Inside Macy’s Inc.’s Enterprise-wide Transformation

Take another look at Macy’s Inc.

After decades of being derided as a slow-moving, overstored retail dinosaur, Macy’s is transforming, regaining relevance, and capturing more shoppers in the process.

More from WWD

Hundreds of weaker stores have been closed and more could do so. The corporate hierarchy has been streamlined, leaving fewer senior managers with broader responsibilities and enabling more things to get done faster. About $900 million in annual costs have been cut out. Off-mall, off-price and digital strategies are evolving, reducing the dependence on the traditional department store though the big boxes still represent the core of the business. In the second quarter of this year, brick-and-mortar represented 70 percent of sales; digital 30 percent. And the Bloomingdale’s division has been getting higher grades from shoppers than other department stores, primarily for quality luxury and contemporary offerings, crisp displays and an energized shopping experience abetted by associations with pop culture.

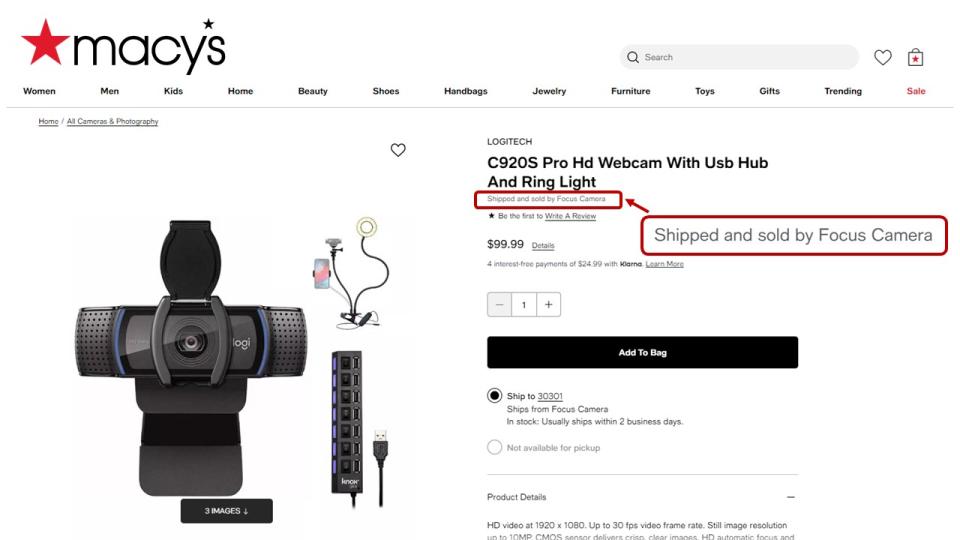

In the works: a complete overhaul of Macy’s private brand portfolio; additional Bloomies and Market by Macy’s off-mall specialty stores; “fresher and more current” holiday 2022 merchandise thanks to improved inventory management and greater liquidity enabling faster receipts of on-demand items, and the integration of the marketplace business model to the Macy’s and Bloomingdale’s e-commerce websites to introduce categories and brands not carried before. Marketplace items are those sold and shipped by third-party brands and indicated as such on the product pages.

Macy’s latest marketing strategy, “Own Your Style,” is a rebranding effort that strives to project some fashion authority and serve customers on a more individual basis.

“Our transformation really started two-and-a-half years ago, February 2020, at our investor day when we launched the Polaris strategy, and then the pandemic happened a month later. But Polaris has turned out to be this durable strategy that’s really helped to differentiate our business,” said Jeffrey Gennette, chairman and chief executive officer of Macy’s Inc. “Today we are just stronger, more agile, definitely financially healthier than before the pandemic. And we are super focused on long-term, sustainable profitable growth.”

The Polaris three-year strategy centers on personalization and the loyalty program; expanding assortments; accelerating digital growth; closing 125 department stores representing $1.4 billion in sales, with 70 of those already shut down; opening smaller-scale off-mall stores; boosting certain private brands into billion-dollar businesses, and reducing costs. Macy’s in 2020 cut 2,000 positions and shut its dot-com headquarters in San Francisco and corporate offices in Cincinnati.

“Polaris has helped to strengthen our customer engagement. It’s helped us expand our merchandise breadth. It’s helped us strengthen our financial health and also helped us expand our enterprise capabilities. Polaris is working. It’s multibanner. It’s multicategory. It’s multichannel,” Gennette said. “It helps us really focus on multiple generations and ethnicities, and it’s multivalue, going from off-price with our two off-price nameplates [Backstage and Bloomingdale’s the Outlet] all the way up to luxury.

“In two-and-a-half years we have expanded our customer base. We have now 44 million customers. That’s strong for us. We have a market-leading digital site. We are number two in apparel, home and accessories,” second to Amazon, Gennette said.

For emerging from the pandemic nimbler and more agile, stronger financially and receptive to introducing new formats, Macy’s Inc. is being honored by WWD as the Best-Performing Retailer, Large Cap, an award that Gennette will accept at the WWD Apparel and Retail CEO Summit. In a rapidly evolving time in the market — when many large retailers were shifting between boom and bust — Macy’s continued to advance on a variety of financial metrics, with revenue growing 39.8 percent to more than $25 billion last year as return on equity hit 46.3 percent.

Gennette and his team deserve credit for something that’s hard to measure — changing industry perceptions of Macy’s for the better. It’s not exactly a miracle on 34th Street, but it is a big accomplishment considering all the company has been through, i.e. bankruptcy, consolidation, the rise of Amazon and online shopping, COVID-19, and the cacophony from pundits preaching the death of the department store.

Yet in the current climate of steep inflation, incessant discounting and possible recession, Wall Street remains cautious on the outlook. The question remains whether Macy’s can keep up the positive image and momentum in the years ahead, or if it’s just having a moment.

Macy’s stock is trading at around $19, well below the 52-week high of $37.95, though some retail analysts believe it’s a good time to buy the stock on the cheap. Competitors, namely Nordstrom, Kohl’s, Amazon, Target and Dillard’s, are also trading down amid the volatile stock market and uncertain future. Department stores are tough, complicated businesses to manage that can generate a lot of cash but not necessarily much profit.

During an interview about how Macy’s is transforming, Gennette was seated in the wood-paneled conference room at the Herald Square flagship where scenes from “Miracle on 34th Street” were filmed. Along with the Macy’s Thanksgiving Day Parade, the 1947 movie is a family favorite and did help establish Macy’s as a destination for Christmas gifts. “It’s a pretty good film. It holds up pretty well,” said Gennette.

The Holiday Positioning

He expects Macy’s to hold up pretty well this holiday season, considering how consumer demand has softened since July and Macy’s own outlook for the year has been lowered. The retailer forecasts net sales for 2022 in the range of $24.34 billion to $24.58 billion and adjusted earnings per share of $4 to $4.20. That compares to an earlier forecast of $24.46 billion to $24.7 billion in sales, and $4.53 to $4.95 in adjusted EPS.

“We are in a much better inventory profile than we were in the past,” Gennette said. “In our second-quarter inventory levels were much more in line with our sales, which gives us the opportunity to flow in the freshness that we need. Freshness is the lifeblood of our business. We are targeting healthy inventory levels all the way through the balance of this year. We have achieved that,” so far.

“We are bringing in a tremendous amount of newness for holiday. Fifty-five percent of our content will be new versus 30 percent, which is where we were in 2019. We feel like we are able to respond to customer needs by having a really good inventory profile. That’s been a big change for us. When I look at inventory productivity, we are very passionate about that. We haven’t always gotten that right. Right now, we are in a good cycle — more conservative planning, building liquidity by having reserves and reacting in season. Those are merchandise mantras. Everyone is aligned on that.”

Gennette said through the pandemic, Macy’s cut annual costs by $900 million and extended debt maturities out while retiring “stacks” of debt. “We have deployed a really healthy capital allocation strategy, and we are now back to where we wanted to be in terms of investment grade profile.”

He also said that about 67 percent of Macy’s customers — considered those who shopped Macy’s at least once in the trailing 12 months — are active members of the Macy’s Stars Rewards loyalty program, compared to 52 percent in 2018. “That gives us tremendous flexibility in terms of speaking to those customers in a unique way,” Gennette said.

The agility of the retailer comes from being a “flatter” organization. “We are making decisions much faster than we ever have,” Gennette said. “Our employees are very engaged. We are working with less layers [of management] with greater spans of control that push the decision making down to the experts.”

Macy’s no longer operates with a president or a chief operating officer, and merchandising, planning and private brands organizations, previously separate for each family of business — women’s, men’s, home, beauty and center core — are blended. Eighteen positions have been boiled down to three leaders, in apparel; beauty and center core, and home and leased businesses. Each of the three oversees merchandising and planning for both market and private brands. “We have less buyers with broader responsibilities. There is also much less infrastructure in stores, close to 60 districts across the country are now down to 24,” Gennette said.

“When you look at the composition of our SG&A [selling, general and administrative expenses], a lot more of that is on our front-line colleagues or what we do in our warehouses or in our call centers, making sure we’re ready for the customer but doing it with as lean of a management organization that we can,” Gennette said.

Macy’s has long been criticized for insufficient customer service and often missing or slow to offer the styles and trends in demand. But Gennette said the company is “committed to serving customers better and doing that by focusing on enterprise capabilities,” meaning if there is a new strategy, such as personalization, or a price promotion, it must be considered across channels, and there’s a system of rewarding associates based on achieving goals, enterprise-wide.

“Personalization would be an enterprise priority online, in the app, in the store,” Gennette said. “Everybody plays when you think about personalization. Everybody plays when you think about having a really sticky loyalty program. If our customers care about a speedy delivery, our supply chain has to be all over that. Own Your Style goes through our site experience, on the app, and in the store talking to a colleague. We are going after enterprise data analytics aggressively and having clear priorities that we want to hit.”

He did acknowledge that Macy’s delivers an inconsistent experience, door to door, in terms of presentation and service, though it is challenging to apply sufficient resources and have the right talent in so many locations.

Reducing the Friction

“The big opportunity,” Gennette added, “is strengthening the customer franchise. We need to offer better experiences as a department store. There is lots of friction in our system still, but we are committed to having less of it over time. If a customer comes into a store and can’t find a sales associate, that could be friction.” Or friction could be when customers can’t find their size. “When a customer goes into an area done by size, we have to make sure it’s filled in for them. There are other times when they want a personalized experience. How do they get to that? Is there a fitting room that’s ready? We have to have a flexible strategy.

“We recognized a number of years ago that we were overstored, that the stores we did have were uneven in the experience they provided to customers. Over the years we have shed a gigantic chunk of the portfolio, a couple of hundred stores. We are down to about 50 remaining that we said we would close over time. We are chipping away at that. This past year we closed six. I do believe that we are coming to a point where the stores we have are in the most important malls. The B-plus through A-plus malls will stand the test of time. There are 500 or so of them.” Macy’s has 446 department stores and Bloomingdale’s has 33.

When considering whether to close a store, Macy’s takes in several factors — profits, costs, the value of the retail real estate versus the value attained through operating the store, the customers shopping the location and using it to pick up online orders, and how much they are spending there. “We look at full profitability, for omnichannel behavior, versus just the store or digital,” Gennette said. “We are getting down to the most important malls in America and that’s where we are investing.

New categories would be things like Toys “R” Us, which is on the Macy’s website and in all Macy’s stores. “We saw an opportunity to create America’s best toy experience both online and in stores. It’s going to be great.”

A few weeks ago the CEO was at Macy’s in Medford, Oregon, and in San Francisco to check out the Toys “R” Us presentations. “What we saw was new customers coming into our brand. Not only are they buying toys but they are also trading off into other categories.”

The investment in toys (Macy’s buys the merchandise for its Toys “R” Us departments) leads to the question of what other voids in the merchandising could be filled. Electronics would be a possibility. “We can be a one-stop shop if we do it right. That is how a modern department store is going to behave,” Gennette said.

Improving service involves personalized messaging. “We are in the early innings of that, but we’ve built the muscle, the technology and the customer information to respond,” Gennette said.

“Today we are doing lots of broad marketing that might be promotional. It might be broad-based discounts like one-day sales or friends and family. We’re bringing that down over time and making specific messaging to individual customers based on their spending pattern and browsing behavior,” Gennette explained. It’s where the loyalty program plays a big role, offering rewards and incentives in a more tailored manner.

He also cited the Macy’s media network, involving putting ads on the website to raise revenues, though Gennette sees it as more than just taking ads. “It’s brand experiences, rich brand experiences, and a lot in beauty and with brands like Ralph Lauren. In many cases, it’s comparable to what they have on their websites,” he said.

Private Brand Reboot

On Macy’s extensive mix of private brands, “you will see us do a complete reinvent of the portfolio in years 2023 through 2025,” Gennette said. “We’re reinventing existing private brands, retiring others, adding new ones. You will see the first new brand in the fall of ’23, and start to see brands like INC totally reinvented. One of the hottest businesses I have right now is the women’s INC brand. It’s been around for years. We are reinvigorating it with new fabrics, new classifications, putting more make into the garments, getting more AUR [average unit retail price] from the products.” Macy’s is also looking to reduce costs by working with fewer, more important suppliers.

The CEO said private brands represent 16 percent of Macy’s total business and that of all the businesses at Macy’s, private brands would grow at one of the fastest rates. Another 10 percent plus of Macy’s volume is generated by exclusive merchandise from brands that aren’t exclusive to the store, bringing Macy’s level of merchandise exclusivity to more than 25 percent of the assortment.

With brick-and-mortar growth, “Where we are going is off-mall,” Gennette said, citing the October conversion of a former Carson, Pirie Scott store in Evergreen Park, a suburb of Chicago, into a Market by Macy’s on the ground floor, and on the second floor, a Backstage store and an expanded micro fulfillment center for servicing online orders in the greater Chicago area. It fits into a “backfill” approach, where Macy’s already has stores in major markets like Atlanta, Dallas and Chicago but sees room to fit in the Market by Macy’s specialty format.

In Chesterfield, a suburb of St. Louis, it’s a replacement strategy. Macy’s is closing a department store in a mall but will open a Market by Macy’s 2 miles away in a power center. “We are now doing the transition of letting customers know where we are going to be,” Gennette said.

“The third bucket” of Macy’s fledgling specialty strategy is going into a new market possibly where Macy’s once had a store but no longer does, or where desirable real estate hasn’t been found, yet the company sees opportunity for business, Gennette explained.

“There are going to be new Market by Macy’s in our 2023 portfolio. We haven’t announced those. It’s premature to tell you.”

Status Report on Off-Mall Formats

Operating 30,000-square-foot Market by Macy’s specialty stores is a far different skill set from operating 150,000- to 300,000-square-foot department stores. Past experiments in the specialty stores haven’t been very successful for Macy’s. Bloomies airport shops had a very short run in the late ’80s.

“It is a big change,” Gennette acknowledged. “But what I love about Market by Macy’s is we are not opening them with these anchors of branded shops that lock you in for a period of time. There is so much flexibility in these. You can only tell so much of the story in 30,000 square feet. You’ve got to make sure you remain flexible. With the beauty floor, we’ve laid out branded experiences but everything else is highly flexible.”

Asked how Market by Macy’s has been performing in its early days, Gennette replied, “It’s been really good. Apparel and beauty have been quite strong out of the box.…We are trying to find what’s the right mix in home. You can’t tell the full home store story. There’s home decor, textiles and no big tickets, no mattresses.”

At the first Market by Macy’s opened in Southlake, Texas, in February 2020, dresses were underplayed. “You are seeing us build up dresses bigger as we add new Market by Macy’s. We had a more balanced mix of private brands and market brands, but we’re seeing in some businesses like men’s that [customers] want more market brands. So we have amplified that.

“You might see fashion jewelry as only 1 percent of the assortment,” though in another location it’s a higher percentage. “We are taking reads on how the customer is responding, making sure we are flowing merchandise based on how the customer is voting.”

Market by Macy’s has an open environment, a racetrack layout, a fitting room complex in the middle, At Your Service for returns and online pickups, and associates that roam the floor with customers.

Bloomies, the scaled-down, curated version of Bloomingdale’s emphasizing luxury, contemporary and casual styles, opened in the Mosaic District lifestyle center in Fairfax, Virginia, last year and will open a second Nov. 17 at the Westfield Old Orchard Mall in Chicago. A third Bloomies will be announced soon.

“We are not going to scale it until it works,” said Gennette, referring to the Bloomies and Markets by Macy’s off-mall formats. “But based on what we learned with both the Macy’s and Bloomingdale’s brands, stay tuned.”

Macy’s Inc. has allocated $3 billion in capital expenditures for the 2022 to 2024 period, which would include new stores, renovations, technology, stock buybacks and dividends. “We believe that’s the right level of capital for a business of our size. We make sure we give a predictable dividend and as of Q2 2022, we’ve got a $2 billion opening from the board and we have spent $600 million so far. We throw off a lot of cash. We are very profitable. But our first order of business is to make sure we are investing in profitable growth for the business,” Gennette said.

The Future for Herald Square

There’s an ambitious redevelopment plan on the drawing boards to build a tower atop the Herald Square flagship and bring $235 million in improvements to the Herald Square area involving car-free, pedestrian-friendly spaces, landscaping and upgraded access to public transportation. The idea is to draw more visitors to the area and make it feel less frenetic.

“It’s a work in progress. There’s no timetable. I don’t want to get ahead of that,” Gennette said. “We are working with the mayor’s office. There is a deep process for us to be able to go forward with the plan,” involving discussions with the city, the MTA, other agencies and neighborhood groups. “We believe we’ve got a great mix of civic improvements that would give us the rights to build a tower atop our Herald Square location, the company’s most important asset. It’s a highly productive building. We are getting great growth out of the building right now, albeit that’s over the 2021 pandemic levels. Tourists are starting to come back. Office workers are starting to come back. We recognize we can do all of this and take care of this asset but also monetize its value.”

In recent years women’s apparel has been a weak spot at Macy’s, though when asked about that Gennette replied: “Women’s is one of our strongest businesses. Part of that is lapping a tough period. We are not under-penetrated in women’s, as a percent of our total business, but we lost market share we know we can get back. We do more market share in men’s apparel than we do in women’s apparel. That gives us a really good calling card to go after the women’s business more aggressively.

“We’re looking at customers more minutely than just under and over 40. What life stage are they in? They’re becoming independent. They’re getting their first apartment. They’re having their first kid. We are looking to our portfolio of market brands and private brands to address those life stages more impactfully. A lot more to come on that.”

From Selling Mopeds to Running Macy’s

Being customer-focused is something Gennette knows a thing or two about.

During high school he sold mopeds on commission at Moped Motors in El Cajon, a suburb of San Diego. “I really enjoyed it and was quite good at it. I made a lot of money selling on commission. I enjoyed figuring out what the customers needed, looking at the products I had and making that connection.”

In college, he majored in Victorian literature and creative writing but he still had the bug so he joined Macy’s right out of college. “I thought I would stay a couple of years and go to business school.”

That never happened, but he briefly left Macy’s to try specialty retailing with FAO Schwarz, where he opened the flagship in Union Square, San Francisco. “After eight months I realized specialty retail was not right for me, so I came back to Macy’s as the store manager in Santa Rosa [California].

“For the first 25 years of my career at Macy’s I went back and forth between stores line and merchandising, and I learned that when you are strategizing merchandise with all of these decisions you make as a merchant, it’s got to be executed with the customer in mind, but it’s got to be executed at the store level.”

In different parts of the country he worked as a sales manager, a floor manager, a store manager, assistant buyer, associate buyer, buyer, divisional, general merchandise manager, director of stores. He became chairman of the former Bon Marché and Macy’s West divisions before they were converted to Macy’s, later ascending to Macy’s chief merchant, then president. He became CEO in 2017, and chairman and CEO a year later.

He’s worked for Macy’s in Atlanta, Minneapolis, New York, San Francisco, Monterey and Santa Rosa. “I’ve been in all these places to learn about different customers, their different needs.”

He did lead the conversion of Lazarus in Ohio and Bon Marché in Seattle to the Macy’s nameplate, which was not an easy task considering the opposition from locals who didn’t want to see their hometown stores forced to replace their nameplates with Macy’s. “There was some pushback but it was the absolute right call,” said Gennette. “This idea of one national Macy’s nameplate gives the business enormous market power.

“Retailing has been my life work for 40 years. But what I love about it is just how complex it is. It rewards those who have talent and ambition. I don’t think retail gets the credit it deserves for offering opportunities in marketing, merchandising, technology, data analytics. There is so much diversity in the business. There is no shortage of opportunities. There are often shortages of great talent.”

The business has been furthered complicated by COVID-19 and requiring leaders like Gennette to rethink how and where employees work, remotely or in the office.

“For somebody like me who said we need to have everybody in person, my point of view has totally flipped,” Gennette said. “To be a great retail brand, you have to have a lot of flexibility for your colleagues who expect that. You can learn to manage virtually. You can learn to develop people virtually. You can learn to have meetings with people in person and people on the screen. One of my senior leaders in finance lives in Chicago. My marketplace leader lives in Minnnesota.

“Looking at the hires we made over the past year, many of them live in different parts of the country. They are just adapting beautifully to what we are doing together,” Gennette said. “There are still going to be times when people have got to come together, brainstorming, planning activities, where everybody benefits by being together, depending on the function. A flexible workplace is really going to serve us well. It’s a requirement for a brand going forward.”