How Are Fashion Shoppers Reacting to Cooling Off of Inflation?

Consumer behavior has been anything but stable over the past few years with people reacting to changes of lifestyles and ongoing economic disruption, but according to new data from Placer.ai, apparel retailers can expect a full return is just around the corner.

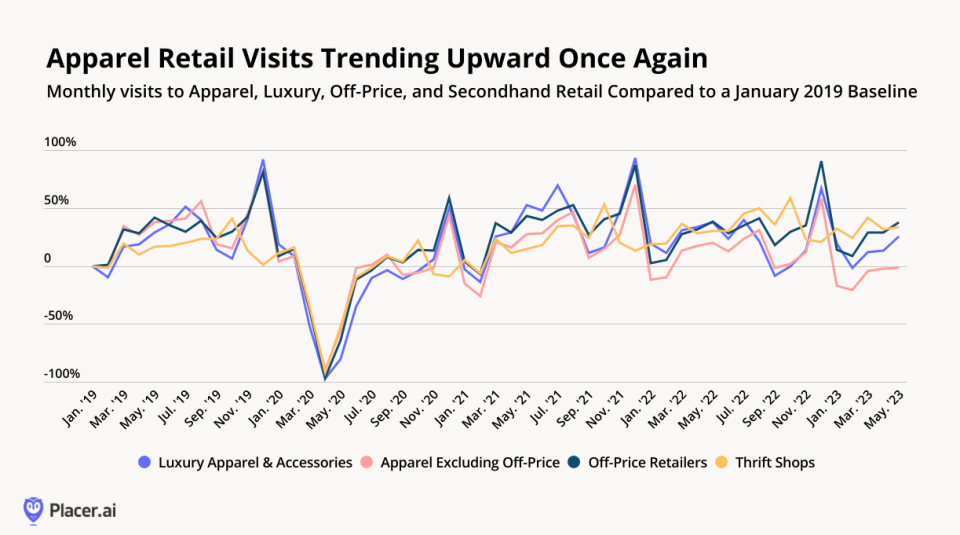

To understand how consumers are reacting to the recent “cooling” of inflation, Placer.ai analyzed data on foot traffic, seeing that the apparel segment (including luxury, secondhand and off-price fashion), finding that numbers are significantly higher than the pre-pandemic period. In fact, the company’s data finds that in May 2023 visits to off-price, luxury and secondhand retailers were 37.9 percent, 25.3 percent and 33.5 percent higher respectively than in January 2019.

More from WWD

Whether the current momentum for growth picks up now, the authors of Placer.ai’s report say it will likely depend on if inflation will continue to fall as well as “how apparel chains choose to approach the upcoming back-to-school and holiday seasons.”

The authors of Placer.ai’s State of Fashion report note the number of trends that emerged over the last few years, acknowledging the importance of understanding the heightened and lowered, points of shopper engagement. Among these trends was revenge shopping and, more recently, trading down.

Data from the company’s continued research finds that the affordable thrift store category has continued to remain strong despite all economic headwinds. Researchers cite growing interest in secondhand clothing, sustainable fashion and the revival of early 2000s trends as key drivers along with the importance of finding value in times of inflation.

On the other end, Placer.ai’s data has seen traditional apparel experience a drop in foot traffic, with the authors of the report speculating this could be due to middle-income shoppers currently seeking bargains not only at thrift shops but at off-price retailers, which have taken a lead with shoppers and capturing 53.8 percent of visit share compared to traditional apparel at 46.2 percent. Notably, the company also predicts that many shoppers are also saving up for luxury purchases.

Looking ahead, experts from Placer.ai advised retailers to be strategic with the upcoming back-to-school and holiday shopping seasons saying that “clothing retailers who can tap into the growing preference for affordability and sustainability may see foot traffic tick upward once again.”

Best of WWD