Inditex Sales Rise as Company Plans to Launch Resale, Livestreaming in the U.S. and Spend Big on Logistics

- Oops!Something went wrong.Please try again later.

PARIS — While luxury spending slows, Zara parent company Inditex saw sales rise across its brands last year, as the fast-fashion retailer remains resilient.

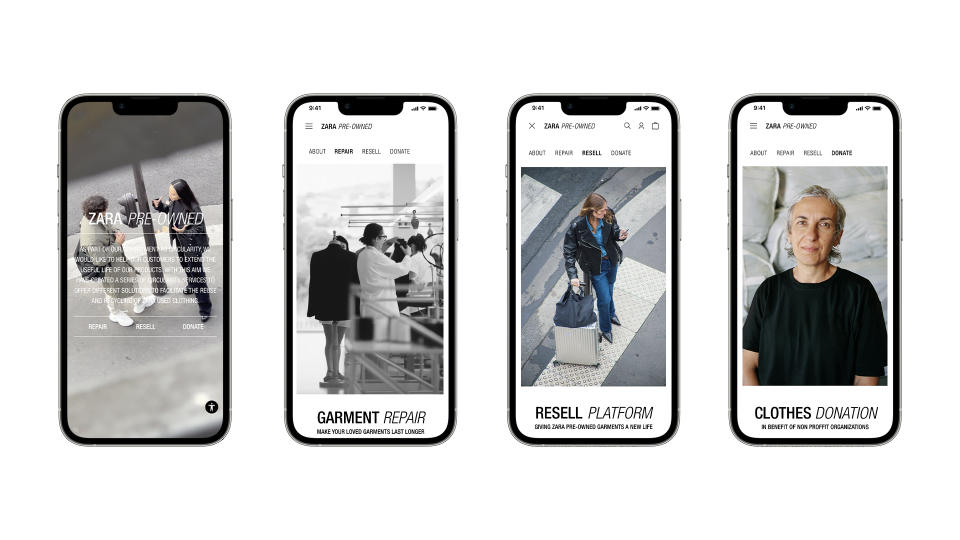

Sales at constant currency were up 14.1 percent to 35.9 billion euros in the full year to Jan. 31. even as the company reduced inventory by 7 percent. It also revealed plans to launch its Zara pre-owned resale concept in the U.S and livestreaming in the U.S. and the U.K. on its own platform in the “coming weeks.”

More from WWD

Inditex is also planning a big spend on logistics, with a 900-million-euro plan to add new distribution centers in Europe, mostly Spain and the Netherlands, over the next two years. Those will be dedicated to the Zara and Bershka brands, as well as one dedicated to footwear and accessories across all of Inditex’s labels.

“This is probably the the moment in which the company has thought it should add muscle for future expansion, for future growth. This is very much our thinking,” said Inditex capital markets director Marcos Lopez in a call with investors following the numbers release Wednesday. “We see very strong growth opportunities and the main goal of the company is always to invest ahead of the cycle to be able to obtain these opportunities in the marketplace.”

“The flexibility and responsiveness of our business in conjunction within in-season proximity sourcing allows a rapid reaction to fashion trends and a unique market position,” added chief executive officer Oscar García Maceiras.

The momentum is rolling on into 2024, with this year’s sales starting strong, up 11 percent year-over-year in the period of Feb. 1 to March 11.

“Momentum in recent weeks is impressive against a mixed macro backdrop especially in Europe,” said Jefferies analyst James Grzinic. The company’s investments so far have pushed its post-pandemic growth into “remarkable” territory.

“We see Inditex’s proposition of good quality, good value fashion resonating more strongly even in its better penetrated region [of Europe]. This at a time of growing discount propositions with poorer quality garments, and a luxury end becoming less affordable to the masses,” he said.

Investors took the news of the infrastructure spend in stride “considering the scale of volume growth in recent history, and the expansion plotted in the future,” Grzinic said.

The investment in distribution for Bershka is a smart strategic move, said RBC analyst Richard Chamberlain. “Currently Inditex’s non-Zara formats have a slightly lower margin but a higher [return on capital expenditures], so it makes sense to expand them alongside Zara including, we think, in time in the important U.S. market.”

The market agreed, with the shares rising to an all-time high, up 7.74 percent to 44.26 euros at close.

It’s a marked contrast to Swedish rival H&M, who saw its full year sales up just one percent in local currencies over the course of 2023. The company has struggled in the face of ultra-fast-fashion competitor Shein, which has been undercutting H&M on price as it readies for an IPO.

Homegrown rival Mango is also hoping to compete and cut into its market share on main street, with plans to open 500 stores worldwide by 2026. It is eyeing 4 billion euros of revenue, though it is still dwarfed by rival Zara.

Zara has successfully played up its fashion credentials with a series of high-profile designer partnerships, such as a capsule collection from model Kaia Gerber and the launch of hair products from stylist to the stars Guido Palau, following the arrival of scion Marta Ortega Pérez as non-executive chair of Inditex in April 2022.

All those sales and tight cost controls have led to a strong cash position, with about 11.4 billion euros on hand. Not content to coast on its brand positioning, the company is gearing up not only for the logistics spend, but on upscaling its experience.

That will be another investment of 1.8 billion euros over the next two years on upgrading its stores with a new, cleaner concept and improving its omnichannel integration, so much so that García Maceiras said it was “not possible” to differentiate between growth strategies of online versus in-store sales, and would not expand on how much of those online sales are fulfilled by its physical stores.

“I would like to highlight that all of this [sales increase] is a consequence of our fully integrated model. It is not possible to understand properly the strength of our online sales without taking into consideration the operational support provided by our stores…and it’s not possible to understand the very positive evolution of our sales in our physical stores without bearing in mind the strong prescription capacity of our our online platforms,” he said.

Still, Inditex had the numbers: Online sales were up 16 percent to 9.1 billion euros in fiscal 2023.

García Maceiras noted that the company’s plan to upgrade Zara stores with RFID tags that can precisely locate merchandise within a store as well as facilitate self check out is now fully operational and that model will be rolled out to other brands.

In-store sales rose a solid 7.9 percent, with footfall up while the company expanded and revamped existing stores and shuttered underperforming locations. Adjusting that mix left 5,692 Inditex doors open by the end of 2023. With this upgrade spend, the company will see about a 5 percent increase of floorspace by 2026.

Growth in new markets was key to its expansion in 2023. Zara opened its first location in Cambodia.

Looking to 2024, Zara will open at The Grove in Los Angeles, Caesars Palace in Las Vegas, in addition to locations in Rome and Hamburg, Germany. Upgrades will come to its outposts in Milan and Shanghai with a new, cleaner concept.

Expansion is also in the cards for Massimo Dutti in Miami, Oysho in Hamburg, Bershka in Mumbai and Zara Home in Bangalore, India.

The Dutti decision in the U.S. was based “after a good level of online sales through the website,” García Maceiras said. He added that “another commercial format” will soon launch in the U.S., but did not specify which brand would make its way to American shores.

Opening physical stores in what the company called “mature markets,” such as Stradivarius in Germany, is based on the strength of online sales and targeting cities where a brand is already well-known.

Inditex will open its first stores in Uzbekistan, though it did not specify for which brand, and reopen its Zara stores in Ukraine.

Inditex’s cornerstone Zara brought in 26.1 billion euros as its top-performing brand, followed by younger skewing Bershka at 2.6 billion euros, Pull & Bear at 2.3 billion euros and Stradivarius at 2.3 billion euros. The younger concepts have been “robust,” Lopez said.

Inditex is leaning on the strength of Zara, with “all concepts” modeled after the fast fashion behemoth’s omnichannelintegration strategy.

The company’s upscale brand Massimo Dutti, which recently reopened a flagship in Paris, brought in 1.8 billion euros, while its loungewear concept Oysho finished up the pack with 744 million euros.

Inditex executives were scant on details about categories, and did not address questions about growth in footwear, for example, but with the new distribution center dedicated to footwear and accessories group Tempe, it will seek “new opportunities.”

This comes as institutional investors including Artemis Investment, Cardano, Clearbridge Investments, Schroders, Dutch asset manager MN and Norway’s sovereign wealth fund call on Inditex for more transparency in its supply chain.

In terms of markets, Europe remains its stronghold with nearly 50 percent of sales coming from the continent, excluding Spain, while its home country adds another 15 percent to its global sales.

The Americas accounts for 19.6 percent of sales, and Inditex sees “significant long-term growth opportunities in the United States,” García Maceiras said.

Asia and the rest of the world represent nearly 17 percent.

Gross profit increased 11.9 percent to 20.8 billion euros, while EBITDA was up 13.9 percent to 9.9 billion euros for the fiscal year.

The results pleased investors. Inditex stock was trading up 6 percent to 43.53 euros at 1:35 p.m. CET.

“We view Inditex as a strong omnichannel fashion retailer, which historically has benefited from its speed to market and product department-driven manufacturing process,” added RBC’s Chamberlain. “Inditex’s strong sales densities have enabled it to earn a high-teens margin historically, which we think it can maintain.”

Best of WWD