As New Leaders Take the Reins, Here’s How to Succeed as a Footwear CEO in 2023

Wolverine Worldwide Inc. became the latest footwear company to make a change at the top when, in mid-August, it announced that CEO Brendan Hoffman had suddenly exited. He was promptly replaced by Christopher Hufnagel, formerly president of the company.

The move was swift, but praised by industry watchers, who regarded the appointment of the Wolverine veteran as a step in the right direction for the challenged parent company of Saucony, Merrell, Sperry and Sweaty Betty, among other brands.

More from Footwear News

As CEO, Hufnagel takes the reins of Wolverine’s broad turnaround effort to lead the footwear giant back to profitability. It’s no small task, but it’s also become the standard job description for new footwear CEOs in 2023.

Since the start of the year, VF Corp., Academy Sports & Outdoors, Under Armour, Adidas, Designer Brands, Converse, Pacsun, Kohl’s, Belk, Red Wing and more major footwear brands and retailers have ushered in a new top executive to their ranks. And that list grows wider — including firms like Foot Locker, Puma and Reebok — when the aperture is expanded to the last 12 months.

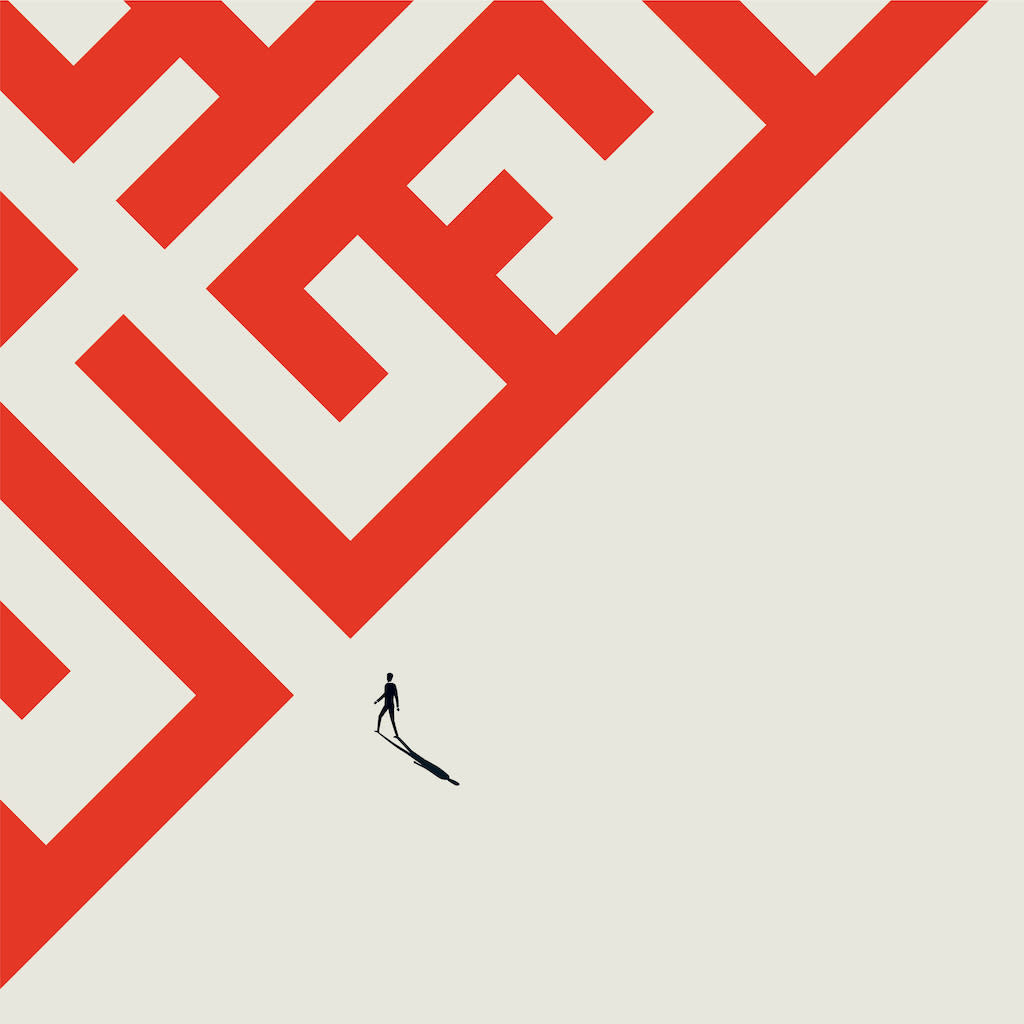

These leaders are entering their roles in an unprecedented time for the footwear industry. The supply chain and pandemic-related issues of the last two years have now been replaced with a slew of other challenges — inflation, foreign exchange headwinds, an oversaturated North American athletic footwear market and cost-conscious consumers with little discretionary income to spend on shoes.

“CEO jobs have always been challenging,” said Craig Rowley, a senior client partner in the consumer sector for consulting firm Korn Ferry. “[But] they’re probably as challenging and difficult as I’ve seen in my career.”

As such, successful CEOs need a new set of qualities to get them through the fog. Namely, a clear vision, a strong sense for what the consumer wants and the ability to pivot quickly when the environment demands it.

Seeing around the corner

In tandem with their CEO shifts, Wolverine, VF, Under Armour, Foot Locker and Adidas have all outlined different business transformation plans this year. These new leaders describe 2023 as a “reset” year, to set up their respective brands for long-term success with a focus on streamlining operations, cutting costs and elevating products.

For example, as Mary Dillon approaches the one-year mark as CEO of Foot Locker, she told FN one of her top priorities is executing on Foot Locker’s transformation plan — or “Lace Up” strategy. In a recent interview, Dillon said it’s important for company leaders to have broader plans that drive “long-term, sustainable, profitable growth,” even if it takes longer to realize.

“Sometimes it takes a minute,” she said. “But at least in the long term, investing in the right places is critical for every business, because the world is changing rapidly.”

But how did these companies — and CEOs — get to this point? According to Bobbie Lenga, who leads the global retail practice for leadership advisory firm Russell Reynolds, some of these problems can be chalked up to a general lack of foresight.

“There are a lot of companies that are going through turnarounds and it’s not because the CEOs, in most cases, had done something so wrong,” said Lenga. “They just didn’t take action fast enough. This business moves so fast … there wasn’t enough innovation and there wasn’t enough transformation.”

An effective retail chief needs a strong vision, or as Lenga put it, the ability to “see around corners.” Just short of predicting the future, retail CEOs need to arm themselves with consumer data and analytics to effectively evolve with consumer preferences.

With an emphasis on turnaround experience, some boards have been looking outside the shoe industry and their own ranks to find their new CEOs.

“Tenure in the industry is not as critical right now,” said Jaimee Marshall, managing partner of executive search firm Kirk Palmer Associates. “If you look across footwear, as well as retail, apparel and accessories, the sector has been troubled, and boards feel like the same old talent might not be the answer.”

For example, VF Corp. in June appointed Logitech International CEO and president Bracken Darrell as its new president and CEO. Analysts were overall positive on Darrell’s potential to turn the company around, despite his lack of experience in the retail and footwear space. And Stephanie Linnartz joined Under Armour as CEO in February after a 25-year stint in the hospitality industry, culminating in her role as president of Marriott International Inc. As for Dillon at Foot Locker, the bulk of her career was spent in the food industry before entering retail in 2013 as the head of Ulta Beauty.

“If the board believes that their company’s current leadership does not yet have a vision for the future and they believe they need to go through dramatic change, the more likely it is they will hire someone completely outside the industry,” said Korn Ferry’s Rowley.

Building strong brands

In his first conference call as Wolverine’s CEO last month, Hufnagel outlined his topline goal: transforming the company into a true “builder of brands” by focusing on product innovation, consumer preferences and demand creation.

But building up brand equity is no small feat right now, as the athletic footwear market, in particular, reels with too many products and not enough demand to sustain it.

Following Hufnagel’s appointment, Williams Trading analyst Sam Poser wrote in a note to investors that Wolverine’s new chief should be careful not to go too hard, too fast. He further explained to FN that athletic brands need to control allocation in a more measured way, even though it may lead to short-term sales dips. This builds brand equity and keeps products desirable as opposed to omnipresent. “Managing brand sanctity drives long-term profitable growth,” Poser said. “[If] you do this, you grow better and more profitably.”

In practice, this might require pulling back distribution across different channels to keep the consumer looking for more. “It looks like what Nike did with Jordan,” Poser said. “You allocate, you control.”

For new leaders entering the sneaker industry, Poser said to take this approach: “It’s counterintuitive, [but] if you do less, you get more.”

Beyond tracking demand, experts agree that for a CEO to be successful, he or she must have a strong sense for what consumers want. Where are they shopping? What products are making them tick? And where will they choose to cut back when their wallets get stretched?

“It’s a matter of how you respond to what your customers are telling you, and how you make adjustments in your business,” said Lenga of Russell Reynolds. “You have to work fast.”

Best of Footwear News

Sign up for FN's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.