How Fed Chair Powell can avoid a stock market nightmare

President Trump’s strategy of defending the economy’s strength in the face of recession fears appears to have worked temporarily. The rebound in bond yields calmed markets on Monday, but the stock market dipped back into the red on Tuesday, with the Dow sinking after two sessions of gains.

Caught in this economic and political firestorm is Fed Chair Jerome Powell. He will be speaking about the challenges for monetary policy at the Fed’s annual Jackson Hole Conference on Friday.

Powell has to walk a tightrope, as he faces relentless pressure from Trump to cut rates as quickly as possible, while maintaining the Fed’s independence. Markets have already priced in more rate cuts this year.

Indeed, that’s why the bar is quite high for Powell’s comments at Jackson Hole. “His last press conference after the July FOMC meeting left real doubt about the Federal Reserve’s future course of action. Markets think he will be clearer at the end of this week,” a recent Datatrek Research note said.

Datatrek Research co-founder Nick Colas says Powell may be able to avoid a sharp decline in stocks simply by signaling that the Fed will “embark on a steady diet of rate cuts through the rest of 2019,” he said.

“Markets have become very specifically convinced of a certain pathway, which is one 25-basis-point cut at every meeting paradigm,” Colas said. “And Powell doesn’t have to say ‘yes, we will cut at every meeting by 25 basis points,’ do a mic drop and walk off. But he does have to indicate that he is amenable to a series of cuts.”

Powell cut interest rates by a quarter percentage point back in July – for the first time since the 2008 financial crisis. That move didn’t satisfy markets or Trump. The president called Powell out on Twitter, saying, “As usual, Powell let us down.” Trump wanted a sign of more – and more aggressive – rate cuts to come.

On Friday, investors will be paying close attention to every word Powell says, looking for clues as to what his monetary policy strategy will be over the next couple of months amid a global economic slowdown, potential recession, and the looming threat of additional 10% tariffs on Chinese imports.

Investor disappointment in Powell’s choice of words could “trigger carnage in the bond and equity markets,” Paul Ashworth, chief U.S. Economist at Capital Economics, said in a note this week.

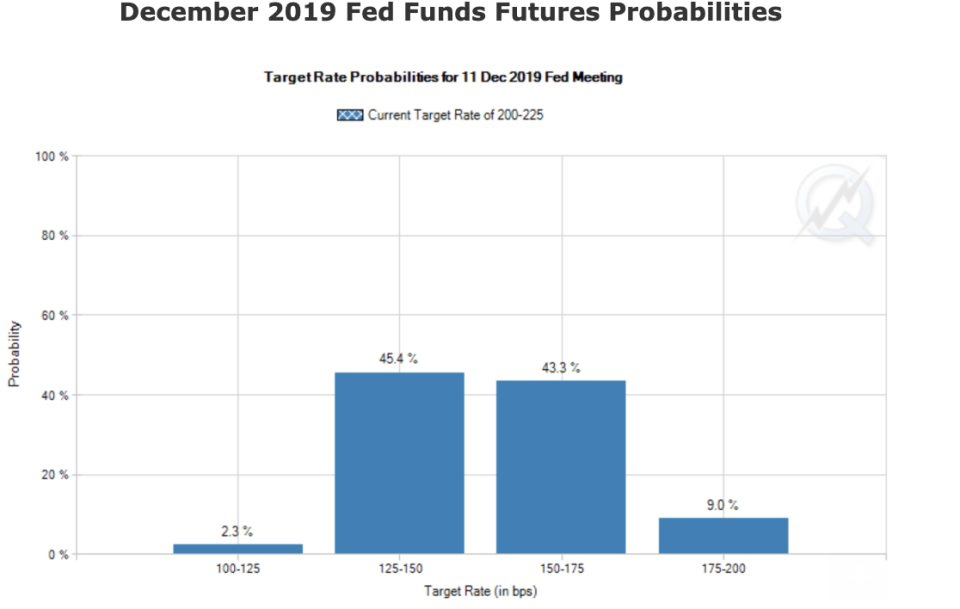

Fed Funds Futures prices indicate that most investors are expecting at least two rate cuts this fall: a 95% chance of a 25-basis-point cut at the FOMC’s September meeting, a 73% chance of another 25-basis-point cut at the October meeting, and 44% odds of one more rate cut or none at all in December.

More from Sibile:

Why Trump’s efforts to keep immigrants out hurts the U.S. economy

Trump delays tariffs to appease Christmas shoppers

Here’s the truth about Trump’s Pledge to America’s Workers

Democratic debates: Fight over free college for rich kids

Trump adds $4.1 trillion to national debt. Here’s where the money went