These Next-Gen Materials Are Wooing Investors and U.S. Shoppers, Report Finds

Next-gen materials are finding their market with both investors and consumers.

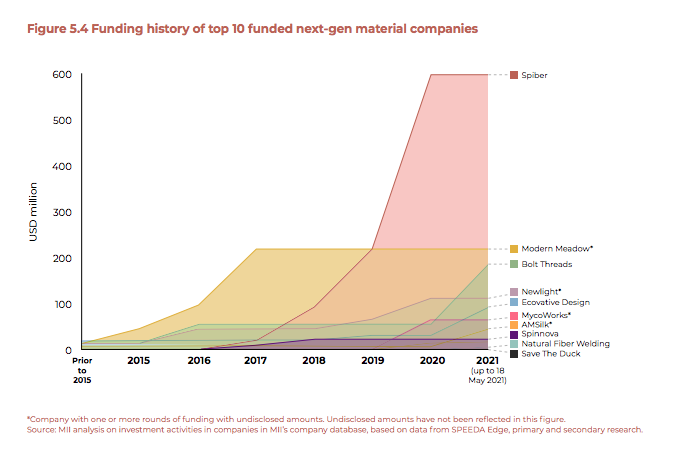

A report released Wednesday from nonprofit Material Innovation Initiative and consumer research firm North Mountain Consulting found $1.29 billion invested in standout material innovation firms from 2015 to May 2021.

More from WWD

Of the materials seeing increased innovation, leather alternatives lead with 49 next-gen materials companies rising up over the last five years with less resource-intensive and more affordable, animal-friendly material options. Silk, wool, down, fur and exotic skins were the other categories deemed valuable to disrupt.

“The findings reveal that cost-competitive next-gen materials could command the majority of many markets,” said Nicole Rawling, cofounder and chief executive officer of the Material Innovation Initiative. “The potential market share ranges from 54 percent for leather to 66 percent for fur.”

Increasingly, fashion has been keen on partnerships in next-gen materials — reaching for the spider silks, mycelium and mushroom-like grown leather alternatives, as well as materials repurposing agricultural waste. Industry namesakes such as Adidas, Nike, H&M, Stella McCartney, Ralph Lauren, Patagonia and Gap were among the biggest buyers and users of these materials, according to the report.

By funding amount, standout material innovators include Japanese biotech company Spiber (a spider silk-maker and collaborator of The North Face) with $599 million in funding to date, Bolt Threads (maker of the “Mylo” leather alternative popularized by Stella McCartney) with $218 in funding and Modern Meadow (animal-free leather grown from collagen) with $184 million in funding. Newlight (maker of AirCarbon and recent collaborator with Nike) follows with $107 million in funding and Ecovative Design (mycelium-based leather from agricultural waste) with $90 million to go toward its growth.

The report profiled companies alongside investor insights that designated speed to launch, scale, commercial viability and industry buy-in as clear delineating factors for success.

Pangaia (behind plant-based down alternatives like “Flwrdwn”), MycoWorks (grown mycelium-maker and an Hermès collaborator), Natural Fiber Welding (in which Allbirds and Ralph Lauren both invested) were also spotlighted in the report for their value propositions and financial backing.

From a sample of some 2,000 U.S. consumers — considered by researchers to be early adopters — the report found 55 percent of respondents preferred leather alternatives over animal leather. Of those who said they preferred animal-based leathers, many indicated it was because of perceived “higher quality and performance,” but, according to the report, “these consumers will be open to switching to next-gen leathers when they are at price, quality, and performance parity.”

Regardless of preference, some 44 percent of consumers are willing to pay more for products made from next-gen materials that align with their values, a figure that echoes previous consumer sentiment reports. And of the majority of respondents who preferred animal leather, most (96 percent) were open to purchasing “alternative leather.” Breaking that down further, most with a preference for animal leather, or 80 percent, were open to the idea of buying plant-based leather, and 71 percent said they’d shop synthetic-based leather.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.