EXCLUSIVE: Social Shopping App Drop Raises $5.5M in Funding

PARIS — Drop, the social commerce shopping app that helps brands slide into consumers’ DMs, has raised a $5.5 million round of seed funding led by a global group of investors, including Vienna-based Speedinvest, with Motier Ventures, the investment office from the owners of the Galeries Lafayette Group, on board.

Paris-based Kima Ventures and London’s Exponent Capital were also in the round, along with a handful of independent investors including WeTransfer founder Nalden and Feed’s founder Anthony Bourbon.

More from WWD

How "The Bachelor" Contestants Have Gone From Reality T.V. to Mega-Influencers

Going Beyond Sociability, Retailers Get Serious About Business With Instagram

Drop was launched in January 2022 by a trio of cofounders from the digital marketing and agency world who saw a gap in direct communications as brands fight for attention among the always changing algorithms of Instagram and other social media.

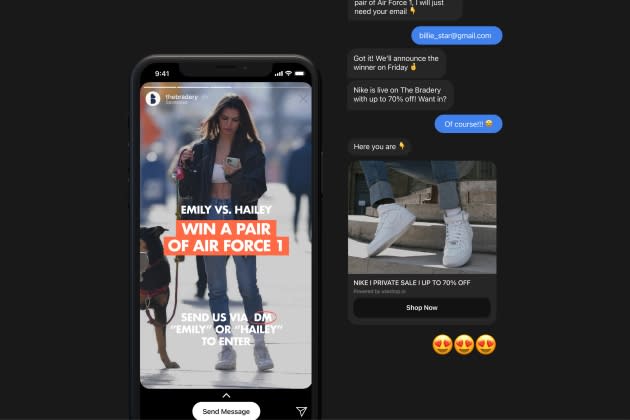

Inspired by social shopping on the Chinese app WeChat, Drop developed direct messaging as a sales channel, enabling customers to communicate instantaneously with a brand without leaving the social media ecosystem or being led to an external website. It comes as the social shopping share climbs in popularity, expected to hit $2.9 trillion by 2026, according to Statista numbers.

“What the vast majority of brands are competing against is conversion optimization,” said cofounder and chief executive officer Benjamin Benichou. “We don’t want to force followers to leave a social media application to visit a website, we want to bring the product directly to them.”

Drop skips the multiple taps of going to a “link in bio,” then following steps to an external site and ensures Stories are not a one-way street.

It reflects the growing trend for Gen Z and Alpha to build a long-term connection with a brand and making commerce less transactional and more community and conversation oriented.

“When a brand has invested for years into growing their following, what they’re seeing right now is this audience is not visiting their website anymore — less than 3 percent of their followers will ever go on their website,” Benichou said of the shifting shopping trends. “Because, overall, the mobile experience of browsing an online catalogue is broken. And the new generation specifically, they prefer to engage with the brand directly, have a personalized experience and then get access to the products.”

The development is particularly timely as Instagram moves more toward video and pushes the Stories section. Drop says its clients have seen a five-fold decrease in cost-per-acquisition and a boost in returns through the social chat.

Another challenge for brands is that Facebook and Instagram parent company Meta has also announced it will re-focus on paid ads, which are increasingly scrolled by.

With Drop, brands can create members-only “secret clubs,” or offer special limited-time pricing through the messaging system, for example. The app can operate in preferred languages of English, French or Spanish.

Asics, Pangaia and Hot Topic are a few of the big international names they are working with, while in France they are working with limited edition sneaker marketplace Wethenew and private sales site The Bradery. Benichou said 50 percent of the brands Drop is working with are digital native direct-to-consumer brands, including sustainable jewelry brand Ana Luisa and lifestyle apparel brand Culture Kings.

Other aspects of the app include dashboard tools that allow first party data understanding of consumer behavior, and Drop is developing a full library of templates for brands to utilize in order to streamline and simplify the process of content creation for social media managers. It’s positioning itself as a bridge between customer management and social commerce.

The funding is going toward staffing up on the engineering side to develop the platform as it rolls out more features and two major brand partnerships expected to launch in the fourth quarter of 2022.