Online-only savings accounts are banking's best-kept secret

Interest rates have been low for so long that there are entire generations that do not remember anything else. For savings accounts, this has meant returns, for most people, amounting to little more than a few cents a month.

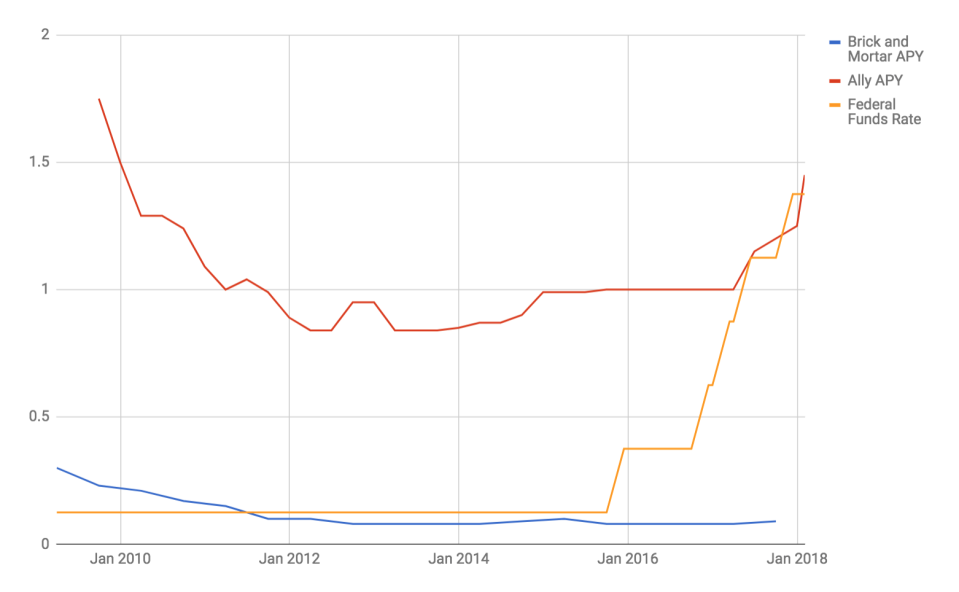

But two things could be an enormous boon for people who want to save: the increased ease of adoption of online savings accounts and the Federal Reserve’s planned rate hikes. Many online savings accounts are already paying in excess of 1.75% in interest in a world where the average brick-and-mortar savings account pays 0.09%, according to Bankrate data.

In case you don’t know, an online savings account is an FDIC-insured standard savings account from a bank that simply doesn’t have a brick-and-mortar presence. (FDIC-insured means that the government guarantees accounts up to $250,000.) Ally, CIT, American Express, Synchrony and Goldman Sachs/Marcus are popular examples. The lack of high overhead associated with a physical presence and competition with other online providers means the bank pays higher interest rates. When you don’t have a physical address, everyone is a potential customer.

Though these accounts have been around since the ’90s, a lot of people, however, don’t know about these accounts or bother with them, says Bankrate’s chief financial analyst Greg McBride, CFA.

In the highs of the last economic cycle when the Fed rate was 5.25%, some of these accounts generated some truly wild numbers for customers.

“In 2006 and 2007, we saw yields on savings accounts at over 5% and some briefly touching 6%,” McBride says.

Most people, however, were stuck with the low interest rates of traditional savings accounts. At that time, McBride says, these accounts only paid 0.46% in interest.

Taking advantage of the rates

Today, it’s easier than ever to open an online savings account and link it to your main bank for easy access. (Or use an online bank as your primary bank.)

“You’re not talking about having to change banking habits or relationships,” says McBride. “You can set accounts online in 10 minutes and link with current accounts.”

With six rate hikes already on the books since the financial crisis and more signaled, online savings accounts are proving even more why they’re a good move. People often bemoan that it takes a long time to see the trickling down of interest rate hikes in their own accounts, but these online accounts have marched up in lockstep with the Fed while traditional bank accounts hugged the zero bound.

Financial planners strongly suggest having an emergency fund for a few months of living expenses, if someone is able to save that much money, and these high-yield savings accounts are good way to avoid or mitigate the typical cost of having cash on hand: depreciation. (In the order of financial priority, having an emergency fund generally comes after paying off high-interest debt and before investing.)

If the Fed follows through and continues rate hikes, the interest rates of these online-only accounts will likely continue to rise as well, making it an even better play to stash cash for consumers.

Is there a reason not to have an online account?

“I can’t think of a good reason. Seriously. Everyone needs emergency savings and the best place is to put it somewhere you can earn returns, have liquidity, and deposit insurance,” McBride says. “Online savings accounts check all three of those boxes.”

—

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: FinanceTips[at]oath[.com].

Passive investing has changed one of the biggest retirement debates