Fashion’s Top Takeaways From Tech Earnings

The latest round of tech earnings isn’t quite over yet, but with Apple’s numbers added to the heap last week, the most influential platforms for fashion, beauty and e-commerce have all weighed in — and by and large, Big Tech appears to be back. Sort of.

Apple’s fiscal fourth-quarter revenue of $89.5 billion beat expectations, as did other top-line figures from fellow giants Google, Meta and Amazon. But this time, it took more to impress investors, who cared less about raw numbers than the companies’ plans, particularly in an era of artificial intelligence driving radical changes in areas like shopping and fashion.

More from WWD

Actor Xiao Zhan Named Boucheron Ambassador, Sophia Webster Celebrates 10 Years in Business

Consignment Aids Resale, ThredUp and RealReal Inch Closer to Profits

Even an apparent rebound in online advertising seemed somewhat anticlimactic, as a new measure of success began to take shape. In the immediate wake of estimate-topping results, shares still stumbled or remained flat when platforms couldn’t convince investors that they would meet the AI moment.

The broad brush strokes paint a portrait of a tech sector in flux, as it continues facing a new reality where merely dominating search, computer software, e-commerce, social media, mobile devices and more is no longer enough. Companies like Google, Amazon and Meta — all of which have spent years touting significant chops in AI and machine learning — were seemingly caught off-guard as the AI explosion ignited over the past year. Cue the mad race to catch up, with a furious array of launches and updates amid critical organizational changes.

That matters to everyone who relies on these platforms, including fashion, for which the most important takeaway may be this: The race for AI, which is already evident in ad products and a growing array of other tools, is only just getting started.

Take Google, for instance.

Google Versus Microsoft

Parent company Alphabet had a great quarter overall, with revenue and income jumping 11 percent to $76.7 billion and 25 percent to $21.3 billion, respectively. Google Cloud hit $8.4 billion with 23 percent growth, while ad sales shot up 18 percent, nearly reaching $60 billion in revenue. That includes, as chief financial officer Ruth Porat put it, “meaningful growth in search and YouTube,” with $44 billion and $7.95 billion, respectively. Apparently companies are spending money on online ads again.

Wall Street should have been euphoric. Instead, shares slumped. That’s because expectations were high for the AI-driven cloud unit and, despite all of its growth, it still disappointed.

Compare that to Microsoft. Its overall $52.9 billion revenue haul and 7 percent growth paled in comparison to Alphabet’s figures, but its cloud efforts performed better. Investors were pleased to see Intelligent Cloud revenue grow 16 percent to $22 billion, including a notable 27 percent boost in Azure and other cloud services, thanks to “higher-than-expected” AI consumption, according to the company.

That’s just the latest chapter in Google and Microsoft’s battle over AI dominance in a consequential, perhaps even existential, fight that goes beyond cloud services.

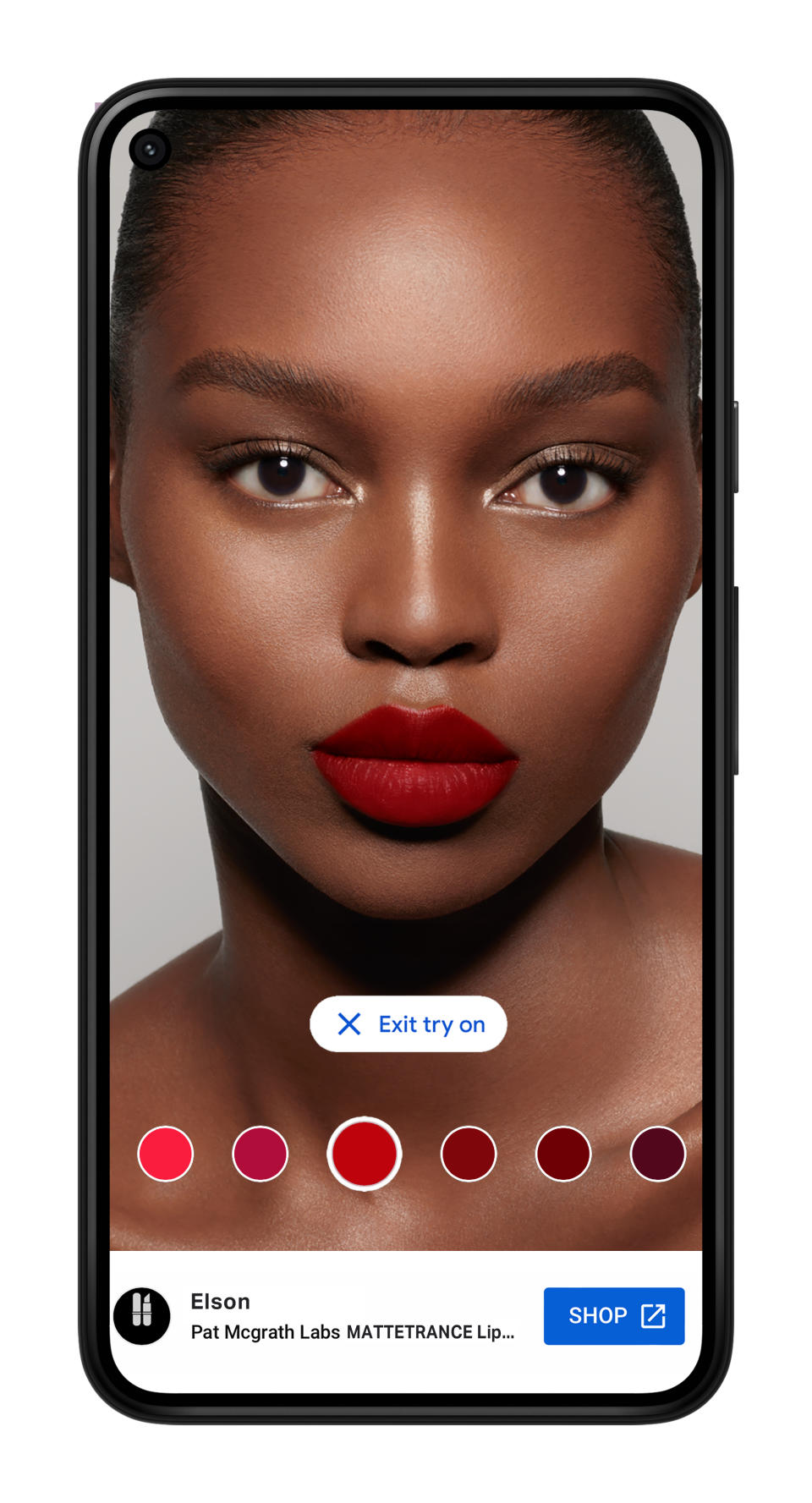

Google has been investing deeply in AI and machine learning for years to hone everything from ad products and search results to Google Assistant and Android cameras, as well as new products and features in development. This year, it also introduced new AI shopping features, including a major overture to the beauty industry with the expansion of augmented reality hair color and makeup try-ons within Google Shopping. The tech giant may have a unique opportunity in this space now, after Snap Inc. has officially stepped back from offering enterprise AR.

Another Google feature for virtual try-on, this time for apparel, uses AI to generate photos of real models wearing different garments. This is an emerging space that has been in the works for years by e-tail juggernauts like Amazon and Walmart, but the AI boom appears to have upped the stakes, not to mention the interest: On Monday, MadaLuxe Group’s Sandy Sholl and Adam Freede officially announced an AI-powered virtual try-on and styling platform called Zelig and $15 million in series A funding from Hilco Global, Bezikian Zareh and others.

The competition for virtual try-ons is just one of many AI-fueled battlefronts for Google, however, as it also developed others for image generation, music and more.

It’s worth noting that not all of its efforts are hits, though. Google Bard, its own version of ChatGPT, arrived earlier this year with deep flaws including factually inaccurate responses. Meanwhile Microsoft, a major backer and partner of ChatGPT developer OpenAI, released BingChat, which uses the same technology.

Now Google seems to be taking stock of its operations and making some hard decisions, including yet another wave of job cuts, this time to its Google Assistant team. Reportedly, up to 20 data scientists were just laid off.

(Google’s not alone: In recent days, the Bay Area has seen several tech companies shear off workers, including e-commerce marketplace Faire, which reportedly plans to lay off roughly 250 employees, reducing its total workforce by some 20 percent.)

Amazon

On the cloud front, neither Microsoft nor Google has caught up to Amazon, at least not yet, but Microsoft’s Azure gained a lot of ground this year. This puts intense pressure on Amazon Web Services, which is why shares didn’t immediately skyrocket on the enormous third-quarter numbers coming out of Amazon. The company pulled in $143.1 billion in revenue and $9.9 billion in earnings, and its advertising arm pumped $12.06 billion in revenue, a 26 percent leap over last year. But Amazon Web Services failed to meet expectations, both in current revenue and in the projections. Since then, the stock has climbed, but that’s due to the strength of the e-tailer’s other businesses.

Ultimately, AI has become the most crucial metric by which the tech platforms are being judged, often overshadowing other successes — even areas previously considered critically important. What also became evident is the need to distinguish types of AI and product offerings. Because they’re not all the same.

In terms of buzz, generative AI leads the pack, thanks to its ability to create original works of art, text, music and more. According to Amazon, “the AWS team continues to innovate and deliver at a rapid clip, particularly in generative AI, where the combination of our custom AI chips, Amazon Bedrock [offer] the easiest and most flexible way to build and deploy generative AI applications.”

Think of Bedrock as a grab-and-go store for AI models, where companies can scoop up whatever model fits their needs and plug in their data. Across the board, there’s a concerted push to make generative AI development easier with no-code solutions, allowing practically any start-up, brand or would-be platform to create their own solutions.

There’s plenty of potential opportunity in this scenario, as well as no small amount of chaos. Even the U.S. government, which is historically slow in addressing new technologies, seems to recognize that. This emerging reality just prompted President Joe Biden to sign an executive order that sets out some early guardrails on AI, because it’s fueling “warp speed” change.

Apple

Even Apple, which is not in the business of making AI tools for people or businesses, faced AI questions during its earnings call on Thursday.

While its efforts aren’t public-facing, the iPhone maker is actually “investing quite a bit” in generative AI, according to the company, and some outlets contend that Apple is building its own ChatGPT competitor. At the very least, it’s using the tech to improve existing products and features. “We view AI and machine learning as fundamental technologies, and they’re integral to virtually every product that we ship,” said Tim Cook, chief executive officer.

The use cases could grow, as its Vision Pro mixed reality headset prepares to launch early next year, and more intelligent, new features could help beef up Apple Watch sales, which apparently flagged as part of the accessories, wearables and home group. That helped make for a mixed period, during which lagging Mac and iPad sales were offset by iPhone revenue growth.

Meta

Meta isn’t in the cloud business either, but it’s no less invested in cranking out AI tools. That wasn’t the big takeaway from Meta’s earnings call, however.

The Facebook and Instagram parent boasted $34.15 billion in revenue that surged 23 percent over last year and more than doubled its earnings, with income coming in at $11.58 billion. Apparently CEO Mark Zuckerberg’s “year of efficiency” worked. Meta’s advertising business has come roaring back, as the parent of Facebook and Instagram broke Wall Street’s third-quarter 2023 earnings forecasts. Revenue rocketed 23 percent to $34.15 billion, as earnings doubled to $11.58 billion.

Zuckerberg also excitedly talked about what the company has been up to, including Meta’s new version of the Ray-Ban Meta smart glasses, the Quest 3 virtual reality headset and a range of software and features, including Emu, a tool that can create high-quality images or stickers, and the new smart assistant Meta AI.

The techie smorgasbord continues with AI Studio, a suite that allows companies to make their own custom AI chatbots, and that’s just the beginning. “We launched an early alpha of business AIs, so that eventually every business can have an AI to interface with customers to do sales and support,” Zuckerberg said. “We laid out the plan to launch creator AIs next year so every creator can have an AI their fans can engage with to help them build out their community.”

The CEO said AI will be the company’s biggest area of investment next year. That’s huge for a company that didn’t blink over losing a whopping $46.5 billion on its metaverse bet, or at least the Reality Labs division that fosters it, since 2019.

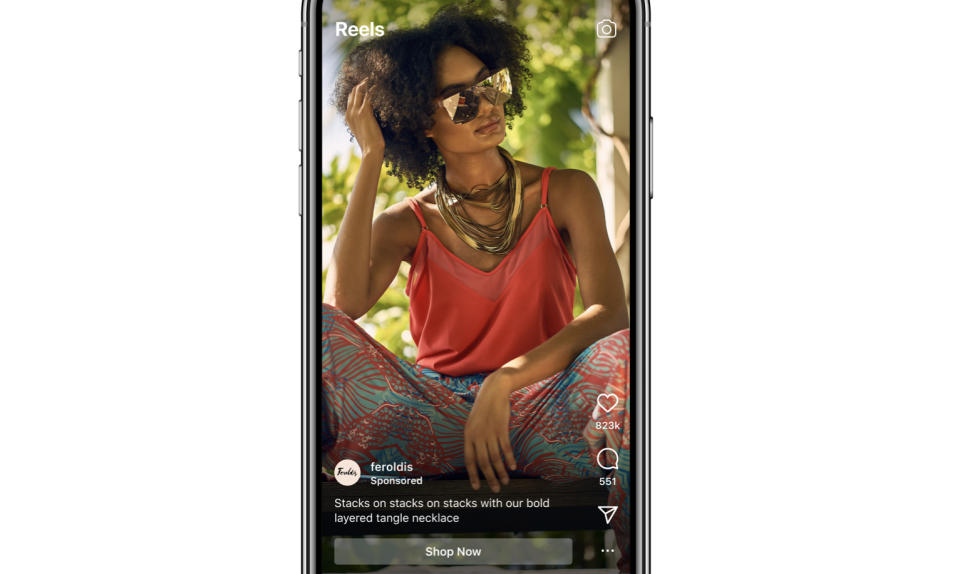

In 2024, Meta plans to push business bots to more companies, and that will be “an important focus,” he added. So will its work with generative AI. The company’s Llama 2 models, which allow developers to create their own AI tools and experiences using natural language, saw more than 30 million downloads in one month. Meanwhile internally, AI-driven recommendations for feeds, Reels videos, ads and integrity systems boosted time spent on Facebook and Instagram — by 7 and 6 percent, respectively — as well as its ad business.

There’s virtually no aspect at Meta that AI doesn’t touch, including business messaging, which Zuckerberg described as “the next major pillar of our business.” As it is, more than 600 million chats between people and businesses happen each day across the company’s family of apps.

As for other efforts, Meta also saw gains with Reels. The short video format, which drove more than a 40 percent boost in time spent on Instagram since launch, is graduating from experiment to a “core part of our apps,” the CEO continued. Threads, Meta’s Twitter clone, marks three months with just under 100 million monthly active users now.

And, in case anyone was curious, none of this means Meta has given up on its metaverse bet. Its latest hardware speaks to this ongoing development. Likely building on the buzz of the upcoming Apple Vision Pro, Meta is promoting the new Quest 3 headset as the world’s “first mainstream mixed reality device.” It also talks up the new Ray-Bans as the first smart glasses that come with Meta AI.

More broadly, metaverse builders have zeroed in on an important connection between their development and the advancements in artificial intelligence. By and large, they see AI as a pivotal tool for enhancing their environments, avatars and wearables, allowing for more sophisticated experiences. It’s unlikely that Meta would miss out on that.

What’s clear for fashion is that the new digital frontier is being defined by smarter, more intelligence-driven tools and consumers who are growing AI-savvier by the minute. In the near term, the tech hands individuals, creators and businesses of any size increasingly sophisticated tools. That sets up a period of intense competition, during which even newcomers and small shops can compete with larger brands in new ways. That’s a snapshot of the current moment in the AI era. But it may be nothing compared to what the next phase will bring, as Big Tech further sinks its teeth in.

Best of WWD