Mortgage repayments skyrocket by 60 per cent since 2021

Mortgage payments have skyrocketed by 60 per cent since 2021, as the stark financial pressures homeowners have been under are laid bare in new research.

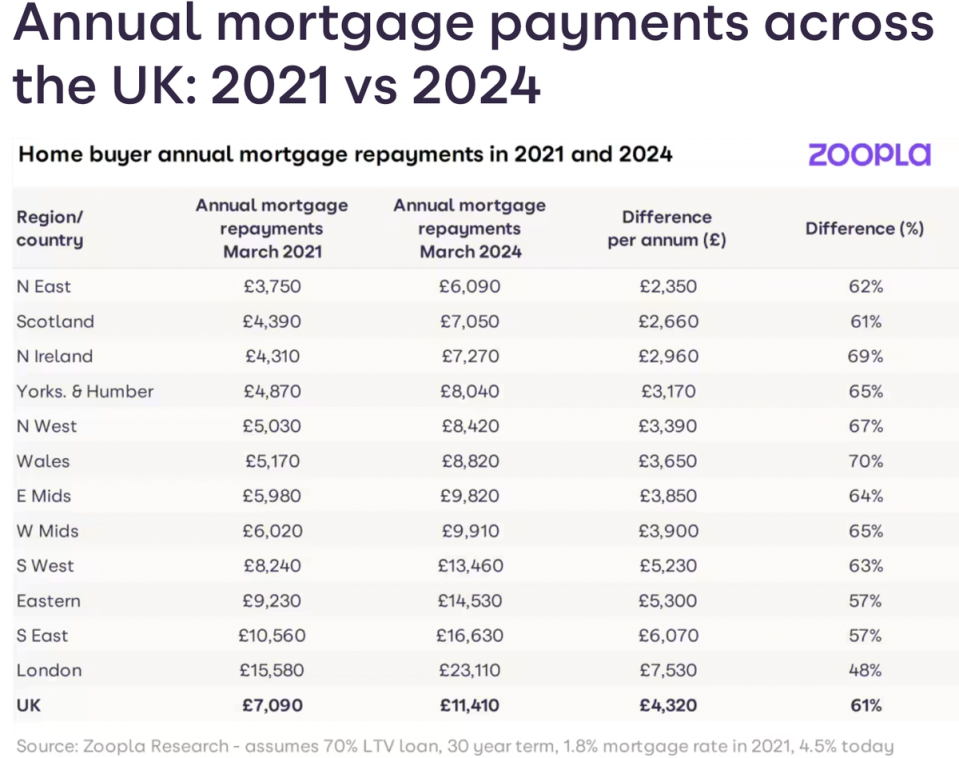

The average buyer is having to find an extra £4,320 a year to pay their mortgage in 2024, with the annual mortgage payment per year now £11,400 compared to £7,000 in 2021.

Higher mortgage rates have impacted the south of England most - the average annual payment is now £23,000 per year in London, compared with £15,000 in 2021.

In the south east, annual repayments on mortgages have risen by £6,000 and in the south west, they’ve gone up by £5,300.

Across the rest of the UK, the picture is less costly, with buyers in the Midlands needing to find an extra £3,900, while buyers in the north east are paying an extra £2,350.

Mortgage rates rocketed amid market turmoil, following the launch of Liz Truss’s disastrous mini-budget in September 2022, with the average two and five-year fixed mortgage rates on the market surging above 6 per cent and later easing back.

More recently, inflation has eased to 3.2 per cent, but money markets think that a cut in the Bank of England base rate is now not likely to take place until June at the earliest, with some traders forecasting a date even later in the year.

Richard Donnell, executive director of research at Zoopla, which conducted the research, said: “At a region and country level there has been a 50% to 70% increase in mortgage repayments for a typical buyer between 2021 and 2024.

“The largest monetary impact is in southern England, where house prices are higher. The annual cost of mortgage repayments for an average priced home is more than £5,000 higher per annum in 2024 than 2021 across the South West, South East, East of England.

“Two thirds of this increase is a result of higher mortgage rates. However, one third is also down to the fact that average house prices are still 13% higher than they were in March 2021.”

Zoopla’s latest research comes as two of the UK’s major mortgage lenders, Natwest and Santander, have announced further hikes in morgage rates that will kick in on Tuesday.

Last week five mortgage lenders, Barclays, HSBC, NatWest, Accord and Leeds Building Society upped rates on some of their mortgage deals.

Amit Patel, an advisor at Trinity Finance, told Newspage: “Two of the biggest mortgage lenders announcing rate hikes is not a great start to the week. This is not good news for borrowers.”