Why health insurance is not enough to save some families with sick kids from financial ruin

My 7-year-old son is in surgery right now and I’m typing this from the hospital waiting room. I can see from the electronic update board hanging on the wall that patient No. 358227 has finished pre-op and the procedure has begun. That’s his number, so I’m nervous.

I’m also angry. Angry that while he is laying on an operating room table, I’m sitting here worried about how much this is going to cost.

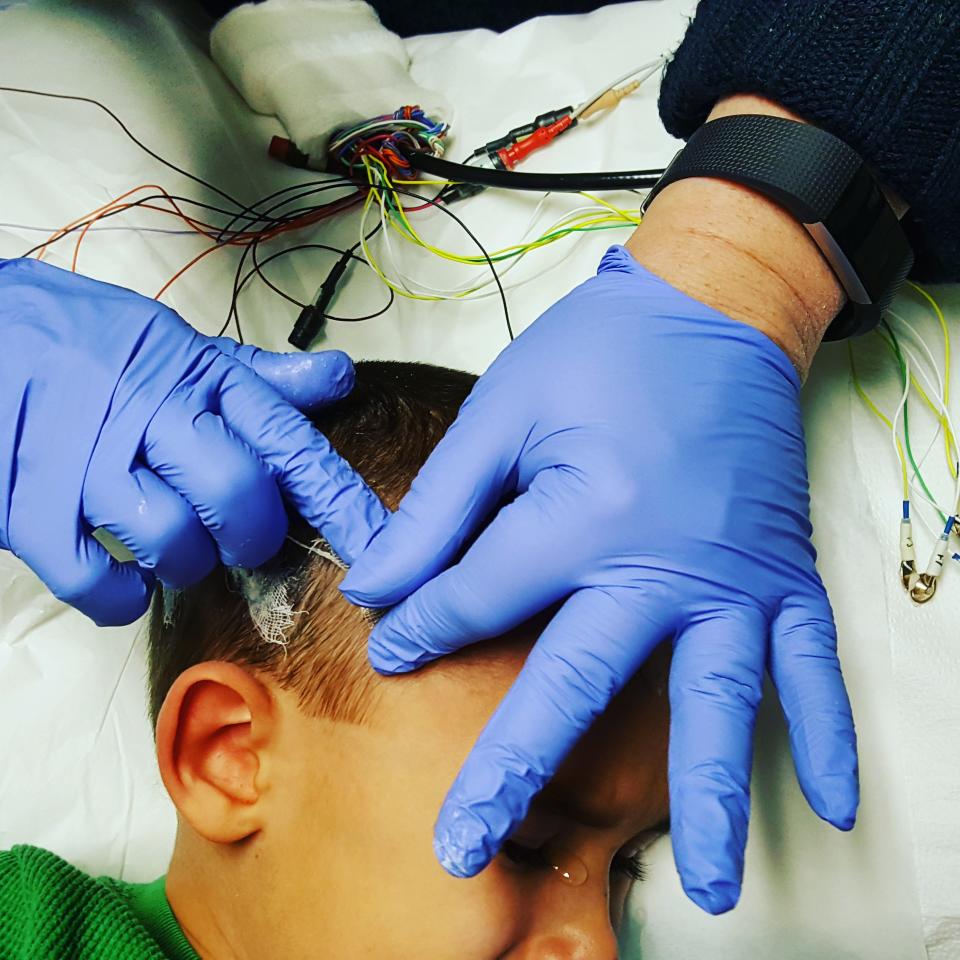

He was 5 when he was diagnosed with epilepsy — unrelenting seizures that leave him unconscious, waking up only to wander around incoherently, unable to dress himself, feed himself, or comprehend simple tasks. He’s a ghost of the child he once was.

Now, just two years since this began, we’ve spent almost $90,000 on his care, despite having insurance through my husband’s employer — insurance that costs us nearly $9,000 a year in premiums and deductibles, and still doesn’t cover even half of the medical bills he incurs.

Prescriptions that run $4,000 a month are constantly challenged by our insurance company as “not medically necessary,” in an attempt to have the doctor prescribe a cheaper, less effective, alternative. Therapy programs to fix the damaged parts of his brain far exceed the number of insurance-allowed visits, or in many cases, simply aren’t covered at all.

In-home healthcare, at a cost of $40 an hour, hasn’t been reimbursed by as much as a single penny, and specialized equipment is routinely found to be ineligible under our policy’s “excluded durable medical goods” clause. There’s also an expensive medical diet, and modifications that had to be made to our home — items our insurance company wouldn’t even dream of covering.

And each night before we tuck him into bed, we hook him up to a monitor that will sound an alarm if he goes into distress. At $6 a night, the price keeps me awake anyway, but not as much as the fear of him dying unexpectedly — a reality for 1 in 150 children with uncontrolled seizures.

To add insult to injury, those expenses don’t even include the ones we incur for our daughter, who has a rare form of Ehlers-Danlos Syndrome. Yes, we have two special needs children.

The costs are staggering. And I know that we are not alone. In fact, there are 79 million Americans struggling to pay their medical bills. According to a survey conducted by the Kaiser Family Foundation in conjunction with The New York Times, 61 percent of Americans with medical debt were insured when they were sick or injured. Of those people, 26 percent had their medical bills denied for payment by their insurance company, and 75 percent reported that they were unable to pay the premiums, deductibles and co-insurances costs their policy required. It’s a lose-lose situation for people already in a terrible position.

Elena Rawls, from Apopka, Fla., knows the feeling all too well. It’s been exactly a year and a half since her then-3-year-old son Aidan, was diagnosed with stage 4 neuroblastoma, an aggressive form of cancer. Since then, Aidan has undergone treatments that span the U.S., in efforts to save his life. And although Aidan is currently responding well, the effects of his cancer have rippled into the family’s finances. With Elena traveling to New York and Michigan for his care, her husband has had to stay in Florida for work.

“It’s brought us down to a one-income family,” Elena tells me, while pointing out that “insurance doesn’t cover regular bills, or food while in the hospital. It’s a huge strain.” One that leaves them relying on fundraisers and donations to offset their expenses. “We’ve been left fighting the insurance company to have tests and treatments covered that are critical to his care, because they wanted us to do something we know isn’t effective,” Elena explains. That’s a stress that no one needs when their child is fighting cancer. “We try to keep moving forward and not let it distract us” she says. “I’ve seen families living in their cars because of the toll cancer has taken.”

That’s a toll that Marlene R., from Chicago (who did not want her last name used), is sadly familiar with. Marlene’s daughter was 14 when she was diagnosed with diabetes. A single mom, Marlene worked hard to provide for her daughter, and couldn’t have been prouder the day she purchased a three-bedroom house. But when the costs of her daughter’s diabetes supplies outpaced what her insurance would cover, Marlene was left with a choice; drop her income low enough to qualify her daughter for Medicaid, or risk her daughter’s life.

Eventually, Marlene resigned from the job that she loved, and got a part-time job working retail. But with her reduced income, the household bills began to pile up, her credit score plummeted, and two months ago, Marlene lost her house, was unable to secure an apartment, and, facing a decades-long housing assistance list in her state, was forced to move into her car. When I asked her what she wished people knew, her voice got quiet and she said, “What it costs to save your child’s life.”

My heart breaks for Marlene, and I’m terrified when I look at my own family’s future. Last year, after adding our third and final child to the family, my husband and I sold our tiny townhouse and built a bigger home, near a school with a good special-needs program; we took out a mortgage we would cover comfortably. But now, overwhelmed with the cost of our son’s care, we are left in a position in which paying our bills means that we can’t pay for the in-home healthcare he needs; it’s a service that will eventually be covered by our state’s disabled children’s fund, should he ever make it to the top of a waiting list that currently has 17,000 people on it, and hasn’t moved a child up, in 15 years.

Two weeks ago, my son’s doctor suggested that my husband and I get divorced. “I’ve had several patient’s parents get divorced, just to get one parent under the poverty line” he told me, hinting that like Marlene’s daughter, Medicaid may be our son’s only saving grace. And it breaks my heart, that in families just like mine who are fighting to save a child, the only way to keep going, may be to walk away from each other.

I don’t know what the answers are to America’s healthcare crisis, but what I do know is that something needs to change.

The electronic board hanging in the corner of the surgical waiting room, now says that my son is out of surgery. I’m looking forward to being able to hold him in my arms, but I’m terrified that at any moment, so much might be ripped from my desperate pleading hands.

It costs a lot to get sick in America. Sometimes, it costs everything.

If you’d like to follow Eden and her son’s fight against epilepsy, you can visit them on Facebook or Instagram.

Read more from Yahoo Lifestyle:

• ‘There are no stepdads in our family — only a dad that has stepped up’

• Teacher asks coworkers to donate extra sick days so he can spend time with his daughter with cancer

• Teen with terminal cancer gets early graduation ceremony: ‘It makes me feel like I matter’

Follow us on Instagram, Facebook, Twitter, and Pinterest for nonstop inspiration delivered fresh to your feed, every day.