What are latest considerations on buying a home in Tallahassee in 2023? | Donald Pickett

You are buying a home in Tallahassee or already live here and considering upgrading to another home. In the last couple of years there have been changes that you may need to be aware of.

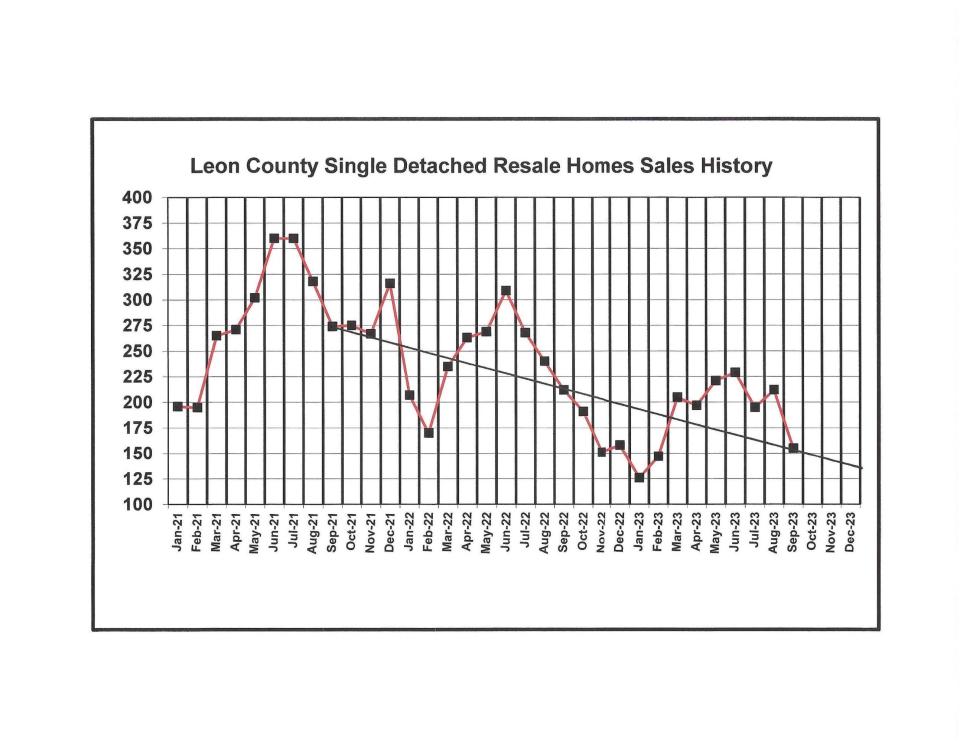

In September 2022 there were 212 single family detached resale homes sold in Leon County, this year there were 165. That is a 22% decrease. What is going on with the home sales market in Tallahassee? In the graph you see the same decrease as in the prior year. This decrease impacts all businesses of the real estate community.

What buyers purchased

What are the “motivated & qualified” buyers purchasing in Tallahassee? From Jan. 1, 2023 through September, we had a total of 2,052 homes sold in Leon County. Some purchased a re-sale home and others new construction. In these nine months the median closed sales price was $330,000.

Breaking it down to re-sales there were total closed sales of 1,702 with a median closing price of $320,000. There were 350 new construction homes closed with a median closing price of $429,725, which is 26% higher than for the cost of a re-sale home.

Qualified customer

What priced home does the average buyer in Tallahassee qualify for? Tallahassee is a “government town” with many residents working at a university, college, or State government and other related businesses.

Some politicians when they run for office promote themselves for keeping the cost of government down. Frequently that is accomplished by keeping the government employee’s salaries as low as possible. This greatly affects our market as to what buyers can afford.

The average annual salary in Tallahassee is $71,608. (city-data.com/government-salaries/region/florida/leon-county/ ). With the monthly salary of $5,959, how much of it can the buyer have to pay the monthly PITI (mortgage payment, interest, taxes & insurance) payment?

Of course, there are expenses for a buyer such as general living expenses for the family, auto payments, credit cards and other expenses. The best starting point in determining your qualification is the help of a professional loan officer who will consider all the factors in determining your qualification.

The monthly payment

First you start with the mortgage loan payment. The current rate is “hovering” around 7.5%, which is “an advertised rate.” It may be less or more depending on the buyer’s financial qualification and credit rating.

Property taxes

In Leon County property taxes, like about every other expense, may increase each year as needed. The Property Appraiser determines a tax value based on the home location, age, living area size, property size and other factors.

An interesting consideration is the tax value of the same home structure is affected by the location of the home. If built in an older neighborhood/subdivision it likely will be valued based on the homes in that area and have a lower value than if built in a newer area.

Homeowners insurance

Insurance, how true the old saying “Cheapest is not necessarily the least expensive.” In my many years selling homes I have had buyers shopping for the cheapest policy to meet the lenders’ requirements. Some considerations like age of the home, age of roof, construction materials and other considerations that an insurance company will consider in their quote for a policy.

Should you purchase flood insurance? If you are in a flood zone of the FEMA flood maps, the lender likely will require it. However, Mother Nature does not always adhere to the historical data used by FEMA and the homeowner may end up with a costly repair or replacement as a result of a natural event such as hurricane, tornado or flood, if not covered in the policy.

The world-wide catastrophes we have experienced with our climate, with rising of the ocean resulting in flooding in Miami Beach is a good Florida example. The recent forest fires and residential fires such as in Maui, earthquakes, and hurricane damage and flooding such as in the Fort Myers area and most recently the Panhandle of Florida. All have an impact on insurance rates, even if you are not living in the affected area.

When you are looking for an insurance company you need to consider the stability of the company. In recent years we have seen companies “pack up and move” from the Florida market. One report I read said nine insurers went out of business in recent years and several are in the process of leaving Florida. Floridians are paying the highest price in the Nation for home insurance. The fallback, Citizens Property Insurance Corp is being overwhelmed.

Home sales projection

A private study shows there are about 47 new home developments in Leon County with 57% under construction and the others in various stages of coming online.

The availability of skilled and unskilled construction workers for new construction is a major problem. New Florida laws are creating a huge scarcity of unskilled labor. This too is delaying construction and increasing the product cost to the buyers. The availability of construction materials is in short supply resulting in an increase in new construction.

In the first 9 months of 2023 the median price for a new construction home was $464,629.So where are the buyers coming from to buy these new homes? The lowest new home price in Leon County was $212,135.

From January through September there were 2052 single family, resale & new, homes with closed sales. 76% of the homes sold for less than $500,000.

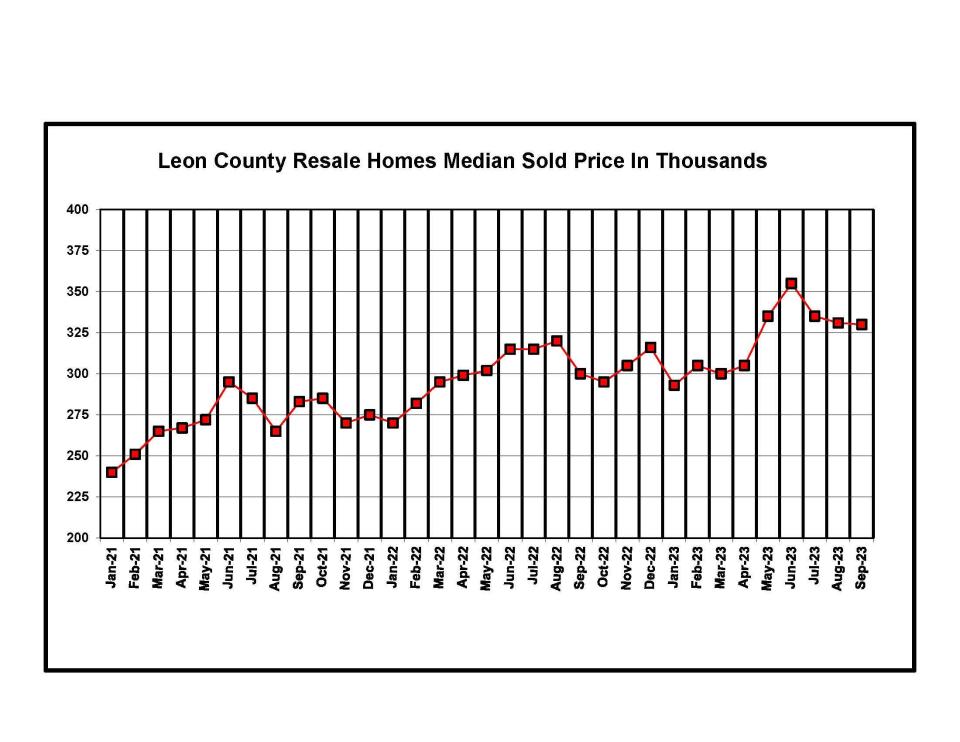

Looking at the graph of Resale Homes Median sold price history from January 2021 to September 2023 shows the history of rising home prices. In the last few months home selling prices have dropped some. Will this continue?

A few factors come into play and maybe we have stretched just how much buyers can/will pay. The graph showing the number of sales continuing to decrease may come into play as well. I have seen other indications that the time of lack of inventory is slowly decreasing to be the biggest problem. Other problems I have mentioned are becoming more of THE problem.

Staying put

Homeowners that purchased a few years ago with a mortgage rate at 3% to 4% are usually not very motivated to “move-up” to a 7.5% mortgage rate. Of course, there are the cash buyers who still must deal with increasing home prices. I have been a Realtor in Tallahassee for 43 years and have witnessed the real estate turmoil around 1990 and again in the 2007 era. I believe we are entering another difficult time in real estate sales.

Donald Pickett, Realtor, GRI, Tallahassee Real Estate N Data Services, Coldwell Banker Hartung. Email at donpick@aol.com.

This article originally appeared on Tallahassee Democrat: Tallahassee home buying data and considerations for 2023