Facing What Matters at Retail

“Less is more” is a common theme with brick-and-mortar retailers. according to Mark Bunney, director of go-to-market strategy at Ingenico.

Speaking to WWD on how retailers can better leverage omnichannel in stride with ever-changing consumer needs, Bunney sees three main areas of contention. First and foremost, retailers need to “understand their customers.” If retailers wish to pave a pleasing experience in their aisles and at the checkout, then they must know exactly who they are and what they need.

Related stories

Doneger Group Taps Michelle Evans as Merchandising Exec

Charlotte Russe Closing, Liquidation Sales Begin Today

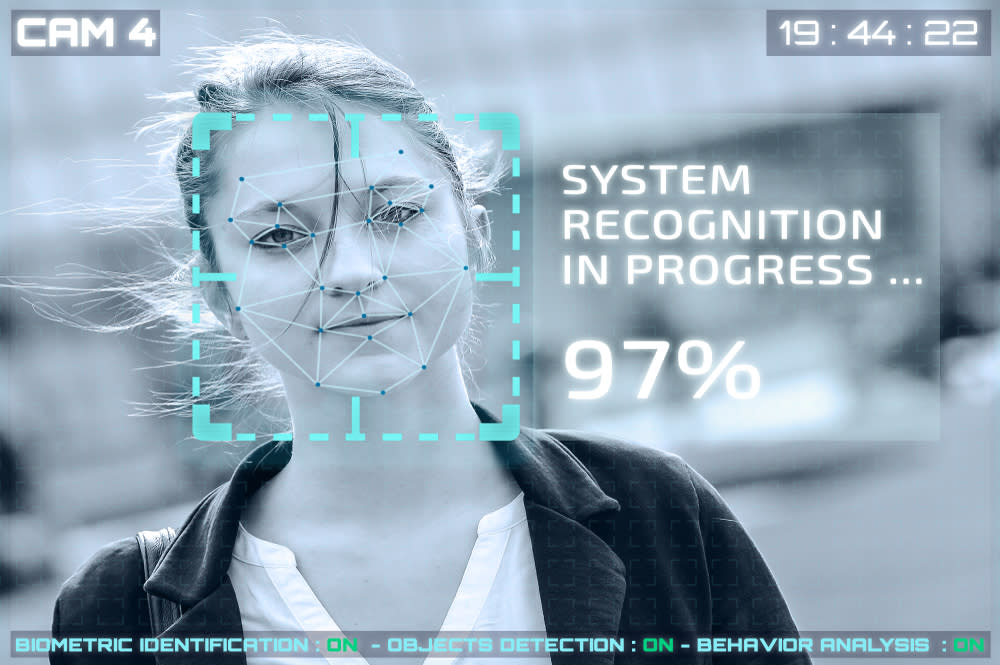

As Facial Recognition Technology Expands, Consumers Remain Wary

In the case of Ingenico, servicing retail clients such as Carrefour, the French multinational grocery chain, the benefit is found in a protective omnichannel payment acceptance solution. While in terms of customer engagement, customers may see value in interactive services at the point of sale.

Carrefour was the “first retailer to deploy a Nexo payment solution on such a large scale, Europe-wide,” said Jacques Behr, executive vice president of Europe and Africa at Ingenico Group, and it did so to activate a wider, more unified payment network.

An increasing trend in the retail store environment is also “rethinking the retail space they [Carrefour] already have.” Perhaps ushered in by the surge in experiential retail, wherein consumer engagement is reached through pop-up activations, rethinking retail likely involves “immersive commerce.”

Blending traditional retail with digital, e-commerce elements creates omnichannel pathways that actually engage the right customer with how they best respond.

Finally, connecting that experience may involve digital screens or contactless payment and undoubtedly, this will urge friendlier mobile transactions which “go anywhere.” Whether leveraging a sales associate in store by aiding them with a mobile screen for checkout is the answer or eliminating the sales associate entirely will depend on the retailer.

When asked about the outlook of retail beyond mobile, Bunney noted “proof-of-concepts” from Ingenico, wherein biometrics and facial recognition represent the next iterations at the payment terminal.

Biometrics, lagging in adoption in the U.S. but adopted in other regions of the world, welcomes privacy concerns as does facial recognition. But with greater security comes greater forfeiting of consumer privacy.

Does the customer want the merchant seeing them transact? The answer lies ahead.

Ultimately, retailers’ greatest challenge is weathering the ever-changing needs of the consumer, walking the aisle maintaining the “right balance” between today’s customer experience demands and tomorrow’s privacy concerns at the payment terminal.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.