Kids are at high risk of identity theft, experts warn — here’s how parents can protect them

There’s a bullseye on baby’s back.

Targeting kids is fast becoming all the rage among shady scammers committing identity theft.

A recent report from the Federal Trade Commission, the governmental overseers of identity theft, revealed that a staggering 22,229 claims of identity theft from kids in the U.S. under age 19 were filed last year. That’s a slight increase from 2018 claims within the demographic when a little over 21,000 tikes and teens reported more than $15 million in fraudulent losses.

Jennifer Leach, associate director of the FTC’s Division of Consumer and Business Education, says the crime against tots often goes undiscovered and unreported for years — especially when the perpetrators are “unscrupulous” family members.

“Our data is just the tip of the iceberg,” Leach explained to the Wall Street Journal.

“With that unique [Social Security number], along with a couple of other bits of information, like a name, address and a birth date, a person can do all sorts of things,” she warned. “[Crooks] can get a loan, rent a house, sign up for government benefits, get utilities, a phone, a job — anything that requires a credit check.”

And foul fraudsters aren’t just nefarious strangers online — in some cases, even moms and dad are the ones doing the dirty work.

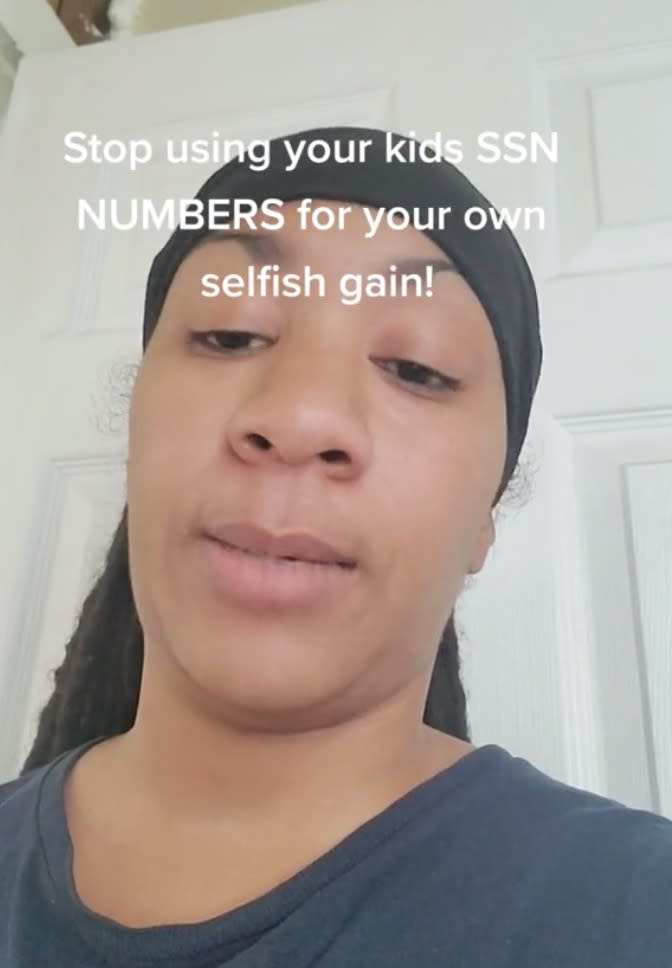

“Stop using your kids’ [Social Security Numbers] for your own selfish gain,” begged content creator @Tealightful_Crone, 40, in a trending TikTok plea.

“I’m still disputing things on my credit that I should not have to be disputing,” the whimpering whistleblower claimed. “These f—ked up parents think it’s OK to use their children’s SSN for their own selfish pursuits.”

Laura Oglesby, a 48-year-old Missouri mom, admitted to stealing her 22-year-old daughter Lauren Hays’ Social Security number to obtain nearly $20,000 in student loans. The shifty mom used the money to enroll in college as her offspring and shockingly pursued hot men in their 20s.

Because most youngsters have clean credit histories, bad guys — be they virtual strangers or close relatives — tend to seek them out as prime prey for financial gains.

Tech-savvy thieves can also easily access an unsuspecting kid’s privileged info by scouring their social media accounts, searching through data breaches, checking public records, engaging with the child directly in online forums or buying the information on the dark web.

Spam emails are also a sneaky hook that ne’er-do-wells use to bait the objects of their deception.

“By engaging with a spam email, even if it’s just to say ‘stop emailing me,’ you’re signaling that you might be susceptible to other forms of manipulation or deceit,” The Post previously reported. “If you get tricked into providing details on these sites, you’re essentially gifting your data to unknown entities.”

With mere crumbs of personal info, hackers are able to hijack a kid’s social media, intercept their physical mail, obtain credit cards in their names or access funds by changing passwords.

Tell-tale signs that a little one’s ID has been breached include their being denied government benefits — like health care coverage or nutrition assistance — as well as receiving debt collection calls for overdue bills, letters from the IRS about outstanding taxes or notices that their student loan applications have been rejected.

Sadly, young, oft-unwitting victims of the crime typically encounter huge hurdles once they become adults.

Kyra B, 28, says childhood identity theft’s left her life in upheaval. The millennial claims her wages have been garnished and she’s been unable to establish certain utility bills in her name.

“This is something I did not do,” screamed a tearful Kyra, detailing the lifelong pangs of fraud to a TikTok audience of 567,000. “I was a kid.”

Parents concerned that their child’s identity has already been breached are advised to lose the compromised account, freeze the kid’s credit report and file a complaint with the FTC.

Here are the agency’s tips for avoiding child identity theft.

Freeze it

“Honestly, there’s no downside to keeping a child’s credit frozen or even freezing it when they are a baby,” said Leach, advising folks to do so via credit bureaus such as Equifax, TransUnion and Experian. “That means they’ll create a credit file for your child and then freeze it, which will stop anything from happening in their credit file.” After children turn 14 or 16, depending on the bureau, they must do this themselves.

Leach also suggests parents ask each bureau to do a credit check, sign up for weekly credit reports and set up fraud alerts.

Ask questions

If your child’s school asks for your child’s Social Security number, ask these questions:

“Why do you need it?”

“How will you protect it?”

“Can you use a different identifier?”

”Can you use just the last four digits of the Social Security number?”

Protect personal information

If you have documents with your child’s personal information, like medical bills or their Social Security card, keep them in a safe place, like a locked file cabinet.

When you decide to get rid of those documents, shred them before you throw them away. If you don’t have a shredder, look for a local shred day.

Delete personal information before disposing of a device

Your computer and phone might contain personal information about your child. Find out how to delete that information before you get rid of a computer or cell phone.