How to Fight Back Against Dynamic Pricing

Our editors independently select the products we recommend. We may earn a commission on items bought through our links.

The key to finding the best price used to be finding the cheapest seller. Comparison shopping was the way to go. But over the last few years that approach – which still feels logical – has ceased to produce the best results. Shoppers now need to consider dynamic shifts in supply and demand. Comparison shopping now occurs across time.

Today's Top Deals

Alexander MacKay, an assistant professor of business administration at Harvard Business School, says his research suggests prices of popular products are dropping or rising by as much as 30% from one hour to the next. Changes of 5% to 10% are typical across products, SKUs, and retailers.

What gives?

The reason for the massive acceleration in price shift is the adoption of dynamic pricing tools across retail. These tools alter the price of a product based on shifts in supply or demand (as well as a number of other factors). And they work fast. Amazon reportedly changes prices for millions of items every few minutes. Companies selling dynamic pricing tools to smaller shops declined to offer specifics on frequency. “Retailers tend to be coy about using dynamic pricing as it still maintains something of a bad reputation among shoppers,” says Michael Orr, a senior director at Blue Yonder, a Scottsdale, Arizona-based company that offers retailers and brands pricing technology tools. But it’s safe to say that prices now change as much as 100 times faster than they did before dynamic pricing became part of the game.

A Quick Cycle of Price Changes

The objective of all dynamic pricing programs, Orr explains, is to find “the highest price the customer will bear.” In other words, these programs precisely track demand in real time. Savvy retailers set them up so inventory moves quickly, shooting for 5% top line revenue growth. Those are the everyday retails. In the luxury segment, dynamic pricing can create margin gains as high as 60%, according to Sularia.

Does dynamic pricing always result in a higher price for the consumer though? Not necessarily.

“When demand is not perfectly predictable, dynamic pricing allows the company to respond by lowering prices to drive customers to low-demand periods,” says MacKay. “This can shift customers away from high-demand periods and reduce the costs of paying for extra capacity.”

In other words, retailers encourage consumers to buy during low-demand periods by dropping prices. Dropping the price of winter coats in March encourages the bargain hunters. In essence, end-of-season-style markdowns persist. There are just more seasons. Put differently, prices used to reflect the month and now reflect the forecast.

This means that disciplined shoppers with a strategy can, in essence, negotiate with algorithms if they understand how to game the system. And, yes, the system can be gamed. Here’s how….

1. Don’t Compare Prices. Compare Prices Over Time.

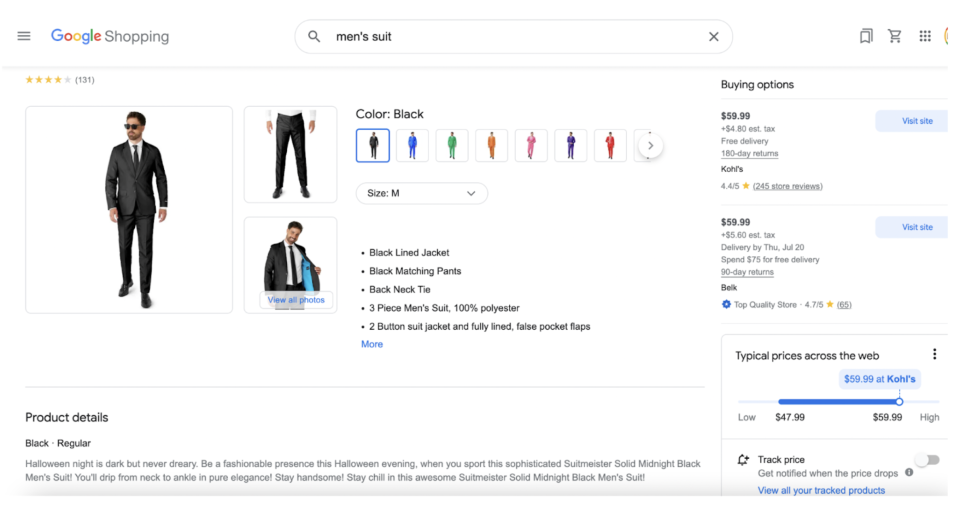

Comparing prices may seem obvious, but the challenge is finding a way to compare prices beyond a single, random moment in time. Merchants have more and better tools for crawling prices, but consumers do have access to a few, notably CamelCamelCamel, which lets shoppers select and track the price of items on Amazon over time, and Google Shopping, which allows consumers to track the price of multiple items across e-commerce stores and platforms. Google Shopping pinpoints the price of an item matched against historical prices over time, and offers prices across different retailers. Customers can continue to watch the evolution of pricing over time. Customers can opt to get notified if the price drops.

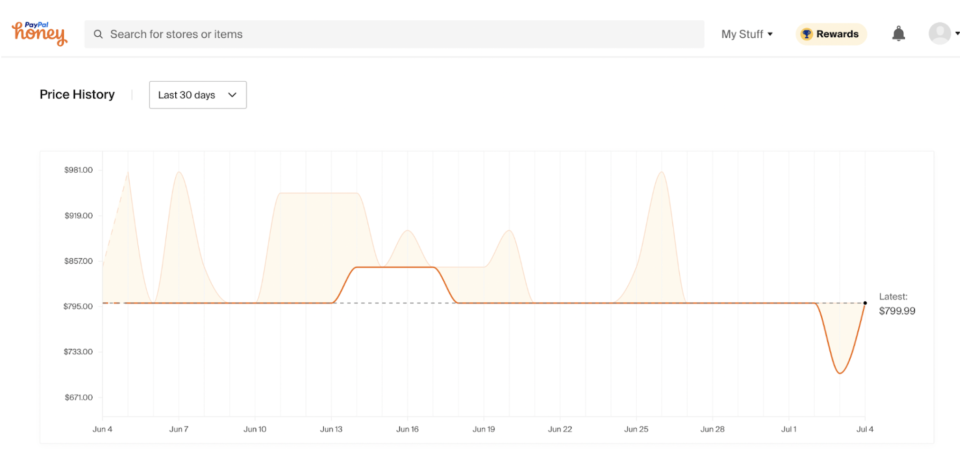

Similarly, PayPal-owned Honey, which offers a browser extension, lets consumers add items to its Droplist feature, in which customers can flag items they want to track and opt to get notified when the price of an item drops. Honey also offers automated comparison shopping for eligible items, letting customers see whether other merchants are offering a better deal.

These tools are by no means the only price trackers available, and could be part of a strategy to understand price trends over time. The findings, however, should be taken with a grain of salt.

The problem with free price trackers is their incentives aren’t always aligned with the shopper, says Sanjeev Sularia, CEO of Intelligence Node, a Mumbai, India-based pricing technology firm. Free price trackers can be tagged to affiliate revenue — where they may earn a commission when a shopper buys an item — and are often dependent on pricing data feeds from retailers. Retailers can delay API feeds so the price consumers see when they click on a retailer’s site is different from what the price tracker shows. Perverse incentives are at play.

2. ‘Crowdsource’ Pricing Intelligence Through Forums

Finding forums to discuss pricing with other shoppers might cut down on time spent bargain hunting. One way to do this is to participate in some of the bigger community forums where pricing is discussed, suggests Trae Bodge, a Montclair, New Jersey-based shopping analyst at TrueTrae.

Slickdeals, for example, is a series of chat threads. “You can have conversations with other shoppers…You could say ‘Hey, I just found this for X. Has anybody seen it for less?” says Bodge.

Slickdeals, which isn’t tied to a specific product category or merchant, also features deals tagged by its user community on its front page. But buyers should beware. Slickdeals discloses that it “may get paid by brands or deals” on promoted items.

3. Ask the retailer if they can lower the price.

In a competitive market, old-fashioned bartering may prompt a retailer to match a lower price on a competing platform to keep you as a customer. Analysts say asking for a better price may work both online and in-store.

“Most e-commerce stores have a chat just go on and just say ‘Hey, I’m looking at this product. Is this the best price or are there any discounts?’” says Jay Myers, co-founder of Winnipeg, Canada-based payment technology company Bold Commerce and a former e-commerce store owner. “Anytime someone would reach out,” and ask for a discount during his period as an e-commerce store owner, “we had coupon codes that were there for our support team to just give people.”

While dynamic pricing is on the rise, retailers are careful not to tread into territory that would lead to the customer feeling like they’re not being given a fair price, says Dhanasekaran Gopal, product head for Optumera, a pricing technology offering from Tata Consultancy Services.

“Retailers have increased investments in understanding competitive prices to ensure that they have a clear view of their competition and how they are positioned,” he says. “Retailers increasingly understand frequently fluctuating prices confuse consumers and negatively impact price perception.”

Before asking a retailer to lower their price, Bodge says it’s helpful to have at least some evidence of a lower price available on a different platform or store. And of course, asking nicely is key, she adds.

“In general, just be a good human,” she says. “If I want someone to do something nice for me, and I’m not nice to them, then it’s not going to work out.”

4. Pretending to buy something and not doing it may or may not land you a discount.

Abandoning the cart – or putting an item into your digital shopping cart and then not making the purchase – is an old trick that sometimes might prompt the retailer or brand to send the shopper a discount coupon or offer some other kind of incentive to complete the purchase.

Sometimes, “if you abandon your basket, very quickly the savvy retailer will contact you on those channels with an offer that’s time sensitive,” says James Miller, a director responsible for product strategy and data analytics at London-based consultancy Pragma. “You’re actually gaming the system to a certain degree…you’re unlocking the next level of benefits.”

Abandoning the cart worked more reliably a couple of years ago but no longer results in a promotional email offering a discount, says Bodge. “If you try it, I’d be shocked if it worked anymore. The technology is catching up,” she says.

5. Time Your Purchase

Retailers tend to see a lot more demands on evenings and weekends, so from a pricing perspective, it might work better to carry out purchases outside of those timing windows, says Miller.

“If you’re kind of going to kind of middle of the day on a Tuesday, you’re more likely to get a better price than you are on let’s say let’s say a Friday at 6pm,” he says.

In addition, timing purchases around major holidays might unlock discounts on bigger-ticket items, such as appliances, says Bodge.

“Three-day weekends are always a good time for home items and large items like mattresses and such,” she says. “Also, if you shop at the end of season, that’s always reliable, obviously.”

Three-day weekends in which to watch for deals could include Labor Day, Memorial Day, Columbus Day, along with other major shopping events like Black Friday, Cyber Monday, the weekend before Mother’s Day or Father’s Day, or after Christmas.

6. Check the Forecast

Checking long-range weather forecasts, though imperfect, might be a way of gauging future demand. Therefore, if due to weather conditions demand might be expected to spike for a particular product, shoppers may want to buy before prices increase.

“If the weather drives demand universally —so you’re making some assumptions — then you’d buy early before prices went up, due to scarcity of product,” says Orr.

For example, if a long, hot summer is projected as part of a long-term forecast, perhaps a consumer might want to get ahead of that by buying early. But he acknowledges that it’s always challenging to make a call on that.

“If [the long-range forecast] says we’re in for a long, hot, dry summer, what that could tell me is or could indicate is that summer goods are going to sell out early,” he says. “If the summer was predicted to be hot and dry, I’d probably buy if dynamic pricing is a reality in that retail chain.”

A consumer, he says, could do the reverse in a colder than usual summer by buying summer clothes at the end of the season. But of course, that brings up a more practical question, he adds.

“Are you happy to wait nine months to put it on again?”

More Top Deals from SPY