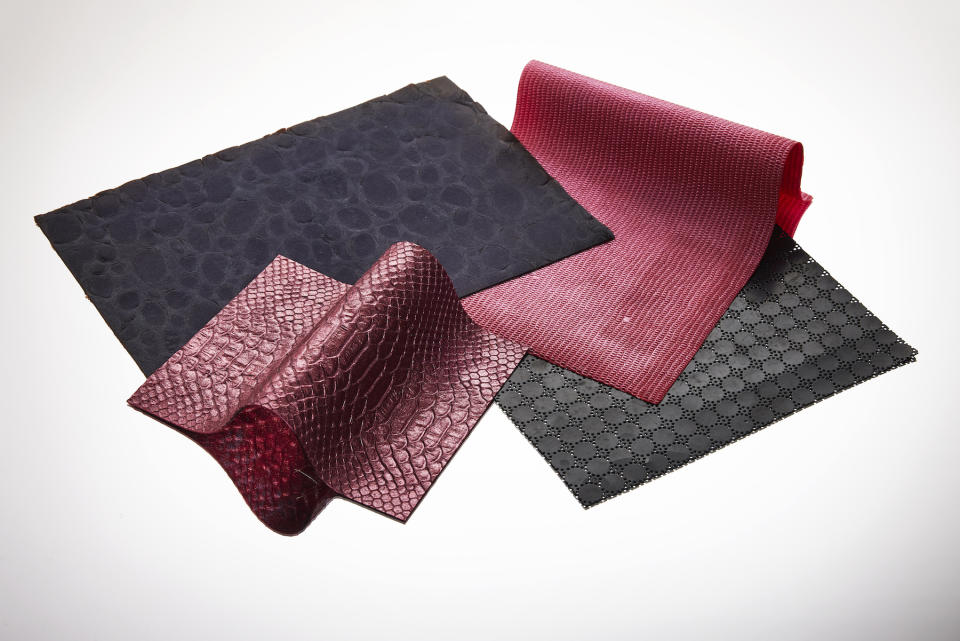

TômTex

Sustainable biomaterial producer TômTex closed a $2.25 million seed round, bringing its total raise to $4.15 million, in November. Spearheaded by founder Uyen Tran, global venture capital firm Happiness Capital led the round. SOSV, Parley for the Oceans, Earth Ventures and MIH Capital, both climate-tech venture firms, also participated.

“I am excited about our recent fundraising success, which will fuel TômTex’s team growth, key hires and expanded manufacturing,” Tran said. “Beyond scaling, it’s a strategic step to secure new contracts and revenue, strengthening our market position.”

Three-year-old TômTex creates proprietary, 100 percent naturally biodegradable materials, including the Series WS, made from shell seafood waste, and the new Series M, made from mushrooms. Both materials utilize raw chitosan, a biopolymer found in seafood shells and mushrooms. TômTex mixes chitosan with other green ingredients using a 100 percent sustainable chemical process.

“[TômTex’s] biomaterial technology is a game-changer, not just for its viability in the market but also for its sustainability,” Eric Ng, general partner at Happiness Central, said. “Investing in TômTex means investing in a scalable platform that has the potential to revolutionize industries while making a positive impact on our planet.”