In Inflationary World, Pricing Power in Women’s Remains Elusive

- Oops!Something went wrong.Please try again later.

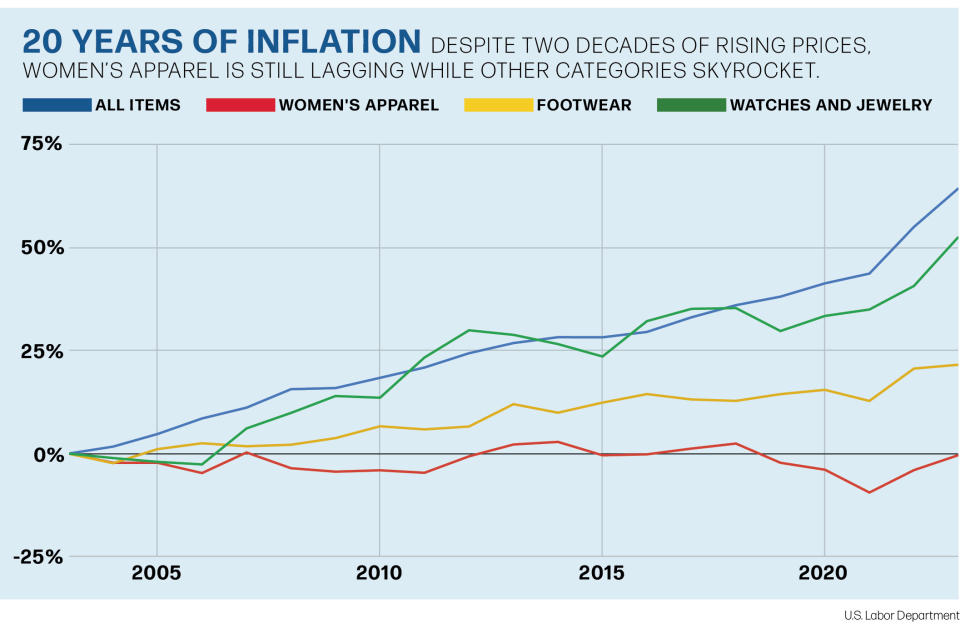

The obsession with inflation rolls on — even as the world of women’s apparel continues to struggle for pricing power.

On Tuesday, Wall Street was placing bets on just how the Federal Reserve will view the combination of slightly slower price increases in the economy last month and a bit of a banking crisis.

More from WWD

Before the failure of Silicon Valley Bank last week, when depositors scrambled to pull their money out and the government had to step in and take over, Fed chair Jerome Powell was signaling that more aggressive interest rates might be needed to combat inflation.

Now the thinking among Fed watchers is that a standstill or just a small rate hike might be in order when the Fed committee that sets the benchmark interest meets again on March 21 and 22.

“The Fed’s actions in March will depend largely on whether the banking system and financial markets calm down by next Wednesday,” said Stephen Stanley, chief U.S. economist at Santander. “If they do, then the case for another rate hike is compelling. Indeed, if this banking stress blows over, we will probably get right back to the prior thought process in terms of the Fed — though any consideration of a 50 basis point rate increase is presumably off the table now, both in March and for the balance of the rate cycle. It is too early to state confidently where we will be next Wednesday.”

Over the past year the Fed has hiked interest rates eight times, rising to a range of 4.25 to 4.50 percent from 0.25 to 0.5 percent — a massive jump in a short period of time.

Wall Street abhors higher interest rates since they make it more expensive to borrow money to trade, so any hope of avoiding additional hikes tend to be welcomed by investors.

That was visible Tuesday as the Dow Jones Industrial Average rose 1.1 percent, or 336.26 points to 32,155.40, as retail bounced back from sharp declines on Monday, when the banking troubles led to worries over the consumer. Among the fashion gainers on Tuesday were Abercrombie & Fitch Co., up 4.6 percent to $26.79; Oxford Industries Inc., 4.5 percent to $114.08; American Eagle Outfitters Inc., 3.6 percent to $13.24; On Holding, 3.6 percent to $20.97, and Canada Goose Holdings Inc., 2.9 percent to $17.89.

Even as the market rebounded slightly, the picture remains murky — and Tuesday’s inflation figures didn’t help. The story in apparel is particularly nuanced, with recent gains as the industry recovers from its COVID-19 slump masking a longer-term weakness.

February women’s apparel prices grew 3.8 percent from a year earlier, as men’s apparel gained 2.2 percent, footwear inched up 0.8 percent and watches and jewelry jumped 8.4 percent, according to the U.S. Labor Department.

Even with these increases, most of the industry significantly lagged the broader economy, where the Consumer Price Index for all goods showed inflation slowing to 6 percent growth last month from a 6.4 percent year-over-year increase in January.

All of this has shoppers feeling the strain.

“Prices are still running hot and hitting consumers in the pocket,” said Neil Saunders, managing director of GlobalData.

Saunders noted that while overall inflation grew at its slowest pace since September, prices are still up 14.4 percent over two years.

“Households are still exhibiting inflation-busting behaviors, including reducing the volume of non-essential products they buy and trading down to cheaper brands,” he said. “As a coping mechanism, consumers also continue to increase their credit card balances and whittle down savings as they try to maintain living standards and their quality of life.”

Indeed, discounters like Walmart Inc. have said that shoppers are having to choose food over fashion.

While many apparel players like Ralph Lauren and Michael Kors have sought to move prices higher, emphasizing brand and their higher-end positioning, the category at large has had trouble establishing pricing power.

Over the past 20 years, women’s apparel prices are down 0.4 percent compared to a 21.5 percent rise in footwear, a 52.6 percent increase in watches and jewelry and inflation of 64.3 percent for all goods.

That weakness in women’s points in part to a more efficient supply chain, lower barriers to trade, the rise of fast fashion and offprice and more. But it also shows that fashion still has some work to do to win hearts, minds and wallets.

Best of WWD