A mom is charging her three young children for rent — but there’s a valuable twist

Even six-year-olds have rent anxiety now.

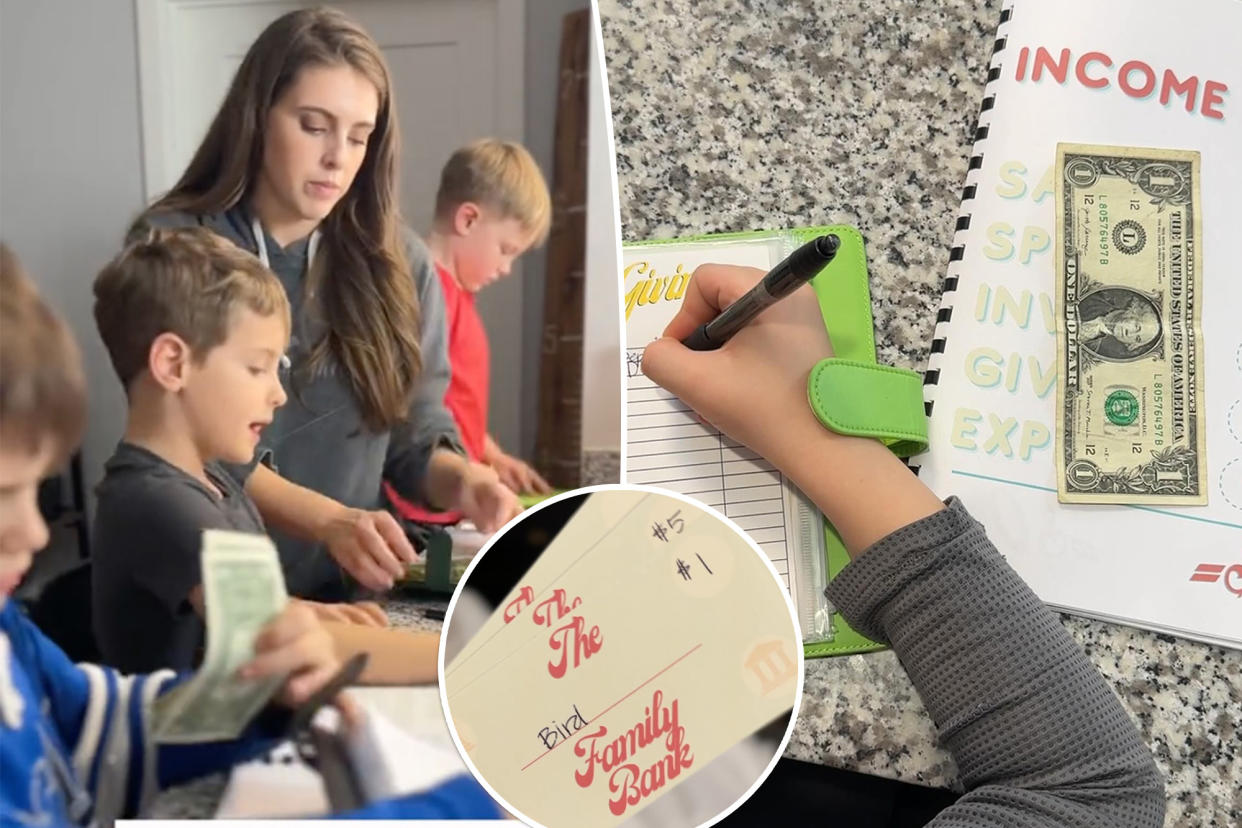

Three elementary school-aged kids are learning how to manage money early on in life — all thanks to their millennial mom, who charges them a pint-sized share of the household living expenses.

Some experts say she’s got the right idea.

Samantha Bird’s children — ages 6, 8 and 9 — each get a weekly allowance like so many others.

But in this case, the trio of junior finance students is expected to set part of their haul aside for rent, utility and groceries.

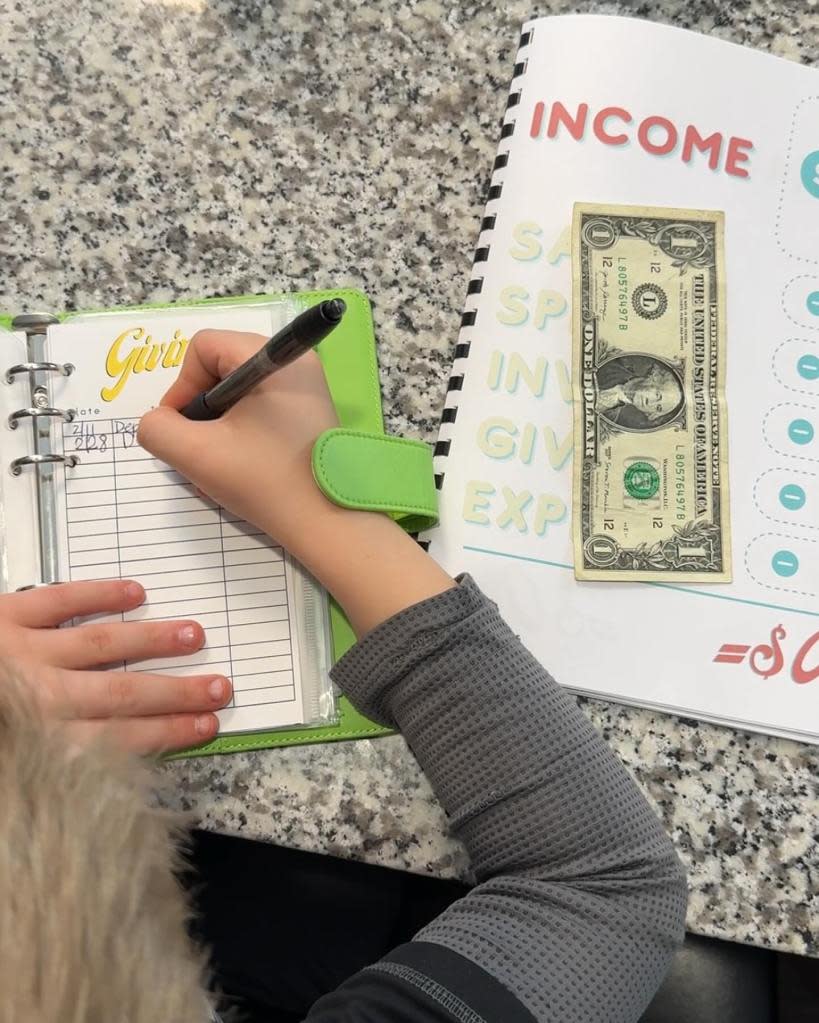

“Each week, they get paid $6. One dollar per week is expected to go toward their [monthly] expenses, Bird explained in a TikTok video, which has garnered 5.7 million views.

Then, on the first of each month, the mini-moneymakers pay $1 each for rent, $1 for groceries and $1 for utilities.

“They track it on their budget trackers and other spending or categories happen after those payments. They set that dollar in a separate envelope for utilities, and then at the beginning of the next month, we charge them for their bill,” the penny-conscious parent explained.

Bird’s goal is to teach her children how to budget and pay bills “in a safe environment,” she said.

Her less than conventional methods received a fair amount of both criticism and praise from other TikTokers.

“What age did you start this? Think it’s a great way to teach financial responsibility,” one person wrote.

“First I was like wow this is ridiculous. then I was like man I wish I learned this at any point of my life,” another shared.

“No need for this. School will teach them all they need to know. Like parallelograms. Which comes in handy during parallelogram season,” someone quipped.

“They’re too young for this. Chances are they’ll become hyper-fixated on money and be over anxious about it. I speak from experience,” a user criticized.

“Kids this age absolutely do not need to learn about expenses and bills. This is a perfect set up for creating financial anxiety,” another said.

Despite the mixed feedback Bird received, MarketWatch experts believe that kids are never too young to learn about financial responsibility.

“When it comes to teaching kids money skills, there isn’t one way to do it,” Rick Kahler, a financial planner and financial therapist and founder of Kahler Financial Group in South Dakota, told the outlet.

“I applaud [Bird] for being aware that she has a responsibility to teach her kids money skills. Whether the way she is going about it is [right] is always one of subjectivity.”

Kate Yoho, a financial adviser at Tennessee-based TBH Advisors, believes that “starting them at that age is great.”

“I love her strategy. It’s good and basic,” Yoho said. “Kids get excited about stuff when they’re little — especially money, because they don’t understand it.”

Michele Paiva, a Pennsylvania-based financial therapist, warned that this specific type of “envelope budgeting” can be uninspiring and anxiety-inducing to kids.

But at the same time, it teaches math skills as well as conversational skills when it comes to discussing finances. It also teaches “that sometimes in life, you have to help others pay bills.”

Bird shared in a different video that she aims to keep it “lighthearted and fun.” She has her kids doing this because she wants them to know financial self-control and to manage expenses — skills they’re going to need when they’re older.

“I want them to grasp the idea of it now while they’re little and this process still feels fun for them,” Bird explained, adding that the money the kids pay will go into individual savings accounts that they’ll be surprised with when they’re older.