In Fashion: Warby Parker at the End of the Digital Revolution

When Warby Parker turns the page and goes public this week, it will mark something of a conclusion to the digital fashion revolution the eyeglass brand catalyzed.

It’s a lot to hang on the brand — probably too much — but Warby Parker is used to playing an outsized role in the industry’s imagination.

More from WWD

Why the Fiorucci Store Was the Mother of All Retail Concepts

Unites States Retail in the Aftermath of Police Brutality Protests

For years it’s been more than a buzzy, direct-to-consumer disruptor of the fragmented eyeglass business or just a promising brand out of the next generation. Warby Parker has been a kind of vanguard – an idea big enough to hold the dreams of a generation of business school graduates and venture capitalists.

So many brands were launched as “The Warby Parker of…” that the pitch became passé (unfortunately, only after the endless stream of press releases heralding the second coming became ridiculous).

But the company’s underlying approach stuck and Warby Parker started standing for more — a way of acting and being and a kind of storytelling that successfully crossed the physical-digital divide. Warby Parker didn’t invent the notion of going right from the factory to the consumer, but the company did embody its modern incarnation and wrapped it all up in an easy-to-understand brand.

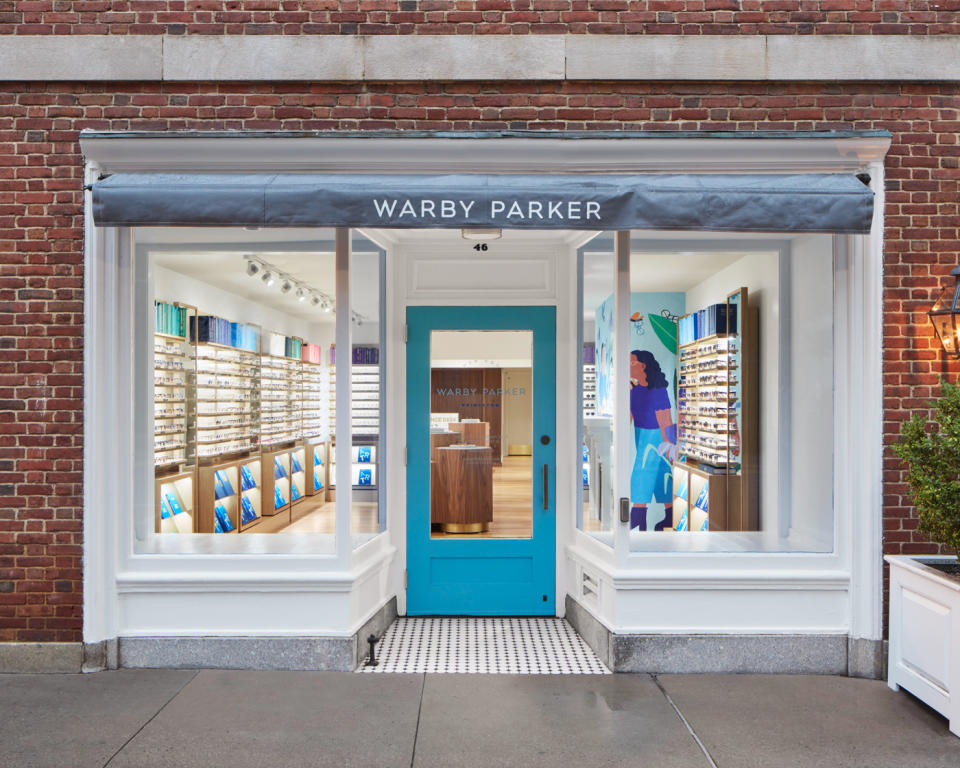

Courtesy

And the legend that grew up around the brand and just who was going to become “The next Warby Parker” suited the company’s purposes.

“I would call it their brand umbrella,” said Jonathan Low, a partner at the Predictiv consultancy who specializes in the financial impact of intangibles like brand and reputation.

“They were given credit for stuff they probably didn’t do because they were new and perky and stylish, so people went: ‘Whoa, look what they’re doing,’” Low said. “Part of the narrative that doesn’t get written about is, you can’t do this stuff if you don’t have this fast machinery behind it executing.

“People are getting the stuff they want [from Warby Parker], when they want it and that takes a lot of effort. The fact that it works is kind of amazing,” he said. “People were willing to trust it for something as important as their eyes. Building that trust was really, in a way, the amazing intangible.”

So Warby Parker is several things.

On the surface, it is the idea of a modern fashion company serving the interests of consumers. Beneath that, it’s a friendly, helpful brand that sells hip eyeglasses online and in brightly lit stores. And at the core, it’s a business chugging away and delivering on its promises.

The digital revolution that Warby Parker helped kick off has come and is now firmly entrenched across all businesses. To some degree or another, everybody is chasing the direct-to-consumer, omnichannel model Warby Parker came to stand for — from retail giants to start-ups.

Now the company’s shares are coming up for grabs, heralding another change.

Warby Parker in a sense is leaving behind its adolescence with a direct listing on the New York Stock Exchange (which is like an initial public offering).

On many levels, that changes nothing for the company, which will continue on after the offering with its plans to keep expanding, adding 30 to 35 stores this year, for a total of 160 locations, while growing sales by up to 36 percent to $537 million.

Courtesy

But the firm’s status as a public company, wearing its sales outlook on its sleeve and reevaluated second-by-second by investors, will give the industry a clearer picture of just what it means to be Warby Parker — the business, not the idea.

Wall Street is putting the company under a new kind of scrutiny and coming in with its own metrics for success.

An analysis by David Trainer, chief executive officer of Nashville research firm New Constructs, said the stock listing might not live up to the company’s most recent private valuation of $3 billion when shares start trading on Wednesday. He pointed to losses of $55.9 million last year and a break-even performance in 2019.

“We believe the stock is worth as little as $640 million,” Trainer wrote. “A $3 billion valuation implies that Warby Parker will overcome some significant hurdles, including reversing a downward trend in profits, growing revenue by more than 600 percent, and generating more revenue than the current eyewear market leader, Vision Source.”

He pegged Warby Parker’s U.S. market share in eyewear at 1 percent, below Vision Source (8 percent), Luxottica (6 percent) and Walmart (5 percent).

“Despite a strong brand and visibility in the marketplace, Warby Parker maintains a very small share of the highly fragmented eyewear market and to make matters worse, consumers are reluctant to purchase eyeglasses online, instead favoring in-store purchases,” he wrote.

The market might just look past such worries and bet that Warby Parker has the brand and chops to remain the next big thing.

Whether the market zigs or zags might mean everything to Warby Parker, but for the rest of the industry, it won’t matter.

The story of Warby Parker has already ushered in a new age and there’s no going back.

In Fashion is a new recurring feature that will analyze the latest financial trends in the retail, beauty and related worlds to see if the tea leaves give some guidance to the future.

More from WWD:

Retail’s Silver Linings and Dark Clouds

The IPO Mania Transforming Fashion and Retail

Brilliant Earth Stock Soars Past Expectation for IPO

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.