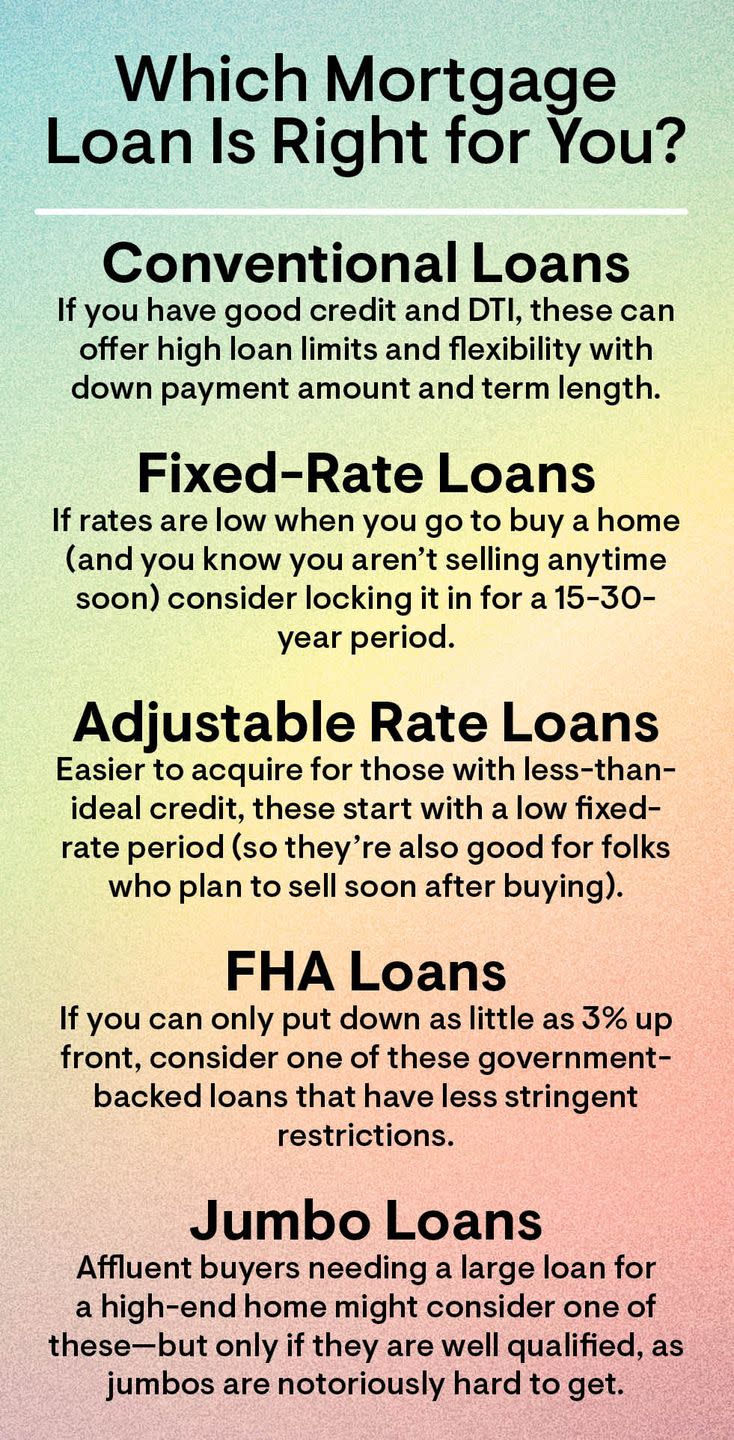

The Most Popular Mortgage Loans and Which One Is Right for You

If you’re looking to buy a home, chances are, you’re also looking at mortgages—and it can be hard to figure out the best one for you. You’ll want to make sure you’re getting the option that’ll save you the most on your down payment, fees, and interest. But when there are so many options available to you, it can be almost impossible to know where to start.

“Depending on factors such as where you live and how long you plan to stay, certain mortgage loans are better suited to a home buyer's circumstances and loan amount,” explains Certified Financial Planner Lauren Anastasio of personal finance company SoFi. Below, check out the most popular options, as well as Anastasio’s insight into determining the one you should consider applying for.

Conventional Loans

“Conventional loans are originated by a bank or private lender, and are not backed or insured by a government,” says Anastasio. “They often have stricter requirements than government-backed loans, but are easier to acquire if you have sufficient assets and good credit.” The upside is flexibility: Conventional loans can be quite large, and range in terms of down payment and term length.

If you apply for a conventional loan, a bank or lender will look at your credit scores and debt-to-income ratio, as well as require a down payment, usually from 5 to 20 percent cash upfront. It’s important to note, though, that if you put down less than 20 percent, conventional loans will require an additional fee each month (the PMI).

There are generally two types of conventional loans: conforming loans and non-conforming loans. In this case, a conforming loan simply means the loan amount falls within maximum limits set by the Federal Housing Finance Agency. A conforming loan will work for you if you know you’re not going anywhere anytime soon, have a good credit score to apply for it, and know you’ll have the money to pay for the down payment and/or PMI. However, if you’re planning to move anytime soon or don’t think you’ll meet the asset requirement, it’s probably not your best option.

Fixed-Rate Loans

“Most loans given are fixed rate mortgages, where the interest rate is fixed for the entire life of the loan. The most common time frames for a fixed rate mortgage loan are 15 and 30 years,” says Anastasio. Even though you’d save a lot in interest on a 15-year loan, the monthly payments are much higher. The downside of a fixed rate mortgage is that if you locked in your interest rate at a time the rates were high, you’re stuck with that higher interest for the life of the loan (unless you refinance), but the advantage of a fixed rate mortgage is ease and predictability when it comes to your budget. “You can rely on that stable monthly payment without a lot of worry,” she says.

Adjustable Rate Loans

“The alternative to fixed-rate loans are adjustable rate mortgages, or ARM loans,” explains Anastasio. “These loans have an interest rate that changes throughout the life of the loan, as interest rates fluctuate.” ARMs usually have an initial fixed-rate period of five to 10 years—so it’s really more of a hybrid loan—before the interest rates shifts to a variable rate that varies depending on the market. In the fixed rate period of an ARM loan, the interest rate is lower than the rate on a traditional fixed rate loan, which can be a draw for some. However, the ARM loan could end up costing more in interest over the lifespan of the loan, especially if interest rate increases in the future are dramatic.

“Home buyers with lower credit scores are best suited for an adjustable-rate mortgage, since people with poor credit typically can't get good rates on fixed-rate loans,” says Anatasio. “In this way, an adjustable-rate mortgage can nudge those interest rates down enough to put home ownership within easier reach. These home loans are also great for people who plan to move and sell their home before their fixed-rate period is up and their rates start moving upwards.”

FHA Loans

An FHA (Federal Housing Administration) loan allows you to put down as little as a 3 percent down payment on your home, because FHA loans are government-backed.

“FHA mortgages can be a great option for first-time homebuyers or people who have lower credit scores,” says Anastasio. “For instance, if you have a debt-to-income ratio of 43 percent or less, or a credit score of at least 580, you can qualify for 3.5 percent down payment.”

The less stringent restrictions make FHA loans easier to obtain for those with less than perfect financials or generally first-time home buyers, but those with the ability to obtain a conventional loan may want to stay away from an FHA option, given that there’s more red tape during the application process. Buyers of FHA-approved loans are also required to pay mortgage insurance—either upfront or over the life of the loan—which hovers at around 1 percent of the cost of the loan amount.

Jumbo Loans

“Jumbo loans can be an option if you need a loan larger than the conforming loan limit, but you don’t have the cash for a larger down payment,” explains Anastasio. “It’s sort of a super-sized loan that has tougher standards than a conforming loan, and it’s more accessible for those with higher incomes, stronger credit scores, cash reserves, and modest debt-to-income ratios.”

Basically, jumbo loans can be more common in higher-cost areas, and generally require more in-depth documentation to qualify. They make sense for more affluent buyers purchasing a high-end home. However, keep in mind that whether or not you need a jumbo loan is determined solely by how much financing you need—not by the purchase price of the property—and they can be substantially harder to get.

Ready for the next step? Here's how to negotiate a mortgage and plan your appraisal.

Follow House Beautiful on Instagram.

You Might Also Like