Overstock Shares, Revenues Seen Lifted by Bed Bath & Beyond Rebrand

MILAN — Just days after acquiring the trusted household Bed Bath & Beyond name before it faded into oblivion, Overstock’s shares surged to an 11th-month high on Nasdaq to $32.57 Monday. Despite macro market headwinds and consumer challenges like rising inflation, analysts say that price is expected to rise further over the next year.

At the end of June, Overstock, which saw its own sales slump in 2022, won a bid for key Bed Bath & Beyond assets and closing the sale for a mere $21.5 million.

More from WWD

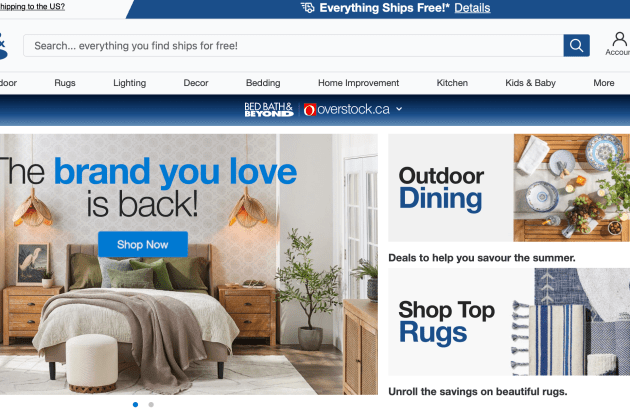

The transaction included the former juggernaut’s website, domain names, database and loyalty-program data, which means that from now on, Overstock will operate under the Bed Bath & Beyond name online and will launch the U.S. domain in August of this year. Analysts are predicting the purchase will help overall sales.

“The name has pretty high brand recognition and should drive traffic to their site, so we view it as prepaid marketing expense,” Wedbush Equity Research managing director and analyst Michael Pachter told WWD.

In 2022, Overstock posted a total net revenue of $1.9 billion, a decrease of 30 percent year-over-year. By comparison, Bed Bath & Beyond’s sales rose to $12.3 billion in 2017, slowing to $7.9 billion in 2021, hit by the in-store retail slowdown caused by the COVID-19 pandemic and the increased focus on private label goods by major players like Target. In April, Bed Bath & Beyond Inc. filed for Chapter 11 protection enabling it to wind down operations and sell off its assets following its failure to turn its business around.

Overstock.com Inc., which is now focused on home, with categories including indoor and outdoor furniture, home decor and area rugs, among other home furnishings products will now add the sort of kitchen, bedding and bath-related products for which Bed Bath & Beyond has been a destination for more than\ 30 years. The online retailer and technology company long recognized for its liquidated inventory, is already operating a Canadian dot-ca (Canadian for .com) under the resurrected Bed Bath & Beyond name.

“We have to wait and see if the customer experience is good enough to retain the BBBY customers they attract, and we expect it will be, but need to see execution and implementation first,” Pachter added. Wedbush raised its price target for its retail business Overstock.com Inc. to $34 from $26 highlighting Overstock’s pricing discipline, stable profitability and positive positioning among home goods retailers. “Overstock can potentially double its revenues over time,” Wedbush said.

Financial services firm DA Davidson echoed this raising its price target to $35 following the news, pointing out management suggested that Overstock’s accessible name had previously negatively impacted sales, especially amid a time when macro headwinds negatively affected the home category.

DA Davidson noted that the shares would likely be lifted over the next year by a rebound in the company’s home e-commerce business.

DA Davidson senior research analyst Tom Forte underscored the meaning of the Bed Bath & Beyond name and said that a boost to sales and profitability are likely on the horizon.

“While management has historically done a very good job running its e-commerce business, the Overstock brand was, likely, negatively impacting its sales. Many consumers may not have understood and appreciated that for some time it has been offering new, full-priced merchandise and it has not served as a liquidator since the early days of dot-com.”

Industry-wide, U.S. players are readjusting their strategies to compete amid trying times, amping up their online capabilities amid the brick-and-mortar downturn. In terms of direct peers, the closure of Bed Bath & Beyond’s physical stores, presented an opportunity for off-price homeware chain players like HomeGoods, which is owned by TJX Companies group, to scoop up its faithful clients.

“This acquisition is a significant and transformative step for us,” said Overstock chief executive officer Jonathan Johnson. “Bed Bath & Beyond is an iconic consumer brand, well-known in the home retail marketplace.”

Looking ahead, Johnson said that the loyalty of the Bed Bath & Beyond brand is likely to drive an improvement in the company’s customer experience and positioned the Salt Lake City, Utah-based company for “accelerated” market share growth.

Enthusiastic about the future of the rebranding, the executive said he was confident management’s ability to cash in on its new name. “I’m excited for consumers to experience the new Bed Bath and — an even bigger and better — Beyond.”

Best of WWD