Short-selling attack costs stricken fund manager Neil Woodford £118m

Under-fire fund manager Neil Woodford has suffered another setback after a short seller targeted on of his biggest investments.

US short seller Muddy Waters Research published a report on Wednesday accusing Burford Capital of “actively misleading investors” on its accounting policies. Burford (BUR.L), which specialises in funding litigation, denied the accusations and said it would provide a detailed response as soon as possible.

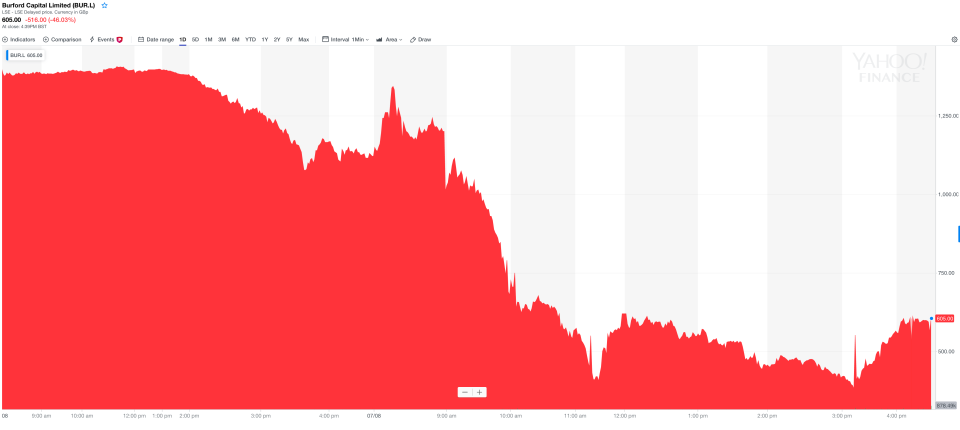

However, the attack from a well-known short seller spooked investors and sent Burford’s share price crashing. Burford Capital’s shares closed down by 46% on Wednesday.

READ MORE: Burford Capital crashes 60% after attack from US short seller Muddy Waters

The collapse is bad news for Woodford Investment, the firm run by high-profile money manager Neil Woodford. Woodford Investment is Burford’s second biggest investor and owns about 7% of the company.

The share price crash means the paper value of Woodford’s investment has declined by £118m since the start of the week to just £92.1m, according to Yahoo Finance UK’s calculations.

Woodford Investment declined to comment when contacted by Yahoo Finance UK.

The timing of Burford’s share price rut could not be worse for Woodford. The money manager was once viewed as one of Britain’s best but was forced to stop investors withdrawing money from his flagship Equity Income fund in June after a liquidity crunch.

Woodford had invested in a high proportion of illiquid investments like stock in private companies and was unable to sell them quickly enough to meet withdrawals. He was forced to freeze £3.7bn in the fund to prevent a “fire sale” that would have resulted in lower returns for all investors. Last week fund administrators confirmed the fund would stay shut until at least December as Woodford tries to sell his investments.

READ MORE: Woodford fund freeze 'undermines trust' in whole industry

Burford Capital is listed as one of the top 10 investments by the Equity Income fund, although it is understood to be not a major priority for divestment given that the shares are liquid.

Woodford is likely still in the green over the life of its investment in Burford. The fund management firm first bought into Burford in 2014, buying a 7.2% stake in the business while the shares were trading around 120.5p. Shares in Burford closed well above that level on Wednesday, at 605p.

Woodford has repeatedly insisted that he is not a distressed seller and expects to realise good prices from his assets. However, Ian Sayers, the chief executive of the Association of Investment Companies, said in a letter to MPs investigating the incident published earlier this week: “These disposals will inevitably secure a lower return for investors than would have been the case if there was there no pressure to sell.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at@OscarWGrut.

Read more: