G-III Apparel Group Logs More Quarterly Losses, But Wall Street Satisfied With Company’s Progress

The losses continue for G-III Apparel Group Inc.

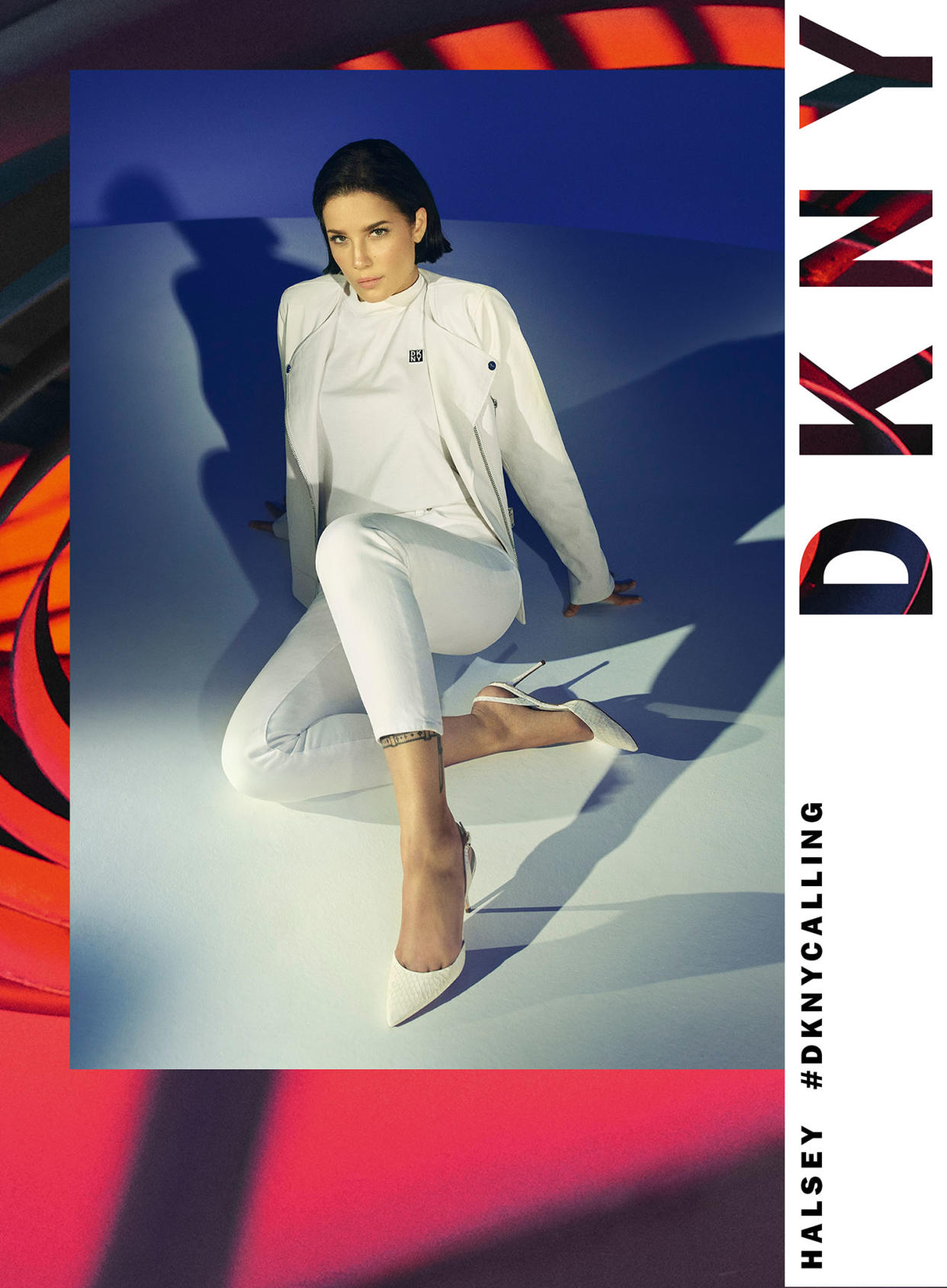

The manufacturer and retailer, parent to the DKNY and Donna Karan brands, reported quarterly results Wednesday morning before the bell, falling short on both the top and bottom lines while it began the process of permanently closing all of its Wilsons Leather and G.H. Bass stores.

“The pandemic has had a major impact on the fashion industry and our second-quarter results,” Morris Goldfarb, G-III’s chairman and chief executive officer, said in a statement. “Our customers now prefer casual, comfortable and functional attire. Through our broad range of brands and product categories, G-III is able to capitalize on these changing trends. We have reset our order book for the balance of the year and shifted our product assortment to ath-leisure, jeans, casual sportswear and coats.”

For the three-month period ending July 31, total company revenues fell nearly 54 percent to $297 million, down from $644 million the same time last year. Retail store revenues in the Wilsons Leather and G.H. Bass businesses, which G-III said in June it would permanently close later this year, were $19.7 million for the quarter, compared with $53.6 million during the same period a year earlier.

The company — which also includes Vilebrequin, Eliza J, Jessica Howard, Andrew Marc and Marc New York in the greater portfolio, in addition to fashion licenses under the Calvin Klein, Tommy Hilfiger, Karl Lagerfeld Paris, Kenneth Cole, Cole Haan, Guess, Vince Camuto, Levi’s and Dockers brands — lost nearly $15 million as a result, compared with profits of more than $11 million a year ago. That’s on top of more than $39 million in losses from the quarter before that.

The losses included about $25.6 million in lease termination fees, severance costs, store liquidation expenses and legal fees, among other things, as a result of the 110 Wilsons Leather and 89 G.H. Bass store closures, which commenced during the quarter.

But despite the losses, Wall Street seemed pleased with the company’s progress. Shares of G-III, which are down approximately 50 percent year-over-year, closed up 8.79 percent to $13.24 a piece Wednesday.

“The ath-leisure the size of our business is growing very rapidly, and fortunately for us, we have three of the world’s best brands that are represented in ath-leisure in department stores and digital sites that we serve and it’s grown amazingly well,” Goldfarb said on Wednesday morning’s conference call with analysts. “Ath-leisure has become a way of life; it’s a way of dressing today. I don’t remember the last time I saw anybody wearing a tie. Nobody is wearing ties and nobody is wearing nested suits to work or to dinner. I’m not sure [ath-leisure is new], but it’s certainly more powerful than it’s ever been.

“Our recently added jeans lines for three of our power brands lend themselves perfectly to today’s casual and active lifestyle,” Goldfarb added.

Although the ceo admitted there are still some headwinds, including the string of recent bankruptcies and the company’s selection of more tailored attire.

“We have a challenging nested suit business,” Goldfarb said. “The more career suits and the go-to church suits are not selling nearly as well as they had historically. And social dresses, as we’re not going to very many parties or weddings. There’s no demand for bridesmaid dresses.

“Our wholesale business will continue to be the primary sales and profit engine to G-III,” he added. “We remain focused on leveraging our wholesale expertise to drive long-term growth. [But] there is a fair amount of bankruptcies that we have been part of. The bankruptcies certainly didn’t help us. Some of the store closures may not help topline [sales].”

The ceo is expecting a roughly 10 percent reduction in revenues for fiscal year 2022.

To help cut costs, Goldfarb said the company refinanced its balance sheet, extended the maturity of its revolving credit facility and term debt to 2025 and reduced SG&A expenses by approximately 40 percent in the most recent quarter, or $16 million. The 20 percent staff reduction will also lead to roughly $22 million in annual savings.

“In addition, the closure of Wilsons Leather and G.H. Bass stores, expected to be completed by the end of this fiscal year, will result in the elimination of significant operating losses,” Goldfarb said.

G-III ended the quarter with nearly $253 million in cash and equivalents and about $409 million in long-term debt. The retailer anticipates revenues will decline between 28 percent and 33 percent during the back half of the year, compared with the same period in 2019.

“The pandemic’s ripple effect on the retail industry has been evidenced with the unprecedented disruption, causing bankruptcy filings and announced store closures,” Goldfarb said. “In our view, the reduction in unprofitable retail store locations will be a long-term net positive for our retailers as they deploy resources to their digital business and top-tier locations, which will ultimately improve their overall financial health.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.