Moda Operandi Dives Into Beauty

Luxury beauty e-commerce has gained a new competitor.

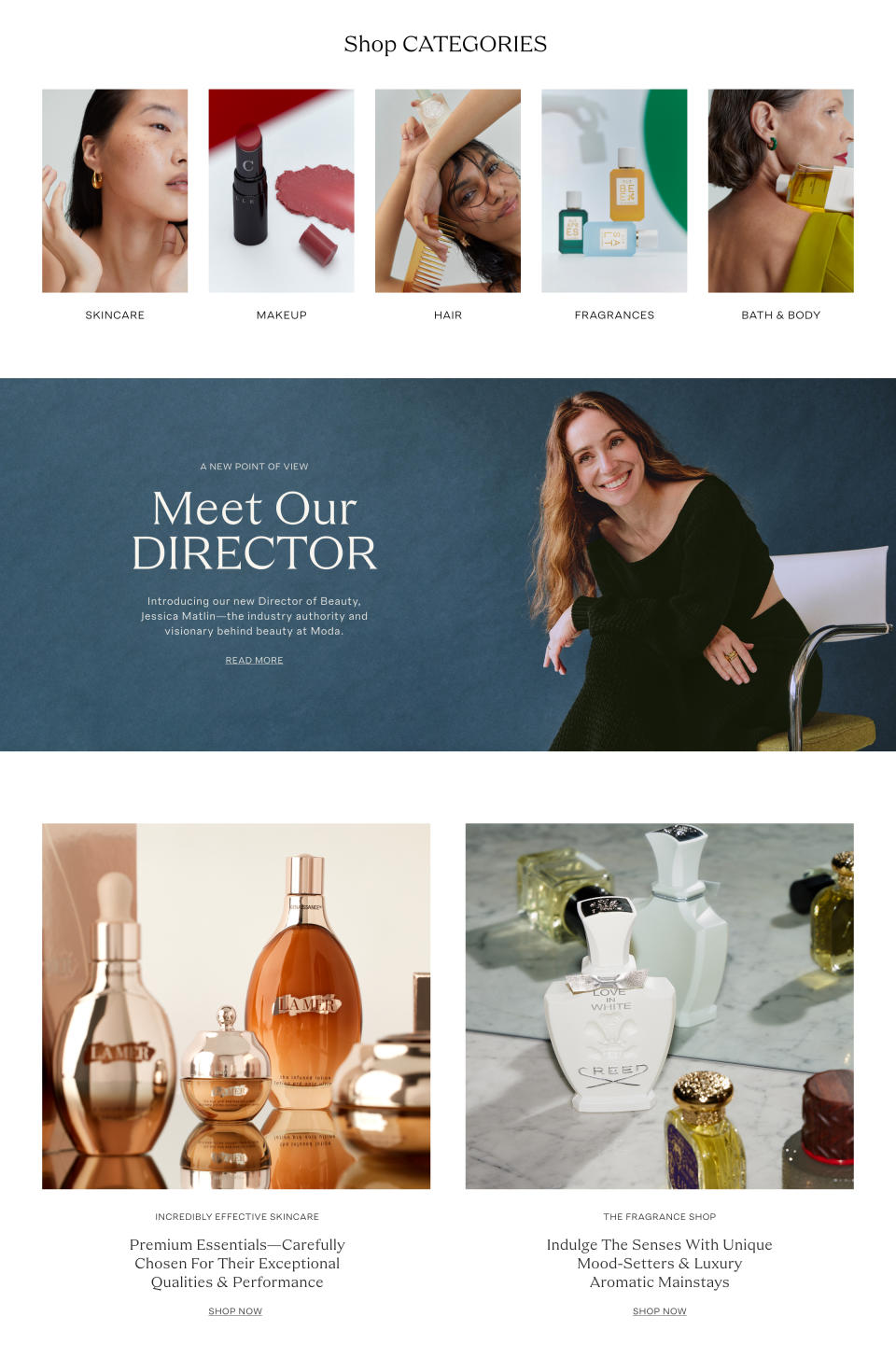

With an assortment currently spanning apparel, accessories, home and fine jewelry, Moda Operandi has added beauty as its latest category. The vertical, which launches Tuesday, features fewer than 300 stock keeping units and a brand matrix spanning from luxury heavyweights like La Mer and Sisley-Paris to cult favorites such as Vintner’s Daughter and The Beauty Sandwich.

More from WWD

The retailer is entering a crowded room. Last year, Farfetch joined the mix with more than 100 prestige beauty brands, and that foray followed its acquisition of specialty retailer Violet Grey. Net-a-porter launched beauty nearly a decade ago, Ssense has deepened its beauty offering and mass players like Kohl’s, Target and Walmart have respectively teamed up with Sephora, Ulta Beauty and Space NK to take prestige beauty to their aisles.

Moda Operandi, though, is starting less aggressively. The debut assortment is under 300 skus with a heavy focus on skin care. Legacy players in the space, such as La Mer, Sisley-Paris, Chantecaille and Supergoop, anchor the brand matrix.

Rife with smaller brands, the assortment also includes 111Skin, Augustinus Bader, African Botanics, Beneath Your Mask, Blue Lagoon, By Far, BeautyStat, The Beauty Sandwich, Costa Brazil, Charlotte Mensah, Crown Affair, Creed, David Mallett, Dr. Barbara Sturm, Dr. Lara Devgan Scientific Beauty, Ellis Brooklyn, Ever Amid, Eighth Day, French Farmacie, Isamaya, Joanna Czech, KNC Beauty, Kismet Olfactory, La Bouche Rouge, Leonor Greyl, Macrene Actives, Matière Première, Monika Blunder, Noble Panacea, Ourself, R+Co Bleu, Regime des Fleurs, Retrouvé, ReVive, Roen, Roz, Révérence de Bastien, Sangre de Fruta, Santa Maria Novella, Sidia, Surratt, Tan Luxe, Taffin, Tata Harper, Tracie Martyn, U Beauty, Vintner’s Daughter, Westman Atelier and Wonder Valley.

The thinking behind the initial foray is to offer hero products from many lesser-known brands — an approach to curation that Jessica Matlin, Moda Operandi’s beauty director, said will help cut the retailer away from the pack as a destination for discovery.

“Moda has always been about a mix of established and emerging brands, and that’s our strong suit,” Matlin said. “Other retailers are about constant newness, more is more. Our strategy is really about what I’m calling heroes and hidden gems. I’m taking the best from my favorite lines, taking the time to put them in the spotlight, rather than bringing on a ton of brands and pushing them to do more and more. I’m not about newness for the sake of newness.”

Newness, a traditional vehicle of growth for beauty brands, will have its place — Matlin described the assortment as “iterative” while adding that it will go deeper into fragrance, nail and wellness in 2023 — but the Moda customer “doesn’t want this constant deluge of product,” she contended.

“No matter what your income level is, you want to be given the best, you don’t want to spend hours and hours doing that research,” she continued. “The Moda client comes to us for something that’s truly been vetted. At the end of the day, it has to be beautiful, it has to be elevated, it has to be exquisite. If you’ve spent money on a beauty product at Moda, it’s going to feel fabulous.”

The average unit price of the assortment is $120. “The Beauty Sandwich is $300, but we also have products that are $30, which are much more competitively priced if you’ve never shopped at Moda before. This is an opportunity for those who’ve never shopped Moda to have a great experience and also discover some new brands,” Matlin said.

Jim Gold, Moda Operandi’s chief executive officer, predicted beauty will comprise roughly 10 percent of the company’s business. “Beauty will also act as an introductory point for new customers, allowing them to get to know what we are all about at a more accessible price point,” he said via email. “Beauty and wellness is a fun, engaging and fertile category, and it will only become more important to our clients over time.”

Gold continued that though high momentum throughout the first half of 2022 softened a bit toward yearend, the company “still ran nice increases, especially within our apparel business, with the evening category and exclusive capsules as particular bright spots.”

It’s still a good time for prestige beauty, though. According to data from the NPD Group, the category jumped 15 percent in the third quarter, up to $2.1 billion in total sales in the U.S.

The thinking behind launching beauty was filling in the gaps of Moda Operandi’s aspirational lifestyle proposition. “Our customer engages with Moda as a lifestyle brand: we offer her a whole world of style; fashion, entertaining, fine jewelry purchases and gifting, and now we are thrilled to extend our offering to include beauty,” said Lauren Santo Domingo, the company’s cofounder and chief brand officer, in an email.

“Coming from an editorial background, it has always been vital to me that Moda tells designers’ stories, and we’re excited to offer a platform to tell beauty brands’ stories in the same way that we’ve done in our fashion, home and jewelry spaces,” she continued.

Matlin’s entire career has been in editorial and media, save for a brief stint at Space NK, and she most recently worked as the beauty director at Harper’s Bazaar. She still cohosts the beauty podcast Fat Mascara with Jennifer Goldstein, which explains her experiential, narrative approach to selling product.

“We create these special experiences for our clients, and it’s going to be a tremendous point of difference. It’s something that’s been successful for us — to be able to bring our clients closer to our brands and create that real connection,” Matlin said. “There’s an emotional component to beauty that sometimes gets lost, and we’re able to create these special connections.”

Moda has hosted private experiences with makeup artist Gucci Westman, as well as trips to Iceland and Brazil for Blue Lagoon and Costa Brazil, respectively. Online, the beauty homepage will “pluck out those heroes and hidden gems and give them their moments to shine in different ways,” Matlin said. “We’ll have videos and moments for brands to tell their own stories.”

The service front will also play a role in acquiring and keeping beauty shoppers. “Our client is very devoted to Moda. Our top clients are very close with their private client advisers, and they lean on them for clothing, apparel, home or fine jewelry,” Matlin said. “We know our clients, we know what they’ve been asking for. We work a lot with our private clients and did a lot of research with them prior to me getting here — fragrance, skin care and particular brands came up that informed a lot of our buy.”

The debut offering is replete with skin care because the Moda client is “a skin care obsessive,” Matlin said. She’s eyeing other categories for expansion, though. “The timing is ripe for Moda to double down on fragrance, and the team is really behind fragrance for 2023,” she said. To that end, the homepage will have a dedicated section for niche perfumery dubbed The Fragrance Shop.

Beauty brands joining the site see a few different opportunities, from that content and storytelling perspective to bolstering their credibility in the luxury space.

“We wanted to see what the opportunity could look like from a storytelling and content perspective,” said Ron Robinson, founder and CEO of BeautyStat. “This gives us the ability to reach new customers, maybe one that’s more fashion-savvy, but one we call from a psychographic perspective the ‘anti-aging warrior.’ She doesn’t mind spending a little more on a prestige product that works, and we think this partnership will extend our reach to that consumer.”

That thinking was in line with Yannis Alexandrides and Eva Alexandridis, cofounders of 111Skin. “111Skin has been the brand of the runway, it’s what models, aestheticians and makeup artists use to get faces ready. Having the ability of the products together with the availability of the dresses and the accessories makes sense,” Eva Alexandridis said. “The audience who is looking at shopping on Moda is exactly our client. We are very aligned in, first of all, the service they provide, and the strategy of focusing on specific products.”

“We are in Saks Fifth Avenue, Neiman Marcus, Cos Bar. We already have all the distribution we want, now we are only expanding at places that make perfect sense for us,” added Alexandridis. “Fashion connects with us, it connects with our clients. We welcome the inclusion of beauty on a platform with fashion because, if you look beyond the superficial commercial benefits, it makes sense that someone who wants a beautiful accessory would also want healthy skin.”

Bullish on the partnership, Charles Rosier, cofounder and CEO of Augustinus Bader, said the Moda customer exactly mirrors those of his brand. “They have an audience which is common to the profile of their customer base, and it fits our customer base as well,” he said. “I’m interested in seeing their point of view and how they want to approach their advisory and experience to their customers.”

Acknowledging the rising pressure from the competition, Rosier added that Moda’s most loyal — and top-spending — clientele would help buoy the category. “They have very close relationships with their VIP clients,” he said. “If you have such consumers, it doesn’t seem too hard to achieve penetration of the beauty category.”