One troubling theme is permeating the IMF's spring meeting

WASHINGTON—Leaders from the International Monetary Fund have taken the organization’s spring 2018 meeting as an opportunity to express their dissatisfaction with the current state of the global economy and its leadership.

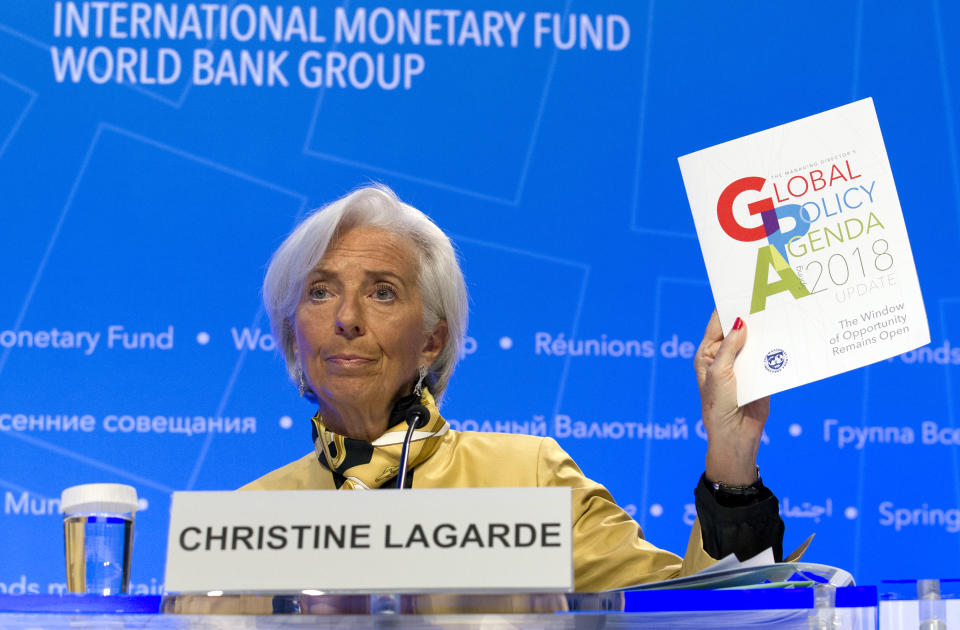

The organization’s fall 2017 Global Policy Agenda (GPA) update and the jubilation for synchronized global growth that swept through that conference just six months earlier have given way to the mendaciously hopeful warning, “The Window of Opportunity Remains Open” – the title of spring 2018’s GPA.

While U.S. President Donald Trump and his anti-trade, protectionist policies were rarely mentioned explicitly, they cast a shadow over the proceedings.

“More clouds accumulating”

IMF Managing Director Christine Lagarde opened her press conference on Thursday, telling reporters from around the world, “Near term prospects for the global economy continue to be bright. But while the sun is shining … we are seeing more clouds accumulating on the horizon.”

She continued, setting the tone for what was to come, “It is when the sun is shining that you fix the roof. Some governments have fixed the roof, but certainly not all. More needs to be done to sustain this upswing and foster long-term growth.”

Lagarde then highlighted the all-time high in global debt (now $164 trillion, or 225% of global gross domestic product), a lack of international cooperation, rising financial market volatility and elevated asset prices and growing protectionism around the world – though it was clear to everyone listening that she was referring to one country in particular: the U.S., which is the on advanced economy where the debt ratios are expected to grow.

Vincent Reinhart, chief economist at Standish Mellon Asset Management, a subsidiary of BNY Mellon, said ahead of the meeting’s start that he was expecting the optimism from October’s meetings to carry-over.

“Definitely in the fall that was the beginning of the talk about synchronous expansion and by the time the meeting was over people were pretty giddy,” he said. “I think the risk coming out of this meeting is they don’t emphasize enough that this is the good time when you’re supposed to be preparing for the rainy day.”

Instead, the rainy day was just about all officials talked about.

Lagarde’s deputy at the IMF, David Lipton, painted an even bleaker picture in a later session in which he, often without being asked, spoke at length about the decentralization of trust and lack of faith in national and international institutions, the displacement of workers, world leaders’ lack of weapons to take on the next financial crisis and many other maladies.

“I would say that the problem is that if the next big economic downturn is somehow harsh and involves failures because of debt stress it may well be that countries have much less room for maneuvering or dealing with the problem,” he said during his hourlong session.

Asked if there was anything else “blinking red” as a warning that he wanted to point out before taking questions, Lipton was silent for 5 seconds then replied, “Not really.”

On a scale of 1-10, experts give the U.S. a 5.75, 6, and 6.5

There seemed to be general agreement that economic fundamentals remain strong, as the IMF’s recently released growth projections showed global growth rising to 3.9% in 2018 from last year’s estimate of 3.7%, and the U.S. rising to 2.9% growth this year from expectations of 2.7% growth.

In October, that would have been the focus of comments from officials, economists and finance experts. This year, it seems to be all about what could go wrong and how the rally may be unsustainable.

“There’s a lot of momentum, there’s a lot of demand [currently] and I think the worries still are about how do we sustain growth over the medium and long run, not how do we get growth this year,” Jason Furman, a professor at Harvard University’s Kennedy School of Government and a former chairman of the Council of Economic Advisers, told Yahoo Finance on the sidelines of the meeting.

Furman participated in a panel on the U.S. economic outlook with fellow economists Jared Bernstein, of the Center on Budget and Policy Priorities; Doug Holtz-Eakin, of the American Action Forum; and John Taylor, a professor at Stanford University who was on the short list of Trump’s choices to lead the Federal Reserve. When asked to grade the U.S. economy today on a scale of 1-10 the group’s grades were 6, 6.5 and 5.75, with Taylor abstaining, saying he was “more optimistic going forward.”

Holtz-Eakin, who served in the administration of President George H.W. Bush and on the campaign of Sen. John McCain in 2008, and Taylor, George W. Bush’s first Treasury Secretary, both said they approved of the new direction the Trump administration had pushed the economy with deregulation and the recently enacted tax cuts, but professed having worries – Taylor about continued underwhelming growth and the increasing budget deficit and Holtz-Eakin about the administration’s immigration stance and trade policy.

At the IMF’s opening press conference, one of Lagarde’s responses seemed to be a directly aimed at the American president. Answering the very first question from a reporter with China Central Television who asked how the IMF felt about “protectionist action started by the U.S. having intensified tensions with its trading partners, including China,” Lagarde seemed to release a bit of frustration.

“As I told you in the very beginning, growth is currently being driven by more investment than we have seen in the previous years and more trade,” she said. “So why damage those two engines that are effectively working for growth?”

More from the IMF/World Bank meetings:

It will take ‘trillions of dollars’ to fix the world’s education problem

World Bank issues first-ever poverty bond, gets $1.5 billion

IMF’s Lagarde ‘very pleased’ and ‘supportive’ of Trump’s tax cut

Breaking up tech giants like Facebook and Amazon isn’t the answer, says IMF’s Lagarde

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.