Investors aren't all that worried about Italy

Italy’s political dysfunction sent markets around the globe tumbling on Tuesday after fears grew about what new elections in the euro zone’s third largest economy could mean for the European Union. But much as they may hem and haw at the uncertainty facing markets, market participants seem largely unafraid.

There may be short-term losses to the euro currency or Italian equity or bond holders, but the country’s political tension – like most bouts of uncertainty in recent years – is likely to be shrugged off by investors in a matter of time, experts say.

“Markets are very over-conditioned to crisis these days,” said Joseph Trevisani, chief market strategist at WorldWide Markets in Woodcliff Lake, New Jersey.

The market’s fear gauge (^VIX) shows that while Tuesday’s selling sparked worry, it wasn’t all that much, even compared to earlier episodes of volatility this year.

“For all the talk about increased market volatility, it’s worth noting that a read of the VIX” showed “a level of 13.22 at last Friday’s close,” John Stoltzfus, chief investment strategist at Oppenheimer, said in a note to clients. “That’s a drop of over 64% from when it spiked in February to a level of 37.3. Investors are now less worried about near-term prospects for the market than they were in late January and early February.”

Political turmoil hasn’t yet overthrown basic economic ideas

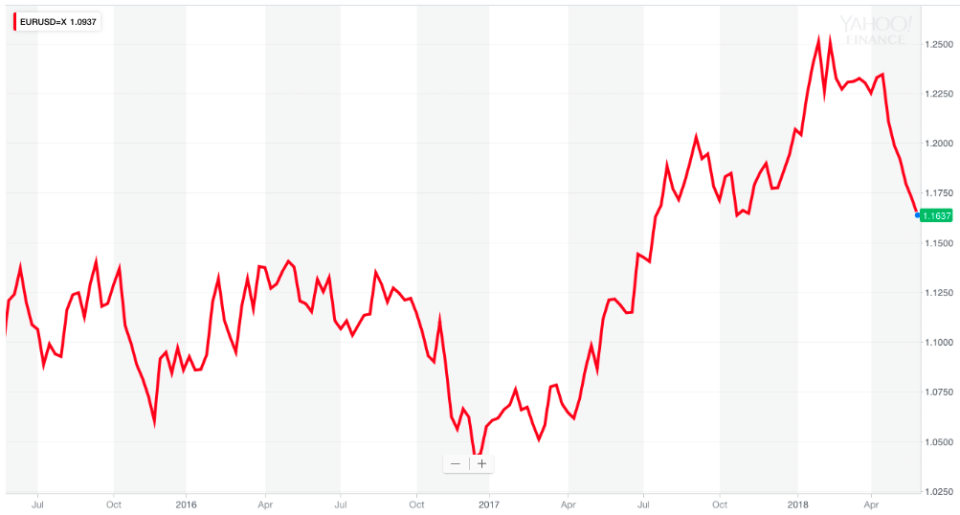

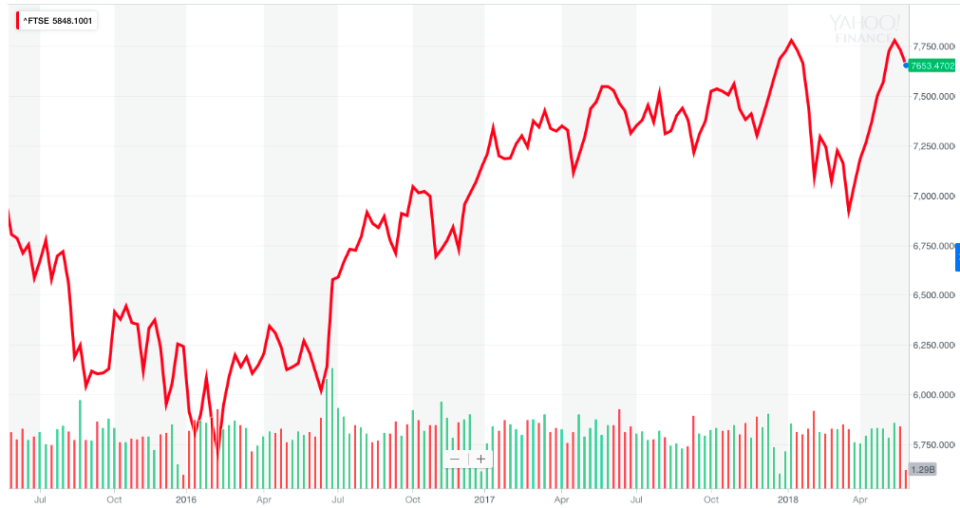

Worries about geopolitics have weighed on stock and bond prices in recent years, but have not led to lasting turmoil or downturns. Trevisani points to Britain’s 2016 vote to leave the European Union as well as recent national elections in the Netherlands, France and Germany and the Catalonia independence movement that threatened to split Spain as examples of Europe’s troubles. Despite these, the euro had managed to hold its own against the dollar and European stocks have gained.

“There isn’t any sense that these movements and ideas are going to overthrow basic economic ideas like the idea that trade is worthwhile, that trade is good. There’s no threat here,” Trevisani told Yahoo Finance. “There’s no sense anywhere I can detect that … the fundamentals are under threat.”

After falling by nearly 20% after the Brexit vote, the British pound had recovered nearly all of its value against the dollar in April and British stocks have gained, with the London FTSE 100 (^FTSE) gaining over 20% in the nearly two years since the vote.

The decision by British citizens to leave the EU certainly didn’t hurt U.S. equities (^GSPC), which have rallied 29%.

Selling today could make way for buying tomorrow

On Tuesday, investors sold stocks and piled into safe-haven U.S. Treasury bonds, gold and the dollar as fear that Italy’s upcoming repeat election could become a referendum on Italian membership in the European Union. But if history is a guide, it won’t take too long for the market to regain its risk appetite.

“Stock markets move up and down, and the selling seen today could easily give way to buying tomorrow as bargain hunting investors emerge,” said Bankrate.com’s chief financial analyst Greg McBride in a note on Tuesday. “Investors should resist any urge for a knee-jerk reaction.”

McBride noted that day-to-day market moves largely are not driven by long-term investors but by traders, who profit from short-term buying and selling. On Tuesday the traders “sold first and waited to ask questions until later,” he said.

The rising tensions in Italy appear to be “a temporary political problem and not something larger,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in an email to clients.

“Although a major exit from the euro zone, such as Italy leaving, would be a negative for the stability of markets, as long as the Eurozone remains in place – which I believe is likely – then markets should eventually return to normal.”

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.