The Rack Attack

Nordstrom Rack has been underperforming for a few years, mistakes were made, but there’s plenty happening in an all-out effort to right the ship.

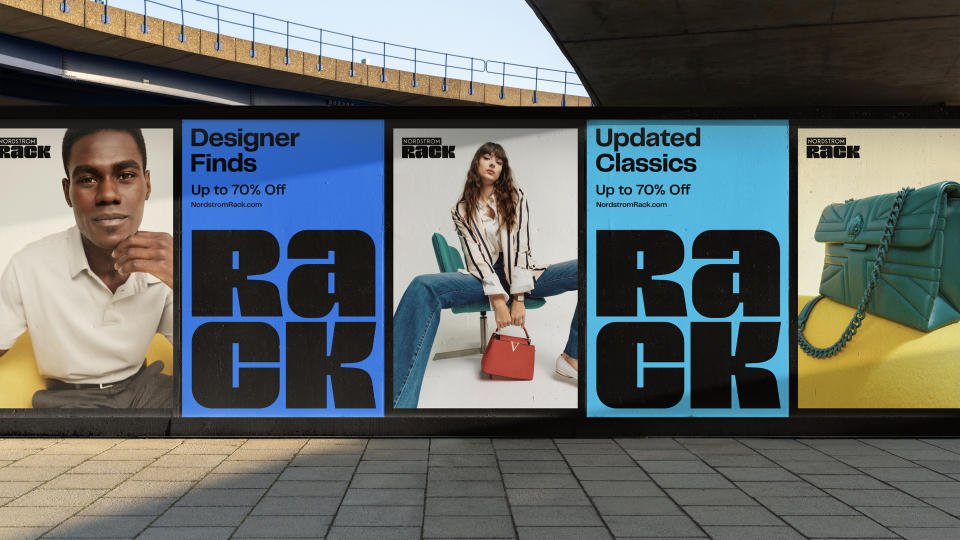

Underscoring they remain undeterred about the future of the $4.8 billion Rack off-price operation, Nordstrom executives told WWD that 20 Rack stores are opening in nine states this year. They also said that Rack is rebranding with a new logo, ads and messaging that makes a clearer connection to the upscale Nordstrom name and better communicates the proposition “great brands at great prices.” And executives are promising that shoppers will see more of their favorite brands — those sold at Nordstrom department stores — filter into Rack stores and website at Rack discounts, generally a third to 70 percent off regular prices. Lately, among the brands being advertised are Adidas, Madewell, Kate Spade, Vince, Cole Haan, MAC, Sam Edelman and Levi’s. You can also find items at Rack from such brands as Paige, Boss, Tommy Bahama, Topshop, Lucky, Joe’s, Rag & Bone, Theory and Akris Punto.

More from WWD

“This year is a pivotal year for us because we’ve been working to get Rack back on track,” Jamie Nordstrom, chief stores officer at Nordstrom Inc., told WWD.

“We see a tremendous opportunity to add a lot more stores in the U.S., both within markets where we already do a lot of business, but in locations that are more convenient for our customers. We are actively out in the market looking for new locations because we think we have a long runway ahead of us in the coming years to continue to expand.”

Rack is remaking its product mix by prioritizing 50 well-known and productive brands sold at the Nordstrom full-price banner. Executives expect Rack will have a strong assortment in place by mid 2023.

Ninety percent of the top 50 brands at Nordstrom are also carried at Rack. While these brands accounted for half of Rack sales in 2022, they make up 60 percent of what’s been ordered for the first half of ’23. For 2024, they will comprise 60 percent of what’s ordered for the first half, according to the executives.

Rack does manufacture “a fair amount of merchandise,” for its stores, Nordstrom said, without indicating how much of Rack’s assortment is specifically manufactured for the business and how much is from Nordstrom department stores and Nordstrom.com. “When we see voids, we will have product made. The focus is on quality and value, not just can I make that shirt cheaper. But we are more focused on closeouts — transfers from our full-price department stores,” the executive said.

The last time Rack expanded significantly with brick-and-mortar was when 27 stores opened in 2015. At the end of the fourth quarter of 2022, there were 241 Rack stores in the U.S., as well as seven in Canada, which will be closed by June. Nordstrom’s six department stores in Canada are also closing.

“Being in growth mode is a very helpful thing for a business,” said Nordstrom. “You’ve got more people focused on the business. You’re a bigger deal with the vendor community. You attract better talent and it just creates an energy and an engine on the business that makes the comp-store sales and everything better. Everything gets better when you are growing.”

Rack’s fourth-quarter sales were down 8.1 percent from the year-ago quarter, though for all of 2022 sales were up 1.1 percent to $4.8 billion from $4.76 billion in 2021.

About two years ago, as business was faltering, the company undertook a thorough analysis of Rack and came up with a strategy to retrieve more merchandise from top brands, increasing the delivery flow, increasing pack-and-hold merchandise, and strengthening brand awareness.

“Two, three years back, we made some strategic bets that didn’t pan out. And in retrospect, we lost sight of what is most important to our customers, which is great brands at great prices,” said Nordstrom. “There were some well-intended efforts to attract different customers with different price strategies,” including lower prices. “What we learned was, customers come to a Nordstrom Rack store for brands. They come for great brands. And primarily, it’s the brands that they see in a Nordstrom full-line store.

“They’re not coming to a Nordstrom Rack store with a kind of a ‘price first’ mentality. They’re looking for their favorite brands. They’re looking for great prices, and we got away from that. Pure and simple. We did not deliver on that brand promise to customers.

“We tried some things that didn’t work and went into it eyes wide open. But anytime you try something that doesn’t work, there’s value in it — you learn what does work. And I think it just reinforced what we always knew to be true.

“Every once in awhile you have to monkey with things a little bit. We were trying to figure out what our next stage of growth would be with Rack. We had just come off of seven, eight years of dramatic growth, comp store growth, and also opening a lot of stores.”

By 2018, the Nordstroms put a hold on Rack store openings, thinking that the world didn’t need a lot more stores as everyone began shopping online more and digital was soaring. “That was where our focus was going to be,” Nordstrom said.

Now the focus is back to brick-and-mortar. Launching 20 Rack stores this year is part of Nordstrom Inc.’s overarching two-year-old “Closer to You” strategy, which advocates bringing conveniences to consumers, such as offering pickups and returns of online orders at Rack and Nordstrom stores, or at the Nordstrom Local service hubs, as well as opening Rack stores closer to where people live and work.

“People are willing to drive across town for a great shopping center, a great shopping experience,” said Nordstrom. “In off-price, there’s clear data out there that customers won’t drive more than 15 minutes. Which means location is really, really important in the off-price world. So if you can operate a store closer to where you know a lot of your customers are, you’re going to be a better solution for them. And we’re going to see those customers come in a lot more often…T.J. Maxx has somewhere around 3,000 stores, but I think they have been very disciplined about being that convenient option for customers. That’s why we see a lot of opportunity.”

While the company hasn’t set a cap on how many stores Rack could ultimately operate, Nordstrom agreed that it was realistic 20 stores could open annually over the next few years. “By the latter half of this year we’ll have a better idea of what the next couple of years look like.”

Asked what would be the preferred venues for Rack, Nordstrom said, “It’s locations providing convenience, that regional power center, those strip malls. Some of our most productive stores share a parking lot with Whole Foods. There are shopping centers that are hyper-convenient hybrid locations for where people live. And if you get the right mix of retailers in there, those are great spots. And there’s a lot of them out there.”

In appearance, the next wave of Rack stores won’t be much different from the old ones. Stores don’t have a lot of bells and whistles and are not expensive to open. “Probably that last 50 stores that we opened are going to look pretty similar to the next 50 stores in terms of layout, look and feel,” Nordstrom said. However, Nordstrom said that the branding has changed, so the ads, graphics and signs are different.

With the all-important merchandise initiatives, “We’re still in that transition mode,” Nordstrom said. “I think every day you walk into one of our stores, it’s going to look better and better and better in terms of the brand assortment, the quantities and the values. That is a big focus. But again, we know what’s made us successful in the past in terms of assortment quantity and the turns we need. You want that customer to see something new every time they come in for their favorite brand. It’s a rich recipe to pull that off. We got away from it. This year, we’re getting back to it.”

To expedite changes, Rack has beefed up its management, becoming less centralized with other Nordstrom Inc. units, with some of the Rack newcomers veterans of other off-pricers. Key Rack players added in recent months have been Nancy Mair, senior vice president, merchandising, formerly with Burlington; Stacy Lippa, vice president, supply chain, formerly with Five Below, and Carl Jenkins, senior vice president, overseeing the stores. They are all new positions. Also, Kelly Wotton-Gantner became vice president and divisional merchandise manager. She had been a Nordstrom senior director of merchandise, and earlier worked at Macy’s Backstage, TJX, Beall’s, and Bob’s Stores.

“If you go back 10 years ago, Rack was a separate business unit from our full-line stores. At the same time, Nordstrom.com was a separate business unit. We saw opportunities to get better outcomes if we broke down some of those silos and we got a lot of benefits,” which in effect involved some degree of centralizing functions. “I wouldn’t say we went too far with it. We had to break all the silos down to find out where the value of the focus actually comes from. So we’ve added some of those [roles] back in.”

In another change, Rack stores had been fulfilling Rack.com orders. That’s been put on hold, but is expected to be revived as RFID is rolled out.

“We are rolling out RFID company-wide this year,” said Nordstrom. “By the end of this year, every building in our company will be RFID-enabled. All of our merchandise will have RFID tags. That will open the door for a lot of capabilities like filling orders out of Rack stores, but also a lot of other things that you can do just in terms of inventory efficiency and tracking and reporting. It’s about ‘findability’ and accuracy.”

Asked what sets Rack apart from other off-pricers, Nordstrom replied: “Our value proposition is providing the same brands that you would see in a Nordstrom full-line store. Brands want to be with other great brands. Within the off-price world, we think we provide the best solution for that, at scale. But we’ve also got to do our part in being good partners with the brands. That means having the right amount of inventory and ordering at the right time. We see a lot of opportunity to do a better job at that. We’ve not done a very good job on that over the last few years, and our results reflected that. This year, we’re getting back to that.

“There’s been nothing worse than when we ordered a bunch of inventory, and then we realized we got too much and we have to call the vendor and say, ‘We can’t take any more. You gotta cancel that order.’ Our inventory grew faster than sales in 2022. We have fixed that. And we are building that inventory back with the right assortment. That’s going to play out over the next couple of quarters.”

Rack’s sweet spot is in the contemporary market. “It’s probably our biggest opportunity. It’s what our customers come to us for,” said Nordstrom. “We’re an authority in that part of the market and we see that as a place where we need to really win. I don’t think we’ve done a good job on that last few years. Designer is not as big of a deal for Rack. True designer is not where our focus is.”

Nordstrom also said that Rack has been growing its home business. “We see that as an opportunity.” In addition, Rack recently launched prestige beauty, at full price, with plenty of smaller travel-size items.

Rack’s rebranding, developed in partnership with global branding agency Jones Knowles Ritchie, aims to further differentiate the chain in the highly competitive and loud off-price retail market, and better broadcast the Nordstrom connection. The rebranding is evident on Rack’s website, app, marketing campaigns, on store signs, on social media, and in email communications.

“When you look at the logo, you see something that is both bold but there’s also a friendliness, a bit of familiarity with the font style. It’s a very deliberate balance,” said Red Godfrey, vice president of creative at Nordstrom Inc.

“The new logo is inspired by the Rack logo from the ’70s and ’80s and modernized. The Nordstrom name sits atop the Rack name like an eyebrow, and as the Rack logo gets smaller, depending on whether it’s on a shopping bag, or in an ad, that Nordstrom eyebrow can stretch over two, three or four letters of Rack. So it’s an interesting thing to have Nordstrom be louder, or the ability for it to be louder and illegible. But at the same time create something that’s much more distinct for the Rack customer.” Also the color palette is brighter, and evolved with a set of signature blues, Godfrey noted.

Rack was launched in 1973. “The whole identity of the Rack has not been changed for about 12 years,” said Godfrey. “What we term as great brands, great prices, is super important for us. So being able to tell that story clearly and make the brands the hero is something embedded into our approach. So you’ll see that both graphically. At the end of our ads, you’ll see a list of some of those customers favorites to scroll through, just to give customers an idea of the type of brands they’ll be able to find. We’re choosing brands that we know resonate with customers, and have a good presence,” online and in stores.

Asked if the company was spending more on marketing and advertising, Godfrey replied, “In terms of our marketing, we are leaning into the Rack because it is a growth opportunity. Of course, we want to tell people that we’re opening new stores. But our marketing is becoming more and more efficient. It feels more cohesive.” With Easter just past, “We’ll be moving on to a big summer story and supporting categories around the season.”

Best of WWD