Fluctuating Freight Rates, 3PLs and Nearshoring Dominate 2023’s Logistics Conversation

The drastic shakeup across the supply chain during the Covid-19 pandemic has led to an eventful 2023 for logistics, defined by declining container demand, an ensuing freight recession and cost-cutting strategies from Amazon and FedEx to UPS.

Vincent Iacopella, executive vice president, growth and strategy at Alba Wheels Up International, believes container demand and rates will rise again once companies clear through last year’s inventory glut.

More from Sourcing Journal

Any change in rates could hinge on whether ocean carriers add capacity at the rate of demand, which Iacopella said didn’t happen when a similar scenario occurred in the summer of 2020, leading to the price surges.

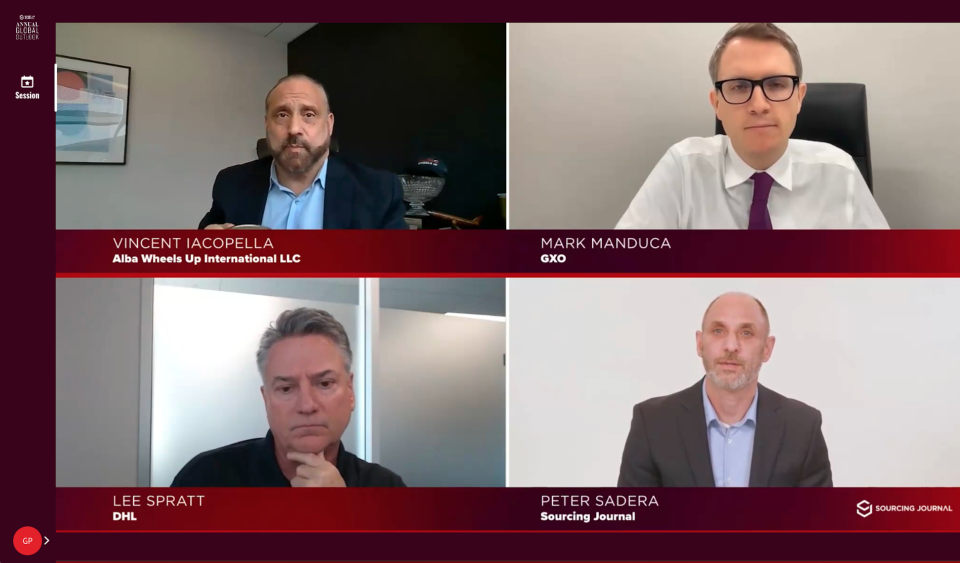

But regardless of price, Iacopella said during a panel discussion at Sourcing Journal’s Global Outlook event that Alba’s customers want stability above all else so they can better project future costs.

“Customers want a three-to-five year budgetable cost. Rather than these fluctuations between $1,800 and $20,000 containers, carriers, terminals and importers want a stable, fair price that is forecastable,” Iacopella said. “If you ask me if the $1,800 container is good for importers, I’m not so sure. Can you use that number to project in 2024, and 2025, and can you count on that number being that low in the outgoing years,”

As the logistics landscape continues to shift and companies rein in spending, third-party logistics providers (3PLs) and warehouse outsourcing are gaining traction—as seen by recent news from TikTok.

“The 3PL segment is the fastest-growing segment we’ve seen over the last three years,” Lee Spratt, CEO, Americas, DHL ECommerce Solutions, said during the pandemic. “It is now our largest segment that we serve. I see nothing but growth opportunity there.”

Both Spratt and Mark Manduca, chief investment officer at GXO Logistics, advocated for 3PL technologies in helping retailers get SKUs closer to the consumer, particularly to save both costs and time.

Manduca believes billions of dollars will flow “from the in-house into the out-house” as the companies prioritize warehouse automation and nearshoring. More than 30 percent of GXO’s warehouses are automated, Manduca highlighted, noting that the firm’s retail clients typically have about 5 percent to 8 percent of their operations automated.

“You’re seeing customers wanting to right-size themselves, for who they want to be from an e-commerce standpoint. A lot of my customers have one in five items bought online today. The reality is, a lot of them want to be three out of five by 2030 or 2035,” said Manduca. “This is going to be an outsourcing story. People are going to want to remove their back office from their books into a 3PL space.”

Manduca believes the fragmented 3PL industry is is ripe for consolidation in the coming years, particularly as the shipping industry seeks to get closer to the end consumer and uncertainty colors freight rates.

“You’re going to see organic consolidation, such as companies that both Lee and myself are looking after,” Manduca said. “You’re also going to see inorganic consolidation taking place in this industry as shipping companies [come] in and [buy] up 3PLs.”

As companies turn to 3PLs and seek to shift some volume out of China, efforts to nearshore in markets like Mexico show it’s a viable alternative. For companies seeking a shift into local markets, they must account for both the management of the supply chain itself, as well as the customs regulations that are in effect.

Additionally, understanding duty policy is vital, whether it be Section 301 tariffs affecting Chinese goods, or the de minimis threshold of $800 on duty-free imports.

“I mention those because you might have had a percentage of your inventory eligible for duty-free direct-to-consumer, but maybe the pressure wasn’t there to break that out and go to northern Mexico at the time,” Iacopella said. “You can still leverage U.S. ports in L.A. and Long Beach to get to northern Baja. Companies like it—during the pandemic, we had inventory three days away from every consumer and retailer. They don’t want it sitting on a vessel waiting to berth six weeks out of Long Beach.”

As retailers and brands continue to curb costs through 3PLs, expect the lean mindset to become the norm moving forward.

“I think everyone in the space is going to be [managing costs] for the next several years until the economic situation gets better,” DHL’s Spratt said.

When preparing for the holiday season and determining their 2023 outlook, businesses should examine sector-specific data.

“Look for microchips, and agricultural chemicals being strong,” Iacopella said. “Consumer goods are going to be a little softer. It’s not going to be across the board, boom or bust.”