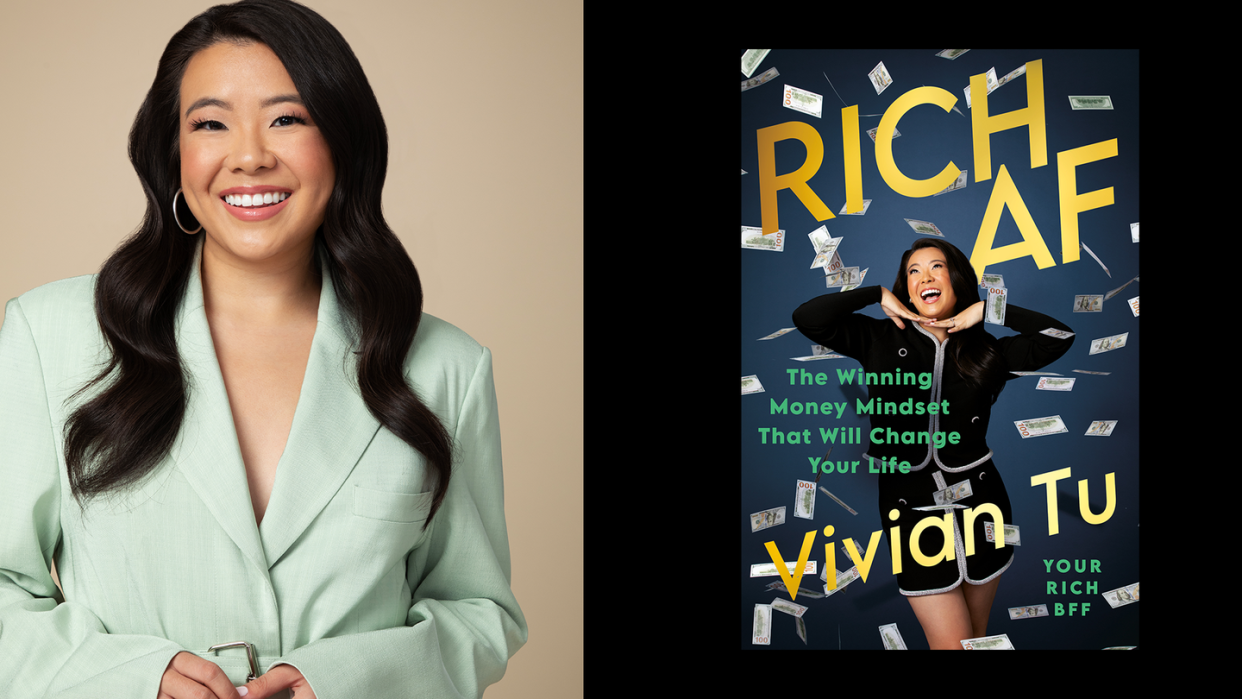

Exclusive: Read an Excerpt from Vivian Tu’s (Aka Your Rich BFF) New Book, Rich AF: The Winning Money Mindset That Will Change Your Life

"Hearst Magazines and Yahoo may earn commission or revenue on some items through these links."

For every money, career, or travel problem you’ve ever experienced, Vivian Tu (aka Your Rich BFF and your favorite Wall Street girly) has a solution…and she’s probably made a TikTok about it, too. Wondering how to make your kids rich? What to do when you get laid off? How much is too much to keep in Venmo? FYI: She's been there, done that.

But if you've been itching for more in-depth money advice in Vivian's signature, anti-gatekeeping fashion and (let's be real) a finance book that’s actually fun to read, may we point you to Vivian’s very first book that will be released on December 26, 2023?!

Cosmo got early access to Rich AF: The Winning Money Mindset That Will Change Your Life, and let's just say that it's absolutely bursting with entertaining, easily-digestible wisdom on handling your money—with absolutely no latte-and-avocado-toast shaming to be found. Vivian is the big sister you wish you had in Rich AF, coming in clutch with practical tips on asking for a raise and finding your "FU number" while also diving deep into taxes and HSAs in a way that's shockingly easy to understand.

Here's what to expect, according to Penguin Random House:

From TikTok star and Your (favorite) Rich BFF Vivian Tu, the definitive book on personal finance for a new generation.

When Vivian Tu started working on Wall Street fresh from undergrad, all she knew was that she was making more money than she had ever seen in her life. But it wasn’t until she found a mentor of her own on the trading floor that she began to understand what wealthy people knew intuitively—the secrets to beating the proverbial financial game that has, for too long, been male, pale, and stale.

Building on the lessons she learned on Wall Street about money and the markets, Vivian now offers her best personal finance tips and tricks to readers of all ages and demographics, so that anyone can get rich, whether you grew up knowing the rules to the game or not. Vivian will be your mentor, dispensing fresh, no-BS advice on how to think like a rich person and create smart money habits. Throughout the pages of Rich AF, Vivian will break down her best recommendations to help you maximize your earnings to get more out of your 9-to-5, understand the differences between savings accounts, and where you should keep your money, identify the tax strategies and (legal) loopholes you need to retire in style, overcome investing fears to secure wealth for generations, and much more!

Rich AF will equip readers with the tools and knowledge to not only understand the financial landscape, but to build a financial strategy of their own. And with Your Rich BFF at your side, you’ll be able to start your financial journey already in an affluent mindset, making the most of your money and growing your wealth for years to come.

Sounds pretty darn good, right? Don't forget to preorder Rich AF before it officially comes out on December 26, and keep scrolling to read an exclusive excerpt from Vivian's book!

An Excerpt From Rich AF: The Winning Money Mindset That Will Change Your Life

By Vivian Tu

I TAKE CARE OF FUTURE ME: The Saving Section

To illustrate the importance of having money saved, let me tell you the story of how I chopped off part of my finger with a bread knife, how it grew back, and why you should have an emergency fund. (TW: blood, medical debt, drunken mistakes)

For my twenty-fifth birthday, I booked out a private section of a fun bar so I could drink and eat tacos with my friends. I was psyched, and I wanted to go in ready to party. So, that afternoon, I took a nap (didn’t wanna be sleepy at the bar), and when I woke up, I was like, “Huh, I could use a snack” (didn’t wanna get too drunk too fast, tacos notwithstanding).

So I grabbed a bread roll that I had picked up from Maison Kayser that morning, and a bread knife, and I started to make a sandwich. But as I’m trying to slice this crusty roll, the knife slips.

I look down, and all I see is a little nub fall onto the white kitchen countertop.

I look at the nub. I look at my finger. I look at the nub.

And all I could say was, “Oh no—I think I need to go to the hospital.”

My boyfriend SPRINGS into action and grabs a paper towel. He immediately wrapped my finger and squeezed it super tight. We took the elevator down from our apartment while my man googled “nearest hospital” on his phone while carrying my nub in some Tupperware.

In the most New York thing ever, we got into a yellow taxi, took the scenic ride up Eighth Avenue, and arrive at the Mount Sinai ER, where I was HYSTERICALLY SOBBING because the shock wore off in the cab, and my finger HURT. Your fingertip has a zillion nerve endings, and all of mine were straight-up not having a good time.

Then, after the nightmare that was getting to the ER, I had to go through a full metal detector, sit in the lobby, and pretend like there wasn’t blood seeping through my now fully red paper towel. (Oh, and while I was sitting there, I literally heard the PA system go, “Custodial services to the lobby,” and I realized they were talking about the puddle of blood now pooling at my feet.)

Fortunately, I was able to get in front of a doctor, and they shot my finger full of lidocaine, took my X-ray, and bandaged me up. I was in the hospital for six hours or so. Worst birthday ever.

The happy ending is that over the next few months, my finger liter-ally regenerated. (Which... apparently fingers do?! Who knew.) The not happy ending, though? The most infuriating aspect of this entire experience?! A month later, I got sent a bill for my little birthday party at Mount Sinai.

For $16,000.

Fortunately, I had good insurance, so I personally didn’t owe nearly that much. But the bill for my portion was still $1,300, which is a legit chunk of change.

And that is why, my friends, I always advise people to have savings and an emergency fund before they begin investing. If my money had been tied up and I didn’t have $1,300 in an account that basically said in case of emergency, I wouldn’t have been able to pay my medical bill in a timely manner. That could’ve caused me to go into medical debt, and that would have had a negative impact on my credit score.

Saving will save your ass when you fuck up (or life fucks you over), and it will make your dreams come true when the time is right. Basically, saving is the foundation of financial security.

The subset of people that make the shittiest, worst decisions with their money? It’s not a certain gender. It’s not a certain race. It’s not a certain age group. It’s people who don’t have options. It’s people who are desperate.

By having a good amount in savings, you don’t have to make decisions from a place of desperation. You know that you have enough money to cover your basic expenses, handle any surprise bills, and gradually build up the cash to buy the stuff that you want. You feel secure, stable, and generally chill.

Because when you’re saving, and your needs are met, and you aren’t stressing constantly about your bills, then you get to graduate and do other cool financial shit, like invest, fund your retirement, buy property, and all the other things that get your money making you money— aka living like a rich person.

How to Bank Like A Rich Person

When we’re talking about “saving money,” we’re actually talking about two different things: (1) spending less money on stuff and (2) literally putting your money away into a designated container (i.e., a bank account). But be real: Do you actually understand how your bank accounts work—or if they’re even the best ones for you?

Rich people are engaging with banks early in life, shopping around, and building a straight-up Avengers-level team of accounts. They are shamelessly in long-term relationships with multiple financial institutions: they keep savings at Bank A for the killer high-yield savings product, but do checking with Bank B because they get unlimited ATM fee reimbursements. They know that all banks want to reward and retain their loyal customers, so they figure why not be a loyal customer of several banks so they can choose from a bunch of insider offers?

While most of us are just letting ourselves be acquired as customers whenever a bank happens to leap into our frame of vision, rich people know they’re worth a lot to that bank. And not in a “we’re all family and truly value our customers” way. Like, in a cold, hard, cash way.

See, when you put your money into a checking account or into a savings account, it does not just sit there. It goes out and makes the bank money. Not you— the bank.

In other words, when you put money into a savings account, you are essentially giving the bank or credit union a loan. They will then turn around and lend that money out to people, and you better believe they’re charging those people interest. Then, to pay you for parking your money there, banks will pay you on average about 0.06 percent in interest each year. And since the bank is paying you literal pennies compared to the interest rates they charge when they lend out your money, they really, really need you as a customer.

For rich people, this dynamic is crystal clear. That’s why they have no problem not only shopping around for the best accounts to use in their “team,” but leveraging their worth as a customer so that banks won’t push them around.

So here are two things to keep in mind to bank like a rich person. One, banks don’t want you to switch banks. They’re counting on you being lazy. Take advantage of that and look around. See what other, maybe better, banks you could move your money (or some of it) to.

Two, banks will do so many things for you before they let you leave. They not only can waive that late fee or send you a free book of checks or whatever, they will do it happily, because it’s good business sense. Got an overdraft charge? Slapped with an ATM fee? Call them up and just ask for it to disappear—you’d be shocked how easy this can be.

From RICH AF: The Winning Money Mindset That Will Change Your Life, by Vivian Tu, in agreement with Portfolio, an imprint of Penguin Publishing Group, a division of Penguin Random House LLC. Copyright © Vivian Tu, 2023.

Rich AF: The Winning Money Mindset That Will Change Your Life, by Vivian Tu, will be released on December 26, 2023. To preorder the book, click on the retailer of your choice:

Amazon Barnes & Noble Bookshop.orgHudson BooksellersBooks A MillionWalmart

You Might Also Like