How to Properly Write a Check to Make Sure It Remains Secure

My dad was a banker when I was growing up, so he emphasized the importance of financial literacy even when my little brother and I were still at the piggy bank stage. When our elementary school started a student-run bank to teach us about saving, we were among the first ones in line to open bank accounts so our hard-won allowance money could start earning interest. I still remember how proud I felt holding my very first checkbook at the ripe old age of 10.

Decades later, my checkbook spends most of its time in my desk drawer. In the age of online bill payment systems and credit card points, I write relatively few checks these days. But when I do, I can still picture my dad leaning over my child-sized hands, showing me where to put each of the crucial bits of information to ensure it's filled out correctly. If you're like me and sometimes have to pause to remember how to write a check when it's time to pay rent, bills or other expenses, we're here to help. This step-by-step guide will ensure you don't miss any.

Before writing a check

You know what they say: An ounce of prevention is worth a pound of cure. Save yourself a headache later by first making sure you've got the funds in your account to cover the check you're writing, especially if it might be close. If your check bounces, which is what happens when there isn't enough money in your account to cover it, that can lead to penalty fees from your bank or other legal concerns.

And if you can, consider using alternate payment methods that might be greener, not to mention save you the hassle of filling out a check and reordering more when they run out. Many companies offer online bill-pay, including automatic payments so you can set it and forget it. Using a debit card instead of writing a check will also create an automatic record of your transactions, so you don't have to worry about doing that yourself.

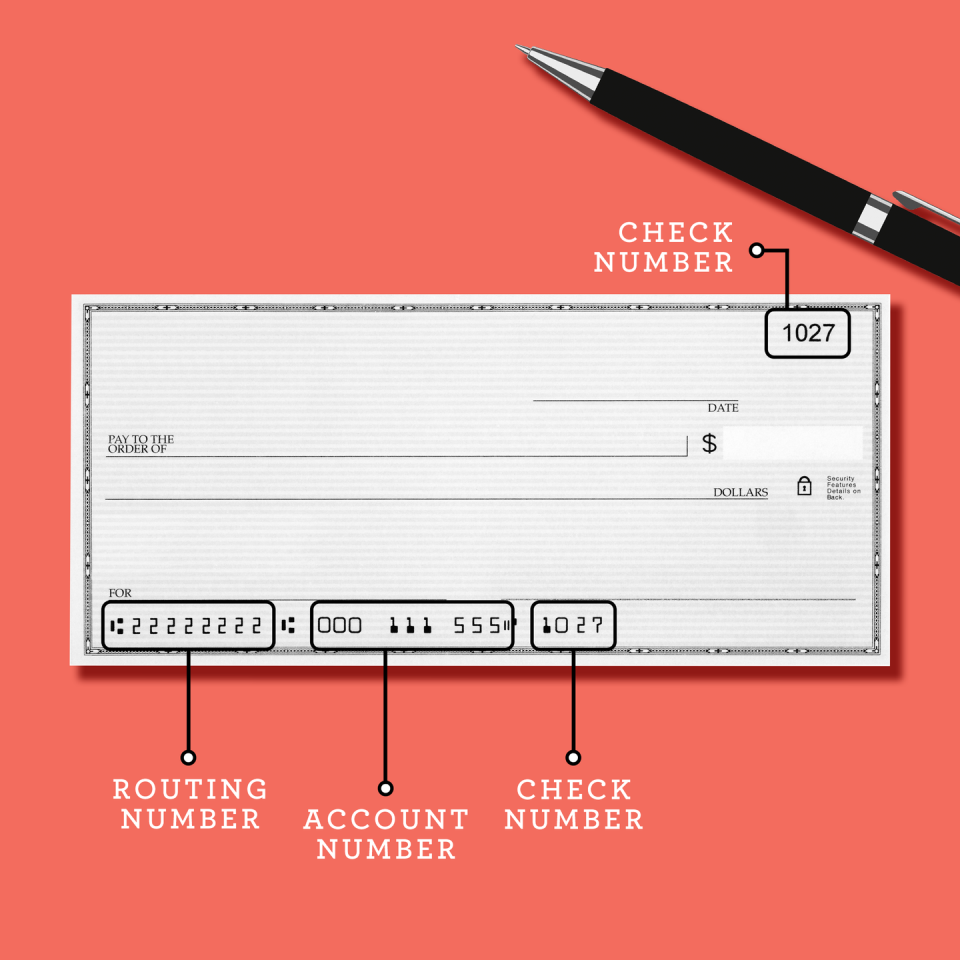

Know your numbers

When you're looking at a check, there are a few numbers you'll need to know. These are important because they indicate which check you're writing so you can keep track of it, as well as the account it's coming from and the bank where it's held.

Bank routing number. This is the unique identification number for your bank. It's also the number you'll be asked for if you're using online bill pay when they ask for the routing number.

Account number. This is your individual checking account.

Check number. This one indicates which check you're using. You'll want to record this in the check registry (more on that later) so you know which checks you're using for which transactions.

How to write a check

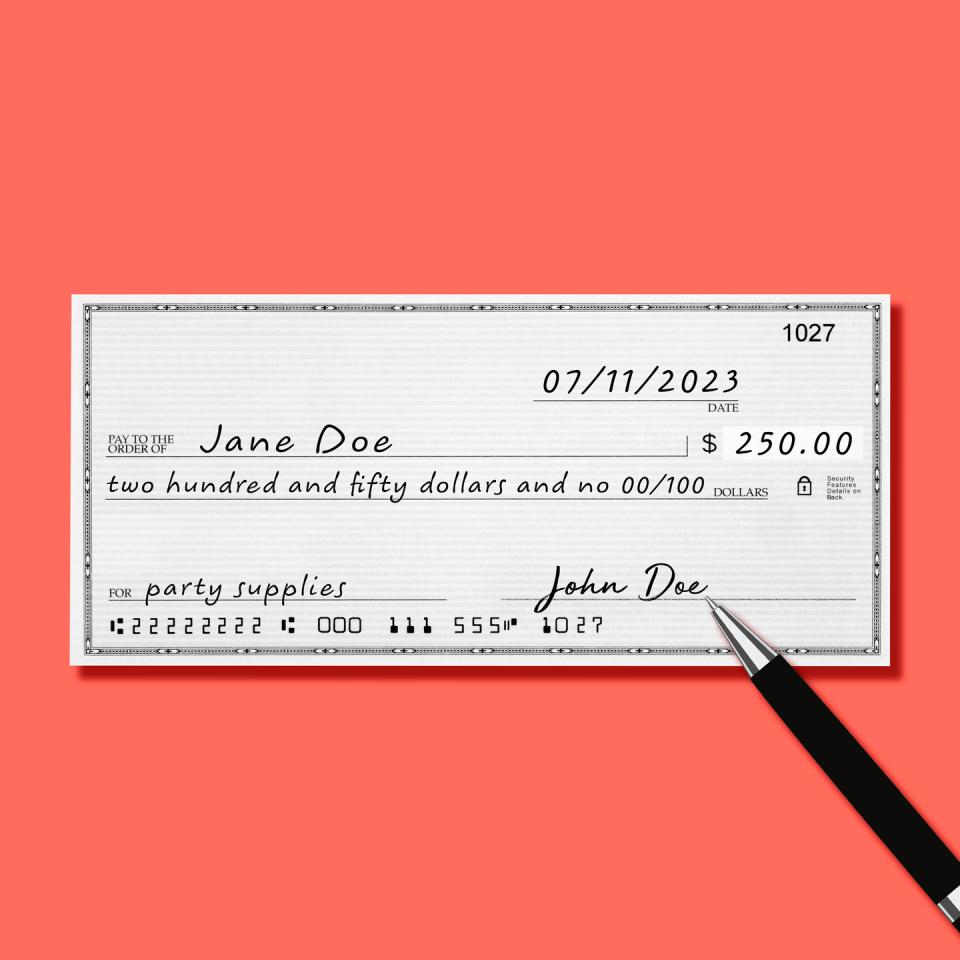

When you're filling out a check — in pen, don't forget! — take care to use each field correctly so you don't have to start over and waste checks. Always write legibly and use both numbers and letters where indicated, so there's no question about how much you want your bank to take out of your account and who it's going to.

Here's where everything goes.

Date. Put the date you're writing the check in the field in the upper right corner. That will tell the person who's receiving it when you wrote it. If you need to postdate a check, write in a future date that will indicate when it can be cashed. You may need to do this if you're sending a check earlier than when it's due and you don't have the funds to cover it at the exact moment, or just don't want the money taken out until it's time.

Payee. Next to where it says "pay to the order of," write the name of the person or business that will receive the check.

Check amount (numerical). Here's where you write the amount the check is for in digit form. Fill the entire box so no one can add extra numbers and increase the amount the check is for. For example, if you're writing a check for $250, you can write $250.00 to fill the entire box and make sure there's no confusion about the exact amount.

Check amount (text). Below the payee line and to the left of where it says "dollars," write out the amount the check is for in words. Writing it out in both words and numerals ensures there's no confusion over the amount. You want to fill in the entire line here, too. If you're writing a check for $250, you'd write, "two hundred and fifty and 00/100." Instead of writing out cents, you would put the cent amount slash 100. In that case, if you're writing a check for $15.50, you'd write, "fifteen and 15/100." The "dollars" part is already printed on the check so no need to write that out.

Memo. This is where you write what the check is for. It's not legally required, but will help you track your check if there are any issues. Get as detailed as will be helpful for your own records.

Signature. Finally, sign your check on the line in the bottom right corner to indicate you agree to pay the amount above to the person or company you've designated to receive it. The check isn't valid until you sign it, so don't forget this step.

Record your check

After you've written your check, it's a good idea to record it in your check register. You can use the register that comes with your checks, a spreadsheet or any other method that works for your money management system.

Your records should include:

Check number

Date the check was written

Payee, or who you wrote it to

Amount

A memo detailing what the check was for

Tips for writing checks

Both before and after you write a check, it's important to make sure it's secure so you don't fall victim to bank fraud. Here are a few tips to make sure your check is safe.

Use pen. Fill out your check in blue or black permanent ink instead of pencil. That will ensure no one can change the fields after you fill them out.

Never sign a blank check. Putting your signature on a blank check essentially gives anyone in possession of it free rein to withdraw as much money as they want. That's why we recommend only signing your check after it's totally filled out.

Void all mistakes. If you make an error, write the word "void" across the check. Then tear it up and throw it away so it can't fall into the wrong hands.

You Might Also Like