What’s going on with Burke Decor?

Weekly Feature | Mar 27, 2024

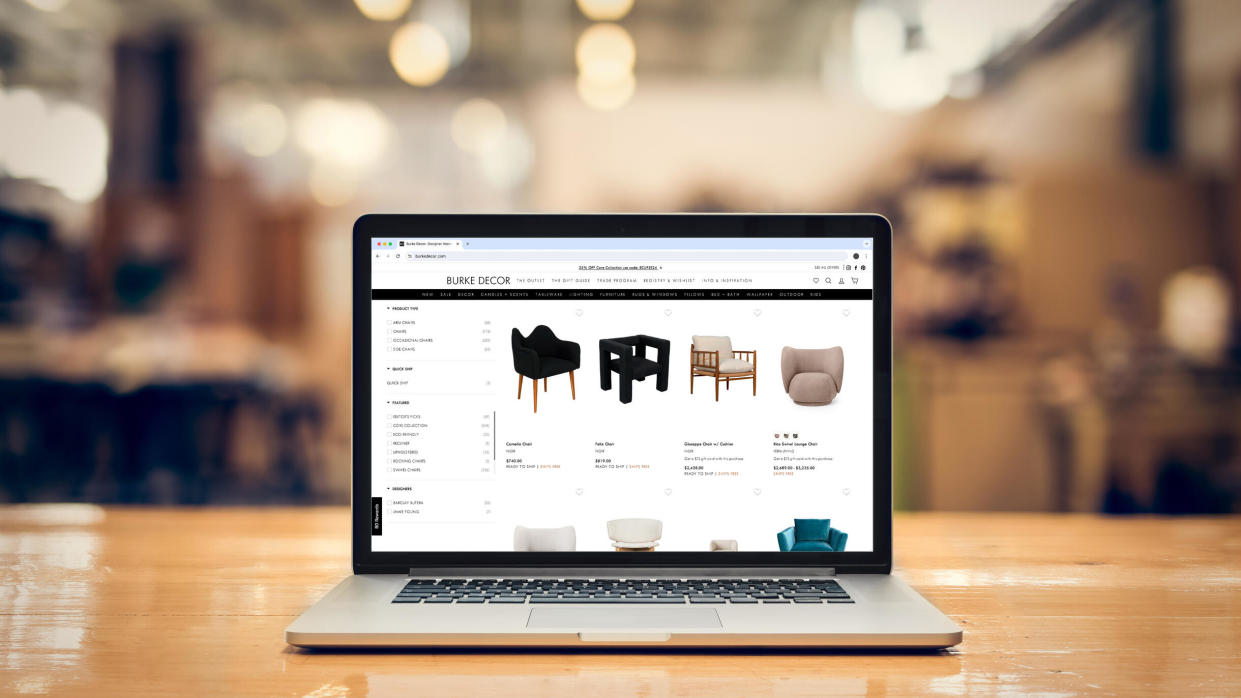

Last June, designer Colleen Hart was shopping online for a project when she found herself visiting Burke Decor. The site, an attractively designed e-commerce platform, had a wide selection, beautiful photography, and an easy-to-use interface. More importantly, it had the pieces Hart was looking for—a chair by Four Hands and a mirror by Made Goods—listed as in stock. She clicked to buy and moved on. Two months later, the trouble began.

Burke Decor, founded in 2007 by entrepreneur Erin Burke, has managed to not only survive but grow for almost two decades in a field—home goods e-commerce—not known for its stability. The site pulls off the neat trick of having a lot of product (400,000 pieces, according to Burke) while also feeling curated around a design-forward aesthetic. In a nutshell: The elevated vibe of a boutique with a range that feels more like Wayfair.

By carrying trade-friendly brands like Four Hands, Noir and Eichholtz, Burke Decor has also become a resource for designers who want to shop a brand but don’t meet the pricing minimums required to open their own accounts and do business directly. However, starting in the summer of 2023, some designers—and consumers—began to experience customer service issues that have dragged on for months.

The chair Hart ordered, supposedly in stock in June, didn’t arrive until August—and it was the wrong chair. She was told that the correct one was on back order. The mirror was also delayed. Fearing that she’d miss a key project deadline, the designer ordered a mirror from another site and requested a cancellation from Burke Decor, which replied that it was too late—the order had been shipped. When the mirror finally showed up in September, Hart didn’t need it, so she returned it and asked for a refund on both the mirror and the chair, roughly $2,700. Seven months later, she still hasn’t received payment.

“From September up until about January, I would check in every few weeks with an email or a call,” she says, but the communication from the company was confusing. “A lot of their emails were like, ‘Oh, we have a new accounting software.’ They even said they sent a check, but no check ever came through.”

Another designer we spoke with had a similar experience. Susan, who asked to be referred to only by her first name, ordered two dressers from Burke Decor in early January, one of which was advertised as shipping within five to 10 business days, another within 14 to 21 business days. Both deadlines came and went without a dresser.

Susan canceled the order and asked for a refund, which was promised but never delivered. After she began looking into the company online, she found a parade of red flags.

Among them: Burke Decor has an “F” rating from the Better Business Bureau, accompanied by more than 150 one-star reviews since last summer and more than 450 complaints filed (many of which have been addressed by the company). On another review site, Trustpilot, the company has almost 600 one-star ratings. Meanwhile, Burke Decor had limited comments on its Instagram account, but an ongoing Reddit thread has been chronicling customers’ frustrating experiences with the company.

Across the reviews, a common story emerges: Sometime over the last nine months, a customer would place an order with Burke Decor. Shipment would be delayed past the advertised window, or there was an issue with the product. The customer would cancel the order, then ask for a refund, which kicked off a monthslong struggle to collect it. Phone messages and emails went unanswered; ACH info was requested for transfers that were never delivered. Throughout it all, many online reviewers say, it was difficult to get clear communication from the company.

PLANS FOR A TURNAROUND

In communications with Business of Home, Burke acknowledges the customer service issues and says the company is working to amend them. In recent weeks, she has hired The Watley Group, a Los Angeles–based advisory firm that specializes in restructuring and corporate turnarounds. Speaking with BOH, CEO John Bryan says that, while he did not want to understate the complaints raised against Burke Decor, he pointed to the larger context of a site that “has a total customer base of over 600,000 over the past few years.”

“The number [of orders] that have been mishandled is a very small percentage,” he says. “We accept they have been mishandled, and the company is going to absolutely do everything to maintain those customer relationships and make those customers happy. … But the number of actual undelivered orders and customers who have not received refunds is very small.”

Both Bryan and Burke declined to provide the specific numbers of customers owed refunds or with missing orders, or the extent of any debt owed to vendors. However, they say the plan is to provide refunds and make-goods to affected customers.

“We had a subset of orders during a specific time period impacted by changes in our credit card processing environment, whereby we have had to work individually with clients to issue credits via an alternate method as we do not store credit card information,” wrote Burke in a statement. “We understand this was an incredibly frustrating experience and have been working to resolve this for all impacted clients as efficiently as possible. We are actively offering impacted clients compensation and free merchandise on a case-by-case basis.”

In recent days, activity on Burke Decor’s BBB profile shows that the company has been communicating with complainants and offering refunds. It has also been offering direct payments in a slightly unorthodox fashion—through Zelle and Venmo.

That’s exactly what happened to a Michigan-based customer named Nancy Reed, who says that she had been chasing down a refund on a $2,000 rug since November and that Burke Decor had stopped responding to messages in January. Last week, an editor from Business of Home publicly responded to Reed’s post on X about her experience with the company; coincidentally or not, she received a message from Burke Decor two days later offering a direct refund through Zelle. She declined, asking to speak to a representative on the phone. She has not heard back since.

Another customer, Andrew Silva, had been trying to collect a refund on a vase he ordered in January but never received. After a frustrating series of exchanges with customer service, he filed complaints with the Better Business Bureau and the Ohio attorney general (Burke Decor’s corporate headquarters are in Youngstown) and started a Facebook Group on Monday called “Burke Decor Scammed Me” to try to centralize information for jilted customers.

On Tuesday he received a refund offer through Zelle and accepted—a payment he says came directly from Erin Burke. The company also offered him a free vase, which he accepted as well. Silva is planning to keep the Facebook group up. “People are waiting to hear what’s going on,” he says.

CUSTOMER SERVICE CHALLENGES

The exact timeline of Burke Decor’s issues is unclear, though the pattern of online reviews suggests that problems mounted during the latter half of 2023. After catching wind of customer service issues earlier this year, BOH reached out to Erin Burke via email. Toward the end of January, she acknowledged the situation, attributing it to a switch the company had made toward “automated self-service solutions” during a seasonal spike in orders.

“In an effort to be more efficient, the launching of this initiative (and unforeseen concurrent internal system issues) we do feel like we lost the personal touch that we had previously been able to provide to our community and prided ourselves on,” she wrote at the time. “We are in the process of reactivating our concierge services.”

However, the negative reviews continued to pile up online throughout February and March, and several customers continued to struggle to reach anyone at Burke Decor, or receive a refund on a returned or canceled order.

Speaking with BOH last week, Bryan provided additional insight as to what had gone wrong in the first place. “There were two or three macro situations that took place, [including an] increase in interest rates,” says Bryan. “Lenders, especially smaller lenders, suddenly have a much higher cost base. The lending community tries to increase its own liquidity at the expense of the working capital of their clients, which [includes] companies such as Erin’s.”

In a statement provided to BOH, Burke added more detail: “The business climate compounded with complex and unexpected lender issues, as well as systems changes and ‘updates’ we have faced with our e-commerce partner, payment processors, and search and advertising platform issues [with] Google [and] Meta that are beyond our control have presented significant challenges.”

In conversation and a follow-up email, Bryan and Burke outlined a seven-point recovery plan that includes cost-saving initiatives to hold down prices, increased staffing, communication training for existing employees, a restructuring of marketing initiatives to “save millions on customer acquisition and retention,” and partnering with vendors to “ensure optimal product assortment and to further develop the company's private label initiatives.” The company is also exploring outside investment.

“We are actively and strategically working to resolve and restructure to address all of these issues, as well as revising our freight systems and tech stack so as to better service our customers, partners and vendors,” wrote Burke. “We are aware of the recent concerns and how they are impacting our customers and suppliers, and we are totally dedicated to resolving each and every issue.”

Bryan emphasized that the company is well positioned for a turnaround. “For the most part, [the issues] were experienced quite a number of months ago, and we are going to do everything to repair that,” he says. “We recognize and accept that we have some repairs to make, and we have some things that we’re going to absolutely fix. But this is not going to be an ongoing situation.”

The designers who have been caught up in Burke Decor’s struggles may be a difficult audience to win back—especially as the company’s troubles come in the midst of a two-year period that has seen several high-profile vendors collapse, leaving the trade in the lurch.

A designer from Chicago who asked not to be named says that her firm had orders affected by both the Interior Define debacle and the shutdown of Mitchell Gold + Bob Williams. A longtime satisfied customer of Burke Decor, she placed four orders with the site last November. They haven’t arrived. She’s also still waiting for a refund from a prior order. “Is this where we are now? I have to start Googling brands that I’ve been doing business with for a long time, every time I order?” she says. “It’s just not a sustainable practice. We’re too busy for that.”

Additional reporting by Aidan Taylor

Want to stay informed? Sign up for our newsletter, which recaps the week’s stories, and get in-depth industry news and analysis each quarter by subscribing to our print magazine. Join BOH Insider for discounts, workshops and access to special events such as the Future of Home conference.