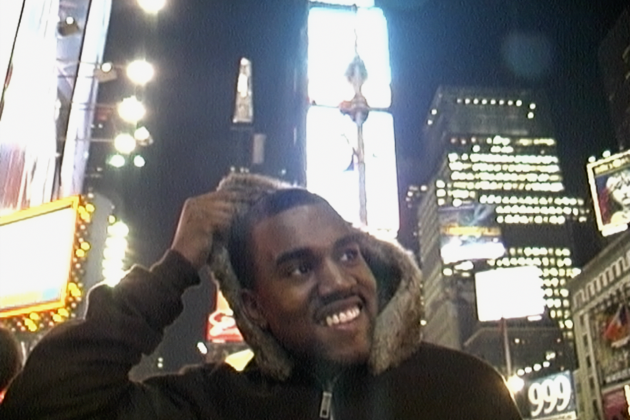

Kanye West and Gap Terminate Partnership

- Oops!Something went wrong.Please try again later.

Kanye West, who now goes by Ye, successfully walked away from his increasingly troubled relationship with Gap Inc.

Shares of Gap initially inched up 1.3 percent early trading following word that Ye gave the retailer notice that he was terminating the deal, alleging that Gap failed to live up to its agreement to distribute Yeezy product. But as the day wore on, the broader market switched from positive to negative, and shares of Gap followed suit, closing down 3.6 percent to $9 a share.

More from WWD

In an internal memo to employees Thursday afternoon, Gap brand chief executive officer Mark Breitbard addressed weeks of headlines about Ye’s very public discontent with Gap, and said the company would “wind down the partnership.”

While the move avoids what could have been an extended legal fight, it also helps Gap move on now and with what Breitbard said was a dose of new energy.

“Yeezy Gap was launched to be a disruptive, highly creative endeavor — one that’s challenged us to think and operate differently, attracted new, younger and more diverse customers, and enabled our talent to deliver incredible work with unmatched dedication, grit and creativity,” Breitbard said. “We are truly grateful to our Yeezy Gap team members who have given so much to build this brand, and we will take the new, hyper-entrepreneurial ways of working we learned through this process with us as we move forward.”

But ultimately, he said Gap and Ye did not see eye to eye.

“While we share a vision of bringing high-quality, trend-forward, utilitarian design to all people through unique omni experiences with Yeezy Gap, how we work together to deliver this vision is not aligned,” he said.

Earlier in the day, Ye’s attorney, Nicholas Gravante Jr. of Cadwalader Wickersham & Taft, told WWD: “Gap left Ye no choice but to terminate their collaboration agreement because of Gap’s substantial noncompliance.

“Ye had diligently tried to work through these issues with Gap both directly and through counsel,” Gravante said. “He has gotten nowhere. Gap left him no choice but to terminate their agreement. Gap’s substantial noncompliance with its contractual obligations has been costly. Ye will now promptly move forward to make up for lost time by opening Yeezy retail stores.”

Gravente and two other attorneys sent a letter to Gap on Thursday, officially pulling the plug on the agreement and referring to a back and forth after Ye informed Gap of what he saw as a breach of contract on Aug. 16.

“It is apparent from your response that Gap has abandoned its contractual obligations under the strategic agreement…disclaimed any intention to attempt to cure the material breaches identified in the notice — which, in any event, are incurable,” the termination letter said. “Notably, Gap does not dispute that it has failed for over two years to sell a single product in a single Gap store, including any of its 500-plus stores in North America. Nor does Gap dispute that it has failed for over two years to open a single dedicated store anywhere in the world.”

The lawyers said Gap instead is attempting to “avoid its clear contractual obligations through a tortured reading of the agreement that would render Gap’s contractual obligations illusory.”

Specifically, Ye argues that the company has failed to sell Yeezy products in Gap’s stores or open dedicated stores to the line.

The letter and the termination was seen as a show of force — one that was either needed to nudge Gap, or one that helped Gap take a step it wanted to take anyway.

“Ye has the legal equivalent of an army standing by to escort him out of the deal with Gap — a termination notice from not one but three law firms, including prominent litigators,” said professor Susan Scafidi, founder and director of the Fashion Law Institute at Fordham Law School. “While Gap may argue that it has time remaining under the initial agreement, the alleged failure to sell any [Yeezy] products in brick-and-mortar stores during 2021 is a serious hurdle for the retailer. Since the deal was signed after the start of the pandemic, it’s unlikely that market conditions during 2021 would excuse any nonperformance.”

On top of the legal considerations — and however the contract between Ye and Gap would ultimately have been interpreted by a judge — the retailer was also facing the court of public opinion.

“Gap’s attempt to hold onto a famous partner who has made it clear that he wants nothing further to do with the deal runs the risk of alienating Ye fans who might otherwise buy the products — a problem in enforcing any celebrity collab or spokesperson relationship, and even more so with an individual as prominent as Ye,” Scafidi said. “The real question now is what it may cost Ye to walk away, either in terms of legal fees or a possible settlement with Gap, and of course what the separation will mean for the value of Gap.”

Some saw Ye as riding to Gap’s rescue in 2020, signing a deal with the basics mainstay to sell his buzzy brand and set up Yeezy stores.

Right after the deal was announced, shares of Gap shot up nearly 19 percent to $12.07 and Ye received warrants for up to 8.5 million shares of the company’s common stock — about 2.3 percent of the company.

Many analysts were generally positive on the agreement, seeing an effort by the company, with also owns Athleta and Old Navy, to reenergize its namesake. But despite all the online attention generated by the partnership, Yeezy looks were few and far between at Gap and sold online.

The Yeezy Gap Engineered by Balenciaga goods, which are part of a separate agreement, were more prominent.

While Yeezy was once seen as a big part of Gap’s future, the lack of a real stock reaction to the legal back and forth could be tied more to the fact that the brand is not currently a major factor in Gap’s sales.

“Had Yeezy done for Gap what Gap wanted to do initially, this would be a bigger deal,” said Simeon Siegel of BMO Capital Markets. “At the end of the day, it is not surprising that Yeezy is not providing Gap with the uplift that Gap wanted.”

It’s not clear now just why the partnership fell short of expectations or if one side or the other is at fault, but Siegel said the retailer is ultimately is going to have to move on.

“Gap now has to figure out how to fix themselves and grabbing the flashy name hasn’t been the answer,” Siegel said.

And it’s going to press forward with the sting of Ye’s departure.

“Kanye’s decision to terminate his partnership with Gap will come as a blow to the brand, which had pinned its hopes on Kanye’s magic to help revitalize interest in its ailing business,” said Neil Saunders, managing director of GlobalData. “It is also an embarrassment for Gap, which announced the deal with the iconic artist with much fanfare.”

The odd-fellows partnership might have been doomed from the start.

“Gap is a cautious company with a stale brand that usually eschews bold moves,” Saunders said. “In contrast, Kanye is a radical innovator who loves to shake things up. While Kanye could have injected a dose of energy into Gap, the incompatibility of the two visions meant that frustrations were inevitable. In some ways, Kanye was just too extreme for Gap. We also believe that Gap was too quick to rush headlong into a deal with Kanye because it was keen to generate headlines and stimulate interest in its brand.”

And Yeezy is just one of many moving parts at the company.

Sonia Syngal, the Gap CEO who signed West to the deal, left the company abruptly in July and the firm is still looking for a successor.

Syngal was repeatedly asked about the Yeezy brand on regular conference calls with analysts.

In March 2021, for instance, she noted: “Partnerships are important part of the future of the brand. We have a big launch coming up with Yeezy Gap. And I spoke to [Ye] last night. He’s very, very focused on this incredible opportunity. We’re both very excited about it. And he and Mark [Breitbard, global head of Gap brand] and the entire Gap team are heads down and believe this to be a very big potential for us and look forward to sharing more with you as we launch in the first half.”

But the talk eventually turned to the Yeezy-Gap-Balenciaga tie up.

This May, Syngal noted, “The Yeezy Gap Engineered by Balenciaga launch drove urgency with customers and generated brand buzz in Q1 with 6.6 billion media impressions. Additionally, you can expect the brand to expand across wholesale and marketplaces later this year.”

Now Syngal is out at Gap, and so is Ye.