Find an Extra $1,000 in Your Budget Before Black Friday

Advertiser Disclosure: At Slickdeals, we work hard to find the best deals. Some products in our articles are from partners who may provide us with compensation, but this doesn’t change our opinions.

Black Friday deals are going to be fire this year, and if you aren’t careful, snagging all of those flash deals could also burn your wallet. Avoid the extra stress on your budget by planning ahead. You still have about a month to save up before Black Friday, and if you implement these money-saving tips, you can sock away a few extra hundred dollars — painlessly.

If you are one of the diligent few who can follow ALL of these tips, you can save $1,000 or more before you start your holiday shopping. Actually, if you max out all of the tips below, savings could be closer to $3,000 depending on what you plan to spend this month. But let’s get real — life can get busy and sometimes it’s only practical to follow a few of these tips. That works too. Even following a couple of these tricks will help you stash money aside. Pair these savings with great sales to keep your budget in check for 2021 and set up for financial success as you move into 2022.

1. Stop Pouring Into the Java Money Pit

Potential Savings: $150

We know that you know you spend too much at Starbucks or your other favorite coffee, tea or smoothie joint. We get it. It’s part of your morning ritual, but at $4 to $6 a drink (or more if you can’t resist a warm cheese Danish), you are throwing away an average of $150 between now and Black Friday (assuming you spend $5 x 30 days).

With that savings, you can even buy your own espresso machine during Black Friday and make tastier brews at home, saving even more money in the long run.

2. While You’re At It, Opt for PB&J Over Takeout

Potential Savings: $232

At the end of a long workday, nothing hits the spot like a platter of tacos or Asian takeout. The Simple Dollar reports that the average American spends $232 each month to eat meals prepared outside the home. While we know this tip won’t win any popularity contests, you really could choose to make a peanut butter and jelly sandwich for dinner rather than hitting up the drive-thru. Some other fast, affordable meals that are easy to eat for lunch or dinner include spaghetti, canned soup or frozen pizza.

We aren’t asking you to eat like this forever, but instead to rethink your fast food splurges when you have food in the pantry or fridge.

3. Join a Warehouse Club NOW for Free to Bring Your Grocery Bill Down

Potential Savings: $100 – $300

Have you noticed grocery store prices slowly creeping up? It’s not just in your mind. Food prices have gone up by several percentage points in the past couple of years, but shopping for your groceries at a warehouse club can help keep your receipt total down. Today.com reported that Sam’s Club’s prices are 33 percent lower than the largest supermarket chains. Not only can you save on your grocery bill, but you can also pay less for gas and Black Friday deals.

Right now, you can even get a technically-free Sam’s Club membership. If you sign up for a Sam’s Club membership by October 31st, you will receive a $45 eCard, which makes this as close to free as you can get.

4. Return Those Regret Buys

Potential Savings: $100 – $200

Turn your buyer’s remorse back into cash by checking your return window. Stores like Costco, Walmart, Target and Kohl’s have generous return windows and will take back items you are not pleased with, even if the original tags aren’t on them.

I just found a pair of boots in my closet and a pair of overalls in my daughter’s closet — both untouched for a few months and with the tags still on. Thankfully, these Target purchases were saved in my Target app, making returning the items for a $66 refund a breeze. Even if a store will not give you a cash refund, opt for a store credit or gift card and use it during Black Friday shopping. Psst…these stores have the best return policies.

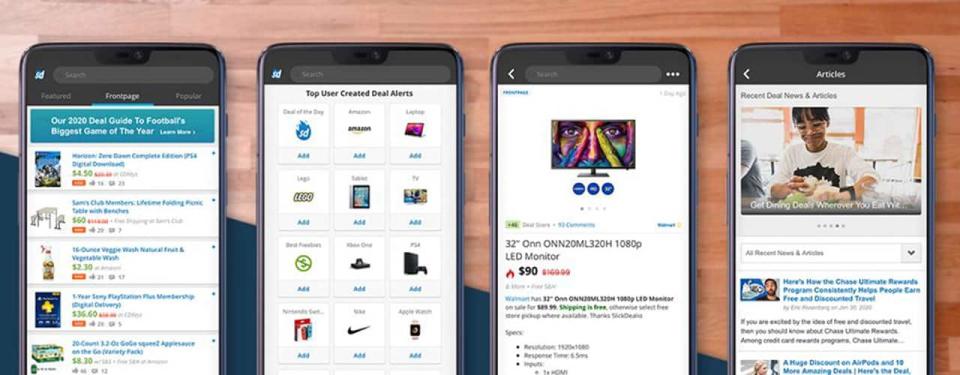

5. Search Slickdeals Before Checking Out

Potential Savings: $200 – $1,000

One habit that I have used for years is searching on Slickdeals before committing to a purchase. I search things like:

Dog food deals

Amazon Subscribe & Save deals

Cheap toys for my gift closet

Brand name clothing deals

Tech and TV deals

Gift card deals

Coupon codes

Sure, I can save myself a few seconds and just buy any package of dog food in the store, but doing a Slickdeals search first saves me a quick $5 to $10. Rinse and repeat this process for everyday purchases like diapers, snacks and toiletries, and the small savings add up quickly. And when you are ready to upgrade your tech, TV or appliances, make sure to check Slickdeals first since deal hunters find deals on the best brands, often for hundreds or thousands less than retail.

Checking the Slickdeals app often and setting Deal Alerts have also helped me grab hot gift card discounts and deals that sell out quickly.

6. Review Your Amazon Purchases Over the Past Three Months

Potential Savings: $100

Amazon makes online shopping a breeze, which can be a bad thing when you realize you don’t always use or need many of your binge purchases. Thankfully, returning items to Amazon is just as easy, and you might be surprised by how long your return window is open.

Our Lifestyle Editor, Kim Martin, even tried to return a $25 Amazon Basics duffle bag that was too big. Amazon refunded the amount and said to keep the item. Talk about a win-win! Even if Amazon wants you to return an item, there are hundreds of different Amazon Drop locations, including nearby Whole Foods and Kohl’s.

7. Pause Your Subscriptions for a Hot Second

Potential Savings: $100

Now is the ideal time to go through your subscriptions and memberships to see what can be canceled or paused temporarily. When I did this, I discovered that I was being charged for HBO’s monthly streaming service and not even using it. Furthermore, I discovered a few book and online class subscriptions that I loved, but was not using enough to justify the cost.

I wasn’t ready to cancel all of my subscriptions, but I can live without them for a month and reap the savings. I paused my Hulu streaming and pushed back my Thrive grocery box and HelloFresh meals.

There’s also a slight chance that if you cancel Amazon-owned subscriptions, like Audible or Kindle Unlimited, now, you might make your accounts eligible for Black Friday trials or sign-up deals.

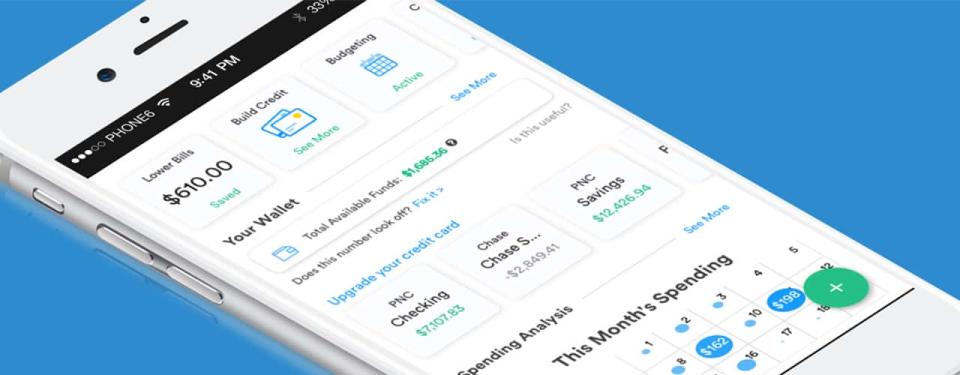

8. Use Trim to Lower Pesky Bills

Potential Savings: $150 or more

Some people can work wonders with customer service reps and get a discount on their cell phone or car insurance bills. I am not one of these people. If you are in the same boat, welcome. Trim is made for us.

Simply link this bot with your accounts, and Trim will fight to have your bills lowered and even help you cancel unwanted bills.

9. Declutter and Cash Out (Even on Unwanted Gift Cards)

Potential Savings: $500

Watch an episode of Tidying Up with Marie Kondo on Netflix, and you will have all of the motivation you need to declutter and list unwanted items. Right now, I am on a selling spree, listing all big items I don’t want on OfferUp or Facebook Marketplace, and all smaller, valuable items on eBay. So far, I have made $500, and the house looks a whole lot cleaner.

One item I ended up selling was a $45 Massage Envy gift card for $30 on eBay. This card sat in my desk drawer for two years, and I had no plans to use it. You can also sell gift cards on verified websites like Gift Card Granny.

What are you waiting for? ‘Tis the season to save, so you can have wiggle room in your budget to buy those Black Friday deals. Set your Deal Alerts now, too, so you can find the best discounts on the items you really want this year.

Up Next:

This Black Friday Price Guarantee Lets You Score Deals Even Earlier from Best Buy

Walmart’s Early Black Friday Sale Is Already Beating Amazon Deals

Our editors strive to ensure that the information in this article is accurate as of the date published, but please keep in mind that offers can change. We encourage you to verify all terms and conditions of any product before you apply.