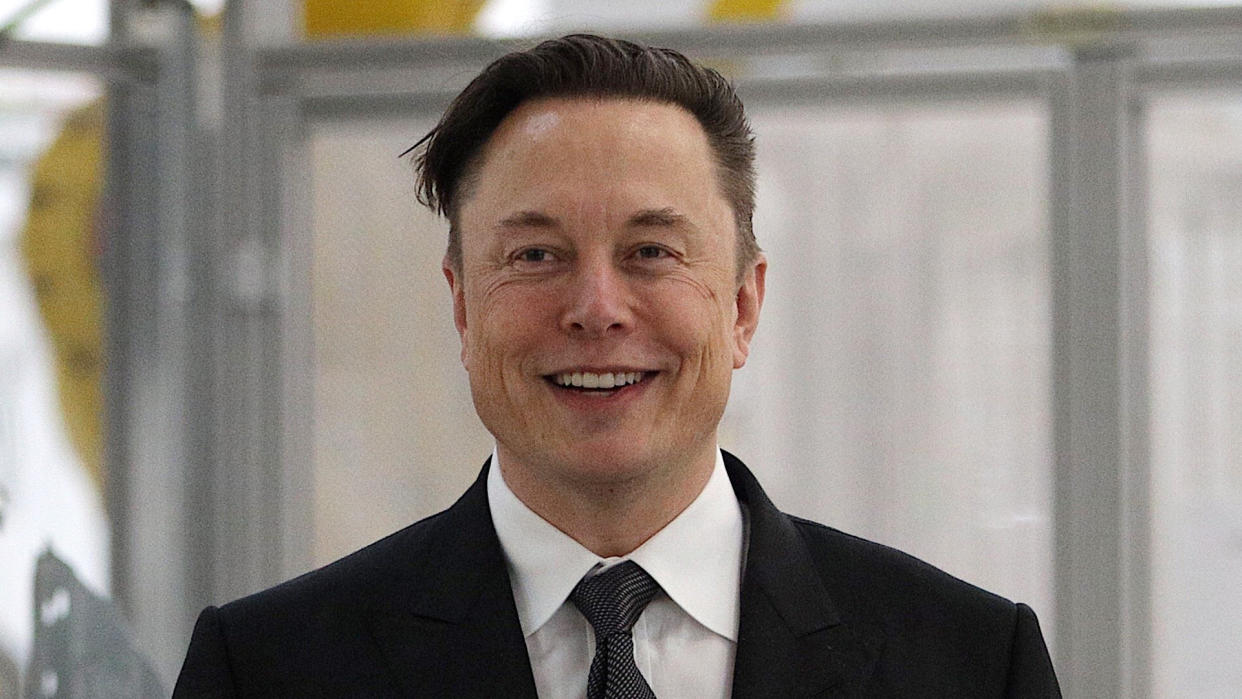

A Look at Elon Musk’s Finances During His Headline-Grabbing Year

- Oops!Something went wrong.Please try again later.

The past year took millions of Americans on dizzying financial rollercoaster rides, but none more so than the richest man in the world. Most famously — or infamously — Elon Musk added a multibillion social media giant to the portfolio of corporations he controls, and he leveraged his ownership of Tesla to do it. No matter your position on Twitter in the Musk era, the purchase gave the world a peek into how corporate titans move money to pull off deals worth tens of billions of dollars.

See: Top 10 Richest People in the World

Wealthy Millennials Aren’t Banking on Stocks: Here’s What They’re Investing In Instead

Jan. 4: Tesla Shares Top $400 for the Last Time in 2022

Tesla shares ended the Jan. 4 trading session at $383.20, but they reached $402.67 at their high point that day. It was the last time TSLA would breach the $400 mark in 2022. Tesla shares lost half their value during the year and were trading below $180 as of Dec. 9.

A great deal of Musk’s wealth is tied up in his Tesla stock — he still commands a 15% stake, according to Reuters — so the steep drop in share price dramatically affected his buying power, borrowing power and net worth in what would shape up to be a most expensive year for Elon Musk.

April 20: The Boring Company Secures Financing That’s Anything But

In the spring, The Boring Company — which Musk created to beat traffic by boring tunnels underground — announced that its Series C funding round had raised $675 million. The injection of investor cash earned Boring a $5.675 billion valuation.

Take Our Poll: Do You Think People Should Invest In Crypto?

April 25: Twitter Agrees To Sell

After several weeks of speculation, back-and-forth and headline-grabbing drama, Twitter’s board agreed to sell the social media giant to Elon Musk for an estimated $44 billion. The board accepted Musk’s bid of $54.20 per share, which was well above the stock’s value at that time but less than some industry watchers thought Musk should have paid.

The board wasn’t necessarily sweet on the deal.

Musk had disclosed a 9.1% ownership stake and threatened to launch a hostile takeover. A few days earlier, Musk proved he wasn’t just window-shopping when he filed $46.5 billion in financial commitments to close the deal, including $25.5 billion in debt financing and $21 billion in equity financing.

April 26-29: Musk Sells $8.5 Billion Worth of Tesla Stock

In the three days that followed the board’s decision to sell Twitter, Musk sold $8.5 billion worth of Tesla stock to drum up the cash needed to close the deal:

Tuesday, April 26: Musk sells 3.7 million shares worth $3.3 billion

Wednesday, April 27: Musk sells 735,000 shares worth $654 million

Friday, April 29: Musk sells 5.2 million shares worth $4.5 billion

He received an average of $883.09 per share, and his selloff represented just 5.6% of his stake in the company — less than 4% if you include the stock options he controls. The enormous increase in trading volume was enough to sink the company’s stock, which lost 12.2% of its value on the Tuesday that Musk started his liquidation. It was the biggest one-day drop since 2020.

June 13: SpaceX Releases Other-Worldly Fundraising Numbers

In mid-June, MarketWatch reported that Musk’s SpaceX company, founded in 2002, had a massive round of fundraising that brought in a fresh investment of $1.7 billion, which earned the company a roughly $125 billion valuation.

Oct. 27: Musk Closes the Twitter Deal

At the end of October, the drama surrounding Musk’s Twitter takeover finally came to a close after six months of speculation and false starts with a four-word tweet from the man himself: “The bird is freed.”

The EV magnate’s foray into social media signaled a new era that began with mass layoffs, an exodus of advertisers and intense public controversy.

The purchase cost Musk $44 billion — $46.5 with closing costs. According to Reuters, Musk’s equity commitment of $33.5 billion included his 9.6% Twitter stake, which was worth $4 billion at the time.

The move took the publicly traded company private.

Year’s End: Musk’s Losses Top 12 Figures — and Now He’s No. 2

On Nov. 21, Bloomberg reported that Elon Musk had lost more than $100 billion in 2022. The halving of Tesla’s value, steep crypto losses and the gargantuan Twitter deal were mostly to blame for the 12-figure loss of wealth, which represented the biggest drop in net worth of any billionaire in the world.

Musk was worth an incredible $340 billion just one year earlier and today he has an estimated fortune of $173.9 billion. Despite 12-figure year-over-year losses, Elon Musk has only dropped one spot as of Dec. 14. He’s now the second-richest person behind Bernard Arnault and family.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: A Look at Elon Musk’s Finances During His Headline-Grabbing Year