Can Fast Fashion Compete With Entry-level Luxury Brands?

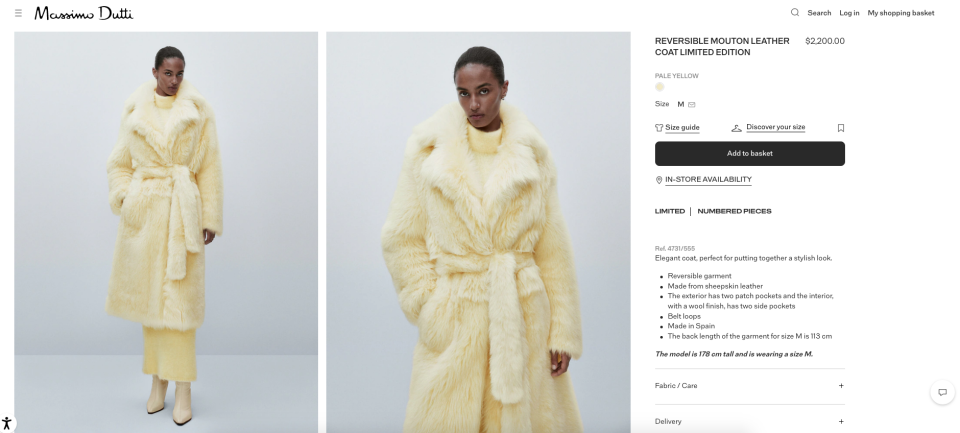

MILAN — When the TikTok account @trendswithtate posted a video commenting on a Massimo Dutti shearling coat that was retailing at $2,000 on the brand’s website, comments and likes soared, reaching almost 50,000 interactions.

“I honestly would have never expected my video to blow up,” Tate Morrison, the creator behind the account, told WWD. Commenters on the video were either pointing out that they would never buy a coat that costs so much from a fast-fashion brand, or praising Massimo Dutti for its bold move.

More from WWD

Savage x Fenty Vol. 4 With Cara Delevingne, Johnny Depp, Taraji P. Johnson & More

Dixie D'Amelio Kicks Off Album Launch with Party at Nightingale

The gap between ultra fast fashion and fast fashion has become more evident than ever, and as brands like Zara, Mango, Massimo Dutti and &Other Stories try to elevate their image, they’re elevating prices as well.

The term “ultra fast fashion” was first used during the pandemic, and describes brands such as Chinese online retailer Shein, which produces enormous amounts of clothing in a short period span. Each day, Shein introduces almost 6,000 designs to the website, and the business can take as little as three days for a clothing item to be planned, produced and marketed, according to a McKinsey & Co. report.

But while ultra-fast-fashion retailers are selling items that cost as little as $10, some more “traditional” fast-fashion brands are attempting to move upmarket, repositioning themselves as more expensive.

Andrea Batilla, author of the books “Instant Fashion” and “The Fashion’s Alphabet,” and former headmaster of the Istituto Europeo di Design and brand consultant, said “they are like the most beautiful girl with the worst reputation. Everyone wants them but we know that they can be toxic, this is why they are trying to clean their image.”

Recently, Zara presented an Atelier Collection shot by famed fashion photographer Paolo Roversi with the goal of celebrating “high-end designs and exquisite craftsmanship.” Items, mainly coats and dresses, were priced at around $400.

“These fast-fashion companies are able to position themselves above ultra-fast-fashion brands,” said Batilla.

According to Cécilia Moussy, the Paris-based fashion trend forecaster and consultant for luxury brands who previously worked at Tagwalk, the fashion search engine that gathers information about fashion shows, designers, trends and new talents, “the price alone can no longer justify the high-end character of a clothing brand, and it is not the only indicator to define what a premium product should be.”

Indeed, customers, especially Gen Z, are extremely aware of fast fashion’s damages — and have high expectations around transparency.

“The more these brands are meeting the pricing of premium brands and the more consumers will expect transparency regarding the materials and fabrics, a real craftsmanship and an added value that will allow those brands to stand out from the other competitors,” said Moussy.

Case in point: Morrison noted that while she succumbs to the convenience of fast fashion every once in a while, she prefers to spend more money on items that have “some sense of exclusivity, in addition to a guaranteed high-quality craftsmanship.”

In September, the Swedish apparel brand COS debuted its first New York Fashion Week see now, buy now runway collection to an audience that included Anderson .Paak, Angus Cloud and Emily Ratajkowski with a cast of supermodels including Paloma Elsesser. During the show, the retailer launched eveningwear, with dresses and accessories priced at around 200 pounds.

Showing during fashion week is a way for fast-fashion brands “to build the brand identity,” Batilla said. “Differently from other players, COS has a strong brand identity.”

Today, high-street retailers are looking for the relevance and closeness to customers that higher-end brands enjoy. To get there, brands are not only raising prices, they are also working toward more sustainable practices.

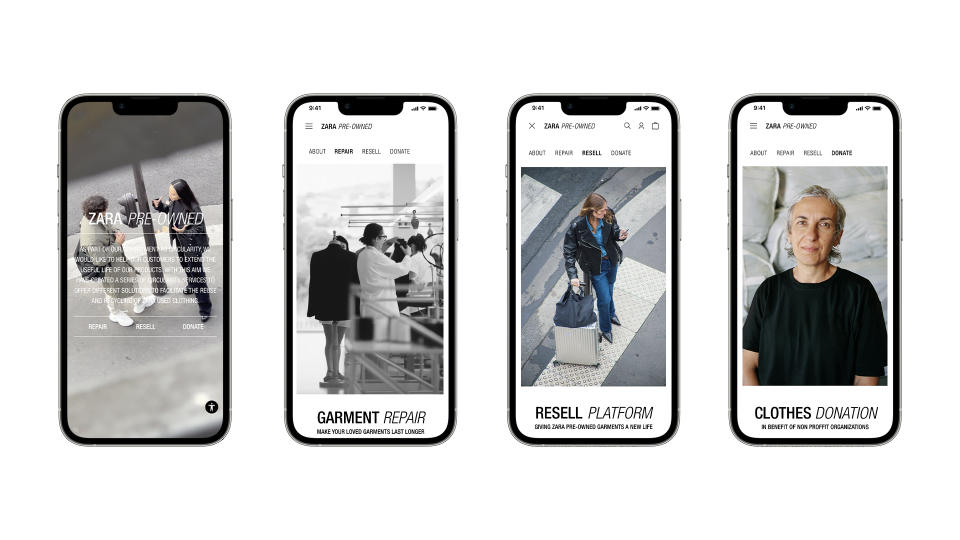

Last month Zara said it was entering the resale market with the aim of helping customers repair, resell or recycle their clothing. During the pandemic, the secondhand market reached its peak, as people started shopping more consciously and cherishing what they already owned. According to Boston Consulting Group, in 2022 the estimated market’s value is between $100 billion and $120 billion worldwide.

Morrison said she has recently “spent more time and energy trying to find secondhand pieces from thrift or vintage shops.”

These types of new services could help fast-fashion brands “acquire a more prestigious image,” Moussy said. And going forward, companies could “eventually divide their offer into two ranges: a first mass market range, accessible because of its reasonable prices, and a second higher range with a promise of higher-value clothing,” Moussy noted.

The line is thin between a strategic marketing move and a shift to truly elevate the brand as one more aware of sustainable and social practices. But some fast-fashion brands are moving forward with greener production, eco-conscious lines and supply-chain transparency.

Zara, for example, said by 2025 all of its linen and polyester fabrics will be sustainable, and by 2030 H&M said it will recycle all of its products. Mango has targeted using 100 percent sustainable cotton and 50 percent recycled polyester in its collections by 2025.

“The example of Massimo Dutti’s coat is perfect to understand how it isn’t important whether it is good or bad,” Batilla said. “At the end of the day, we are talking about it.”

Best of WWD