Fintech’s Future Is on the Money

As consumers continue to face economic challenges and the shift toward more flexible payment options solidifies, data analysts from Juniper Research have predicted that the number of buy now, pay later (BNPL) users will surpass 900 million globally by 2027, increasing from 360 million in 2022.

Having grown slowly over the last decade, in the past three years BNPL companies have become mainstream, with consumers now used to at least one — if not more — installment payment options at every online retailer’s checkout. With a standard setup of four payments over two months (or “pay-in-four”), BNPL services have been embraced for their transparency, flexibility and ease of use across the board, but as they grow, these companies have taken on a larger role in the consumer journey.

More from Footwear News

Paris Hilton & Bretman Rock Spotlight Y2K Fashion in Klarna's New Commercial

How Higher Inflation Could Mean More Returns This Holiday Season

Today’s BNPL companies describe themselves as “disruptive, forward-thinking and consumer obsessed.” They offer consumers not only more payment options, with plans spanning weeks to years, but also educational materials for best financial practices, entertaining articles and tips for upcoming trends and information on sustainable brands and retailers that support causes close to a consumer’s heart.

Below is an in-depth look at the new advancements from major BNPL players.

Affirm

Affirm, founded in 2012, originally entered the market to offer an option that was truly transparent for both consumers and merchants. The flexible alternative to credit cards and other pay-over-time services provides consumers with two options — the interest-free, biweekly, pay-in-four plan or a monthly payment plan — that can range from six to 60 months, generally ranging from zero to 36 percent APR. Affirm’s integrated partners reach 60 percent of U.S. commerce and include Walmart, Target, Amazon, Shopify and American Airlines, among others.

“Affirm has spent more than 12 years building out our technology, underwriting and partnerships to empower millions of consumers and help hundreds of thousands of merchants drive growth,” said Libor Michalek, president of Affirm.

In addition to BNPL, the company has invested in technology for a more flexible checkout process and has built out direct-to-consumer (DTC) offerings with a debit card offering, called the Affirm Card, which, the company reports, is seeing steady growth. In the third quarter of 2023, Affirm reported 16 million active consumers, 34 percent growth in transactions per active user, 36 percent growth in transactions and 88 percent of transactions from repeat users.

Afterpay

Similarly, when Afterpay entered the BNPL space in 2015, it was designed to be accessible, simple and safe with the goal of giving consumers a way to avoid compounding interest products that lead to revolving debt. Today, the Afterpay app is a top destination for shoppers to discover new brands and find deals, with mobile transactions increasing 196 percent since 2020. The app offers unique editorial content to consumers, which also gives merchants a new advertising channel to increase visibility. The company is a marketing partner for commerce, giving retail brands opportunities and insights to drive consumer awareness through its platform, including serving as the presenting partner of New York Fashion Week for the past several seasons.

“Despite increasing interest rates that have challenged the fintech space, we’re pleased to see continued growth this year,” said Alex Fisher, head of revenue for North America at Cash App and Afterpay. “Afterpay has adapted to the needs and demands of retailers and consumers alike by expanding our product suite, thus offering additional flexible options at checkout and advertising solutions that enhance both sides of our network.”

Notably, Afterpay was acquired by Block in 2022, which brought together the Square, Cash App and Afterpay ecosystems. In Q2 2023, Afterpay reported 22 percent growth year over year.

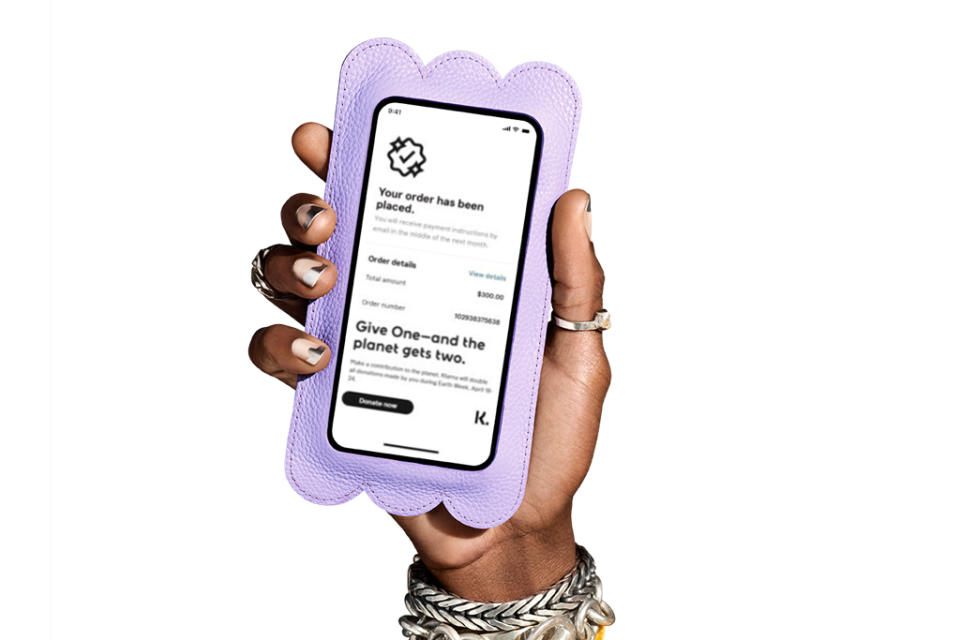

Klarna

Known for its pink branding, Klarna, which launched originally in Sweden in 2005, has seen tremendous momentum in the U.S., reporting that the region is its biggest market by revenue as of December 2022. Klarna’s network consists of 150 million consumers and 500,000 retail partners globally, including H&M, Saks, Sephora, Macy’s and Nike, among others.

In addition to its BNPL offerings, which tout “unparalleled flexibility and security,” the company says its marketing business is its fastest-growing revenue stream.

Committed to always improving the shopping experience, Klarna’s edge in the space also comes from continued investments in new technology, including AI. Klarna was one of the first brands to work with OpenAI to use its protocol to build an integrated plugin for ChatGPT, offering a more personalized experience. Powered by Clarity AI, Klarna also recently unveiled “conscious badges,” which give users worldwide access to comprehensive sustainability metrics about their purchases.

“Our vision is to leverage these innovations to become a global shopping destination, elevating the entire shopper journey from discovery to transaction to the post-purchase experience,” said David Sandstrom, chief marketing officer at Klarna.

Paypal

With a network of over 345 million global active merchants, PayPal entered the BNPL space with existing trust and loyalty. The company launched its pay-in-four solution in 2020, allowing merchants to add the flexible, interest-free payment option at no additional cost. PayPal’s BNPL solutions also include a monthly payment solution for larger purchases spanning across six, 12 or 24 payments, with APR rates as low as 5 percent.

“Buy now, pay later has seen incredible growth over the past few years,” said Greg Lisiewski, vice president of global credit at PayPal. “It isn’t just about use, but where it’s being used and by whom. Additionally, we’re seeing an expansion of BNPL use beyond the expected millennial and Gen Z demographic to a more even split with baby boomers and Gen X. BNPL is now a tool consumers expect to see at checkout as a payment option to help them manage their finances, and its use will only continue to grow as we provide consumers insight into how much they are pre-qualified to spend with our pay-later products.”

Sezzle

Financial education and conscious consumerism are deeply ingrained in Sezzle’s platform, which launched in 2016 and represents the only B Corp company in fintech. The company’s Sezzle U initiative has provided consumers with answers on building good credit, budgeting and general money management. With this, consumers paying with Sezzle can choose from among options to pay in full, pay in four installments or in long-term monthly payments through referral partnerships with other financial institutions.

Sezzle also stands out with its opt-in option to build credit — the only BNPL that allows consumers to build credit via pay-in-four. At the same time, Sezzle offers shoppers a grace period as permitted by applicable law for failed payments and after the period, if payment is still delayed, the consumer is no longer allowed to make additional purchases, thus preventing a cycle of debt. In 2023, Sezzle introduced Sezzle Premium, which gives consumers access to exclusive offers.

“2023 has been a year of rebirth for Sezzle,” said Charlie Youakim, co-founder and CEO of Sezzle. “We spent the past year building and creating an entire suite of new product features intended to bring our shoppers closer to financial freedom. In our eyes, our biggest key differentiator is that Sezzle gives shoppers, no matter where they stand on their credit journey, the ability to learn the building blocks of credit.”

Zip

Australian-born fintech company Zip similarly prides itself on being a values-driven, customer-first business, putting high value on giving back and doing good in the realms of sustainability, mental health and financial empowerment, while also furthering diversity, equity and inclusion efforts. The company has a global scale with core markets being Australia, New Zealand and the U.S.

“We consider BNPL to be a significant step toward financial democratization, especially for the one in three Americans who are unfairly assessed by traditional financial institutions,” said Larry Diamond, CEO at Zip. “At Zip, our sophisticated decision model allows us to serve this underserved segment. It considers various data points, including our customers’ needs and circumstances, so that we can be extremely responsive and responsible in our credit decisions.”

Moreover, Zip aims to serve its audience while helping them build responsible financial behaviors and works to consistently introduce new features with consumer empowerment in mind. Diamond said he believes that these initiatives ultimately benefit Zip’s retail partners, by expanding their customer base, being inclusive while positioning payment flexibility as a strategic growth lever versus just a checkout option.

Splitit

Deviating from other BNPL solutions, Splitit keeps a distance from consumers. Its installment-as-a-service offering is built into retailers’ existing checkout flow. With this process, consumers do not create an account with Splitit, allowing the retailer to own the relationship and journey with its customers. While eliminating account creation, Splitit also taps into consumers’ existing credit on their own credit cards for zero percent interest installments. Any consumer with available credit on their credit card is automatically pre-qualified to use Splitit for the value of that available credit. Splitit’s approval rates are over 85 percent compared to 60 percent on legacy BNPL platforms.

“Splitit is so much more than pay-in-four,” said Nandan Sheth, CEO of Splitit. “We are focused on creating valuable relationships with our partners, including AliExpress, Visa and Ingenico, to continue to power growth at scale for our white-label, installments-as-a-service technology. We are intent on bringing installments to physical in-store checkout through our partnership with Ingenico, which will innovate BNPL at the point of sale.”

Recent developments from the company include the launch of Pay After Delivery, a new, flexible way to instill confidence in consumers to pay in installments after their items are delivered. Additionally, Splitit has introduced and launched a faster payment experience for its white-label solution called SplititExpress, which seamlessly enables checkout in under 2 seconds and also supports installment payments via GPay and ApplePay.

Best of Footwear News

Sign up for FN's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.