EXCLUSIVE: Paco Rabanne Is Revving Up With Makeup, More Boutiques

- Oops!Something went wrong.Please try again later.

PARIS — Paco Rabanne is ready for its close-up, and global expansion on multiple fronts, having synced up its fashion and fragrance businesses.

Abbreviating its name to simply Rabanne, the Puig-owned fashion and fragrance house is launching makeup, kicking off a d-to-c intensification with a flagship boutique in New York City — and slowly applying its new visual identity to various product lines and retail spaces.

More from WWD

Disclosing a host of changes and initiatives exclusively to WWD, Puig beauty and fashion president José Manuel Albesa also reported strong business momentum at Paris-based Rabanne, which has been logging 40 percent growth in recent years — and is poised to soon cross the 1 billion euro revenue threshold.

“There’s been an elevation of the brand, and a feminization of the brand. It’s been a lot of work these last five years,” he said in an interview.

And it’s all coming together in 2023, by all accounts a big year for Rabanne with a now-unified image between fashion and fragrance dubbed One Rabanne. Crystalizing this is the new logo for the entire brand, with typeface inspired by the brand’s 1968 hit perfume Calandre, a monogram that is being trickled into textile patterns, accessories and fragrances.

“The brand is having a moment that is incredible,” Albesa enthused.

It’ll reach a zenith during Paris Fashion Week in September, when Rabanne unveils its spring 2024 collection on the runway with expanded ranges of eveningwear, denim and knitwear — and the Avenue Montaigne flagship will bear the new lower-case Rabanne banner.

By that time, the playful new Rabanne makeup, with 90 stock keeping units housed in gleaming silver-colored tubes and compacts, will have landed on the brand’s e-commerce site and counters in Selfridges in the U.K. and Sephora in Europe, with Ulta Beauty in the U.S. coming on stream Oct. 1.

Albesa made clear the crucial contribution of designer Julien Dossena, who has revved up Rabanne’s fashion credibility, reworked and clarified the brand’s key aesthetic codes, and recently made important inroads with celebrities by adding more eveningwear.

For example, when Beyoncé stepped onto the stage at the Stade de France last month, she wore a gleaming, waist-cinched Rabanne gown assembled from round, mirror-effect plates.

Dossena arrived as creative director of the fashion house 10 years ago, and he’s been locked in to lead Rabanne’s next chapter.

Albesa would not comment directly on the French designer’s contract, but it is understood that it was recently renewed, which should squelch recurring speculation Dossena might soon defect to another fashion house.

“There is nothing to announce. Julien is here to stay,” Albesa said with a laugh and a big smile. “And he’s more excited than ever to explore new themes, and he’s more energetic than ever.”

“The brand has such an iconic and immediately recognizable legacy; it’s a unique and strong vision we carry on,” Dossena said. “We try our best to honor the values of the founder: freedom and empowerment.”

WWD broke the news on March 3 that Dossena would become the latest guest designer to realize a one-off haute couture collection for Jean Paul Gaultier, also owned by Puig.

The show is scheduled for July 5 during Paris Couture Week, and Albesa hinted that Dossena would blend Rabanne references with Gaultier’s vast and eclectic oeuvre, achieved over a career spanning 50 years.

Another high-profile project is in view: a holiday collaboration with Swedish fashion giant H&M. WWD also broke the news of that project on Feb. 22, though officials at both companies remain mum about the tie-up.

Dossena burst onto the fashion radar in 2006, when he won a prize at the International Festival of Fashion and Photography in Hyères. He went on to spend four years as a senior designer at Balenciaga, working under then-creative director Nicolas Ghesquière, who instilled in him an exacting, forward-looking approach to design.

Dossena joined Paco Rabanne, famed for its Space Age designs, in early 2013 under then-creative director Lydia Maurer, and in parallel launched his own label, Atto, which he put on hold to concentrate on Paco Rabanne when he was promoted to creative director later that year.

Albesa said the designer, then 30 years old, instantly won the approval of the fashion press, fond of his meticulous yet zesty designs with a futuristic sheen.

“Julien has this capacity to continue innovating,” Albesa said. “While remaining consistent and very loyal to the brand codes, he’s able to — every single time — bring something new, and how this is now being infused into accessories, into jewelry, into beauty, into makeup is incredible.”

Calling Dossena “instrumental in creating the house,” Albesa characterized him as “more than a fashion designer. He has a vision for the brand.”

Among the key codes of the brand that now appear across fashion, accessories and beauty products are metal mesh, silver and gold in combination, square chain links, and round and hole-punched metallic discs like the ones the founder hammered into “12 Unwearable Dresses” back in 1966, cementing Rabanne’s fame.

Albesa grabbed a clicker to show on a large monitor a rendering of a future Rabanne makeup stand. Incorporating marble amid the gleaming silver and gold. The unit includes large images of Rabanne jewelry, fashions and handbags, portraying the aesthetic complicity between all categories.

In dropping the Paco from the house name, Rabanne falls in line with a host of designer-founded brands consumers know by the family name, including Dior, Saint Laurent, Balenciaga and Mugler. Albesa noted that in losing Paco, Rabanne can focus further on its feminization.

About 10 years ago, the Rabanne team presented a chart outlining how all the facets of the brand’s fashion and fragrance branches could converge, and that’s been implemented little by little since.

“From today, all that is new is completely aligned — that means we are revamping our packaging and bottles in fragrances, our strategy of how to elevate the brand,” Albesa explained. “So it’s a huge turnaround that has been cooking for years and starts to see the light now. It’s a very important elevation — keeping the values of Rabanne, for sure.”

Dossena has been key to all that in creating an overarching brand ecosystem, including what products look like, the executive underlined.

“The chemistry comes from Julien, it was his vision,” Albesa said. “Each fragrance is going to take one code of the brand, and it’s going to promote it.”

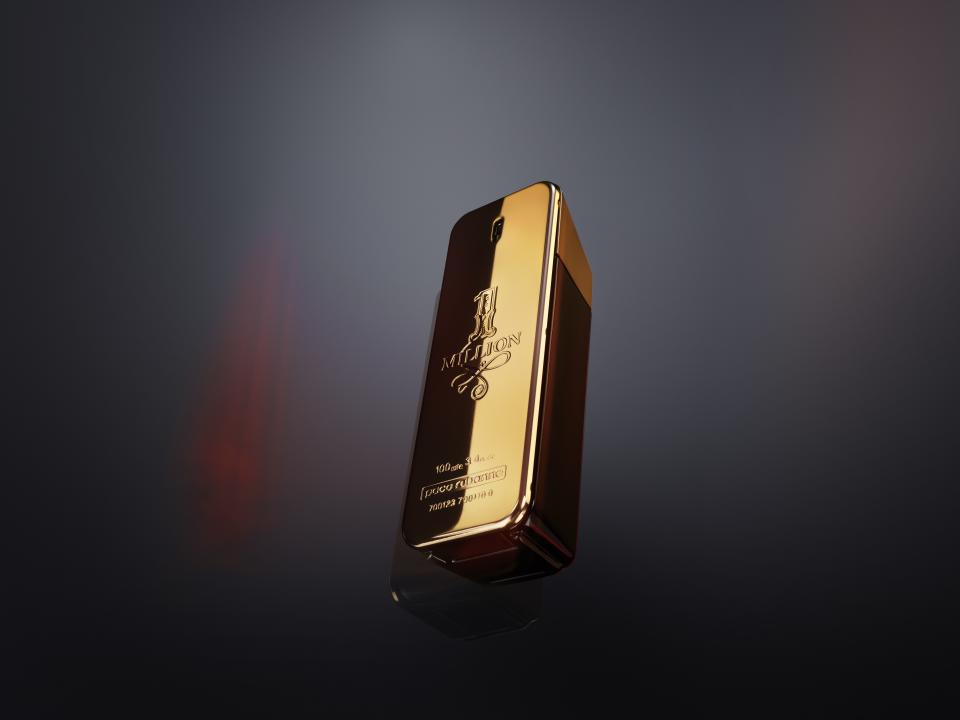

Rabanne’s perfume business, which ranks among the top-five fragrance houses worldwide, has a number of bestselling men’s scent franchises. One Million is in the top four and Invictus in the top seven. A goal for Phantom, already among the 20 bestsellers, is to climb to the top 10 by 2025.

To start shifting the scales, with women’s fragrances taking on greater weight, there’s been a change of strategy.

“We decided to work on stand-alone feminines,” said Albesa, referring to Fame, with its own advertising and vision. “We are choosing a feminine hero by brand, who will be its image. We give the feminine fragrances the capacity to shine.”

The strategy is working, with Fame becoming the best launch in 2022 in the markets where it was introduced, according to NPD Group. Further, Puig has gained a number of market share points in women’s fragrances this year and Albesa believes that momentum should accelerate.

“Then comes the makeup, which is also another way of injecting this feminization of the brand that is more consistent with the fashion,” said Albesa, who believes the time is ripe for the color cosmetics, since Rabanne has so much momentum today. “This makeup is a way to show fashion and beauty together.”

Puig has been delving into the makeup category across its stable of brands with launches for Carolina Herrera, Dries Van Noten and Christian Louboutin, not to mention Charlotte Tilbury, which the group acquired in 2020.

Taking a differentiated approach has always been key, according to Albesa. Rabanne has done that with its fragrances, coming to the market with daring storytelling and juices.

“Paco Rabanne is the first fashion designer doing indie makeup,” Albesa said. “It’s a very collective approach — by the people for the people.”

Diane Kendal was chosen to be Rabanne’s beauty creative director. Brand executives were attracted by her philosophy that “there’s no beauty — only beauties.” Standards are not imposed.

The color cosmetics range has four categories: One for foundations, with 30 references, is dubbed Nudes. Eyephoria, for eyes, comprises 29 units; Rouge Rabanne has 21 lipsticks, while Arts Factory, with 10 skus, includes artistry-inspired products.

The gender-free products with sustainable — vegan, cruelty-free and 98 percent natural — formulas, infused with skin care, have been developed with the help of a community of people.

“It’s very modern makeup. Textures are super important,” said Albesa, calling the easy-to-use color cosmetics “nomad” due to their carry-ability.

Shimmer Bomb, with spray-on glitters, comes in an aerosol can; pressed eye powders are encased in oh-so-Rabanne metallic compacts, while foundations come in squeezy shiny tubes.

“It’s very playful makeup, which you apply with your fingers,” Albesa said.

The ad campaign — with Rabanne-clad models taking the makeup from chain-link bags, a pocket or boot, then trying it on and posing — is playful as well. Stef Mitchell photographed the ad.

The makeup’s prelaunch will take place on Rabanne’s direct-to-consumer platform rabanne.com, starting Aug. 21, followed by Selfridges on Aug. 31; Sephora in France, Italy, Germany, Spain and Portugal on Sept. 12, and Ulta Beauty at the start of October.

Prices will be in the accessible luxury range, from about $20 to $40.

Rabanne executives aim for the brand to rank among the top 10 in makeup — as well as top five in the eye segment — in doors where it is carried during launch. After, it should place among the top-15 color cosmetics brands globally by 2030.

Rabanne could ultimately stretch into other beauty categories, such as skin care.

For both Rabanne fashion and beauty, the stated purpose is to “galvanize young generations in order to forge a more inclusive and creative future.”

Albesa explained the purpose goes beyond product, to cultural relevance stretching into digital, music and communities. “We have planned for each of our brands to have a cultural aspect,” he said.

Spanish founder Paco Rabanne died last February at age 88, remembered for his futuristic vision and use of nonconventional materials.

The house went through a silent period to mourn his death, with Dossena paying homage at his fall 2023 show last March, parading some archival dresses for the finale.

(Dossena started dabbling in menswear starting with the spring 2020 season, but it was quickly phased out.)

Albesa declined to give revenue figures for the fashion house, but said year-to-date, fashion sales have been doubling.

Dossena’s designs are sold in about 300 wholesale doors. In addition to the Avenue Montaigne flagship, which opened at number 39 in 2021 and replaced a unit for Nina Ricci, also owned by Puig, there is a smaller Rabanne store on Rue Cambon.

Albesa noted the brand’s direct-to-consumer sales are tracking 80 percent ahead of last year.

The executive said he’s zeroing in on a lease for a Rabanne flagship in New York’s SoHo district that should open in the first half of 2024. After that, he has his sights set on London for the next location.

The Avenue Montaigne flagship is also slated to double in size next year.

Such developments should help counter the lingering industry perception that Barcelona-based Puig, while formidable with fragrances and beauty products, doesn’t have its heart in the fashion business.

Albesa argued that Puig is unique among Europe’s big luxury groups insofar as it operates brands, not separate fashion and beauty divisions, which can create an aesthetic gulf.

For example, when Belgian designer Van Noten launched fragrance and lipstick last year, he approached those categories just like he sets about creating his fashion, garden or home decor: with a clash of concepts and a riot of colors, prints and textures.

Albesa called it “a beautiful exercise of how the DNA of the fashion came into the beauty.”

Still, he acknowledged there is work to do in growing the d-to-c portion of Puig’s fashion houses’ sales via directly operated retail; in building lucrative accessories categories, and improving gross margins in apparel.

“We still need two, three years to fine-tune those three subjects,” he allowed. “We take it very seriously, though perhaps we work at a different speed. We don’t face the same pressure as other groups so we’ve been putting a lot of thought in what we do.”

Albesa noted that Rabanne has expanded the product range around its popular chainmail 1969 bag, including nano and micro versions, whose origins can be traced back to the steel aprons worn by French butchers back in the day.

“All of a sudden we see a lot of young consumers wanting to own a piece of Rabanne,” Albesa marveled.

Best of WWD