What Happens Now to Effective Altruism, SBF's Pet Philosophy?

- Oops!Something went wrong.Please try again later.

"Hearst Magazines and Yahoo may earn commission or revenue on some items through the links below."

If you listened carefully during the arrest of Sam Bankman-Fried and the implosion of his cryptocurrency empire—the exchange FTX and the hedge fund Alameda Research—you might have heard the squeak of a spigot closing.

A year ago Bankman-Fried founded the FTX Future Fund, a grant and investment–making organization to “improve humanity’s long-term prospects.” The group said it would distribute “at least $100 million,” maybe up to $1 billion in 2022, aimed at causes like pandemic prevention, nuclear disarmament, and the “safe” development of artificial intelligence.

These existential preoccupations align with the ethos of “effective altruism,” a philanthropic movement that has swept through the Bay Area, picking up acolytes like the Facebook billionaire Dustin Moskovitz and his wife Cari Tuna; LinkedIn co-founder Reid Hoffman; Palo Alto’s favorite prophet gerontologist, Aubrey de Grey; even Elon Musk. To put it pop culture terms: if Will Sharpe’s character on The White Lotus existed in real life, he would be an effective altruist, and Aubrey Plaza would side-eye him for it. The most prominent advocate of all was Bankman-Fried, or SBF as the 30-year-old former billionaire is known, and his fall from grace has now forced rank-and-file effective altruists to wonder if their brand helped fleece retail investors.

Even before the FTX debacle and the subsequent reckoning, the rise of this ideology signaled a radical shift in donor mentality in Silicon Valley. Its prime directive is to do the most good possible, by prioritizing giving to the world’s biggest, most solvable, and most “neglected” causes. The benchmark example is bed nets for malaria prevention; another area of concern is the long-term survival of living beings. The grandchild of philanthro-capitalism, it resonates with young, up-and-coming, data-worshiping investors and their sense that having an answer is better than not.

“It’s an appealing framework for billionaires,” says Rhodri Davies, a philanthropy expert at the University of Kent. Where traditional philanthropic modes seek to distribute power in addition to money, effective altruism implies that it’s best if donors give the money but keep the power. “As somebody who has made a lot of money, you’re exactly the best person to determine how money should be most rationally distributed in the world, and you’d be doing a disservice to the world if you didn’t take it upon yourself to fulfill that function.”

The origins of the concept can be traced back to at least the 1970s, when the Australian philosopher Peter Singer argued that if people can make relatively painless sacrifices to prevent global suffering, they must. In 2009 Will MacAskill, now a 35-year-old philosophy professor at Oxford, and a colleague, Toby Ord, started incubating a friendlier, more accessible, more sharable version, launching “Giving What We Can,” a pledge to give 10 percent of their incomes to “effective” charities—measured, of course, with data, the technocrat’s lingua franca.

"Data is the story of the victors, the story of the data collectors,” says the computer scientist and artificial intelligence expert Timnit Gebru, who adds that such overconfidence in their numbers betrays an “air of superiority and 'we know best.'” But that’s also the language of a generation of tech tycoons reared on the start-up mentality of moving fast and breaking things, damn the consequences.

“Over the past three decades the charitable sector has been pushing toward greater measurement, but usually within a cause, like weighing the effectiveness of charities in animal welfare or cancer research,” says the philanthropy historian Benjamin Soskis. “But effective altruism insisted people think about how we decide on the causes themselves and their trade-offs. That type of thinking about charitable giving is becoming more public, and that’s something an effective altruist can take some credit for.”

Even as an undergrad at MIT, Bankman-Fried seems to have grasped the power behind the message; later he would wrap an overtly commercial agenda in the invisibility cloak of dogooderism. The jargon and the existing effective altruism network brought him the first loans to launch his company—$50 million from Skype co-founder Jaan Tallinn—and the first 15 of Alameda’s staffers. The more money SBF got, the better for us all, or so the argument went. As his fortune swelled—and it was once estimated at $26 billion—so did exposure for his pet philosophy and its most charismatic evangelist: MacAskill.

In May, MacAskill projected that effective altruism–aligned foundations would need to spend $2 billion a year, based on FTX’s wild growth and the then-high value of Moskovitz’s Facebook stock. Perhaps the faithful weren’t taking sufficiently aggressive swings, he said: “Solving the big problems in the world isn’t about acting in a way that feels appropriate. It’s about doing the highest-impact thing.”

By September MacAskill’s book, What We Owe the Future, made the best-seller list and earned an endorsement from Musk, who described it as “a close match for my philosophy.” Where old-school Singer disciples agonized over spending too much on groceries, the newer cohorts enjoyed weekly meet-ups and conference retreats that were seen as a path to career advancement.

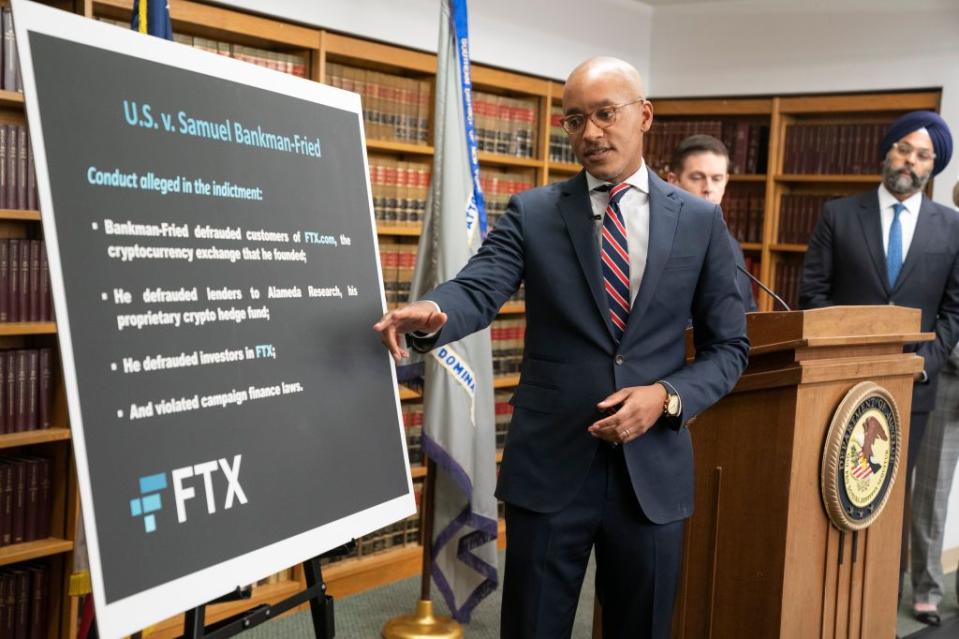

Then November came and FTX crashed. A month later Bankman-Fried was arrested in the Bahamas, accused by the U.S. Justice Department of fraud after misusing billions in customer money. (He has denied the charges.) MacAskill wrote an abject apology on Twitter: “If those involved deceived others and engaged in fraud (whether illegal or not) that may cost many thousands of people their savings, they entirely abandoned the principles of the effective altruism community.” The fallout hasn’t exactly been good for the cause.

For the 9,000-plus who signed the 10 percent pledge and the 200 or so effective altruism “chapters” around the world, the question has become whether they were duped by a huckster and his paper kingdom. They couldn’t necessarily have foreseen any wrongdoing at FTX—professional investors didn’t either—but perhaps the disheveled boy genius living in a Bahamas ivory tower shouldn’t have been held up as an ideal.

“Effective altruism is predicated on the idea that you’re better able to assess risk and what’s going to happen in the future than anyone else,” Davies says. “If your defense is that you didn’t have a clue, it undermines your brand.”

A week after FTX filed for bankruptcy, a gaggle of philosophers gathered far, far away from tech’s corridors of power. At an annual symposium at Georgetown University, social entrepreneurship was on the agenda. Intellectuals argued that while effective altruism has improved the philanthropic approach to accountability, current events made clear that a subject once discussed mostly within academia has had secondary consequences.

“If more bad actors come into the movement and start doing bad and dangerous, disastrous things,” said Jeff Sebo, a professor at New York University, “maybe some of these ideas are simply dangerous.” Maybe, he went on, the message is impossible to convey without implying a blanket justification for harm in the process. Is the way to do the most good to destroy effective altruism? Sebo wanted to be optimistic, but he didn’t have an answer. “The jury is still out.”

Unfortunately for Bankman-Fried, a grand jury is less reflective. The one prosecutors convened decided there was enough evidence to indict him on what may be “one of the biggest financial frauds in American history.” His trial in New York remains a year or more away. He has pleaded not guilty.

Sam Bankman-Fried illustration by Joe Darrow.

This story appears in the February 2023 issue of Town & Country. SUBSCRIBE NOW

You Might Also Like