Microsoft Touts New AI Tools for Retail

Microsoft, maker of the world’s most used PC software, wants its AI to similarly dominate the retail world. On Thursday, the Windows maker revealed a new set of artificial intelligence offerings aimed at enhancing the shopping experience, both behind the scenes and for customers, with generative AI.

Copilot, billed as “your everyday AI companion,” is the umbrella banner of Microsoft’s expansive AI initiative that spans consumers at home on Windows PCs and employees in workplace settings. Now four new offerings under that umbrella are taking up multiple aspects of retail, from helping store associates to AI-driven personalization for customers.

More from WWD

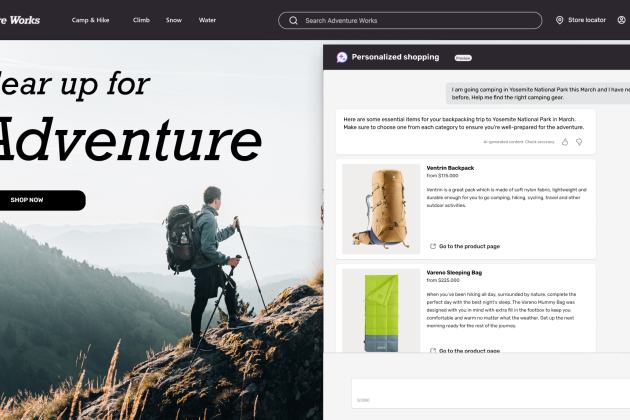

Microsoft’s Cloud for Retail is previewing a new template that enables personalized shopping using natural language. Although it’s a pre-made Copilot template on Azure OpenAI Service, it doesn’t force a rigid conversational structure, like the previous generation of customer service chatbots. Think smarter bots capable of chatting with shoppers about their needs and offering options, as though a person was behind the keyboard.

In one example, an online shopper tells an adventure store’s chatbot that he’s looking for camping gear for a trip to Yosemite National Park. The bot knows the time of year and destination, so it suggests a sleeping bag and tent for colder weather, plus a lightweight backpack, and recommends a few bestsellers at the store.

The tech titan isn’t alone in promising more humanistic AI, but there’s a key difference, according to one of its promo videos: The template allows partners to offer a “more intuitive, personalized and enjoyable retail experience, all on the retailer’s existing technology platforms.”

Indeed Microsoft’s computer software is the most widely used operating system in the world, with Windows broadly accounting for 64.3 percent share of the market across desktops, tablets and consoles. Its computer software also dominates the retail sector. Even a small adjustment can create waves of change at that scale.

But the company has more in mind that just better customer service bots. Other new features focus on internal communication, store operations, data analytics and marketing.

The company introduced AI-based suggestions in Microsoft Teams for conversation starters, prompts and images to improve exchanges from corporate down to the store level, among other tools to support associates on the frontlines. In another example from Microsoft, a store employee wonders what to do about broken items found inside a display. “The store operations Copilot template automatically interprets the intent and rephrases the question, then provides an answer,” the narration said, as it searched for “the procedure for damaged inventory in a promotional display.” The bot then automatically started a replacement request through a voice interaction.

New offerings connect retail data to its Fabric analytics platform and enable additional insights, such as “frequently bought together.” For marketers, updates in Copilot in Dynamics 365 Customer Insights promise to simplify campaign management and boost effectiveness.

All of these moves and others comprise Microsoft’s bid to “modernize the in-store experience,” which it plans to showcase in a few days’ time at NRF 2024 in New York City.

The tech company has made its goal of becoming retail’s go-to AI provider rather plain — if not with these announcements, then certainly earlier this week, when chief executive officer Satya Nadella showed up at Walmart’s CES keynote in Las Vegas. Microsoft’s considerable work to advance its generative AI capabilities is foundational to the retail chain’s new genAI product search feature.

These moves and others make for an intense AI race, and not just for the tech makers. According to Google Cloud data, 81 percent of decision-makers in the American retail sectors urgently want to adopt generative AI. That may help explain why the Microsoft rival Google Cloud unleashed its own flurry of tools on Thursday that beef up searches tuned to each retailer, enhanced customer service bots and even new hardware and software that bring high-powered computing and data storage right into brick-and-mortar stores.

“In only a year, generative AI has morphed from a barely recognized concept to one of the fastest-moving capabilities in all of technology and a critical part of many retailers’ agendas,” said Carrie Tharp, vice president of strategic industries at Google Cloud.

Microsoft, Google, Amazon and plenty more are out to make shopping faster, smarter, more enjoyable and, of course, more profitable for the brands and stores behind it. Consider that there’s already a multitude of new services and tools set for 2024, and the new year isn’t even two weeks old yet.

The race for AI may seem exciting, though chaotic, but it’s likely a strategic cacophony pointed at a specific direction: retail.

“Retail has the direct pulse of the consumer,” Paul Pallath, vice president of applied AI at tech consulting firm Searce, told WWD. “It’s also impacted by changing consumer expectations. When people can just talk to some abstract thing and get a lot of excitement, in terms of responses, that has shifted the expectations of the customers from a retail standpoint.”

Pallath, who led AI technology globally for Levi Strauss & Co. until last year, sees more than just the innovation of the tech, but its relevancy in how consumers provide rich data through their interactions, informing how they experience brands.

“I think that is where all of these big companies, Google, Microsoft, Amazon and all of them would want to double down on the retail space, because that’s where a lot of significant impact is, from a revenue top-line standpoint, as well as bottom line.”

AI, as a technology, has made major leaps forward in the recent past, but most of the experts, both critics and proponents, agree that it’s still far from perfect. For instance, Pallath cited “hallucinations,” in which the AI comes to an erroneous conclusion or generates inaccurate information. Putting that in front of customers would give any retailer pause.

In that light, it makes sense that Microsoft and others would focus on internal and workflow improvements, while taking measured steps for public-facing features. “Companies are also thinking about, ‘Let us be confident by internally using these conversational agents for internal purposes,’ because the risk is less from a brand standpoint,” Pallath added.

“But once we are confident we want to unblock, we want to have 10 percent of our customers exposed to these interfaces so that we can learn from them. And then eventually we’ll go out to a larger customer base.”

In other words, the frenzy of retail’s AI revolution is only just getting started.

Best of WWD