‘Let Reebok Be Reebok’ Is ABG’s Mantra for the Brand

The torch has officially been passed.

After months of prep work with seemingly weekly announcements about the lining up of new brand partners, Authentic Brands Group has finally completed its long-awaited acquisition of the Reebok brand from Adidas. The 2.1 billion-euro deal was first announced in August and marks the brand marketing company’s largest acquisition to date.

More from WWD

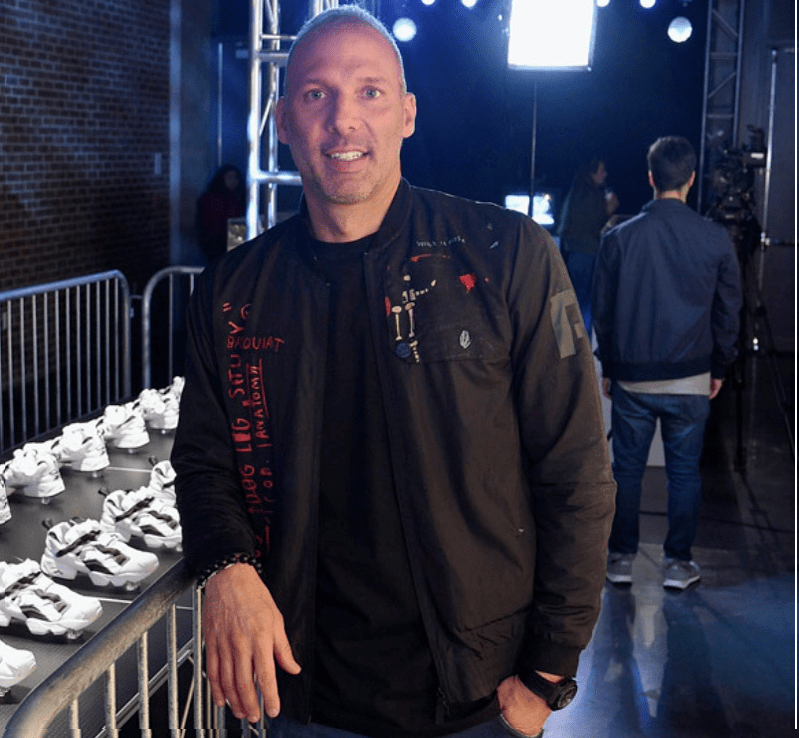

“It’s the biggest deal we’ve done ever, times three or four,” said Jamie Salter, founder, chairman and chief executive officer of ABG. Reebok, which has $3.7 billion in retail revenue globally, is projected to grow to $5 billion next year after ABG has a year of operating the business under its belt, and $10 billion within five years, Salter predicted. “With the partners we’ve lined up, we’re fairly confident we should get there. And the sun, moon and stars don’t have to align perfectly for that to happen.”

To get to those numbers, the go-forward plan is simple, its management team stressed: Let Reebok be Reebok, meaning that it will mine its heritage as a brand at the intersection of sports and style.

“Reebok is a brand that needs no introduction,” Salter said. “The Reebok team has done an incredible job of cementing Reebok’s place in the minds and hearts of consumers. Through ABG’s operating model, Reebok will have the ability to evolve and embrace its iconic creativity, quality and innovation. It’s time to let Reebok be Reebok.”

Over the past six months, ABG has announced a slew of new licensing partners for the brand globally, ranging from its own SPARC Group — which will be the operating partner for Reebok in the U.S. and oversee its Boston-based global brand hub, the Reebok Design Group — to New Guards Group, the buzzy Milan-based division of Farfetch Ltd., that will be Reebok’s core operator in Europe and will collaborate with the brand to create luxury collaborations that will be sold in more than 50 countries.

Arguably the most important deal is the one with SPARC, a joint venture between ABG and Simon Property Group, which also operates ABG’s Brooks Brothers, Eddie Bauer, Forever 21, Aéropostale, Lucky Brand and Nautica businesses.

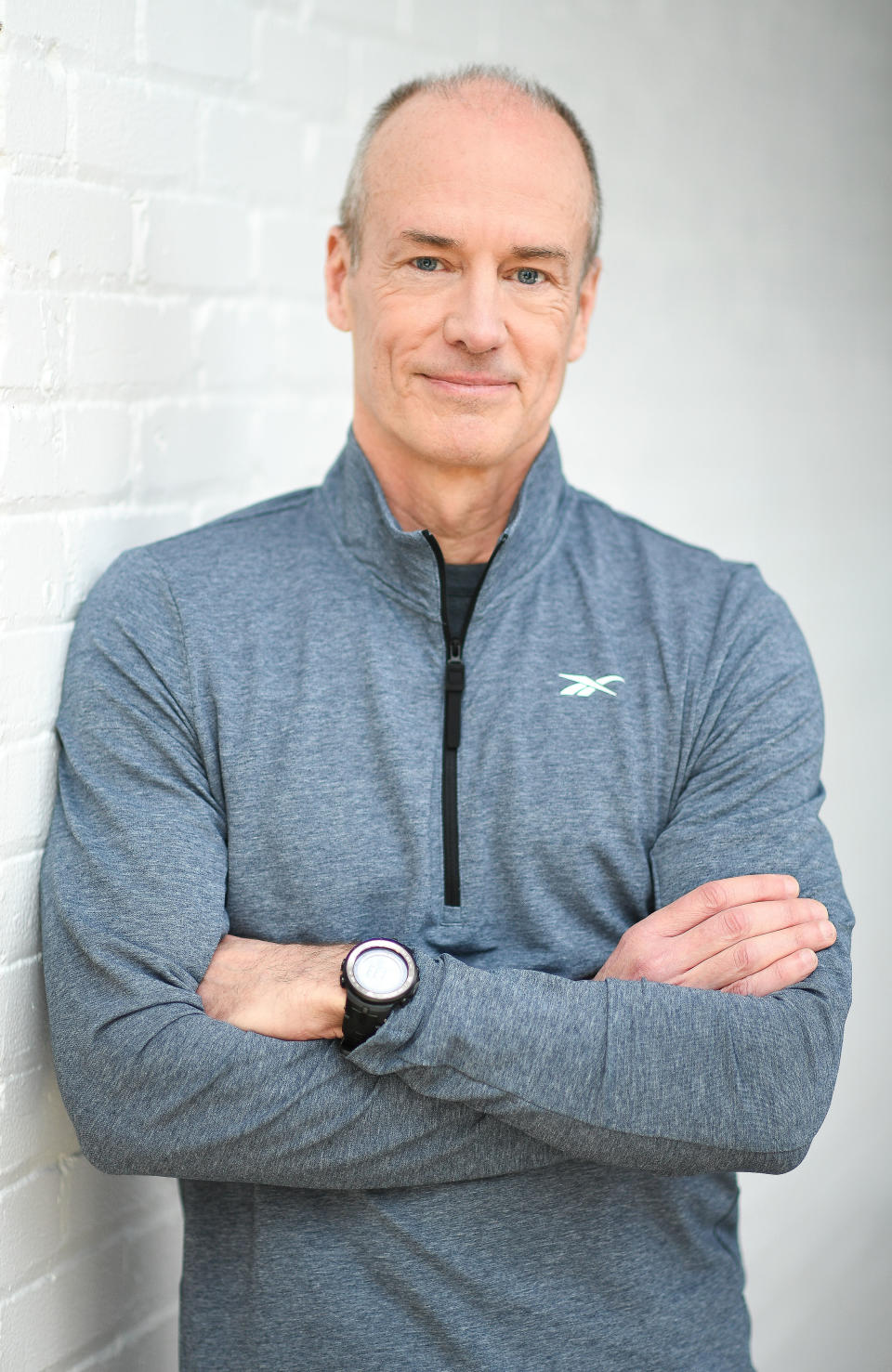

Although ABG is essentially a licensing company, Matt O’Toole, Reebok’s president who now serves as president of RDG, said: “It’s not incredibly complicated. Reebok in Boston will create product and marketing for the world and all of the product sold is product we create centrally. But instead of being distributed by Adidas subsidiaries, it will be distributed by best-in-class companies in the marketplace globally.”

He said that in the past, the company would have to concentrate its limited resources on one particular geography or category, but by licensing the rights to others in the regions and product categories where they excel, it allows Reebok to simply concentrate on delivering the best merchandise mix to all.

Other partners signed so far include Foot Locker U.S., which will expand its Reebok assortment and offer exclusive product in America; JD Group for its 2,850 stores and websites including Finish Line, JD and DTLR in North American and Europe; Tristate Holdings for China, Hong Kong, Macau and Taiwan; Al Boom Marine for the GCC, Middle East and North Africa; Aditya Birla Fashion Retail Ltd. for India, Bangladesh, Bhutan, Maldives, Nepal and Sri Lanka; The Falic Group for Latin America; Accent Group Ltd. for Australia and New Zealand; MGS for Israel; Bounty Apparel for Southern and Sub-Saharan Africa, and Distrinando for Argentina.

Responding to criticism that ABG is more focused on signing deals than creating product, Salter said: “That’s not true. Our business model is to sign best-in-class partners globally and not to miss a beat on Day Two when it comes to letting Reebok be Reebok.”

Salter said by adding Reebok to ABG’s portfolio, it proves that the corporation can take on any brand and build a network of partners to grow it globally. “We’re in all the important markets around the world now or on the one-yard line line, like Japan and [South] Korea.”

O’Toole said all the recent deal-making didn’t distract the Reebok team from creating compelling product, saying: “There is a lot that had to happen in anticipation of ABG’s ownership. But it was necessary to make sure we can now hit the ground running with our new operating partners.”

Salter has been open with his thoughts that Adidas — which had owned the brand since 2006 — always treated Reebok as afterthought and that was overshadowed by its parent. “Adidas did everything right,” he said. “They protected Adidas, which is exactly what I would have done, but now, we can do everything for Reebok. We can unleash it and bring it back to what it was 15 years ago when it was at the top of its game.”

O’Toole echoed what Salter has said publicly about life under its former German parent. “Adidas had to make decisions about which of its two sports brands to allocate resources to,” O’Toole said. “And Adidas won most of those competitions. If you’re an Adidas shareholder, then you believe Adidas made the right choices, but it wasn’t to the benefit of Reebok.”

But under ABG, he said, Reebok will represent the company’s sole premium sports brand and the focus will be solely on growing the business.

O’Toole said that despite the distractions of the impending sale, Reebok actually managed to post its biggest year in 2021, thanks to a focus on “our icon strategy, which is built around the most recognizable models of our brand.” This was most successful in the U.S., Europe and Latin America, he added, and is a “good launching point” for future growth.

“We had a really outstanding year in 2021, better than 2020, of course, but also significantly better than 2019 in terms of both the top and bottom line,” he said. “Product has always been at the forefront of Reebok, and we are committed to upholding the standard that our brand fans and consumers have come to expect. 2021 was a banner year for Reebok, and in part that was a credit to our focus on the iconic silhouettes that immortalize the brand. Under new ownership, we have an exciting opportunity to reclaim our place in the market and take Reebok to even greater heights.”

Nick Woodhouse, president and chief marketing officer of ABG, weighed in: “Reebok is one of the few super brands that has the permission to play in any space. Its position at the intersection of fashion, sports and culture allows Reebok to be elastic while staying true to its celebrated ethos and unmistakable DNA.”

Among the innovations that Reebok is credited with creating are the first spiked running shoe; The Pump; the Nano, and the Floatride.

Todd Krinsky, senior vice president and general manager of product for Reebok, added: “We know this industry is based on strong icons and consumers go back to what they know and love.”

For Reebok, that breaks down into three segments: Classic, Training and Running, he said, categories that represent 80 percent of the overall athletic footwear market, positioning Reebok well for future growth. Among the most popular items for Reebok, he said, are the Club C tennis-inspired court silhouette sneaker that launched in the mid-’80s in the U.S. and Europe, and the Nano, one of the bestsellers in premium training. And this year, he said, Reebok will relaunch its Classic Leather, a heritage jogger.

Krinsky believes Reebok has been successful in its ability to straddle heritage and modernity. “There’s definitely a consumer who goes for an iconic look and for them we have our OG offering,” Krinsky said. “Then there’s the consumer who likes nostalgia with a twist.” For the latter, he said Reebok offers collaborations with popular partners who provide their distinct twist to its archival products and also tasks its internal design team to update models with a modern flair.

With collaborative product, Reebok has worked to “bring a little more scale” to the program, Krinsky said. So instead of 50 small drops, the brand throws its muscle behind larger efforts such as the popular Maison Margiela partnership for Reebok’s Club C and Classic Leather models. The Cardi B collection was also a standout, he said, as was the collaboration with streetwear brand Awake. And the “Jurassic Park” collection was also a top seller for Reebok in the pop culture space.

“The most successful collaborations are with partners who buy into the Reebok DNA,” he said.

Krinsky said he’s “incredibly excited” about working with New Guards on future collaborations that will help to “elevate the brand globally” and create “really high-end, must-have product.” He expects the first fruits on this newly inked relationship to be in the market in 2023, hopefully early in that year.

But he said that no particular names have been decided on yet. “It could be from within their stable,” he said, “but we’re also talking about outside collaborators.” New Guards owns Off-White, Palm Angels, Heron Preston and Marcelo Burlon.

Woodhouse said rather than finding an athlete or celebrity to put his or her name on a Reebok sneaker — “There are very few names in the sneaker world that move the needle,” he said — ABG is more likely to focus in on expanded distribution, Web 3 and the metaverse in the future. “It’s the age-old debate,” he said. “What is the ROI on those names? There’s room for someone or something, but it would have to be transformative.”

One of Reebok’s former collaborators was Kerby Jean-Raymond, founder of Pyer Moss, who is exiting the brand on March 1 as its global creative director. The two started working together on a co-branded footwear collection in 2016 and he was named vice president of creative direction for the company in 2020.

Days before his departure was announced, Reebok also laid off 150 people at its Boston headquarters, including several people on the design team. That has led to questions about how Reebok will retain its identity under its new owners.

Salter said these cuts were made in anticipation of Reebok being absorbed into the SPARC business and he’s not expecting to make any other reductions in staff.

Woodhouse bristled at the idea that without Jean-Raymond, the designs will have no direction. “Reebok is hot, look at their sales and how they’re doing in the resale market at StockX and others. That’s a testament to the Reebok product team. If we went in and changed the product direction, we’d be making a big mistake. So they need to keep doing what they’re doing and we’ll do what we do best, which is expose them to more eyeballs around the world.”

And he pointed to the deal with New Guards as a way to bring Reebok to a whole other level. “It’s tip-of-the-pyramid product that will give us access to customers we want access to.”

O’Toole said there’s no smoking gun about Jean-Raymond’s departure whose contract expired at the end of February and was not renewed.

“The backstory is the front story,” he said. “We have had an amazing relationship with Kerby for four years, first with Pyer Moss and then as creative director.” He said he “directed three seasons” of product, some of which still has yet to hit sales floors, and Jean-Raymond was among the first to identify the “richness and authenticity of our DNA and focus on us being ourselves. That will be part of Kerby’s legacy with Reebok.”

“Beyond that, it was one of the most successful partners we’ve had, but both of us are headed in a new direction. We have a new business model and Kerby’s star continues to rise. You know how it is in fashion: there’s a shelf life on things like this.”

One collaborator that is expected to continue working with Reebok in the future is Victoria Beckham, who signed a multiyear deal with the brand in 2017. Her fall 2022 has already been completed, O’Toole said, and the two are in discussions on future collaborations. It doesn’t hurt that her husband, David Beckham, last week signed a deal with ABG to co-own and manage his brand. “So it’s all the family now,” he said with a laugh.

And while it no longer works officially with CrossFit — Reebok cut ties with the company in 2020 after controversial tweets by its CEO surfaced — O’Toole said several CrossFit athletes are still on Reebok’s roster and the brand is “looking for other fitness opportunities. It’s not just signing celebrities, but working with a cross-section of people.”

Another change for Reebok under ABG is that SPARC will now be operating its 400 Reebok branded retail stores globally. “SPARC is a retailer with more than 1,700 retail doors and ABG contemplates them taking over our retail footprint,” O’Toole said.

Reebok’s marketing will also reflect its new ethos. The company just launched “Life Is Not a Spectator Sport” campaign for spring, a reboot of its original campaign from the ’80s, featuring a series of short films starring former basketball star Allen Iverson as well as a lineup of athletes and artists. O’Toole said this is another “nod to letting Reebok be Reebok.”

Reebok’s head of marketing continues to be Caroline Machen, who joined the brand from Ralph Lauren five years ago and works with Krinsky on brand messaging.

For Reebok, footwear still accounts for the lion’s share of the business, or two-thirds of current sales, Krinsky said, but the team believes apparel can play a larger role in the future. “We definitely see that share shifting,” he said, as lifestyle product makes more of an impact.

Womenswear is also expected to grow, they said. Women’s accounts for 42 percent of sales but O’Toole said the heritage of the brand has always been rooted in womenswear, starting with the aerobics craze of the 1980s and popularized by Cybill Shepherd wearing a pair of orange Reebok high-top sneakers to the 1985 Emmy Awards.

“We’re not just putting a stake in the ground in 2022 saying we’re a women’s brand,” Krinsky said. “Our archive is skewed to the female consumer and there are rich stories we can amplify.”

In addition, O’Toole said it’s clear that women are the ones who are “really leading in setting apparel and footwear trends.”

Salter believes the number-one growth area for Reebok will be apparel, which “can use some work. At ABG, we’re very strong on the apparel side, especially at SPARC, our partners in the U.S.” But that’s not to take away from the footwear business, which he expects to continue to grow as well as the new distribution strategy helps get “more skus on the shelf.” Reebok may also benefit from Nike’s recent push to highlight its own direct-to-consumer efforts at the expense of some of its wholesale accounts, notably Foot Locker. “Getting more skus on the wall will increase the business quite dramatically,” Salter said.

He also sees opportunities to add new categories and distribution. “Reebok is sold all over the world, but it’s small in certain markets,” he said, mentioning Australian and Latin America as examples. “But with partners like we have now, they tend to excel more quickly. They have an entrepreneurial spirit and drive harder and faster.”

Woodhouse added that Reebok’s classic products, while more commonplace in the U.S., are not available overseas. “There’s lots of value to unlock with our existing franchises,” he said. “We think there’s two to three years of runway.”

And where does Shaquille O’Neal fit into the picture? The former basketball great is a partner at ABG and was an ambassador with Reebok in the ’90s when he signed a deal for several popular sneaker drops.

Woodhouse responded: “Shaq will be very involved. He gives us advice daily.” And the deal with Reebok will allow ABG to continue to promote his shoes, which is “like paying ourselves now.”

Salter added: “Shaq is very, very respected — there are some people who don’t even know he played basketball. He’s built a franchise and he’s a big giver. He’s very charitable and called me yesterday with an idea about doing something on the charity end with Reebok.”

As Salter looked toward the future with Reebok in the ABG fold, he said there is no plan to move away from the strategy that has worked so well in the past and helped the company grow to a valuation of nearly $13 billion.

“We’re pretty calculated in everything we do,” he said. “We’re going to go slow, figure out what’s right and what’s wrong — that’s how we built our business. Today, 25 percent of ABG is entertainment and 75 percent is lifestyle. Combining entertainment and lifestyle has proven to really work.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.