G.H. Bass: The Reinvention of a Heritage Brand

There’s an adage about making lemonade when life gives you lemons. That could be the way to describe the strategy underway at G-III Apparel Group.

The $2.8 billion company that counts more than 30 owned and licensed brands in its portfolio including DKNY, Karl Lagerfeld, Andrew Marc and Cole Haan found out at the end of last year that it will be losing two of its largest licensees: Tommy Hilfiger and Calvin Klein. PVH Corp., which owns those brands, will be taking the licenses for the women’s North American wholesale business back in-house by the end of 2027. Those two brands accounted for 50.7 percent of G-III’s revenue last year.

More from WWD

But Morris Goldfarb, G-III’s longtime chief executive officer, had seen the handwriting on the wall and had already begun diversifying the company’s portfolio and focusing its efforts on its owned brands, including Vilebrequin, which it acquired in 2012, and Sonia Rykiel, which it bought in 2021.

Another beneficiary of this newfound strategy is G.H. Bass, which G-III has owned since 2013. The company traces its roots to 1876 when George Henry Bass got into the shoe business in Wilton, Maine. He is credited with making plough shoes for farmers, moccasins for woodsmen and even outfitted golfer Bobby Jones for all of the sport’s major championships. But his most famous creation was the Weejun, a revamped Norwegian farm shoe and the world’s first penny loafer, which he introduced in 1936.

While the brand’s history remains key to its messaging, there’s a new day dawning under the tutelage of president Chris Paulk, who spent 13 years with Tommy Hilfiger, joining G-III in the fall of 2020 as a consultant. He was elevated to the newly created position of president of Bass in September 2021.

“We’re a 150-year-old start-up,” Paulk said. “It was very mass distributed and we had no control over the business. We’re reestablishing a brand that had lost its way.”

The goal, he said, is to “refresh, reprice and reposition.”

Since his appointment, Paulk and the Bass team — which includes Ronald “JR” Hancey Jr., vice president of design — have been working hard to elevate the product offering, revamp the logo, finish closing its fleet of outlet stores and focus more on direct-to-consumer selling.

Paulk said the restructuring is still a work in progress with key messaging about to drop for spring and further updates planned for the web site. But the team started with product, because “that is the greatest storyteller.”

Although changes abound, one constant is the brand’s focus on its flagship product. The Weejun still represents some 80 percent of Bass’s overall sales, a figure that is not broken out within G-III’s results.

“The Weejun is like water to us,” Paulk said. “It’s totally essential and the gateway to everything else we do.”

He described the Weejun as a genuine, handsewn, tubular moccasin slip-on. But today, it’s more than just the trademark leather loafer in black or brown. The shoe is now offered in a rainbow of colors and a number of different materials including suede, flannel and crocodile. There are mule slides, tassel versions, a rubber Easy Weejun, and the popular new super lug-soled model which is now as big a seller as the traditional style.

“The Weejuns are the hallmark of the brand, but we brought some modernity to it,” Paulk said.

Beyond the Weejuns, the company offers an assortment of dress shoes, bucks, boat shoes and Chelsea boots; an outdoor collection called the Field Series of high-quality; waterproof leather shoes and boots, and its highest-priced offering, 1876, with Goodyear-welted soles and other premium bells and whistles that retails from $295 to $365.

Recently, the Bass offering has been expanded to include several capsules such as Modern Ivy, a collection based on the brand’s New England roots that includes shoes — both Weejuns and other models — there are styles with Harris tweed and houndstooth fabric uppers, as well as wool vamps and chenille patches inspired by vintage varsity jackets. “We’re not just Weejuns,” Paulk said. “There are so many other ways consumers can enjoy the brand.”

But with all its products, the goal is the same. “We’ve returned to intentionally crafted shoes with the right materials,” he said. The bulk of the shoes are manufactured in El Salvador in a tannery the company has used for decades, but it is also using plants in the Dominican Republic and Mexico. Together with the team in the El Salvador factory, Bass developed a soft box leather that it is now using to make the shoes more comfortable.

These updates — along with higher manufacturing, supply and freights costs — have also led to price increases. Most Weejuns now retail for $175, up from $110 three years ago.

But despite the price hike into what Paulk characterized as the “accessible luxury space,” there has been no pushback from consumers, he contended.

The competition now is seen more as Allen Edmonds in men’s rather than Cole Haan or Clark’s, and Kate Spade and other contemporary brands in women’s. Sales of the brand are almost evenly split between men’s and women’s.

Discounting is also being discouraged, a shift from the past when the shoes were discounted at both the company’s outlet stores as well as the wholesale accounts that used to represent the lion’s share of the business.

“I come from a full-price d-to-c retail background,” Paulk said, adding that the goal is to create a connection with the customer based on the relationship with the brand, not the price.

“When you buy the shoe, the relationship starts,” he said. “The Weejun has a life of its own outside of Bass. Everybody knows it, but not everybody knows the story.”

The distribution strategy has also been dramatically changed. Last spring, Bass began working to update its e-commerce platform. “We look at the site as our digital flagship store,” said Marlene McDade, senior vice president of global marketing. “It’s the number-one priority for us.”

The effort is being spearheaded by new hire Brian Kalma, a veteran of Zappos and Gilt, who recently joined G-III to oversee all digital efforts for the corporation. Paulk said he will be working with Bass to “create a more-frictionless digital experience for the consumer.”

The e-commerce site is even more important today in light of Bass’ decision to exit retail in the U.S. At one point, there were 250 outlet stores around the country, but those have slowly been shuttered, with the final units closing in fiscal 2021.

There are three retail stores in Japan — two in Tokyo and one in Osaka — a key market for Bass, but those are operated by GMT, its distribution partner in that country.

The wholesale strategy has also updated. Although wholesale still represents 50 percent of overall sales globally, the partners have been chosen carefully. “We work with the best retailers in the world,” Paulk said. “But we’re being more selective.”

In the U.S., the distribution has been shifted and the footwear is now offered at Nordstrom, Bloomingdale’s, Urban Outfitters, Anthropologie, Madewell and Extra Butter, while internationally, Mr Porter, Selfridges, Harvey Nichols, Rinascente, Matchesfashion, Printemps, Browns, Beams and others are the key accounts.

“Where we do show up at wholesale, we want to partner with retailers who will build the brand with us,” Paulk said.

Although footwear remains its core business, Bass also has an apparel arm, called Bass Outdoor. The line, which is heavily skewed to outdoor-related clothing for men, women and children, is produced by licensees and launched exclusively at Macy’s in 2020.

“It’s an accessible lifestyle brand with an uncomplicated, modern approach,” McDade said. “We’ve built a really nice business there,” Paulk added.

In the future, they hinted, expect more apparel as well as other classifications to make their appearance under the G.H. Bass name.

“We have a feet-first strategy,” Paulk said, “and we will expand into other lifestyle categories eventually, but we’re going to take our time.”

To introduce the new Bass to customers, the company is also planning an aggressive spring marketing campaign that will launch on Monday.

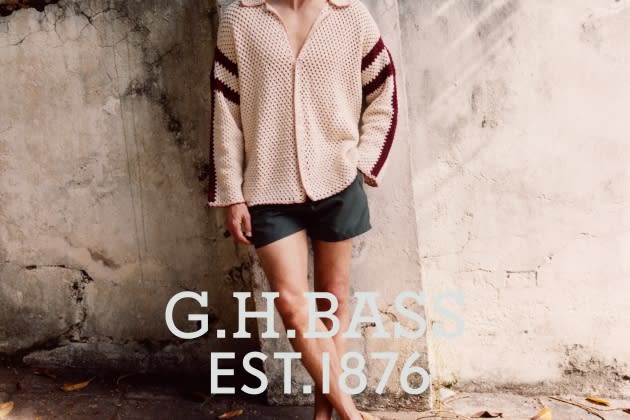

Titled “American Escape,” the campaign, shot in Old San Juan, Puerto Rico, by Ryan Plett and styled by Hannah Krall, features male and female models and is intended to communicate the “colorful and carefree” spirit of the brand, McDade said.

Static images and videos will be featured on the brand’s website and social media channels. “It’s mainly a digital advertising strategy,” she said, adding that the brand also produces catalogs that have proven to be popular, a strategy it will deploy more frequently in the future.

Paulk summed up Bass’s reinvention this way: “We want to be good stewards of the brand. There’s so much history there and we want to be a contributor to that for generations to come. We believe the best way to honor our heritage is to focus on the future.”

Best of WWD