I Paid Off A Large Chunk Of Personal Debt Last Year — Here Are The 13 Lifestyle Changes & Habits That Allowed Me To Do That

In the world of ambient stress, there are few things that top credit card debt.

New Line Cinema

It's always there, questioning your every spending decision ("Can you really afford that appetizer?"), and the longer you let it sit there unbothered, the more it grows and affects your credit score.

Recently, I made the decision to finally pay off the proverbial red number that's been growing since my early 20s. And at the end of last year, I was finally able to pay off my entire credit card balance!

Nickelodeon

As someone who recently crossed the 30s threshold, I figured that now would be a good time to start cleaning up my accounts. (If I were a more responsible financial planner, I would have started five years ago, but alas.)

I've also started thinking more about my long-term goals, like homeownership, starting a family, or (AHHH) retirement. I know the thinking these days: What's the point of planning for anything when the world is ending? But I figure that even if the apocalypse is coming, the people with the most resources (aka: money) will be better prepared to weather the literal storm than anyone else. At the very least, it's my way of doomsday prepping.

Here are the best budgeting tips I have adopted to keep expenses low.

I've also included the habits that I've seen the most financially-savvy people in my life live by.

In general, it's a good rule of thumb to focus on your three biggest expense buckets. For most people, that's food, transportation, and housing. (You'll notice that a good number of my own tips have to do with food!)

1.Eat the same thing every day for lunch.

I got into this habit after sharing the same brunch with my boyfriend every weekend for a year. "It's the same thing I've been eating every weeknight for the last three years," he told me one day. I get it — I haven't tired of it in the last two years, and I've also gotten into the habit of making it for lunch on most weekdays. It's actually a pretty popular (and fairly inexpensive) meal in Germany, where I now live after relocating from New York City. The meal is literally called Abendbrot (aka: "evening bread"), and it's money- and time-saving.

Here's what that meal consists of for me: two soft-boiled eggs (with a bit of habañero Tabasco sauce), one roll of bread (and when I say roll, I mean a pretty dense, whole wheat German roll), and miscellaneous spreads and finger foods — like butter, olives, hummus, carrots, and cheese. It might look ~fancy~ above, but at its most basic level, it's a vegetarian meal consisting of eggs and buttered bread. What's there not to love about that?

2.Go vegetarian at least a few days a week.

I accidentally became a weekday vegetarian when I started adopting the above habit of eating the same lunch and brunch every week. Decades of eating a western, meat-heavy diet had conditioned me to think that I would collapse with weakness if I didn't have a portion of chicken or other meat with lunch and dinner, but alas, all that happened is that I saved a lot of money.

There are loads of reasons to become at least a part-time vegetarian, including environmental and ethical reasons, but the most immediate change you can expect to see when you cut meat out of your diet is cash savings. (For me, it was around $75 a month by substituting chicken breasts for eggs or a can of beans.)

3.Make dinner with friends instead of going out.

One result of quarantine was realizing that going out for a meal was absolutely not crucial to hanging out with my friends. I love that we've finally normalized catching up over walks and homemade meals — which also allow for more conversation and flexibility.

When you cook at home, it's easier to splurge on little things like a bottle of wine or a simple dessert, there's no pressure to leave your table long after you've finished eating, and there are always leftovers you can graze on throughout the week. And yes, you do save a lot of money.

For dinner inspiration, here are 56 pretty simple recipes (and 28 vegetarian recipes) anyone can try at home.

4.When you do go out, drink alcohol less — or not at all.

The more I examine my spending practices, the more I realize how psychologically loaded they are. Take alcohol, for example.

For a long time, I thought that no dinner out was complete unless it was paired with a glass of wine or cocktail. On one hand, I always felt like I needed the social lubricant that is alcohol to get over my anxiety and function in a social setting. On another hand, even when I didn't feel like I needed a glass of whatever, I often told myself that I deserved to "treat myself."

But after a year and a half of being at home and easing out of social drinking, I realized that alcohol is way less necessary than I thought to my feeling comfortable, or even enjoying myself. For the most part, I had come to associate alcohol and "a good time" from pure repetition, never experimenting with disentangling the two.

Now, I don't drink unless the situation really calls for it — for example, if I'm at a restaurant that specializes in my favorite cocktail. And swapping water for alcohol has saved me $5 to $20 on every bill.

5.Cut down travel expenses by road-tripping locally, doing house swaps, or going camping.

I'll admit it: A lot of my credit card debt was accrued while traveling to far-off places, like Peru, Kyrgyzstan, Scotland, etc. I don't necessarily regret the actual trips, but I do wish I had financially planned them rather than given myself a blank check to treat myself on every aspect of every trip.

Being stuck at home and exercising extra precaution with regard to flying for the last almost-two years of the pandemic was unnerving, but on the upside it did force me to rethink the way I used to travel. I've spent the last two summers making mostly local trips to nearby cities on trains and buses and rediscovering the lush forests of Berlin. I know people who've downscaled even further by organizing camping and kayaking trips (where the biggest part of their expenses are their train ticket to the camping site), or who've saved on hotel costs by organizing apartment swaps with friends around the world.

6.Downgrade your phone's data plan.

CBS

Downgrading your data plan won't save you thousands a year, but it will lessen the mental load of your bills. And keeping a low overhead (aka, my life's operating costs) means I have more flexibility to pay for unexpected expenses that come up here and there.

Here are other tiny things I cut that didn't save me lots of money, but did make me feel better about my monthly output: I got on my brother's Spotify Family subscription and canceled my own, stopped buying books and starting borrowing e-books from my public library, and started buying generic medication instead of brand name.

7.Start an Excel sheet where you log every single expense.

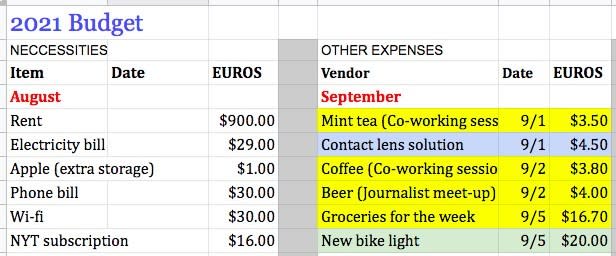

I generally hate tracking things, but tracking expenses was an essential step to figuring out where I could afford to cut expenses. At the end of my first month of tracking — which literally just involved inputting the name of the expense, the date, and the amount into a sheet (see spreadsheet with modified numbers above) — I organized the expenses by color. When I reviewed all the categories, I made the unexpected discovery that I was spending a huge fraction of my budget on gifts for other people.

Which brings me to my next budgeting tip...

8.Give DIY birthday gifts.

NBC

This tip is hard for me on many levels.

On a surface level, I love giving gifts because I feel like it's a tangible way for me to show my love for someone. I also grew up not receiving many gifts, so I sometimes feel an extra need to prevent the disappointment I so often experienced as a child. Part of me also feels embarrassed by the idea of giving DIY gifts, because it would make me reveal the fact that I'm tight on cash and maybe result in judgment. A lot of this is what my therapist would call, "fortune telling," a cognitive distortion in which you predict a negative outcome, and it's fascinating to see its symptom manifest in my spending practices.

In the future, I know I could save a ton of money by simply DIYing thoughtful gifts. Anytime I feel a little nervous about gifting a handmade gift, I think about the fact that a majority of the gifts I've kept and treasured over the years have been handmade. Some of my favorites include a fake "resume" spelling out my greatest skills as a person (gifted to me during a time when I was going through an unsuccessful job search), a glittery decorated frame with a picture of me and the gifter, and a blank journal sewed together from various types of fancy paper (I'm a hardcore journaler).

Here are a few great DIY gift ideas for anyone who's looking to do the same.

9.If you live in city where it's possible, opt for biking, walking, or public transportation instead of driving.

Fox

It's probably easier for me to say this since I live in a city with decent bike infrastructure, but if you have the option, I highly recommend it. In my city, a single one-way ticket on the subway or bus costs around $3.50. And unless the bike ride takes me more than 40 minutes or it's pouring rain, I always prefer to bike over taking public transportation. Given how often I'm traveling within the city, that's at least $20 that I save every week that I can put toward a meal out with friends.

Of course, if biking is not an option for you for whatever reason, I recommend public transportation, or even ride-sharing.

If you're on the fence, I'll add that I understand why it's hard to think about changing your way of getting around. How we get from point A to point B is usually one of the most stressful parts of our day, even when we have it locked down. If you have social anxiety, I can especially understand why you might find the idea of changing your mode of travel more difficult. But I challenge anyone able who thinks they can't carpool, or can't walk to work, or can't figure out bus schedules to try it for just ONE DAY this month. You'll likely realize that the first day is the hardest, but experimenting the route just once may ease most of your fears or discomfort.

10.Get used to saying no.

Universal Pictures

One of my biggest challenges when it came to saving money used to be my inability to say no. As with a lot of people, it gives me social anxiety, induces FOMO, and just plain-out makes me sad. But recently, I realized that my inability to decline invitations to dinners out, fun activities, or travel was making me lose control over my finances. It was as if everyone around me controlled my bank account and not me.

But then I started practicing saying no. Saying no was uncomfortable and mentally distressful at first — the epitome of the nervous grinning emoji. 😬 I started with easier nos first: "No, I can't go on a last-minute vacation with you," and, "No, I don't want to order takeout for the second night in a row." Then I moved on to the more difficult nos: "No, I don't want to split the bill in half – can we each pay for what we ordered instead?" and, "No, I don't want to buy your extra ticket to that sold-out show." Like with many things, I've realized that the actual moment of saying no is the hardest. After that, I feel pretty damn good about myself.

11.Work out at home or outside instead of paying for a gym membership.

Going to the gym used to be a core part of my day — I used to work out in the morning, shower, and then go straight to the office. But since quitting my gym membership, I've leaned into the joys of home workouts.

Working out at home means I have more flexibility over when I work out (aka right when I get up, before I've had a chance to come up with excuses, or in the afternoon when my food coma sets in), and feel way more inclined to experiment with different exercises. As a woman, I also feel safer moving however I want, without the dread of unwanted attention.

12.Plan any spending above $20 (or whatever threshold feels right for you).

Brat TV

There was a time in every millennial's life when "spontaneity" was the word of the day. We were told that to be happy, we had to embrace unplanned, last-minute trips, treat ourselves to gifts out of our budget "just because," and generally partake in random activities meant to enrich our lives or make us more interesting.

But you know what makes me happy these days? Planning my haircuts, my shopping trips, and all my travel at least a few weeks or months in advance. There's science to back up this "anticipation happiness": one 2010 study of 1,530 Dutch adults even found that those going on a vacation "experienced their highest level of happiness in the weeks and months before a trip." In general, I find that planning any purchases above $20 make me appreciate those purchases more (or change my mind about them in the first place). At the very least, and when I'm shopping online, I try to leave things in my cart for a minimum of 24 hours.

Rethinking this way of shopping has also made me realize that retail therapy is a completely unproductive way of addressing my emotional hiccups. (Just plain old therapy is a more efficient solution. Here's a beginner's guide to therapy — and how to pay for it — if you're interested.)

13.And finally, if you're still in your teens or 20s, don't try to live like you have the budget of a high-flying thirtysomething.

If I could summarize the irrational and ultimately catastrophic spending habits of late teens and twentysomethings in two words, they'd be: "Music festivals." I can't believe that as early as 19 years old, I was sold the idea that I should somehow be able to afford a $300+ weekend ticket to a two-day music festival. I love music and going to shows, but IMO, the music festival industry is the worst embodiment of the predatory claws of capitalism, especially on the youth.

If I could give my younger self one piece of advice, it would be to shamelessly create a life where I can find joy and pleasure on my own terms, a life that I can make possible without a credit card. And one that helps me slide into my 30s with financial confidence.