Online Beauty Marketplaces’ Pros and Cons

PARIS — Online marketplaces are increasingly becoming de rigueur for beauty retailers in Europe.

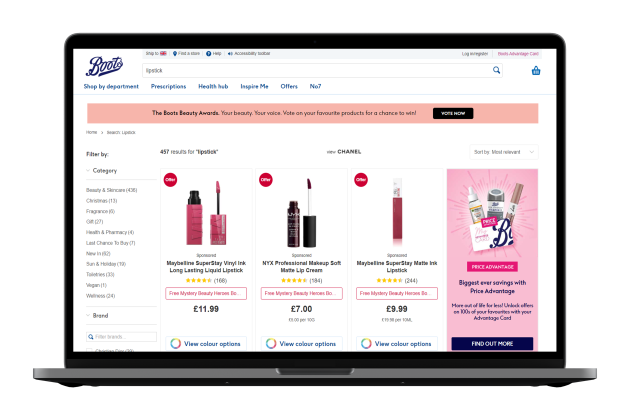

Boots, Farfetch and Douglas are among those to have recently adopted that business model involving multivendor platforms to help expand their product offer, drive volume and update image in the red-hot battle for prestige beauty shoppers today.

More from WWD

How Ana de Armas Transformed Into Marilyn Monroe in 'Blonde'

Chloe Cherry Celebrates Urban Decay Vice Lip Bond Liquid Lip Color Campaign

For beauty brands, marketplaces can give great exposure, among other benefits. But there are downsides for both parties, too.

“The reason there’s been so much interest in marketplaces, from a retailer perspective, is because they see it as a relatively inexpensive way to drive revenue and growth at a time when the demand environment is becoming a little bit more sluggish, and they need something really to pep up the results they put out,” said Neil Saunders, managing director and retail analyst at data intelligence firm GlobalData Retail. “Marketplaces are a very quick solution.”

Many retailers in and out of the beauty space look at the phenomenal success Amazon has had overall, and would like a piece of that, he said.

“The biggest benefit to the retailer is inventory they don’t need to take the risk on,” said Emily Pfeiffer, principal analyst, commerce technology at Forrester Research. “They don’t own it and don’t need to transport it, which is the most expensive and difficult thing you can do with goods. It allows them to fill out their assortment very quickly and, importantly, to sell from earlier in the supply chain right now, [when there are] so many supply chain challenges.”

The marketplace model’s upsides can be huge, but has been eschewed by the likes of Sephora, the world’ largest prestige omnichannel beauty seller.

In early September, British pharmacy and beauty chain Boots announced that the Boots Marketplace will open in spring 2023. The retailer currently carries more than 500 beauty brands in-store and online, and since 2020 has introduced approximately 70 new and cult beauty brands.

“We are really excited about the benefits a marketplace model will allow, including helping us to rapidly expand the range of brands and products that we offer on boots.com across a range of categories, including beauty, health, wellness and baby,” said Paula Bobbett, chief digital officer at Boots. “Marketplace will allow us to respond with agility to market trends with new emerging brands. We can be first to market with new products and services, and respond quickly to customer demand for new and innovative product ranges.”

Brands of any size will be allowed to list their products on boots.com. The retailer plans to take on hundreds of new labels, including established and new names.

“We expect that Boots Marketplace will complement our current product ranges on boots.com, and allow us to offer our customers additional options, including new and emerging or niche brands,” said Bobbett.

“We feel the growth in our beauty offering is going to come from offering more of the extended range via our current brands, whilst also being faster and easier to work with for the newer emerging brands,” she continued. “These smaller brands flex and update their range more frequently, and a marketplace model put the brands in control of optimising their range.”

Boots described the new platform as part of its ongoing digital strategy to explore new and diverse categories for its customers.

“Boots marketplace will also help expand our range of strong beauty adjacent categories, such as beauty tools, accessories and electrical beauty products,” said Bobbett.

Brands will be able to join the platform and, depending on how they perform, have the opportunity to be stocked in Boots’ brick-and-mortar stores.

British retail platform Farfetch in April launched a beauty marketplace with an assortment of more than 100 prestige brands. At launch that included four fragrances from Off-White, a limited assortment online from Browns Fashion and Violette Grey, the London-based luxury retailer and beauty e-tailer, respectively, which are all part of Farfetch’s stable.

The e-tailer looks to differentiate itself with a gender-neutral assortment as part of a strategy it calls “Beauty Beyond Boundaries.”

“If you think about the Farfetch business model, the innovation that José Neves came up with, back in 2008 when Farfetch launched, was exactly the idea that through technology, Farfetch could create a marketplace that would connect directly into the inventory of the brand — or the boutiques, initially — and then add the brands on to this,” said Stephanie Phair, group president at Farfetch.

Farfetch brought the concession model into the virtual realm for fashion. Its stock could be sold to people in-store or online, through the marketplace.

Farfetch tested beauty in 2016, when it teamed with SpaceNK on a limited offering available online. At that point, it tried to replicate the boutique model.

“But clearly, beauty is a very, very different category,” said Phair. “We realized that the marketplace, concession model was even more suited to beauty because the brands are trying to move from wholesale into more direct-to-consumer. They don’t have as much opportunity to do it as fashion businesses have had in the past, so Farfetch coming along and said: ‘Look, we have the experience in this. We’ve done it for fashion, we have to adapt it to the beauty category and do it in a specific way.

“Beauty is a very regionally led business,” she continued. “So we have had to do it with our own warehouse fulfilment by Farfetch, but the stock will be yours, and therefore the margins will be better.’ It was really appealing from a business-model standpoint to the brands.”

That’s a key reason why there’s more movement into the marketplace space. Another plus is that retailers can glean customer intelligence and data about brands and products.

Marketplaces also allow retailers to broaden their brand and product range, including more innovative labels.

“[Retailers] are not going to put something on a shelf, which is very limited real estate, unless they are confident it’s worth it in dollars per square foot over a certain amount of time, if it’s going to move fast enough,” said Pfeiffer. “It is much more affordable to use their digital endless aisle to bring in potentially the full catalogue, use it as a testing ground … [to] then make a more informed decision about what to do on the store shelves.”

Further, a marketplace “can make your website more of a destination,” said Saunders. “You can certainly increase traffic, and that can be helpful for the core brand.”

“As a marketplace, we cater to a number of different personas, and therefore the beauty brands are able to work with us across their entire assortment of product,” said Phair. “Beauty is very much focused on the hero product, the hero brand. But as beauty brands are trying to diversity, to open up as they’re trying to build up more hero products, that visibility into a broader assortment is incredibly valuable.”

She said a marketplace platform like Farfetch is interesting to brands, as well, since it offers a highly targeted luxury audience, which is key as privacy laws have increasingly limited brands’ ability narrow in on specific audiences online. This has helped give rise to brands wanting to advertise — with “creative solutions” — to Farfetch’s audience and new consumers.

To sell beauty, the platform worked on its technology and logistics, and brought in an ecosystem of experts.

“We couldn’t just paste beauty on top of our existing offer; we had to create something bespoke,” said Phair.

One important learning has been that when customers see both a fashion and a beauty page, Farfetch has a higher conversion than when they see just one category.

“We are acquiring new consumers through beauty,” she said.

Douglas has opened a marketplace, too. In late October 2019, the German beauty seller said it was launching an exclusive beauty partner program online in a bid to become the largest marketplace for beauty products in Europe.

At the time, Tina Müller, Douglas Group chief executive officer, said in a statement: “Platform economy is the business model of the future. With the launch of the marketplace and its partner program, we are ringing in the decisive phase of our digital transformation. Douglas is becoming a platform, which allows us to successfully consolidate ourselves as the number-one beauty destination.”

There is no one way e-tailers make money on their marketplaces. Most commonly, they will take a cut of the sale of a product or charge sellers a subscription fee for the likes of marketing, product placement or fulfilment.

Marketplaces can have correlated risks, including a possible cannibalization of products.

“It can take away sales from the core, because someone may decide that they find a product you don’t sell that they prefer – and it’s on the marketplace,” said Saunders, adding there could be overlapping products, and consumers decide to buy from the marketplace rather than a retailers’ own site. “Retailers can manage that, because they still ultimately control the marketplace.”

Another risk he underlined is the confusion marketplaces could cause consumers — about who is selling the product and can remedy problems. Searches can become confusing, as well.

“You can wind up with decision fatigue, with folks having no idea what the product they need is, which one is right for them,” said Pfeiffer. “It can impact the trust that [retailers have] built — and trust is hard to build and easy to lose.”

Careful curation must be top of mind for sellers of beauty, which is a complex category.

“The job of a good retailer is to really sift through a lot of fat and to bring the interesting things to the market and guide customers through the decision-making as to what they buy,” said Saunders. “The marketplace is, in essence, a free-for-all.”

For brands and retailers, Pfeiffer said: “It’s a loss of control for both in different ways.” When retailers outsource their fulfilment, they can also lose a hold of a large part of their customer experience.

“On the other side, a brand that sells directly to consumers is now handing off that piece of the experience to their retailers,” she added.

“A challenge of the marketplace model is ensuring the customer experience, including the returns and delivery service, meets our high standards,” continued Bobbett. “We will address this by having strict filtering in place, so that anytime customers buy or interact with Boots via our website, app and stores they will have a good and consistent experience.”

Another challenge might be the backlash that can stem from a retailer’s taking intelligence from a marketplace to bolster its own business. And due to supply chain issues these days, brands might be not be able to keep up with demand.

“Often for the brand, if they’re smart, they’re holding back some portion of inventory for their own selling channels to replenish their own stores, to sell on their own websites, for their key partners,” said Pfeiffer.

“When a consumer is most concerned with price, a marketplace might be very appealing,” she continued. “When [it] is most concerned with quality and authenticity, it may not.”

Competition is rife.

“There’s already a lot of retailers that are selling products into a marketplace,” continued Saunders. “So you’ve got to work really hard to get people to come to your site.”

In certain cases, retailers fixing their core businesses should take precedence over launching a digital marketplace, he added.

That said, the upsides to the marketplace model remain huge, and more launches are expected in the near future in the beauty space.

“Retailers will be keen to add additional strings to their bow,” said Saunders.