How to Get the Perfect Brows: Benefit vs. Anastasia Beverly Hills

Brows are hotter than ever in the beauty business and two brands, in particular, are battling for a large piece of the action.

According to digital research firm L2’s study “Brow Wars: The Battle for Market Share in an Emerging Category,” Benefit Cosmetics and Anastasia Beverly Hills are duking it out online for market share in the fast-growing brow category.

More from WWD

LVMH Ramps Up Métiers d'Excellence Apprenticeship in the U.S.

Benefit Cosmetics Taps Alix Earle for Limited-edition Beauty Bag

The two brands account for a third of all search results on Sephora and Ulta Beauty, as well as the first (Benefit) and second (Anastasia) most searched brands for eyebrow related inquiries on both Sephora and Ulta.

Earlier this week, The NPD Group reported that brows and lips were among the fastest-growing makeup categories during the third quarter of this year. Sales of brow related items in particular saw a 37 percent bump in sales, driven by innovation and product that made an “antiaging statement” for more mature customers.

From a brand perspective, Jane Fisher, client strategy at L2, said that while Anastasia and Benefit have been extremely successful in the space online — they’ve taken different approaches. Benefit is sticking to creating “best in class brand conten,” and Anastasia puts continued energy into its influencer relationships and content on Instagram, where the brand has 11.8 million followers.

“Rather than building online tutorials, they [Anastasia] have laser focused their strategy on cultivating those influencer relationships and then using those relationships to give the brow category an outside share of voice on their social platform,” Fisher explained.

She pointed out that 46 percent of Anastasia’s Instagram posts mention a brow product — which is higher than other brands that are leaders in the category.

The two brands might have a first mover advantage for now ‚ Anastasia Beverly Hills is often credited with sparking consumer interest in eyebrows — but other companies are starting to catch up.

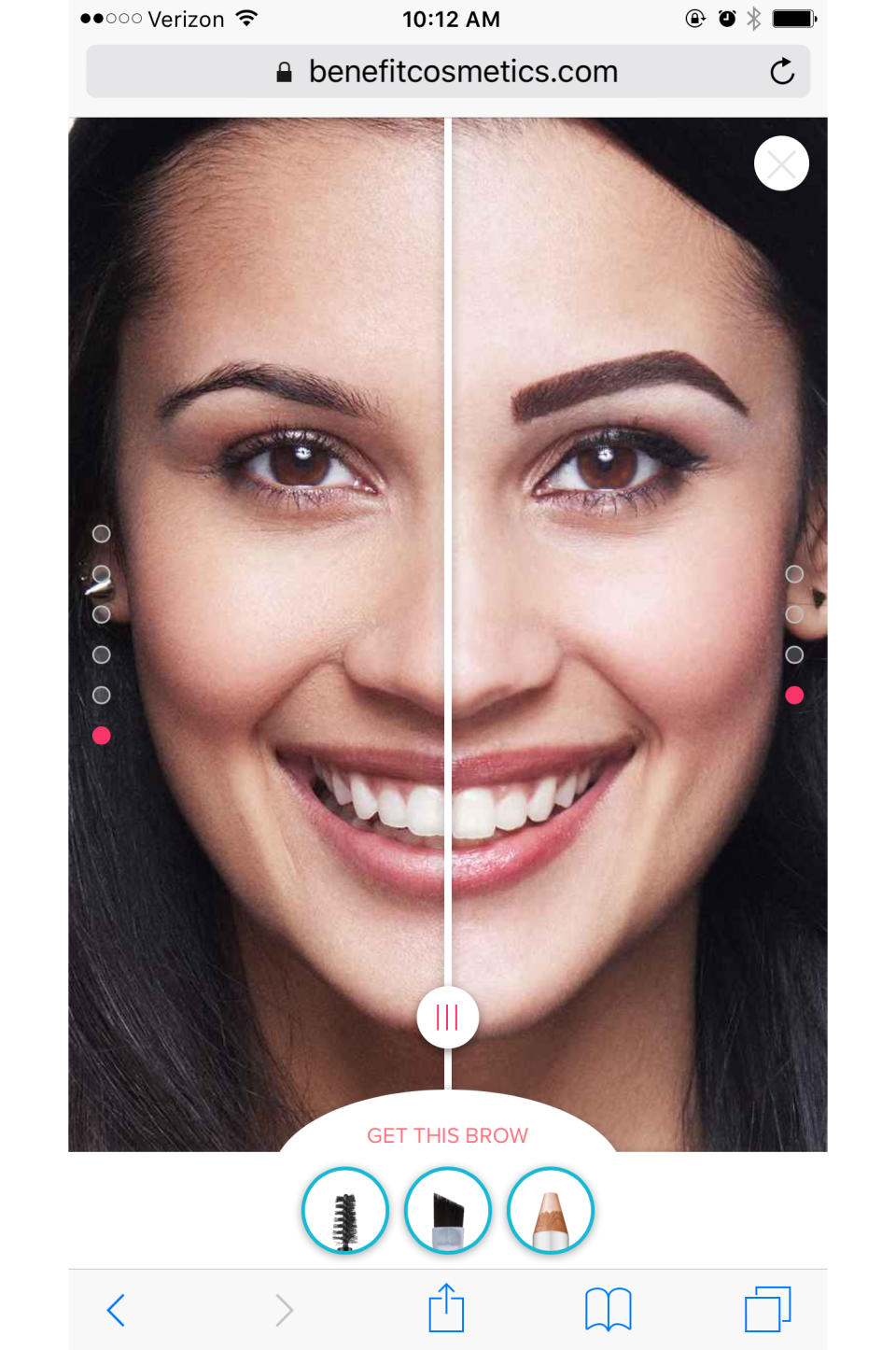

Largely, this means making brow-specific investments from Google product listing ads, or PLAs, to updating relevant product pages (this could include textural swatches of product, tutorials and before-and-after photos). For instance, Tarte has brow tutorials on-site, E.l.f. shows textural swatches and Wunder2 has capitalized on PLAs — a whitespace in the sector, Fisher said.

Courtesy Photo

Wunder2 has also capitalized on Amazon’s less crowded prestige beauty offerings, and as an official distributor on the site, the brand’s Wunderbrow has managed to become the top-selling brow product on the site.

On Amazon, newer to the scene Wunder2’s Wunderbrow has managed to secure its place as the top-selling brow product on amazon.com.

“It’s a very challenging landscape for other brands to break into the consideration set, which is part of the reason why Wunder2’s strategy was so smart. They circumvented those channels [Sephora and Ulta] basically entirely and focused on growing in a channel that was less crowded,” Fisher said, adding that the brand has been able to “deftly optimize for the Amazon platform.”

Best of WWD