This Is Going to Be a Very Different, Very Online Holiday Shopping Season — Especially for Clothes

Inflation and supply-chain issues mean smaller discounts and more "out of stock" notifications, according to experts.

Photo: Demetrius Freeman/Bloomberg via Getty Images

Last year's holiday season was...what it was. Honestly, I think I blocked some of it out. In 2021, though, things seem to be looking up. For many of us, it's (somewhat) more feasible to travel, gather with loved ones and, of course, shop 'til you drop during holiday sales. Capitalism's favorite time of the year is upon us, and the experts predict we'll be spending a lot of money. But it's not exactly the return to "normalcy" some might expect.

On Wednesday, Adobe released its annual online shopping predictions — the most comprehensive report of its kind — for the the 2021 holiday season (Nov. 1 - Dec. 31), based on analysis of a trillion visits to U.S. e-commerce sites, as well as global transactions in over 100 countries. As e-commerce's share of overall retail grows (which it does every year), online shopping behavior becomes more and more representative of shopping behavior, period, which makes Adobe's report increasingly relevant.

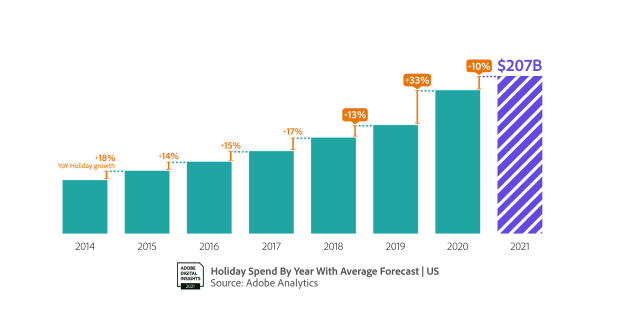

Image: Courtesy of Adobe

In the United States, we're expected to spend $910 billion online — a 10% increase over last year. That may seem fairly small, but not when you think about the year we're comparing it to: In a pre-vaccine 2020, the pandemic pushed more holiday shoppers to e-commerce than ever, and online spending grew 33% compared to 2019. According to Taylor Schreiner, director of Adobe Digital Insights, that's essentially the equivalent of two normal years of growth.

The $910 billion estimate is "stronger than we would have expected 2021 to be had we made an estimate pre-pandemic," he tells me: "This trend [towards e-commerce] was happening anyway. We just fast forwarded about a year from where we would've been. We're roughly 45% up on 2019." That means shoppers aren't rushing back to stores just because it's safer now — at least not to browse and shop or elbow competitors out of the way on Black Friday.

One trend that will see shoppers making brief visits to stores (or their curbs) is the rise of buy online/pickup in-store (or "BOPIS"), which is being adopted by more retailers and more consumers. Schreiner says this peaked right before Christmas last year (presumably for last-minute gifts), dipped back down, then peaked again in April, in line with vaccine rollouts — hence Adobe's prediction that it will become dramatically more popular this holiday season. Schreiner notes that some of this increase in "BOPIS" (and e-commerce sales in general) will be driven by the growing popularity of ordering groceries online, which, of course, isn't a seasonal habit.

Another e-commerce feature gaining steam is buy now/pay later services like Afterpay and Klarna. According to a survey Adobe conducted, shoppers plan to use this for clothes more than any other category.

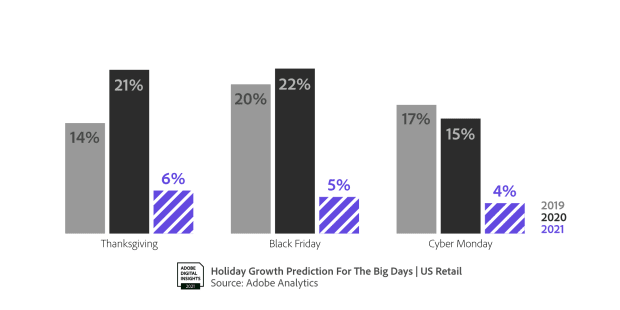

Image: Courtesy of Adobe

Another interesting finding is the decreasing relevance of specific shopping holidays, like Black Friday and Cyber Monday. Predicted revenue for these two is trending downward, as these may no longer be the best days for deals and consumers aren't expected to be as focused on these days as they shop. Plus, deals might be more spread out, for a few possible reasons: There's the simple fact that these "holidays" were born out of a brick-and-mortar world in which we're no longer living, and retailers may not want to have to compete with every other retailer on discounts. However, it could have more to do with the pandemic's affect on the global supply chain: As issues up and down it abound, retailers may be concerned about their ability to fulfill massive amounts of orders from a single day; these are also expected to lead to smaller discounts overall, and difficulty finding certain items in stock.

"What's holding us back from an enormous holiday season is continuing supply chain problems," Schreiner says. After the pandemic hit, Adobe saw four to five times more "out of stock" messages than normal; Schreiner says that trend is not likely to go down during the holiday season — it might even go up. In the case of clothing, which is the category experiencing more stock issues than any other, that's not even counting products that are technically in stock but sold out of several sizes and styles. The apparel supply chain tends to be complicated, with many processes and materials being sourced from different points throughout the world.

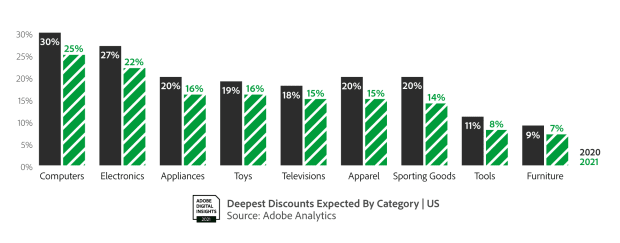

Image: Courtesy of Adobe

Holiday discounts are expected to shrink, and while there will still be promotions, they may not be as "door-busting" as usual. Overall price reductions are expected to be in the 5% to 25% range, while the historical average is 10% to 30%. For apparel specifically, the deepest discounts are expected to be around 15%. (In 2020, they were 20%.) With the supply chain issues, retailers may be padding their profit margins with smaller discounts to make up for lost sales on sold-out items. Adobe also attributes this prediction to inflation: Overall, pre-holiday e-commerce prices are up 3.3% compared to last year; historically, prices are already down 5% year-over-year at this point.

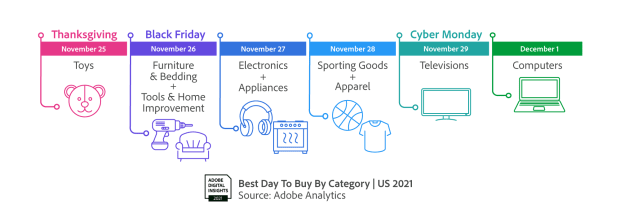

Image: Courtesy of Adobe

Bottom line: Holiday shopping might be a little frustrating this year, with higher prices, sold-out favorites and shipping delays. Adobe does offer a few tips, including predictions on the best days to find deals on specific categories. If you want clothes, for instance, plan to spend Sunday, Nov. 28 cozied up with your laptop, credit card in hand, and try to resist all the promotions you're likely to see before that — unless you have your eye on something very specific. It might not be available for long.

Never miss the latest fashion industry news. Sign up for the Fashionista daily newsletter.