Looking for a deal? Check out the 10 housing markets where home prices are falling the most

Who doesn’t love a deal? Homebuyers certainly do.

With home prices and mortgage rates uncomfortably high, many aspiring homebuyers are desperate to find ways to save money on what might be the largest purchase they will ever make.

Nationally, home prices rose 0.3% year over year in February, to a median of $415,500, according to Realtor.com® data. But there are places where home prices are falling.

Yes, you read that correctly.

Homebuyers can save a pretty penny in these housing markets, which span the pricey West Coast to the more affordable South and Midwest regions of the country, according to a recent Realtor.com report.

“A lot of the [housing] inventory that’s coming onto the market is in a more affordable price tier,” says Realtor.com Chief Economist Danielle Hale. “When you have more affordable listings coming onto the market, it’s also going to push down the overall price.”

The number of homes for sale increased in all but two of these markets. When there are more options for buyers to choose from, that also helps to keep prices in check.

To come up with its findings, the Realtor.com economics team compared median list prices in February 2024 with February of 2023 in the 50 largest metropolitan areas.

Why home prices have come down by so much in Miami

The COVID-19 pandemic hot spot of Miami experienced the largest price declines. The median home list price fell 8.2% year over year, to a median price of $550,000 in February. Meanwhile, the number of homes for sale in the metro shot up 37.4% in February compared with the same month a year earlier.

The price drops are a sharp, 180-degree turn for the Magic City. Prices surged along with the temperatures over the past few years as more folks from other parts of the country moved to the metro.

“There was a COVID craze the last few years. We had so many people come from New York and California,” says Sam DeBianchi, a Realtor® at DeBianchi Real Estate in Fort Lauderdale, FL. She also does business in nearby Miami.

More than 117,000 New Yorkers moved to Florida in 2021 and 2022, according to figures from the Florida Department of Highway Safety and Motor Vehicles. In 2023, 53,581 moved into the state.

Prices in the metro spiked, hitting a high of $625,000 in June, representing a staggering 56% increase over just two years. But what goes up must eventually come down.

“Sellers over the last few years were really inflating their asking prices because they were getting them,” says DeBianchi. “This year is really when reality has hit, and you’re seeing those price drops. I don’t think it’s anything to panic over. Most sellers are still making money. They’re just not making as much money.”

The rising cost of insurance is also bringing home prices down in the coastal Miami area.

“Florida’s condo market is faltering as the increasing intensity of natural disasters pushes up home insurance costs, and HOA fees soar in the wake of the 2021 Surfside condo collapse,” says luxury real estate agent Jenny Lenz. She is the managing director of Dolly Lenz Real Estate. “New condo listings are soaring as sellers try to offload their properties.”

Where home prices are falling across America

Several traditionally more affordable, Midwestern markets also saw prices fall. Hale attributed the price cuts in Oklahoma City, Cincinnati, and Kansas City, MO, as a result of more smaller, cheaper homes going up for sale. This has helped to drag down the median list prices in these metros.

Prices are also down in some of the nation’s priciest metros on the West Coast. Median home list prices slipped 2.3% in San Jose, CA, the heart of Silicon Valley, and ticked down 1.3% in San Francisco.

“Those areas are very closely tied to the technology industry, and tech has been on a bit of a roller coaster over the last couple of years,” says Hale.

Prices fell sharply in those metros during the pandemic as workers who were newly permitted to work remotely moved to cheaper parts of the country. Then as these areas rebounded, the tech industry was rocked by layoffs. Now, many tech companies in the area are focusing on artificial intelligence.

“You had some excitement about what AI might mean for the Bay Area, and some sellers might be trying to capitalize on that,” says Hale. “New listings are also up in the [San Francisco] Bay Area.

“We’re at a point in time where your experience in the real estate market depends on where you are,” says Hale. “It’s more local now than it has been at other points of time.”

These are the cities where home prices are falling the most:

1. Miami

February median home list price: $550,000

Median list price year over year: -8.2%

2. Oklahoma City, OK

February median home list price: $323,000

Median list price year over year: -7.4%

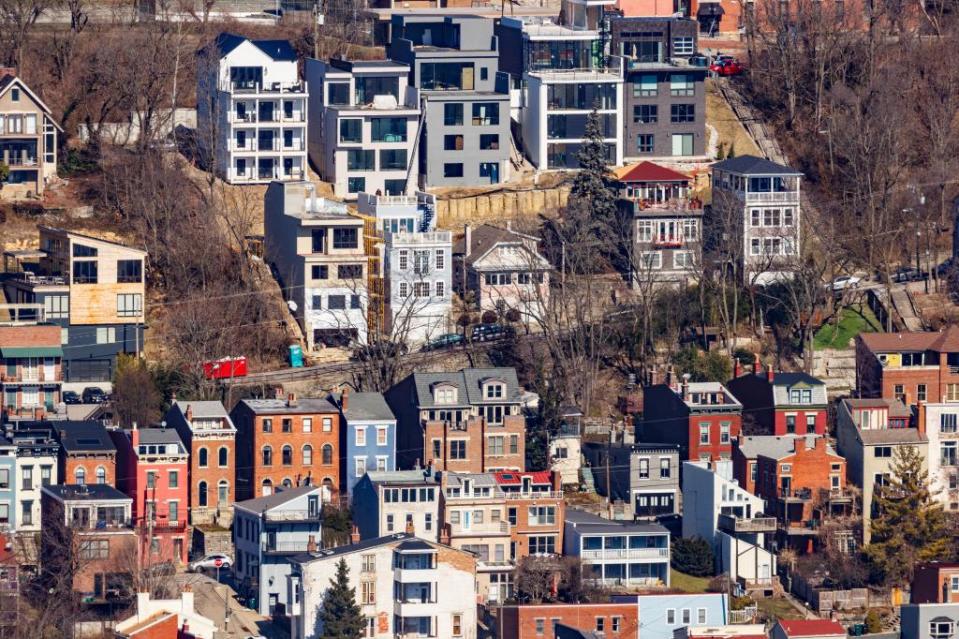

3. Cincinnati, OH

February median home list price: $337,000

Median list price year over year: -6.4%

4. Kansas City, MO

February median home list price: $421,000

Median list price year over year: -4.9%

5. Denver, CO

February median home list price: $610,000

Median list price year over year: -3.6%

6. San Jose, CA

February median home list price: $1.367 million

Median list price year over year: -2.3%

7. Raleigh, NC

February median home list price: $440,000

Median list price year over year: -2.2%

8. San Antonio, TX

February median home list price: $335,000

Median list price year over year: -1.5%

9. San Francisco

February median home list price: $989,000

Median list price year over year: -1.3%

This story was originally published on Realtor.com, a real estate and rentals site. In addition to homes for sale, you can find rentals like Scottsdale apartments, Austin apartments, Tampa apartments, and more.

10. Portland, OR

February median home list price: $600,000

Median list price year over year: -1.2%